The global LiDAR Market has accounted to $1,811.5 Million in 2023 and is estimated to grow at a CAGR of over 12 % during the forecast period of 2018 to 2023 majorly driven by the rising demand of mapping and surveying in various applications such as agriculture, infrastructure, transportation, and corridor mapping. The technological superiority of LiDAR compared to its alternatives along with the capability to provide enhanced efficiency with reduced human efforts is expected to drive the market growth in the near future.

What is LiDAR?

LiDAR stands for light detection and ranging or it can also be defined as laser imaging detection and ranging It is a remote sensing method in which light is used in the form of a laser to measure variable distances to the earth. It is a combination of 3D scanning and laser scanning hence sometimes it can be defined as 3D laser scanning. LiDAR can be segmented into three types they are Solid-State LiDAR, Airborne LiDAR, and Terrestrial LiDAR. Some of the benefits of using LiDAR technology are the ability to capture large amounts of area in a relatively small amount of time and low requirement of manual labor. LiDAR mapping system uses the most convenient technique to cover or scan the area which is called as drone lidar survey. LiDAR systems collect information by sending thousands of pulses of light per second and by calculating the time it takes for the pulse to reach the LiDAR sensor. This results in the accurate analysis and 3D description of geometric structures.

LiDAR can provide accurate information even in the case of obstructions such as bridges and tunnels. LiDAR in automobiles is used in self-driving cars as it can provide visibility in all directions all the time. The precise distance of the objects in relation with the car can be precisely known through LiDAR technology. Geospatial industry is expected to witness significant growth when compared to other segments and is expected to reach $706.7 million by 2023. LiDAR systems that incorporate a micro electro mechanical system (MEMS) scanner have a high signal to background ratio which results in high performance.

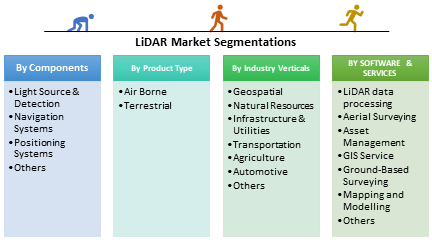

This report incorporates an in-depth analysis of the LiDAR market by component, product type, software & services, market share, industry verticals, and geography. The major components of LiDAR technology in the scope of this report includes light source & detection, navigation and position systems. The market by product type has been presented into two sub-segments namely airborne and terrestrial.

What are the major applications for LiDAR technology?

The various industry verticals assessed in this report include automotive, environment, infrastructure & utilities, geospatial, transportation, and defense & aerospace industries among others. LiDAR technology is being used in both manned and unmanned aerial systems. They are also used in inertial navigation systems to calculate the exterior orientation and for geo-referencing and in military & law enforcement for vehicle speed measurement.

LiDAR technology is used for many applications in various domains such as archaeology, agriculture, infrastructure and automotive. They are majorly employed in high-resolution 3D cameras, handheld 3D scanner, corridor mapping, laser imaging software, drone lidar survey and so on. LiDAR technology finds its application in forest management which helps in measuring the vertical structure of the forests as well as mapping the ground beneath it. Airborne LiDAR is used in applications such as Flood modeling, pollution modeling, urban planning & management. They are extensively used for visualization in game developing and metrology due to their ability to recreate any kind of environment.

Market Research and Market Trends of LiDAR Ecosystem

- The advancements of latest technologies such as single-photon and Geiger-mode LiDAR is expected to change the market drastically in the near future as they are effective particularly in the aerial mapping

- In 2017, The United States Geological Survey (USGS) Broad Agency has announced the launch of 3D Elevation Program (3DEP) initiative according to which high quality topographic data and a wide range of three dimensional representations of the natural and constructed features of the country has to be gathered with the help of LiDAR technology over an 8 year period

- Scientists at National Oceanic and Atmospheric Administration (NOAA) of the United States are planning to incorporate the usage LiDAR technology in order to increase the accuracy of the weather forecast

- LiDAR technology has provided enormous opportunities for autonomous cars as it can create 360 degrees high-resolution 3D view of the surrounding area and also developed products such as lidar rangefinder which offers accurate and fast ranging up to the wide distance. This is expected to have a huge impact on the market in the near future.

Who are the Major Players in the LiDAR market?

The companies referred to in the market research report include Faro Technologies Inc, Velodyne LiDAR, Leica Geosystems AG, Quanergy LiDAR Systems Inc, Riegl Laser Measurement Systems GmbH, Teledyne Technologies Inc and so on

What is our report scope?

The report incorporates in depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2018-2024.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

1. LiDAR Market - Overview

1.1. Definitions and Scope

2. LiDAR Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. LiDAR Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. LiDAR Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. LiDAR Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. LiDAR Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. LiDAR Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. LiDAR Market – By Components (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Introduction

8.3.2. Laser Scanners

8.3.3. Navigation Systems

8.3.4. Positioning Systems

8.3.5. Others

9. LiDAR Market – Product Type (Market Size -$Million / $Billion)

9.1. Introduction

9.2. Airborne LiDAR

9.2.1. Topographic

9.2.2. Bathymetric

9.3. Terrestrial LiDAR

9.3.1. Mobile

9.3.2. Static

9.3. Solid-State LiDAR

10. LiDAR Market – By Platform (Market Size -$Million / $Billion)

10.1. Aerial

10.2. Sattelite

11. LiDAR Market – Software and Services (Market Size -$Million / $Billion)

11.1. Introduction

11.2. LiDAR Data Processing

11.3. Aerial Surveying

11.4. Asset Management

11.5. GIS Service

11.6. Ground-based Surveying

11.7. Mapping and Modelling

11.8. Others

12. LiDAR Market – By Industry Verticals (Market Size -$Million / $Billion)

12.1. Introduction

12.2. Geospatial

12.3. Defense & Aerospace

12.4. Corridor Mapping

12.4.1. Roadways

12.4.2. Railways

12.4.3. Others

12.5. Engineering

12.6. Infrastructure & Utilities

12.7. Transportation

12.8. Environment

12.8.1. Forest Management

12.8.2. Coastline Management

12.8.3. Agriculture

12.8.4. Pollution Modelling

12.9. Exploration

12.9.1. Oil & Gas

12.9.2. Mining

12.10. Automotive

12.11. Others

13. LiDAR Market – By End Use Applications(Market Size -$Million / $Billion)

13.1. Segment type Size and Market Share Analysis

13.2. Application Revenue and Trends by type of Application

13.3. Application Segment Analysis by Type

13.3.1. Geology and hazards

13.3.2. Forestry Survey and planning

13.3.3. Navigation

13.3.4. Meteorology and Fire

13.3.5. Land Use and planning

13.3.6. Archeology Survey

13.3.7. Agriculture Mapping

13.3.8. Geospatial Mapping

13.3.9. Others

14. LiDAR - By Geography (Market Size -$Million / $Billion)

14.1. LiDAR Market - North America Segment Research

14.2. North America Market Research (Million / $Billion)

14.2.1. Segment type Size and Market Size Analysis

14.2.2. Revenue and Trends

14.2.3. Application Revenue and Trends by type of Application

14.2.4. Company Revenue and Product Analysis

14.2.5. North America Product type and Application Market Size

14.2.5.1. U.S.

14.2.5.2. Canada

14.2.5.3. Mexico

14.2.5.4. Rest of North America

14.3. LiDAR - South America Segment Research

14.4. South America Market Research (Market Size -$Million / $Billion)

14.4.1. Segment type Size and Market Size Analysis

14.4.2. Revenue and Trends

14.4.3. Application Revenue and Trends by type of Application

14.4.4. Company Revenue and Product Analysis

14.4.5. South America Product type and Application Market Size

14.4.5.1. Brazil

14.4.5.2. Venezuela

14.4.5.3. Argentina

14.4.5.4. Ecuador

14.4.5.5. Peru

14.4.5.6. Colombia

14.4.5.7. Costa Rica

14.4.5.8. Rest of South America

14.5. LiDAR - Europe Segment Research

14.6. Europe Market Research (Market Size -$Million / $Billion)

14.6.1. Segment type Size and Market Size Analysis

14.6.2. Revenue and Trends

14.6.3. Application Revenue and Trends by type of Application

14.6.4. Company Revenue and Product Analysis

14.6.5. Europe Segment Product type and Application Market Size

14.6.5.1. U.K

14.6.5.2. Germany

14.6.5.3. Italy

14.6.5.4. France

14.6.5.5. Netherlands

14.6.5.6. Belgium

14.6.5.7. Spain

14.6.5.8. Denmark

14.6.5.9. Rest of Europe

14.7. LiDAR – APAC Segment Research

14.8. APAC Market Research (Market Size -$Million / $Billion)

14.8.1. Segment type Size and Market Size Analysis

14.8.2. Revenue and Trends

14.8.3. Application Revenue and Trends by type of Application

14.8.4. Company Revenue and Product Analysis

14.8.5. APAC Segment – Product type and Application Market Size

14.8.5.1. China

14.8.5.2. Australia

14.8.5.3. Japan

14.8.5.4. South Korea

14.8.5.5. India

14.8.5.6. Taiwan

14.8.5.7. Malaysia

15. LiDAR Market - Entropy

15.1. New product launches

15.2. M&A's, collaborations, JVs and partnerships

16. LiDAR Market – Industry / Segment Competition landscape Premium

16.1. Market Share Analysis

16.1.1. Market Share by Country- Top companies

16.1.2. Market Share by Region- Top 10 companies

16.1.3. Market Share by type of Application – Top 10 companies

16.1.4. Market Share by type of Product / Product category- Top 10 companies

16.1.5. Market Share at global level- Top 10 companies

16.1.6. Best Practises for companies

17. LiDAR Market – Key Company List by Country Premium

18. LiDAR Market Company Analysis

18.1. Market Share, Company Revenue, Products, M&A, Developments

18.2. Faro Technologies Inc

18.3. Leica Geosystems AG

18.4. Quanergy Systems, Inc

18.5. Riegl Laser Measurement Systems GmbH

18.6. Teledyne Technologies Inc

18.7. Company 6

18.8. Company 7

18.9. Company 8

18.10. Company 9

18.11. Company 10 and others

"*Financials would be provided on a best efforts basis for private companies"

19. LiDAR Market -Appendix

19.1. Abbreviations

19.2. Sources

20. LiDAR Market -Methodology Premium

20.1. Research Methodology

20.1.1. Company Expert Interviews

20.1.2. Industry Databases

20.1.3. Associations

20.1.4. Company News

20.1.5. Company Annual Reports

20.1.6. Application Trends

20.1.7. New Products and Product database

20.1.8. Company Transcripts

20.1.9. R&D Trends

20.1.10. Key Opinion Leaders Interviews

20.1.11. Supply and Demand Trends

List of Tables

Table 1 LiDAR Market Overview 2021-2026

Table 2 LiDAR Market Leader Analysis 2018-2019 (US$)

Table 3 LiDAR Market Product Analysis 2018-2019 (US$)

Table 4 LiDAR Market End User Analysis 2018-2019 (US$)

Table 5 LiDAR Market Patent Analysis 2013-2018* (US$)

Table 6 LiDAR Market Financial Analysis 2018-2019 (US$)

Table 7 LiDAR Market Driver Analysis 2018-2019 (US$)

Table 8 LiDAR Market Challenges Analysis 2018-2019 (US$)

Table 9 LiDAR Market Constraint Analysis 2018-2019 (US$)

Table 10 LiDAR Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11 LiDAR Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12 LiDAR Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13 LiDAR Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14 LiDAR Market Degree of Competition Analysis 2018-2019 (US$)

Table 15 LiDAR Market Value Chain Analysis 2018-2019 (US$)

Table 16 LiDAR Market Pricing Analysis 2021-2026 (US$)

Table 17 LiDAR Market Opportunities Analysis 2021-2026 (US$)

Table 18 LiDAR Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19 LiDAR Market Supplier Analysis 2018-2019 (US$)

Table 20 LiDAR Market Distributor Analysis 2018-2019 (US$)

Table 21 LiDAR Market Trend Analysis 2018-2019 (US$)

Table 22 LiDAR Market Size 2018 (US$)

Table 23 LiDAR Market Forecast Analysis 2021-2026 (US$)

Table 24 LiDAR Market Sales Forecast Analysis 2021-2026 (Units)

Table 25 LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 26 LiDAR Market By Components, Revenue & Volume,By Laser Scanners, 2021-2026 ($)

Table 27 LiDAR Market By Components, Revenue & Volume,By Navigation Systems, 2021-2026 ($)

Table 28 LiDAR Market By Components, Revenue & Volume,By Positioning Systems, 2021-2026 ($)

Table 29 LiDAR Market By Components, Revenue & Volume,By Type 4, 2021-2026 ($)

Table 30 LiDAR Market By Components, Revenue & Volume,By Type 5, 2021-2026 ($)

Table 31 LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 32 LiDAR Market By Product Type, Revenue & Volume,By Airborne LiDAR, 2021-2026 ($)

Table 33 LiDAR Market By Product Type, Revenue & Volume,By Topographic, 2021-2026 ($)

Table 34 LiDAR Market By Product Type, Revenue & Volume,By Bathymetric, 2021-2026 ($)

Table 35 LiDAR Market By Product Type, Revenue & Volume,By Terrestrial LiDAR, 2021-2026 ($)

Table 36 LiDAR Market By Product Type, Revenue & Volume,By Mobile, 2021-2026 ($)

Table 37 LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 38 LiDAR Market By Industry Verticals, Revenue & Volume,By Geospatial, 2021-2026 ($)

Table 39 LiDAR Market By Industry Verticals, Revenue & Volume,By Defense & Aerospace, 2021-2026 ($)

Table 40 LiDAR Market By Industry Verticals, Revenue & Volume,By Corridor Mapping, 2021-2026 ($)

Table 41 LiDAR Market By Industry Verticals, Revenue & Volume,By Roadways, 2021-2026 ($)

Table 42 LiDAR Market By Industry Verticals, Revenue & Volume,By Railways, 2021-2026 ($)

Table 43 LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 44 LiDAR Market By Application, Revenue & Volume,By Application 1, 2021-2026 ($)

Table 45 LiDAR Market By Application, Revenue & Volume,By Application 2, 2021-2026 ($)

Table 46 LiDAR Market By Application, Revenue & Volume,By Application 3, 2021-2026 ($)

Table 47 LiDAR Market By Application, Revenue & Volume,By Application 4, 2021-2026 ($)

Table 48 LiDAR Market By Application, Revenue & Volume,By Application 5, 2021-2026 ($)

Table 49 LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 50 LiDAR Market By End Use Applications, Revenue & Volume,By Geology and hazards, 2021-2026 ($)

Table 51 LiDAR Market By End Use Applications, Revenue & Volume,By Forestry Survey and planning, 2021-2026 ($)

Table 52 LiDAR Market By End Use Applications, Revenue & Volume,By Navigation Systems, 2021-2026 ($)

Table 53 LiDAR Market By End Use Applications, Revenue & Volume,By Meteorology and Fire, 2021-2026 ($)

Table 54 LiDAR Market By End Use Applications, Revenue & Volume,By Land Use and planning, 2021-2026 ($)

Table 55 North America LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 56 North America LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 57 North America LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 58 North America LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 59 North America LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 60 South america LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 61 South america LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 62 South america LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 63 South america LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 64 South america LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 65 Europe LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 66 Europe LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 67 Europe LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 68 Europe LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 69 Europe LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 70 APAC LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 71 APAC LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 72 APAC LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 73 APAC LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 74 APAC LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 75 Middle East & Africa LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 76 Middle East & Africa LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 77 Middle East & Africa LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 78 Middle East & Africa LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 79 Middle East & Africa LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 80 Russia LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 81 Russia LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 82 Russia LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 83 Russia LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 84 Russia LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 85 Israel LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 86 Israel LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 87 Israel LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 88 Israel LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 89 Israel LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 90 Top Companies 2018 (US$)LiDAR Market, Revenue & Volume,

Table 91 Product Launch 2018-2019LiDAR Market, Revenue & Volume,

Table 92 Mergers & Acquistions 2018-2019LiDAR Market, Revenue & Volume,

List of Figures

Figure 1 Overview of LiDAR Market 2021-2026

Figure 2 Market Share Analysis for LiDAR Market 2018 (US$)

Figure 3 Product Comparison in LiDAR Market 2018-2019 (US$)

Figure 4 End User Profile for LiDAR Market 2018-2019 (US$)

Figure 5 Patent Application and Grant in LiDAR Market 2013-2018* (US$)

Figure 6 Top 5 Companies Financial Analysis in LiDAR Market 2018-2019 (US$)

Figure 7 Market Entry Strategy in LiDAR Market 2018-2019

Figure 8 Ecosystem Analysis in LiDAR Market 2018

Figure 9 Average Selling Price in LiDAR Market 2021-2026

Figure 10 Top Opportunites in LiDAR Market 2018-2019

Figure 11 Market Life Cycle Analysis in LiDAR Market

Figure 12 GlobalBy ComponentsLiDAR Market Revenue, 2021-2026 ($)

Figure 13 GlobalBy Product TypeLiDAR Market Revenue, 2021-2026 ($)

Figure 14 GlobalBy Industry VerticalsLiDAR Market Revenue, 2021-2026 ($)

Figure 15 GlobalBy ApplicationLiDAR Market Revenue, 2021-2026 ($)

Figure 16 GlobalBy End Use ApplicationsLiDAR Market Revenue, 2021-2026 ($)

Figure 17 Global LiDAR Market - By Geography

Figure 18 Global LiDAR Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19 Global LiDAR Market CAGR, By Geography, 2021-2026 (%)

Figure 20 North America LiDAR Market Value & Volume, 2021-2026 ($)

Figure 21 US LiDAR Market Value & Volume, 2021-2026 ($)

Figure 22 US GDP and Population, 2018-2019 ($)

Figure 23 US GDP – Composition of 2018, By Sector of Origin

Figure 24 US Export and Import Value & Volume, 2018-2019 ($)

Figure 25 Canada LiDAR Market Value & Volume, 2021-2026 ($)

Figure 26 Canada GDP and Population, 2018-2019 ($)

Figure 27 Canada GDP – Composition of 2018, By Sector of Origin

Figure 28 Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29 Mexico LiDAR Market Value & Volume, 2021-2026 ($)

Figure 30 Mexico GDP and Population, 2018-2019 ($)

Figure 31 Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32 Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33 South America LiDAR Market Value & Volume, 2021-2026 ($)

Figure 34 Brazil LiDAR Market Value & Volume, 2021-2026 ($)

Figure 35 Brazil GDP and Population, 2018-2019 ($)

Figure 36 Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37 Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38 Venezuela LiDAR Market Value & Volume, 2021-2026 ($)

Figure 39 Venezuela GDP and Population, 2018-2019 ($)

Figure 40 Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41 Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42 Argentina LiDAR Market Value & Volume, 2021-2026 ($)

Figure 43 Argentina GDP and Population, 2018-2019 ($)

Figure 44 Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45 Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46 Ecuador LiDAR Market Value & Volume, 2021-2026 ($)

Figure 47 Ecuador GDP and Population, 2018-2019 ($)

Figure 48 Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49 Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50 Peru LiDAR Market Value & Volume, 2021-2026 ($)

Figure 51 Peru GDP and Population, 2018-2019 ($)

Figure 52 Peru GDP – Composition of 2018, By Sector of Origin

Figure 53 Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54 Colombia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 55 Colombia GDP and Population, 2018-2019 ($)

Figure 56 Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57 Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58 Costa Rica LiDAR Market Value & Volume, 2021-2026 ($)

Figure 59 Costa Rica GDP and Population, 2018-2019 ($)

Figure 60 Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61 Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62 Europe LiDAR Market Value & Volume, 2021-2026 ($)

Figure 63 U.K LiDAR Market Value & Volume, 2021-2026 ($)

Figure 64 U.K GDP and Population, 2018-2019 ($)

Figure 65 U.K GDP – Composition of 2018, By Sector of Origin

Figure 66 U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67 Germany LiDAR Market Value & Volume, 2021-2026 ($)

Figure 68 Germany GDP and Population, 2018-2019 ($)

Figure 69 Germany GDP – Composition of 2018, By Sector of Origin

Figure 70 Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71 Italy LiDAR Market Value & Volume, 2021-2026 ($)

Figure 72 Italy GDP and Population, 2018-2019 ($)

Figure 73 Italy GDP – Composition of 2018, By Sector of Origin

Figure 74 Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75 France LiDAR Market Value & Volume, 2021-2026 ($)

Figure 76 France GDP and Population, 2018-2019 ($)

Figure 77 France GDP – Composition of 2018, By Sector of Origin

Figure 78 France Export and Import Value & Volume, 2018-2019 ($)

Figure 79 Netherlands LiDAR Market Value & Volume, 2021-2026 ($)

Figure 80 Netherlands GDP and Population, 2018-2019 ($)

Figure 81 Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82 Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83 Belgium LiDAR Market Value & Volume, 2021-2026 ($)

Figure 84 Belgium GDP and Population, 2018-2019 ($)

Figure 85 Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86 Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87 Spain LiDAR Market Value & Volume, 2021-2026 ($)

Figure 88 Spain GDP and Population, 2018-2019 ($)

Figure 89 Spain GDP – Composition of 2018, By Sector of Origin

Figure 90 Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91 Denmark LiDAR Market Value & Volume, 2021-2026 ($)

Figure 92 Denmark GDP and Population, 2018-2019 ($)

Figure 93 Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94 Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95 APAC LiDAR Market Value & Volume, 2021-2026 ($)

Figure 96 China LiDAR Market Value & Volume, 2021-2026

Figure 97 China GDP and Population, 2018-2019 ($)

Figure 98 China GDP – Composition of 2018, By Sector of Origin

Figure 99 China Export and Import Value & Volume, 2018-2019 ($)LiDAR Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100 Australia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 101 Australia GDP and Population, 2018-2019 ($)

Figure 102 Australia GDP – Composition of 2018, By Sector of Origin

Figure 103 Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104 South Korea LiDAR Market Value & Volume, 2021-2026 ($)

Figure 105 South Korea GDP and Population, 2018-2019 ($)

Figure 106 South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107 South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108 India LiDAR Market Value & Volume, 2021-2026 ($)

Figure 109 India GDP and Population, 2018-2019 ($)

Figure 110 India GDP – Composition of 2018, By Sector of Origin

Figure 111 India Export and Import Value & Volume, 2018-2019 ($)

Figure 112 Taiwan LiDAR Market Value & Volume, 2021-2026 ($)

Figure 113 Taiwan GDP and Population, 2018-2019 ($)

Figure 114 Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115 Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116 Malaysia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 117 Malaysia GDP and Population, 2018-2019 ($)

Figure 118 Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119 Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120 Hong Kong LiDAR Market Value & Volume, 2021-2026 ($)

Figure 121 Hong Kong GDP and Population, 2018-2019 ($)

Figure 122 Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123 Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124 Middle East & Africa LiDAR Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125 Russia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 126 Russia GDP and Population, 2018-2019 ($)

Figure 127 Russia GDP – Composition of 2018, By Sector of Origin

Figure 128 Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129 Israel LiDAR Market Value & Volume, 2021-2026 ($)

Figure 130 Israel GDP and Population, 2018-2019 ($)

Figure 131 Israel GDP – Composition of 2018, By Sector of Origin

Figure 132 Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133 Entropy Share, By Strategies, 2018-2019* (%)LiDAR Market

Figure 134 Developments, 2018-2019*LiDAR Market

Figure 135 Company 1 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 136 Company 1 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137 Company 1 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 138 Company 2 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 139 Company 2 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140 Company 2 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 141 Company 3LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 142 Company 3LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143 Company 3LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 144 Company 4 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 145 Company 4 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146 Company 4 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 147 Company 5 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 148 Company 5 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149 Company 5 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 150 Company 6 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 151 Company 6 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152 Company 6 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 153 Company 7 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 154 Company 7 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155 Company 7 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 156 Company 8 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 157 Company 8 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158 Company 8 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 159 Company 9 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 160 Company 9 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161 Company 9 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 162 Company 10 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 163 Company 10 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164 Company 10 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 165 Company 11 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 166 Company 11 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167 Company 11 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 168 Company 12 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 169 Company 12 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170 Company 12 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 171 Company 13LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 172 Company 13LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173 Company 13LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 174 Company 14 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 175 Company 14 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176 Company 14 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 177 Company 15 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 178 Company 15 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179 Company 15 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Table 1 LiDAR Market Overview 2021-2026

Table 2 LiDAR Market Leader Analysis 2018-2019 (US$)

Table 3 LiDAR Market Product Analysis 2018-2019 (US$)

Table 4 LiDAR Market End User Analysis 2018-2019 (US$)

Table 5 LiDAR Market Patent Analysis 2013-2018* (US$)

Table 6 LiDAR Market Financial Analysis 2018-2019 (US$)

Table 7 LiDAR Market Driver Analysis 2018-2019 (US$)

Table 8 LiDAR Market Challenges Analysis 2018-2019 (US$)

Table 9 LiDAR Market Constraint Analysis 2018-2019 (US$)

Table 10 LiDAR Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11 LiDAR Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12 LiDAR Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13 LiDAR Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14 LiDAR Market Degree of Competition Analysis 2018-2019 (US$)

Table 15 LiDAR Market Value Chain Analysis 2018-2019 (US$)

Table 16 LiDAR Market Pricing Analysis 2021-2026 (US$)

Table 17 LiDAR Market Opportunities Analysis 2021-2026 (US$)

Table 18 LiDAR Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19 LiDAR Market Supplier Analysis 2018-2019 (US$)

Table 20 LiDAR Market Distributor Analysis 2018-2019 (US$)

Table 21 LiDAR Market Trend Analysis 2018-2019 (US$)

Table 22 LiDAR Market Size 2018 (US$)

Table 23 LiDAR Market Forecast Analysis 2021-2026 (US$)

Table 24 LiDAR Market Sales Forecast Analysis 2021-2026 (Units)

Table 25 LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 26 LiDAR Market By Components, Revenue & Volume,By Laser Scanners, 2021-2026 ($)

Table 27 LiDAR Market By Components, Revenue & Volume,By Navigation Systems, 2021-2026 ($)

Table 28 LiDAR Market By Components, Revenue & Volume,By Positioning Systems, 2021-2026 ($)

Table 29 LiDAR Market By Components, Revenue & Volume,By Type 4, 2021-2026 ($)

Table 30 LiDAR Market By Components, Revenue & Volume,By Type 5, 2021-2026 ($)

Table 31 LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 32 LiDAR Market By Product Type, Revenue & Volume,By Airborne LiDAR, 2021-2026 ($)

Table 33 LiDAR Market By Product Type, Revenue & Volume,By Topographic, 2021-2026 ($)

Table 34 LiDAR Market By Product Type, Revenue & Volume,By Bathymetric, 2021-2026 ($)

Table 35 LiDAR Market By Product Type, Revenue & Volume,By Terrestrial LiDAR, 2021-2026 ($)

Table 36 LiDAR Market By Product Type, Revenue & Volume,By Mobile, 2021-2026 ($)

Table 37 LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 38 LiDAR Market By Industry Verticals, Revenue & Volume,By Geospatial, 2021-2026 ($)

Table 39 LiDAR Market By Industry Verticals, Revenue & Volume,By Defense & Aerospace, 2021-2026 ($)

Table 40 LiDAR Market By Industry Verticals, Revenue & Volume,By Corridor Mapping, 2021-2026 ($)

Table 41 LiDAR Market By Industry Verticals, Revenue & Volume,By Roadways, 2021-2026 ($)

Table 42 LiDAR Market By Industry Verticals, Revenue & Volume,By Railways, 2021-2026 ($)

Table 43 LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 44 LiDAR Market By Application, Revenue & Volume,By Application 1, 2021-2026 ($)

Table 45 LiDAR Market By Application, Revenue & Volume,By Application 2, 2021-2026 ($)

Table 46 LiDAR Market By Application, Revenue & Volume,By Application 3, 2021-2026 ($)

Table 47 LiDAR Market By Application, Revenue & Volume,By Application 4, 2021-2026 ($)

Table 48 LiDAR Market By Application, Revenue & Volume,By Application 5, 2021-2026 ($)

Table 49 LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 50 LiDAR Market By End Use Applications, Revenue & Volume,By Geology and hazards, 2021-2026 ($)

Table 51 LiDAR Market By End Use Applications, Revenue & Volume,By Forestry Survey and planning, 2021-2026 ($)

Table 52 LiDAR Market By End Use Applications, Revenue & Volume,By Navigation Systems, 2021-2026 ($)

Table 53 LiDAR Market By End Use Applications, Revenue & Volume,By Meteorology and Fire, 2021-2026 ($)

Table 54 LiDAR Market By End Use Applications, Revenue & Volume,By Land Use and planning, 2021-2026 ($)

Table 55 North America LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 56 North America LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 57 North America LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 58 North America LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 59 North America LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 60 South america LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 61 South america LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 62 South america LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 63 South america LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 64 South america LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 65 Europe LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 66 Europe LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 67 Europe LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 68 Europe LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 69 Europe LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 70 APAC LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 71 APAC LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 72 APAC LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 73 APAC LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 74 APAC LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 75 Middle East & Africa LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 76 Middle East & Africa LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 77 Middle East & Africa LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 78 Middle East & Africa LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 79 Middle East & Africa LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 80 Russia LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 81 Russia LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 82 Russia LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 83 Russia LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 84 Russia LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 85 Israel LiDAR Market, Revenue & Volume,By Components, 2021-2026 ($)

Table 86 Israel LiDAR Market, Revenue & Volume,By Product Type, 2021-2026 ($)

Table 87 Israel LiDAR Market, Revenue & Volume,By Industry Verticals, 2021-2026 ($)

Table 88 Israel LiDAR Market, Revenue & Volume,By Application, 2021-2026 ($)

Table 89 Israel LiDAR Market, Revenue & Volume,By End Use Applications, 2021-2026 ($)

Table 90 Top Companies 2018 (US$)LiDAR Market, Revenue & Volume,

Table 91 Product Launch 2018-2019LiDAR Market, Revenue & Volume,

Table 92 Mergers & Acquistions 2018-2019LiDAR Market, Revenue & Volume,

List of Figures

Figure 1 Overview of LiDAR Market 2021-2026

Figure 2 Market Share Analysis for LiDAR Market 2018 (US$)

Figure 3 Product Comparison in LiDAR Market 2018-2019 (US$)

Figure 4 End User Profile for LiDAR Market 2018-2019 (US$)

Figure 5 Patent Application and Grant in LiDAR Market 2013-2018* (US$)

Figure 6 Top 5 Companies Financial Analysis in LiDAR Market 2018-2019 (US$)

Figure 7 Market Entry Strategy in LiDAR Market 2018-2019

Figure 8 Ecosystem Analysis in LiDAR Market 2018

Figure 9 Average Selling Price in LiDAR Market 2021-2026

Figure 10 Top Opportunites in LiDAR Market 2018-2019

Figure 11 Market Life Cycle Analysis in LiDAR Market

Figure 12 GlobalBy ComponentsLiDAR Market Revenue, 2021-2026 ($)

Figure 13 GlobalBy Product TypeLiDAR Market Revenue, 2021-2026 ($)

Figure 14 GlobalBy Industry VerticalsLiDAR Market Revenue, 2021-2026 ($)

Figure 15 GlobalBy ApplicationLiDAR Market Revenue, 2021-2026 ($)

Figure 16 GlobalBy End Use ApplicationsLiDAR Market Revenue, 2021-2026 ($)

Figure 17 Global LiDAR Market - By Geography

Figure 18 Global LiDAR Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19 Global LiDAR Market CAGR, By Geography, 2021-2026 (%)

Figure 20 North America LiDAR Market Value & Volume, 2021-2026 ($)

Figure 21 US LiDAR Market Value & Volume, 2021-2026 ($)

Figure 22 US GDP and Population, 2018-2019 ($)

Figure 23 US GDP – Composition of 2018, By Sector of Origin

Figure 24 US Export and Import Value & Volume, 2018-2019 ($)

Figure 25 Canada LiDAR Market Value & Volume, 2021-2026 ($)

Figure 26 Canada GDP and Population, 2018-2019 ($)

Figure 27 Canada GDP – Composition of 2018, By Sector of Origin

Figure 28 Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29 Mexico LiDAR Market Value & Volume, 2021-2026 ($)

Figure 30 Mexico GDP and Population, 2018-2019 ($)

Figure 31 Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32 Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33 South America LiDAR Market Value & Volume, 2021-2026 ($)

Figure 34 Brazil LiDAR Market Value & Volume, 2021-2026 ($)

Figure 35 Brazil GDP and Population, 2018-2019 ($)

Figure 36 Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37 Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38 Venezuela LiDAR Market Value & Volume, 2021-2026 ($)

Figure 39 Venezuela GDP and Population, 2018-2019 ($)

Figure 40 Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41 Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42 Argentina LiDAR Market Value & Volume, 2021-2026 ($)

Figure 43 Argentina GDP and Population, 2018-2019 ($)

Figure 44 Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45 Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46 Ecuador LiDAR Market Value & Volume, 2021-2026 ($)

Figure 47 Ecuador GDP and Population, 2018-2019 ($)

Figure 48 Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49 Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50 Peru LiDAR Market Value & Volume, 2021-2026 ($)

Figure 51 Peru GDP and Population, 2018-2019 ($)

Figure 52 Peru GDP – Composition of 2018, By Sector of Origin

Figure 53 Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54 Colombia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 55 Colombia GDP and Population, 2018-2019 ($)

Figure 56 Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57 Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58 Costa Rica LiDAR Market Value & Volume, 2021-2026 ($)

Figure 59 Costa Rica GDP and Population, 2018-2019 ($)

Figure 60 Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61 Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62 Europe LiDAR Market Value & Volume, 2021-2026 ($)

Figure 63 U.K LiDAR Market Value & Volume, 2021-2026 ($)

Figure 64 U.K GDP and Population, 2018-2019 ($)

Figure 65 U.K GDP – Composition of 2018, By Sector of Origin

Figure 66 U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67 Germany LiDAR Market Value & Volume, 2021-2026 ($)

Figure 68 Germany GDP and Population, 2018-2019 ($)

Figure 69 Germany GDP – Composition of 2018, By Sector of Origin

Figure 70 Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71 Italy LiDAR Market Value & Volume, 2021-2026 ($)

Figure 72 Italy GDP and Population, 2018-2019 ($)

Figure 73 Italy GDP – Composition of 2018, By Sector of Origin

Figure 74 Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75 France LiDAR Market Value & Volume, 2021-2026 ($)

Figure 76 France GDP and Population, 2018-2019 ($)

Figure 77 France GDP – Composition of 2018, By Sector of Origin

Figure 78 France Export and Import Value & Volume, 2018-2019 ($)

Figure 79 Netherlands LiDAR Market Value & Volume, 2021-2026 ($)

Figure 80 Netherlands GDP and Population, 2018-2019 ($)

Figure 81 Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82 Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83 Belgium LiDAR Market Value & Volume, 2021-2026 ($)

Figure 84 Belgium GDP and Population, 2018-2019 ($)

Figure 85 Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86 Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87 Spain LiDAR Market Value & Volume, 2021-2026 ($)

Figure 88 Spain GDP and Population, 2018-2019 ($)

Figure 89 Spain GDP – Composition of 2018, By Sector of Origin

Figure 90 Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91 Denmark LiDAR Market Value & Volume, 2021-2026 ($)

Figure 92 Denmark GDP and Population, 2018-2019 ($)

Figure 93 Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94 Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95 APAC LiDAR Market Value & Volume, 2021-2026 ($)

Figure 96 China LiDAR Market Value & Volume, 2021-2026

Figure 97 China GDP and Population, 2018-2019 ($)

Figure 98 China GDP – Composition of 2018, By Sector of Origin

Figure 99 China Export and Import Value & Volume, 2018-2019 ($)LiDAR Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100 Australia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 101 Australia GDP and Population, 2018-2019 ($)

Figure 102 Australia GDP – Composition of 2018, By Sector of Origin

Figure 103 Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104 South Korea LiDAR Market Value & Volume, 2021-2026 ($)

Figure 105 South Korea GDP and Population, 2018-2019 ($)

Figure 106 South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107 South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108 India LiDAR Market Value & Volume, 2021-2026 ($)

Figure 109 India GDP and Population, 2018-2019 ($)

Figure 110 India GDP – Composition of 2018, By Sector of Origin

Figure 111 India Export and Import Value & Volume, 2018-2019 ($)

Figure 112 Taiwan LiDAR Market Value & Volume, 2021-2026 ($)

Figure 113 Taiwan GDP and Population, 2018-2019 ($)

Figure 114 Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115 Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116 Malaysia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 117 Malaysia GDP and Population, 2018-2019 ($)

Figure 118 Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119 Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120 Hong Kong LiDAR Market Value & Volume, 2021-2026 ($)

Figure 121 Hong Kong GDP and Population, 2018-2019 ($)

Figure 122 Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123 Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124 Middle East & Africa LiDAR Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125 Russia LiDAR Market Value & Volume, 2021-2026 ($)

Figure 126 Russia GDP and Population, 2018-2019 ($)

Figure 127 Russia GDP – Composition of 2018, By Sector of Origin

Figure 128 Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129 Israel LiDAR Market Value & Volume, 2021-2026 ($)

Figure 130 Israel GDP and Population, 2018-2019 ($)

Figure 131 Israel GDP – Composition of 2018, By Sector of Origin

Figure 132 Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133 Entropy Share, By Strategies, 2018-2019* (%)LiDAR Market

Figure 134 Developments, 2018-2019*LiDAR Market

Figure 135 Company 1 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 136 Company 1 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137 Company 1 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 138 Company 2 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 139 Company 2 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140 Company 2 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 141 Company 3LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 142 Company 3LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143 Company 3LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 144 Company 4 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 145 Company 4 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146 Company 4 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 147 Company 5 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 148 Company 5 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149 Company 5 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 150 Company 6 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 151 Company 6 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152 Company 6 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 153 Company 7 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 154 Company 7 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155 Company 7 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 156 Company 8 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 157 Company 8 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158 Company 8 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 159 Company 9 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 160 Company 9 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161 Company 9 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 162 Company 10 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 163 Company 10 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164 Company 10 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 165 Company 11 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 166 Company 11 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167 Company 11 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 168 Company 12 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 169 Company 12 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170 Company 12 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 171 Company 13LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 172 Company 13LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173 Company 13LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 174 Company 14 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 175 Company 14 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176 Company 14 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Figure 177 Company 15 LiDAR Market Net Revenue, By Years, 2018-2019* ($)

Figure 178 Company 15 LiDAR Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179 Company 15 LiDAR Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print