Field Programmable Gate Array (FPGA) Market - Forecast(2024 - 2030)

The FPGA market was valued at USD 4.79 Billion in 2017 and is anticipated to grow at a CAGR of 8.5% during 2017 and 2023. The growing demand for advanced driver-assistance systems (ADAS), the growth of IoT and reduction in time-to-market are the key driving factors for the FPGA market. Owing to benefits such as increasing the performance, early time to market, replacing glue logic, reducing number of PCB spins, and reducing number of parts of PCB, field programmable gate arrays (FPGA’s) are being used in many CPU’s. Industrial networking, industrial motor control, industrial control applications, machine vision, video surveillance make use of different families of FPGA’s.

North America is the leading market for field programmable gate arrays with U.S. leading the charge followed by Europe. North America region is forecast to have highest growth in the next few years due to growing adoption of field programmable gate arrays.

What is Field Programmable Gate Arrays?

Field Programmable Gate Arrays (FPGAs) are semiconductor devices. The lookup table (LUT) is the basic block in every FPGA. Different FPGAs use variable sized LUTs. A lookup table is logically equivalent to a RAM with the inputs being the address select lines and can have multiple outputs in order to get two Boolean functions of the same inputs thus doubling the number of configuration bits. FPGAs can be reprogrammed to desired application or functionality requirements after manufacturing. This differentiates FPGAs from Application Specific Integrated Circuits (ASICs) although they help in ASIC designing itself, which are custom manufactured for specific design tasks.

In a single integrated circuit (IC) chip of FPGA, millions of logic gates can be incorporated. Hence, a single FPGA can replace thousands of discrete components. FPGAs are an ideal fit for many different markets due to their programmability. Ever-changing technology combined with introduction of new product portfolio is the major drivers for this industry.

What are the major applications for Field Programmable Gate Arrays?

FPGA applications are found in Industrial, Medical, Scientific Instruments, security systems, Video & Image Processing, Wired Communications, Wireless Communications, Aerospace and Defense, Medical Electronics, Audio, Automotive, Broadcast, Consumer Electronics, Distributed Monetary Systems, Data and Computer Centers and many more verticals.

Particularly in the fields of computer hardware emulation, integrating multiple SPLDs, voice recognition, cryptography, filtering and communication encoding, digital signal processing, bioinformatics, device controllers, software-defined radio, random logic, ASIC prototyping, medical imaging, or any other electronic processing FGPAs are implied because of their capability of being programmable according to requirement. FPGAs have gained popularity over the past decade because they are useful for a wide range of applications.

FPGAs are implied for those applications in particular where the production volume is small. For low-volume applications, the leading companies pay hardware costs per unit. The new performance dynamics and cost have extended the range of viable applications these days.

Market Research and Market Trends of Field Programmable Gate Array (FPGA) Ecosystem

- FPGA As Cloud Server: IoT devices usually have limited processing power, memory size and bandwidth. The developers offer interfaces through compilers, tools, and frameworks. This creates effectiveness for the customer base and creates strong cloud products with increased efficiency which also included new machine learning techniques, Artificial Intelligence and big data analysis all in one platform. Web Service Companies are working to offer FPGAs in Elastic Compute Cloud (EC2) cloud environment.

- Artificial Intelligence: As an order of higher magnitude performance per Watt than commercial FPGAs and (Graphical Processing Unit) GPUs in SOC search giant offers TPUs (Google’s Tensor Processing Units). AI demands for higher performance, less time, larger computation with more power proficient for deep neural networks. Deep neural network power-up the high-end devices. Google revealed that the accelerators (FGPAs) were used for the Alpha GO systems which is a computer developed by Google DeepMind that plays the board game Go. CEA also offers an ultra-low power programmable accelerator called P-Neuro.

- Photonic Networks for Hardware Accelerators: Hardware Accelerators normally need high bandwidth, low latency, and energy efficiency. The high performance computing system has critical performance which is shifted from the microprocessors to the communications infrastructure. Optical interconnects are able to address the bandwidth scalability challenges of future computing systems, by exploiting the parallel nature and capacity of wavelength division multiplexing (WDM). The multi-casted network uniquely exploits the parallelism of WDM to serve as an initial validation for architecture. Two FPGA boarded systems emulate the CPU and hardware accelerator nodes. Here FPGA transceivers implement and follow a phase-encoder header network protocol. The output of each port is individually controlled using a bitwise XNOR of port’s control signal. Optical packets are send through the network and execute switch and multicasting of two receive nodes with most reduced error

- Low Power and High Data Rate FPGA: “Microsemi” FPGAs provides a non-volatile FPGA having 12.7 GB/s transceiver and lower poor consumption less than 90mW at 10 GB/s. It manufactured using a 28nm silicon-oxide-nitride-oxide-silicon nonvolatile process on standard CMOS technology. By this they address cyber security threats and deep submicron single event upsets in configuration memory on SRAM-based FPGA. These transceivers use cynical I/O gearing logic for DDR memory and LVDS. Cryptography research provides differential power analysis protection technology, an integrated physical unclonable function and 56 kilobyte of secure embedded non-volatile memory, the built-in tamper detectors parts and counter measures.

- Speeds up FPGA-in-the-loop verification: HDL Verifier is used to speed up FPGA-in-the-loop (FIL) verification. Faster communication between the FPGA board and higher clock frequency is stimulated by the FIL capabilities. This would increase the complexity of signal processing, control system algorithms and vision processing. For validation of the design in the system context simulate hardware implementation on an FPGA board. HDL Verifier automates the setup and connection of MATLAB and Simulink test environments to designs running on FPGA development boards. The R2016b has been released that allows engineers to specify a custom frequency for their FPGA system clock with clock rates up to five times faster than previously possible with FIL. This improves faster run-time. From MATLAB and Simulink is an easy way to validate hardware design within the algorithm development environment

- Xilinx Unveils Revolutionary Adaptable Computing Product Category: Xilinx, Inc. which is leader in FGPAs, has recently announced a new product category which is named as Adaptive Compute Acceleration Platform (ACAP) and has the capabilities far beyond of an FPGA. An ACAP is a highly integrated multi-core heterogeneous compute platform that can be changed at the hardware level to adapt to the needs of a wide range of applications and workloads. ACAP has the capability of dynamic adaption during operation which enables it to deliver higher performance per-watt levels that is unmatched by CPUs or GPUs.

- Lattice Releases Next-Generation FPGA Software for Development of Broad Market Low Power Embedded Applications: Lattice Semiconductor, launched its FPGA software recently. Lattice Radiant targeted for the development of broad market low power embedded applications. Device’s application expands significantly across various market segments including mobile, consumer, industrial, and automotive due to is rich set of features and ease-of-use, Lattice Radiant software’s support for iCE40 Ultra plus FPGAs. ICE40 Ultra Plus devices are the world’s smallest FPGAs with enhanced memory and DSPs to enable always on, distributed processing. The Lattice Radiant software is available for free download.

Who are the Major Players in market?

The companies referred in the market research report include Intel Inc, Microsemi, Lattice Semiconductor, Xilinx, Atmel, Quick Logic Corp., Red Pitaya, Mercury Computer, Nallatech Inc., Achronix Semiconductor Corporation, Acromag Inc., Actel Corp., Altera Corp.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2017-2023.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

For more ICT related reports,

please click here

1. Field Programmable Gate Array (FPGA) Market - Overview

1.1. Definitions and Scope

2. Field Programmable Gate Array (FPGA) Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Field Programmable Gate Array (FPGA) Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Field Programmable Gate Array (FPGA) Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Field Programmable Gate Array (FPGA) Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Field Programmable Gate Array (FPGA) Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Field Programmable Gate Array (FPGA) Market - Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

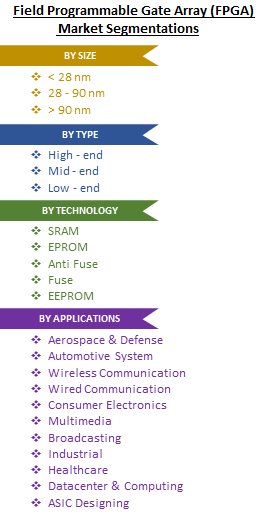

8. Field Programmable Gate Array (FPGA) Market – By Technology (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Introduction

8.3.2. SRAM

8.3.3. Anti -Fuse

8.3.4. Fuse

8.3.5. Flash - based/EEPROM

8.3.6. EPROM

8.3.7. Others

9. Field Programmable Gate Array (FPGA) Market – By Type (Market Size -$Million / $Billion)

9.1. High - end FPGA

9.2. Mid - end FPGA

9.3. Low - end FPGA

10. Field Programmable Gate Array (FPGA) Market – By Size (Market Size -$Million / $Billion)

10.1 Introduction

10.2 Less than 28 nm

10.3 28 – 90 nm

10.4 More than 90 nm

11. Field Programmable Gate Array (FPGA) Market – By Functional Blocks (Market Size -$Million / $Billion)

11.1. Introduction

11.2. Logic Blocks

11.2.1. Transistor Pairs

11.2.2. Combinational Gates

11.2.3. N - Input Lookup Tables

11.2.4. Multiplexes

11.2.5. Others

11.3. Routing

12. Field Programmable Gate Array (FPGA) Market – By Memory (Market Size -$Million / $Billion)

12.1. Introduction

12.2. Distributed Memory

12.3. Block Memory

13. Field Programmable Gate Array (FPGA) Market – By Applications (Market Size -$Million / $Billion)

13.1. Aerospace and Defense

13.1.1. Image processing

13.1.2. Waveform generation

13.1.3. Partial reconfiguration for SDRs

13.2. Wired Communications

13.2.1. Optical Transport Network

13.2.2. Backhaul and Access Network

13.2.3. Network Processing

13.2.4. Packet based Processing and Switching

13.3. Wireless Communications

13.3.1. Baseband

13.3.2. Wireless Backhaul Network

13.3.3. Radio

13.4. Multimedia

13.4.1. Audio

13.4.2. Communications

13.4.3. Video Processing

13.5. Broadcasting

13.5.1. Broadcast Platform Design

13.5.2. High-end Broadcast systems

13.6. Automotive system

13.6.1. Driver Assistance Systems

13.6.2. In-vehicle Infotainment

13.7. Consumer Electronics

13.7.1. Converged Handsets

13.7.2. Digital Flat Panel Displays

13.7.3. Information Appliances

13.7.4. Home Networking

13.7.5. Set-top Boxes

13.8. Industrial

13.8.1. Industrial Imaging and Survillence

13.8.2. Industrial Automation

13.9. Datacenter & Computing

13.9.1. Network Interface Control

13.9.2. Storage Interface Control

13.9.3. Hardware Acceleration

13.9.4. ASIC Designing

13.9.4.1. SOC system Modeling

13.9.4.2. Verification of Embedded Software

13.10. Healthcare

13.10.1. Imaging Diagnostics

13.10.1.1. Ultrasound

13.10.1.2. CT Scanner

13.10.1.3. MRI

13.10.1.4. X-Ray

13.10.2. Wearable Devices

13.11. Video & Image Processing

13.12. Others

14. Field Programmable Gate Array (FPGA) - By Geography (Market Size -$Million / $Billion)

14.1. Field Programmable Gate Array (FPGA) Market - North America Segment Research

14.2. North America Market Research (Million / $Billion)

14.2.1. Segment type Size and Market Size Analysis

14.2.2. Revenue and Trends

14.2.3. Application Revenue and Trends by type of Application

14.2.4. Company Revenue and Product Analysis

14.2.5. North America Product type and Application Market Size

14.2.5.1. U.S.

14.2.5.2. Canada

14.2.5.3. Mexico

14.2.5.4. Rest of North America

14.3. Field Programmable Gate Array (FPGA) - South America Segment Research

14.4. South America Market Research (Market Size -$Million / $Billion)

14.4.1. Segment type Size and Market Size Analysis

14.4.2. Revenue and Trends

14.4.3. Application Revenue and Trends by type of Application

14.4.4. Company Revenue and Product Analysis

14.4.5. South America Product type and Application Market Size

14.4.5.1. Brazil

14.4.5.2. Venezuela

14.4.5.3. Argentina

14.4.5.4. Ecuador

14.4.5.5. Peru

14.4.5.6. Colombia

14.4.5.7. Costa Rica

14.4.5.8. Rest of South America

14.5. Field Programmable Gate Array (FPGA) - Europe Segment Research

14.6. Europe Market Research (Market Size -$Million / $Billion)

14.6.1. Segment type Size and Market Size Analysis

14.6.2. Revenue and Trends

14.6.3. Application Revenue and Trends by type of Application

14.6.4. Company Revenue and Product Analysis

14.6.5. Europe Segment Product type and Application Market Size

14.6.5.1. U.K

14.6.5.2. Germany

14.6.5.3. Italy

14.6.5.4. France

14.6.5.5. Netherlands

14.6.5.6. Belgium

14.6.5.7. Spain

14.6.5.8. Denmark

14.6.5.9. Rest of Europe

14.7. Field Programmable Gate Array (FPGA) – APAC Segment Research

14.8. APAC Market Research (Market Size -$Million / $Billion)

14.8.1. Segment type Size and Market Size Analysis

14.8.2. Revenue and Trends

14.8.3. Application Revenue and Trends by type of Application

14.8.4. Company Revenue and Product Analysis

14.8.5. APAC Segment – Product type and Application Market Size

14.8.5.1. China

14.8.5.2. Australia

14.8.5.3. Japan

14.8.5.4. South Korea

14.8.5.5. India

14.8.5.6. Taiwan

14.8.5.7. Malaysia

15. Field Programmable Gate Array (FPGA) Market - Entropy

15.1. New product launches

15.2. M&A's, collaborations, JVs and partnerships

16. Field Programmable Gate Array (FPGA) Market – Industry / Segment Competition landscape Premium

16.1. Market Share Analysis

16.1.1. Market Share by Country- Top companies

16.1.2. Market Share by Region- Top 10 companies

16.1.3. Market Share by type of Application – Top 10 companies

16.1.4. Market Share by type of Product / Product category- Top 10 companies

16.1.5. Market Share at global level- Top 10 companies

16.1.6. Best Practices for companies

17. Field Programmable Gate Array (FPGA) Market – Key Company List by Country Premium

18. Field Programmable Gate Array (FPGA) Market Company Analysis

18.1. Market Share, Company Revenue, Products, M&A, Developments

18.2. Microsemi

18.3. Lattice Semiconductor

18.4. Xilinx

18.5. Atmel

18.6. Quick Logic Corp

18.7. Red Pitaya

18.8. Mercury Computer

18.9. Nallatech Inc.

18.10. Achronix Semiconductor Corporation

18.11. Acromag Inc

18.12. Actel Corp

18.13. Altera Corp

18.14. Company 14

18.15. Company 15 and more

"*Financials would be provided on a best efforts basis for private companies"

19. Field Programmable Gate Array (FPGA) Market - Appendix

19.1. Abbreviations

19.2. Sources

20. Field Programmable Gate Array (FPGA) Market - Methodology

20.1. Research Methodology

20.1.1. Company Expert Interviews

20.1.2. Industry Databases

20.1.3. Associations

20.1.4. Company News

20.1.5. Company Annual Reports

20.1.6. Application Trends

20.1.7. New Products and Product database

20.1.8. Company Transcripts

20.1.9. R&D Trends

20.1.10. Key Opinion Leaders Interviews

20.1.11. Supply and Demand Trends

List of Tables:

Table 1: Mosquito Repeller Market Overview 2021-2026

Table 2: Mosquito Repeller Market Leader Analysis 2018-2019 (US$)

Table 3: Mosquito Repeller Market Product Analysis 2018-2019 (US$)

Table 4: Mosquito Repeller Market End User Analysis 2018-2019 (US$)

Table 5: Mosquito Repeller Market Patent Analysis 2013-2018* (US$)

Table 6: Mosquito Repeller Market Financial Analysis 2018-2019 (US$)

Table 7: Mosquito Repeller Market Driver Analysis 2018-2019 (US$)

Table 8: Mosquito Repeller Market Challenges Analysis 2018-2019 (US$)

Table 9: Mosquito Repeller Market Constraint Analysis 2018-2019 (US$)

Table 10: Mosquito Repeller Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Mosquito Repeller Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Mosquito Repeller Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Mosquito Repeller Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Mosquito Repeller Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Mosquito Repeller Market Value Chain Analysis 2018-2019 (US$)

Table 16: Mosquito Repeller Market Pricing Analysis 2021-2026 (US$)

Table 17: Mosquito Repeller Market Opportunities Analysis 2021-2026 (US$)

Table 18: Mosquito Repeller Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Mosquito Repeller Market Supplier Analysis 2018-2019 (US$)

Table 20: Mosquito Repeller Market Distributor Analysis 2018-2019 (US$)

Table 21: Mosquito Repeller Market Trend Analysis 2018-2019 (US$)

Table 22: Mosquito Repeller Market Size 2018 (US$)

Table 23: Mosquito Repeller Market Forecast Analysis 2021-2026 (US$)

Table 24: Mosquito Repeller Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26: Mosquito Repeller Market By Type, Revenue & Volume, By High - end FPGA, 2021-2026 ($)

Table 27: Mosquito Repeller Market By Type, Revenue & Volume, By Mid - end FPGA, 2021-2026 ($)

Table 28: Mosquito Repeller Market By Type, Revenue & Volume, By Low - end FPGA, 2021-2026 ($)

Table 29: Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 30: Mosquito Repeller Market By Functional Blocks, Revenue & Volume, By Logic Blocks, 2021-2026 ($)

Table 31: Mosquito Repeller Market By Functional Blocks, Revenue & Volume, By Routing, 2021-2026 ($)

Table 32: Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 33: Mosquito Repeller Market By Technology, Revenue & Volume, By SRAM, 2021-2026 ($)

Table 34: Mosquito Repeller Market By Technology, Revenue & Volume, By Anti -Fuse, 2021-2026 ($)

Table 35: Mosquito Repeller Market By Technology, Revenue & Volume, By Fuse, 2021-2026 ($)

Table 36: Mosquito Repeller Market By Technology, Revenue & Volume, By Flash - based/EEPROM, 2021-2026 ($)

Table 37: Mosquito Repeller Market By Technology, Revenue & Volume, By EPROM, 2021-2026 ($)

Table 38: Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 39: Mosquito Repeller Market By Application, Revenue & Volume, By Aerospace and Defense, 2021-2026 ($)

Table 40: Mosquito Repeller Market By Application, Revenue & Volume, By Wired Communications, 2021-2026 ($)

Table 41: Mosquito Repeller Market By Application, Revenue & Volume, By Wireless Communications, 2021-2026 ($)

Table 42: Mosquito Repeller Market By Application, Revenue & Volume, By Multimedia, 2021-2026 ($)

Table 43: Mosquito Repeller Market By Application, Revenue & Volume, By Broadcasting, 2021-2026 ($)

Table 44: Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 45: Mosquito Repeller Market By Memory, Revenue & Volume, By Distributed Memory, 2021-2026 ($)

Table 46: Mosquito Repeller Market By Memory, Revenue & Volume, By Block Memory, 2021-2026 ($)

Table 47: North America Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 48: North America Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 49: North America Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 50: North America Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 51: North America Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 52: South america Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 53: South america Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 54: South america Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 55: South america Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 56: South america Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 57: Europe Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 58: Europe Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 59: Europe Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 60: Europe Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 61: Europe Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 62: APAC Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 63: APAC Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 64: APAC Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 65: APAC Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 66: APAC Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 67: Middle East & Africa Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 68: Middle East & Africa Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 69: Middle East & Africa Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 70: Middle East & Africa Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 71: Middle East & Africa Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 72: Russia Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 73: Russia Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 74: Russia Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 75: Russia Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 76: Russia Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 77: Israel Mosquito Repeller Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 78: Israel Mosquito Repeller Market, Revenue & Volume, By Functional Blocks, 2021-2026 ($)

Table 79: Israel Mosquito Repeller Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 80: Israel Mosquito Repeller Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 81: Israel Mosquito Repeller Market, Revenue & Volume, By Memory, 2021-2026 ($)

Table 82: Top Companies 2018 (US$) Mosquito Repeller Market, Revenue & Volume

Table 83: Product Launch 2018-2019 Mosquito Repeller Market, Revenue & Volume

Table 84: Mergers & Acquistions 2018-2019 Mosquito Repeller Market, Revenue & Volume

List of Figures:

Figure 1: Overview of Mosquito Repeller Market 2021-2026

Figure 2: Market Share Analysis for Mosquito Repeller Market 2018 (US$)

Figure 3: Product Comparison in Mosquito Repeller Market 2018-2019 (US$)

Figure 4: End User Profile for Mosquito Repeller Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Mosquito Repeller Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Mosquito Repeller Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Mosquito Repeller Market 2018-2019

Figure 8: Ecosystem Analysis in Mosquito Repeller Market 2018

Figure 9: Average Selling Price in Mosquito Repeller Market 2021-2026

Figure 10: Top Opportunites in Mosquito Repeller Market 2018-2019

Figure 11: Market Life Cycle Analysis in Mosquito Repeller Market

Figure 12: GlobalBy Type Mosquito Repeller Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy Functional Blocks Mosquito Repeller Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy Technology Mosquito Repeller Market Revenue, 2021-2026 ($)

Figure 15: GlobalBy Application Mosquito Repeller Market Revenue, 2021-2026 ($)

Figure 16: GlobalBy Memory Mosquito Repeller Market Revenue, 2021-2026 ($)

Figure 17: Global Mosquito Repeller Market - By Geography

Figure 18: Global Mosquito Repeller Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19: Global Mosquito Repeller Market CAGR, By Geography, 2021-2026 (%)

Figure 20: North America Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 21: US Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 22: US GDP and Population, 2018-2019 ($)

Figure 23: US GDP – Composition of 2018, By Sector of Origin

Figure 24: US Export and Import Value & Volume, 2018-2019 ($)

Figure 25: Canada Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 26: Canada GDP and Population, 2018-2019 ($)

Figure 27: Canada GDP – Composition of 2018, By Sector of Origin

Figure 28: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29: Mexico Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 30: Mexico GDP and Population, 2018-2019 ($)

Figure 31: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33: South America Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 34: Brazil Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 35: Brazil GDP and Population, 2018-2019 ($)

Figure 36: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38: Venezuela Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 39: Venezuela GDP and Population, 2018-2019 ($)

Figure 40: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42: Argentina Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 43: Argentina GDP and Population, 2018-2019 ($)

Figure 44: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46: Ecuador Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 47: Ecuador GDP and Population, 2018-2019 ($)

Figure 48: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50: Peru Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 51: Peru GDP and Population, 2018-2019 ($)

Figure 52: Peru GDP – Composition of 2018, By Sector of Origin

Figure 53: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54: Colombia Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 55: Colombia GDP and Population, 2018-2019 ($)

Figure 56: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58: Costa Rica Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 59: Costa Rica GDP and Population, 2018-2019 ($)

Figure 60: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62: Europe Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 63: U.K Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 64: U.K GDP and Population, 2018-2019 ($)

Figure 65: U.K GDP – Composition of 2018, By Sector of Origin

Figure 66: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67: Germany Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 68: Germany GDP and Population, 2018-2019 ($)

Figure 69: Germany GDP – Composition of 2018, By Sector of Origin

Figure 70: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71: Italy Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 72: Italy GDP and Population, 2018-2019 ($)

Figure 73: Italy GDP – Composition of 2018, By Sector of Origin

Figure 74: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75: France Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 76: France GDP and Population, 2018-2019 ($)

Figure 77: France GDP – Composition of 2018, By Sector of Origin

Figure 78: France Export and Import Value & Volume, 2018-2019 ($)

Figure 79: Netherlands Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 80: Netherlands GDP and Population, 2018-2019 ($)

Figure 81: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83: Belgium Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 84: Belgium GDP and Population, 2018-2019 ($)

Figure 85: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87: Spain Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 88: Spain GDP and Population, 2018-2019 ($)

Figure 89: Spain GDP – Composition of 2018, By Sector of Origin

Figure 90: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91: Denmark Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 92: Denmark GDP and Population, 2018-2019 ($)

Figure 93: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95: APAC Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 96: China Mosquito Repeller Market Value & Volume, 2021-2026

Figure 97: China GDP and Population, 2018-2019 ($)

Figure 98: China GDP – Composition of 2018, By Sector of Origin

Figure 99: China Export and Import Value & Volume, 2018-2019 ($) Mosquito Repeller Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100: Australia Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 101: Australia GDP and Population, 2018-2019 ($)

Figure 102: Australia GDP – Composition of 2018, By Sector of Origin

Figure 103: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104: South Korea Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 105: South Korea GDP and Population, 2018-2019 ($)

Figure 106: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108: India Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 109: India GDP and Population, 2018-2019 ($)

Figure 110: India GDP – Composition of 2018, By Sector of Origin

Figure 111: India Export and Import Value & Volume, 2018-2019 ($)

Figure 112: Taiwan Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 113: Taiwan GDP and Population, 2018-2019 ($)

Figure 114: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116: Malaysia Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 117: Malaysia GDP and Population, 2018-2019 ($)

Figure 118: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120: Hong Kong Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 121: Hong Kong GDP and Population, 2018-2019 ($)

Figure 122: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124: Middle East & Africa Mosquito Repeller Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125: Russia Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 126: Russia GDP and Population, 2018-2019 ($)

Figure 127: Russia GDP – Composition of 2018, By Sector of Origin

Figure 128: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129: Israel Mosquito Repeller Market Value & Volume, 2021-2026 ($)

Figure 130: Israel GDP and Population, 2018-2019 ($)

Figure 131: Israel GDP – Composition of 2018, By Sector of Origin

Figure 132: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133: Entropy Share, By Strategies, 2018-2019* (%) Mosquito Repeller Market

Figure 134: Developments, 2018-2019* Mosquito Repeller Market

Figure 135: Company 1 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 136: Company 1 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137: Company 1 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 138: Company 2 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 139: Company 2 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140: Company 2 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 141: Company 3 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 142: Company 3 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143: Company 3 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 144: Company 4 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 145: Company 4 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146: Company 4 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 147: Company 5 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 148: Company 5 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149: Company 5 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 150: Company 6 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 151: Company 6 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152: Company 6 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 153: Company 7 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 154: Company 7 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155: Company 7 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 156: Company 8 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 157: Company 8 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158: Company 8 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 159: Company 9 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 160: Company 9 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161: Company 9 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 162: Company 10 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 163: Company 10 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164: Company 10 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 165: Company 11 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 166: Company 11 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167: Company 11 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 168: Company 12 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 169: Company 12 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170: Company 12 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 171: Company 13 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 172: Company 13 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173: Company 13 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 174: Company 14 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 175: Company 14 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176: Company 14 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Figure 177: Company 15 Mosquito Repeller Market Net Revenue, By Years, 2018-2019* ($)

Figure 178: Company 15 Mosquito Repeller Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179: Company 15 Mosquito Repeller Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print