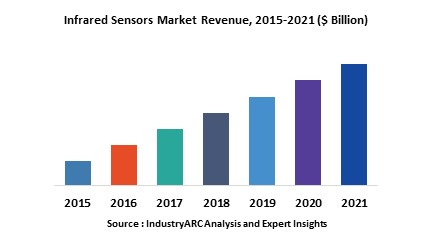

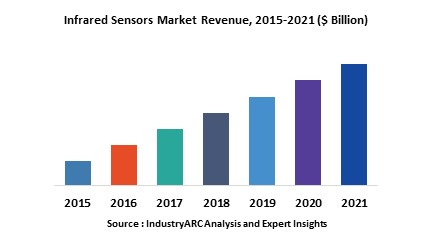

The global infrared market in 2017 is $391.6M in 2017 and is estimated to grow at a CAGR 15.1% during the forecast period 2018-2023. The photo diode market holds the largest market share and generated highest revenue of 98.4M and is estimated to grow at CAGR of 10%. Increasing demand for home automation products, growth of process automation industry and the increasing usage in wireless communication are the key growth factors for IR sensors.

What is infrared sensor?

An infrared sensor is an electronic instrument which is used to sense certain characteristics of its surroundings by either emitting and/or detecting infrared radiation. Infrared sensors are also capable of measuring the heat being emitted by an object and detecting motion. Infrared sensors are components which can detect and produce light in the IR wavelength range. IR sensors have IR light source, medium, optical components and the IR detector. The medium can be a vacuum in case of thermal imaging systems or can be atmosphere

What are the major applications for Infrared sensor?

Infrared sensors have various end use applications which include night vision systems, temperature control, climate control, pedestrian detection, fall detection, pressure monitor, computers, gaming devices, cellphones, LIDAR, , blood glucose monitor, toys, optical power monitors, security devices, home appliances, gas & fire detection systems, spectrometers, thermal imaging etc. infrared sensors are also used in machine vision based products for monitoring assembly line and other automation purposes.

Market Research and Market Trends of Infrared sensor

- New infrared sensors are revolutionizing AR glasses, phone cameras and driverless cars with this infrared sensors are enabling to see through smoke or fog, making autonomous vehicles cheaper and also creating night goggles for augmented reality.

- Si-ware systems a leading player in the industry has developed a small near infrared spectral sensor which is small in size and can be built into a smartphone. This sensor has many industrial and consumer applications. It can further be used in evaluating the health of soils, in food safety and analysis, oil and gas composition, as well as determine the purity of pharmaceutical drugs. Currently, it’s been tested in healthcare, agriculture and petrochemical industries and hence this would drive the market.

- Advanced digital infrared sensors in high speed cameras is used for vegetation-scanning from space to spot changes in human skin cells to help diagnose skin diseases. Also, it is used to map land cover and vegetation growth every two-days. Furthermore, these sensors can also be used for non-space applications.

- Recently, researchers and the Defense Advanced Research Projects Agency announced that they have developed an infrared sensor that runs on essentially zero power. This incredible feat of nanotechnology innovation has the potential for much grander impact than anything that has been seen before.

Who are the Major Players in Infrared sensor market?

The companies referred in the market research report includes Exelitas, Murata manufacturing, Nicera, FLIR, ULIS, Melexis, Raytheon, Texas instruments, Omron corporation, Sofradir.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2018-2024.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

1. Infrared Sensors Market Overview

1.1 Definitions and Scope

2. Infrared Sensors Market- Executive Summary

3. Infrared Sensors Market- Market Landscape

3.1 Comparative Analysis

3.1.1 Product/Service Benchmarking-Top 5 Companies

3.1.2 Top 5 Financial Analysis

3.1.3 Market Value Split by Top 5 Companies

3.1.4 Pricing Analysis

4. Infrared Sensors Market- Market Forces

4.1 Market Drivers

4.2 Market Constraints/Challenges

4.3 Porters five force model

4.3.1 Bargaining power of suppliers

4.3.2 Bargaining powers of customers

4.3.3 Network of new entrants

4.3.4 Rivalry among existing players

4.3.5 Network of substitutes

5. Infrared Sensors Market– By Strategic Analysis (Market Size -$Million/Billion)

5.1 Value Chain Analysis

5.2 Opportunities Analysis

5.3 Product Life Cycle/Market Life Cycle Analysis

5.4 Suppliers and Distributors

6. Infrared Sensors Market– By Spectrum Range

6.1 Short Wave IR (SWIR)

6.2 Mid Wave IR (MWIR)

6.3 Long Wave IR (LWIR)

6.4 Far IR (FIR)

7. Infrared Sensors Market– By Category

7.1 Active

7.2 Passive

8. Infrared Sensors Market – By Type

8.1 Thermopile IR Sensor

8.2 Pyroelectric IR Sensor

8.3 PIR Motion Sensor

8.4 IR Photodiode Sensor

8.5 IR Image Sensor

8.5.1 1D IR Image Sensor

8.5.2 2D IR Image Sensor

8.6 IR Photo Interrupter

8.7 Others

9. Infrared Sensors Market – By Cooling Type

9.1 Uncooled Infrared Sensor

9.2 Cooled Infrared Sensor

10. Infrared Sensors Market– By End Use Sector

10.1 Automotive

10.1.1 Night Vision Systems/Object Detection

10.1.2 Pedestrian Detection

10.1.3 Assisted Parking

10.1.4 Collision Avoidance System

10.1.5 Others

10.2 Healthcare

10.2.1 Temperature Sensor

10.2.2 Heart Rate Monitor

10.2.3 Pulse Oximetry

10.2.4 Imaging Systems

10.2.5 Others

10.3 Semiconductor

10.3.1 Inspection

10.3.2 Wafer Alignment

10.3.3 Failure Analysis

10.3.4 Others

10.4 Military & Defense

10.4.1 Ballistic Missile Defense

10.4.2 Thermal Imaging

10.4.3 Precision Guided Munitions

10.4.4 Others

10.5 Commercial applications

10.5.1 Occupancy Detection System

10.5.2 Security and Surveillance Systems

10.5.3 Others

10.6 Manufacturing

10.6.1 Process Control

10.6.2 Machine Vision

10.6.3 Preventive and Predictive Maintenance

10.6.4 Testing Equipment

10.6.5 Measurement and Monitoring

10.6.6 Others

10.7 Telecommunication

10.7.1 Optical Performance Monitoring (OPM)

10.7.2 Laser beam profiling and wave front analysis

10.7.3 Others

10.8 Others

11. Infrared Sensors Market– By Region

11.1 North America

11.1.1 U.S

11.1.2 Canada

11.1.3 Mexico

11.2 South America

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 South Korea

11.4.4 India

11.4.5 Taiwan

11.4.6 Rest of APAC

11.5 RoW

11.5.1 Middle East

11.5.2 Africa

12. Infrared Sensors Market Entropy

12.1 New Product Launches

12.2 M&As, Collaborations, JVs and Partnerships

13. Infrared Sensors Market- Company Analysis

13.1 Murata

13.2 RoHM Semiconductor

13.3 Melexis

13.4 TE Connectivity

13.5 Honeywell

13.6 Teledyne Technologies

13.7 ams AG

13.8 Vishay Intertechnology

13.9 Broadcom

13.10 On Semiconductor

List of Tables

Table 1. Key Infrared Sensor Companies

Table 2. Key IR Imaging Companies, 2013

Table 3. Infrared Sensors Market By Spectrum Ranges, 2013 - 2019 ($Million)

Table 4. Infrared Sensors Industry - Short Wave IR, 2013 - 2019 ($Million) Table 5. Infrared Sensors Industry – Mid Wave IR, 2013 - 2019 ($Million)

Table 6. Infrared Sensors Industry – Long Wave IR, 2013 - 2019 ($Million)

Table 7. Infrared Sensors Industry – Far Wave IR, 2013 - 2019 ($Million)

Table 8. Infrared Sensors Industry –By Types, 2013 - 2019 ($Million)

Table 9. Infrared Sensors Industry – Passive IR Sensor, 2013 - 2019 ($Million)

Table 10. Infrared Sensors Industry – Thermophile IR Sensor, 2013 - 2019 ($Million)

Table 11. Infrared Sensors Industry – Photodiodes, 2013 - 2019 ($Million)

Table 12. Infrared Sensors Industry – IR Emitters, 2013 - 2019 ($Million)

Table 13. Infrared Sensors Industry –IR Receivers, 2013 - 2019 ($Million)

Table 14. Infrared Sensors Industry – Photointerruptor, 2013 - 2019 ($Million)

Table 15. Infrared Sensors Market – Photo Reflector, 2013 - 2019 ($Million)

Table 16. Market – Tilt Sensor, 2013 - 2019 ($Million) Table 17. Market – IR Linear Arrays, 2013 - 2019 ($Million)

Table 18. Market – Communication Modules, 2013 - 2019 ($Million)

Table 19. Market – By Industry Vertical, 2013 - 2019 ($Million)

Table 20. Market – In Automotive Industry, 2013 - 2019 ($Million)

Table 21. Market – Automotive Industry In Geographic Regions, 2013 - 2019 ($Million)

Table 22. IR Sensor Market – In Night Vision System, 2013 - 2019 ($Million)

Table 23. Infrared Sensors Industry – In Climate Control, 2013 - 2019 ($Million) Table 24. Infrared Sensors Industry – In Pedestrian Detection, 2013 - 2019 ($Million)

Table 25. Infrared Sensors Industry – In Assisted Parking, 2013 - 2019 ($Million)

Table 26. Infrared Sensors Industry – In Distance Measuremnet, 2013 - 2019 ($Million)

Table 27. Infrared Sensors Industry – In Vehicle to Vehicle Communication, 2013 - 2019 ($Million)

Table 28. Infrared Sensors Industry – In Collision Avoidance System, 2013 - 2019 ($Million)

Table 29. Infrared Sensors Industry – In Healthcare Industry, 2013 - 2019 ($Million)

Table 30. Infrared Sensors Industry – Healthcare Industry In Geographic Regions, 2013 - 2019 ($Million)

Table 31. Infrared Sensors Industry – In Temperature Sensor, 2013 - 2019 ($Million)

Table 32. Infrared Sensors Industry – In Fall Detection, 2013 - 2019 ($Million)

Table 33. IR Sensor Market – In Heart Rate Monitor, 2013 - 2019 ($Million)

Table 34. Market – In Pulse Oximetry, 2013 - 2019 ($Million) Table 35. Market – In Blood Glucose Monitor, 2013 - 2019 ($Million)

Table 36. Market – In Blood Pressure Monitor, 2013 - 2019 ($Million)

Table 37. Market – In Optical Coherence Tomography (Oct), 2013 - 2019 ($Million)

Table 38. Market – In Imaging Systems, 2013 - 2019 ($Million)

Table 39. Market – In Semiconductors Industry, 2013 - 2019 ($Million)

Table 40. Market – Semiconductors Industry In Geographic Regions, 2013 - 2019 ($Million)

Table 41. Market – In Photovoltaics Electroluminescence Inspection 2013 - 2019 ($Million)

Table 42. Market – Active Modification of Integrated Circuitry 2013 - 2019 ($Million)

Table 43. Infrared Sensors Market – In Wafer Alignment and Failure Analysis 2013 - 2019 ($Million)

Table 44. Infrared Sensors Market – In Military and Defense 2013 - 2019 ($Million)

Table 45. Market In Military and Defense – By Geographic Region, 2013 -2019 ($Million) Table 46. Market – In Ballistic Missile Defense 2013 - 2019 ($Million)

Table 47. Market – In Thermal Imaging, 2013 - 2019 ($Million)

Table 48. Market – In Illumination 2013 - 2019 ($Million)

Table 49. Market – In Precision Guided Munitions, 2013 - 2019 ($Million)

Table 50. Market – In Missile Tracking, 2013 - 2019 ($Million)

Table 51. Market – In Ladar, 2013 - 2019 ($Million)

Table 52. Market – In Commercial Applications, 2013 - 2019 ($Million)

Table 53. Market –Commercial Applications In Geographic Regions, 2013 - 2019 ($Million)

Table 54. Market –In Residential Control Sysytem, 2013 - 2019 ($Million)

Table 55. Infrared Sensors Market –In Home Appliances, 2013 - 2019 ($Million)

Table 56. Infrared Sensors Market –In Entertainment Devices, 2013 - 2019 ($Million)

Table 57. Infrared Sensors Market –In Printers, 2013 - 2019 ($Million)

Table 58. Infrared Sensors Market –In Computers, 2013 - 2019 ($Million)

Table 59. Infrared Sensors Market –In Gaming Devices, 2013 - 2019 ($Million)

Table 60. Market –In Toys, 2013 - 2019 ($Million) Table 61. Market –In Manufacturing Industry, 2013 - 2019 ($Million)

Table 62. Market –Manufacturing Industry In Geographic Regions, 2013 - 2019 ($Million)

Table 63. Market –In Process Control, 2013 - 2019 ($Million)

Table 64. Market –In Machine Vision, 2013 - 2019 ($Million)

Table 65. Market –In Automation, 2013 - 2019 ($Million)

Table 66. Market –In Preventive and Predictive Maintenance, 2013 - 2019 ($Million)

Table 67. Market –In Testing Equipment, 2013 - 2019 ($Million)

Table 68. Market –In Measurement and Monitoring, 2013 - 2019 ($Million)

Table 69. Market –In Counters and Encoders, 2013 - 2019 ($Million)

Table 70. Market –In Instrumentation, 2013 - 2019 ($Million)

Table 71. Market –In Laser Beam Profiling, 2013 - 2019 ($Million)

Table 72. Infrared Sensors Market –In Spectroscopy, 2013 - 2019 ($Million)

Table 73. Infrared Sensors Market –In Optical Sensing, 2013 - 2019 ($Million)

Table 74. Infrared Sensors Industry –Position, 2013 - 2019 ($Million) Table 75. Infrared Sensors Industry –Proximity, 2013 - 2019 ($Million)

Table 76. Infrared Sensors Industry –Proximity, 2013 - 2019 ($Million)

Table 77. Infrared Sensors Industry In Telecommunications Industry, 2013 - 2019 ($Million)

Table 78. Infrared Sensors Market - Telecommunications In Geographic Regions, 2013 - 2019 ($Million)

Table 79. IR Detectors Market, 2013 – 2019 ($Million)

Table 80. IR Detectors Market By Geographic Regions, 2013 - 2019 ($Million)

Table 81. Infrared Detector Market – By Types, 2013 - 2019 ($Million)

Table 82. Pyroelectric Sensor Based Infrared Detector Market –By Geographic Regions, 2013 - 2019 ($Million)

Table 83. Thermopile Sensor Based Infrared Detector Market – By Geographic Regions, 2013 - 2019 ($Million)

Table 84. Infrared Detector Market – By Applications, 2013 - 2019 ($Million)

Table 85. Infrared Detector Market- Building Automation, 2013 - 2019 ($Million)

Table 86. Infrared Detector Building Automation Market By Geographic Regions, 2013 - 2019 ($Million)

Table 87. Infrared Detector Market- Spectroscopy, 2013 - 2019 ($Million)

Table 88. Infrared Detector - Spectroscopy Market By Geographic Regions, 2013 - 2019 ($Million)

Table 89. Infrared Detector -Internal Temperature Measurement Market, 2013 - 2019 ($Million) 160

Table 90. Infrared Detector -Internal Temperature Measurement Market By Geographic Regions, 2013 - 2019 ($Million)

Table 91. Infrared Detector - Gesture Recognition Market, 2013 - 2019 ($Million)

Table 92. Infrared Detector - Gesture Recognition Market By Geographic Regions, 2013 - 2019 ($Million)

Table 93. Infrared Detector – Microbolometer Market, 2013 - 2019 ($Million)

Table 94. Infrared Detector - Microbolometer Market By Geographic Regions, 2013 – 2019 ($Million)

Table 95. Infrared Detector - Gas and Fire Detection Market, 2013 - 2019 ($Million)

Table 96. Infrared Detector - Gas and Fire Detection Market By Geographic Regions, 2013 - 2019 ($Million)

Table 97. Motion Sensor Based Infrared Detector Market, 2013 - 2019 ($Million)

Table 98. Motion Sensor Based Infrared Detector Market- By Geographic Regions, 2013 - 2019 ($Million)

Table 99. North American IR Sensor Market- 2013-2019 ($Million) Table 100. IR Sensor Market- Brazil 2013-2019 ($Million)

Table 101. IR Sensor Market- Argentina, 2013-2019 ($Million)

Table 102. IR Sensor Market-Mexico, 2013-2019 ($Million)

Table 103. IR Sensor Market –United Kingdom, 2013-2019 ($Million)

Table 104. IR Sensor Market –France, 2013-2019 ($Million)

Table 105. IR Sensor Market- Germany, 2013-2019 ($Million)

Table 106. IR Sensor Market- Japan, 2013-2019 ($Million)

Table 107. IR Sensor Market- China, 2013-2019 ($Million)

Table 108. IR Sensor Market-South Korea, 2013-2019 ($Million)

Table 109. IR Sensor Market- Australia, 2013-2019 ($Million)

Table 110. IR Sensor Market –Other Asian Countries, 2013-2019 ($Million)

Table 111. IR Sensor Market -Rest of The World In Usd Mn (2013-2019)

Table 112. Axis Communications: Total Annual Sales (2011-2013) In Us$Million

Table 113. Drs Technologies Inc., Total Revenue, 2013– 2011 (Usd Millions)

Table 114. Drs Technologies Inc., Revenue- R&D 2013– 2011 (Usd Millions)

Table 115. Flir Systems Inc., Total Revenue, 2013– 2012 (Usd Millions)

Table 116. Flir Systems Inc., Total Revenue, R&D 2013– 2012 (Usd Millions)

Table 117. General Dynamics Corporation: Total Revenue (2011-2013) In Us$Million

Table 118. Nippon Avionics Co. Ltd, Revenues (2011-2013)

Table 119. Omron Total Revenue, 2013– 2012 (Usd Millions)

Table 120. Omron Sales By Segment, 2013– 2012 (Usd Millions)

Table 121. Panasonic Corporation, Total Revenue, 2013– 2011 (Usd Millions)

Table 122. Robert Bosch Gmbh: Total Revenue (2012-2013) In Us$Billion

Table 123. Texas Instruments – Revenue (2011-2013)

Table 124. Zhejiang Dali Technologies Co. Ltd, Total Revenue, 2013– 2011 (Usd Millions)

List of Figures

Figure 1 Infrared Sensor & Detector - Classification

Figure 2 Global Infrared Sensors Market Revenue Forecast, 2013 – 2019 ($ Millions)

Figure 3 Global Thermal Imaging Camera Market Share Analysis, 2013 (%)

Figure 4 Global Process Automation and Instrumentation Market Revenue, 2012 - 2018 ($Billion)

Figure 5 Global Infrared Sensors and Detectors Industry – Value Chain Analysis

Figure 6 Infrared Sensors Average Selling Price Analysis, 2013 – 2019 ($) Figure 7 Global IR Sensor Market – By Spectrum Ranges (2013)

Figure 8 Global IR Sensor Market – By Types (2013)

Figure 9 Global Infrared Sensors Market – By Industry Verticals

Figure 10 Global Market – Health Industry (2013)

Figure 11 Global Market – Health Industry (2013)

Figure 12 Global Market In Semiconductor Industry, 2013

Figure 1 Global Market - Military and Defense, 2013 (%)

Figure 13 Market – Revenue In Commercial Applications for 2013 (%)

Figure 14 Global IR Sensor Market – Application In Manufacturing Sector, 2013

Figure 15 Global Market By Operations, 2013

Figure 16 Infrared Detectors Market Analysis, By Applications, 2013 (%)

Figure 17 IR Sensor Market Revenue Share By Region In Americas (2013)

Figure 18 IR Sensor Market Revenue Share By Region In Europe (2013)

Figure 19 IR Sensor Market Revenue Share By Region In Apac (2013)

Figure 20 Global Market – Product Launches (2010-2014)

Figure 21 Global Infrared Sensors Market – Product Launches – By Key Players (2013-14)

Figure 22 Global Infrared Sensors Market – M&A's, Collaborations, Jv's & Partnerships, By No. of Developments (2010-14)

Figure 23 Global Infrared Sensors Market – M&A's, Collaborations, Jv's & Partnerships, By Company

Figure 24 Axis Communications: 2013 Net Sales – By Geography (Us$Million)

Figure 25 General Dynamics Corporation:2013 Net Revenue – By Business Unit

Figure 26 Product Segment Wise In Percentages, As Audited By Official Auditing Partner E&Y.

Figure 27 Region Wise Share (%) In The Net Sales of 2013

Figure 28 Melexis Nv, Sales By Division - 2013

Figure 29 Melexis Nv, Sales By Geography – 2013

Figure 30 Raytheon Company – Revenues By Segment (2013)

Figure 31 Safran S.A. Revenues By Segment, 2013

Figure 32 Teledyne Dalsa Corp. Revenue By Segment, 2013

Figure 33 Texas Instruments – Revenue By Business Segment (2013)

Figure 34 Texas Instruments – Revenue By End User Segment (2013)

Email

Email Print

Print