Cardiac Implant Devices Market - Forecast(2024 - 2030)

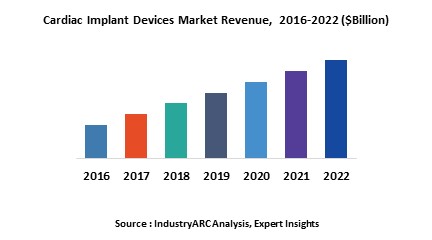

Cardiac implant devices is valued $30,539million in the year 2017 and is expected to grow at a CAGR of 12.5% from 2018-2023.Cardiac implant devices is segmented based on the type of devices in which coronary stunts is having the highest market share in the year 2017 which is valued $9,542 million in the year 2017 and is anticipated to grow at a CAGR of 11.6% from 2018-2023, followed by ICDs which is valued $7,327 million in the year 2017 and is expected to grow at a CAGR of 13.0% from 2018-2023.Increase in the number of elderly people with increased chronic disease will drive the market for cardiac implant devices.

What is Cardiac Implant Devices Market?

Cardiac implant devices are used to treat long term heart conditions such as heart failure and other heart dysfunctions.Implanting devices into the patient’s body is the second stage of the cardiac treatment.Oral medication is considered first and then the devices are implanted into the patient’s body.This cardiac implant devices are segmented based on the device types in which ICDs are considered as the most commonly used device.Advancements in ICD devices are improving the cardiac treatments.

Market Research and Market Trends of Cardiac Implant Device Market

- Cardio vascular device research laboratory is actively involved in the research and development of new medical devices.Their main focus of area include heart failure medical devices and wireless medical devices monitoring system.

- MoMe Kardia device is a wearable device used for monitoring the patient condition and the recorded information is continuously stream to cloud.This device gives an alert message if there is any disturbance in the patient condition which helps to address them quickly.

- Centers for Medicare and Medicaid service (CMS) has proposed changes in ICD device with advanced technology.The advancement in technology in ICD device is a battery powered device placed under the skin of the patient that keeps a track of the person’s heart rate.Thin wires connect the ICD to heart.If there is any abnormal heart rhythm detected the device will deliver an electronic shock to restore a normal heart beat.This device can prevent a patient from sudden deaths.

- ICD has transformed to use an advanced technology by using Medtronic care link monitor device which is a small convenient device that allows patients to gather information by holding an antenna over the implanted cardiac device.This data is automatically downloaded by the monitor and sent through an internet connection.Clinicians can access the patient’s data by logging onto a website from anywhere.

- Implantable drug delivery system is a device which is implanted inside the patient’s body which deliver small amount of drugs on a regular basis.By this system the patient does not need to be injected.By using implantable drug delivery system it gives more consistent drug level in blood when compared to using injections which makes the treatment more effective which will also reduce side effects.The dosage of the drug can be adjusted according to the patient requirements.

- Cardiac system which is a small pacemaker implanted into a patient body which continuously monitor the heartbeat and as soon as AF (Atrial fibrillation) is detected it emits low energy electrical pulse that are hardly felt by the patient.This system does not require any separate set of delivery devices and the system can be switched off and on repetitively as per the patient’s convenience.

Who are the Major Players in Food diagnostic equipment and consumable market?

The companies referred in the market research report includes Ametek Inc, Beckman coulter Inc, Biomerieux Inc, Bio-rad laboratories, Bruker Corporation and many more.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market.Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2018-2024.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

1. Cardiac Implant Devices Market - Overview

1.1. Definitions and Scope

2. Cardiac Implant Devices Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Cardiac Implant Devices Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Cardiac Implant Devices Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Cardiac Implant Devices Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Cardiac Implant Devices Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Cardiac Implant Devices Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Cardiac Implant Devices Market – By Devices (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Cardiac Resynchronization Therapy Devices (CRTs)

8.3.2. Implantable Cardioverter Defibrillators (ICDs)

8.3.3. Implantable Cardiac Pacemakers (ICPs)

8.3.4. Coronary Stents

8.3.5. Heart value Replacement/ Repair Devices

8.3.6. TAVR (Transactheter Aortic Value Replacement) Valves

8.3.7. Watchman implant device

8.3.8. Implantable cardiac loop recorder

8.3.9. Ventricular Assist Devices (VADs)

8.3.10. Catheter ablation

8.3.11. Others

9. Cardiac Implant Devices Market – By Disease Conditions (Market Size -$Million / $Billion)

9.1. Myocardial Ischemia

9.1.1. Acute Myocardial Infarction

9.2. Arrhythmias

9.2.1. Atrial Fibrillation

9.2.2. Ventricular Fibrillation

9.2.3. Ventricular Tachycardia

9.3. Congestive Heart Failure (CHF)

9.4. Angina Pectoris (AP)

9.4.1. Stable Angina

9.4.2. Unstable Angina

9.5. Cardiomyopathy

9.6. Aortic Aneurism

9.7. Others

10. Cardiac Implant Devices Market – By Procedure (Market Size -$Million / $Billion)

10.1. Introduction

10.2. Cardiac Resynchronization Therapy (CRT)

10.3. Open heart surgery

10.4. Angioplasty

10.5. Bypass

10.6. Heart Valve Repair or Replacement

10.7. Others

11. Cardiac Implant Devices - By Geography (Market Size -$Million / $Billion)

11.1. Cardiac Implant Devices Market - North America Segment Research

11.2. North America Market Research (Million / $Billion)

11.2.1. Segment type Size and Market Size Analysis

11.2.2. Revenue and Trends

11.2.3. Application Revenue and Trends by type of Application

11.2.4. Company Revenue and Product Analysis

11.2.5. North America Product type and Application Market Size

11.2.5.1. U.S.

11.2.5.2. Canada

11.2.5.3. Mexico

11.2.5.4. Rest of North America

11.3. Cardiac Implant Devices - South America Segment Research

11.4. South America Market Research (Market Size -$Million / $Billion)

11.4.1. Segment type Size and Market Size Analysis

11.4.2. Revenue and Trends

11.4.3. Application Revenue and Trends by type of Application

11.4.4. Company Revenue and Product Analysis

11.4.5. South America Product type and Application Market Size

11.4.5.1. Brazil

11.4.5.2. Venezuela

11.4.5.3. Argentina

11.4.5.4. Ecuador

11.4.5.5. Peru

11.4.5.6. Colombia

11.4.5.7. Costa Rica

11.4.5.8. Rest of South America

11.5. Cardiac Implant Devices - Europe Segment Research

11.6. Europe Market Research (Market Size -$Million / $Billion)

11.6.1. Segment type Size and Market Size Analysis

11.6.2. Revenue and Trends

11.6.3. Application Revenue and Trends by type of Application

11.6.4. Company Revenue and Product Analysis

11.6.5. Europe Segment Product type and Application Market Size

11.6.5.1. U.K

11.6.5.2. Germany

11.6.5.3. Italy

11.6.5.4. France

11.6.5.5. Netherlands

11.6.5.6. Belgium

11.6.5.7. Spain

11.6.5.8. Denmark

11.6.5.9. Rest of Europe

11.7. Cardiac Implant Devices – APAC Segment Research

11.8. APAC Market Research (Market Size -$Million / $Billion)

11.8.1. Segment type Size and Market Size Analysis

11.8.2. Revenue and Trends

11.8.3. Application Revenue and Trends by type of Application

11.8.4. Company Revenue and Product Analysis

11.8.5. APAC Segment – Product type and Application Market Size

11.8.5.1. China

11.8.5.2. Australia

11.8.5.3. Japan

11.8.5.4. South Korea

11.8.5.5. India

11.8.5.6. Taiwan

11.8.5.7. Malaysia

12. Cardiac Implant Devices Market - Entropy

12.1. New product launches

12.2. M&A's, collaborations, JVs and partnerships

13. Cardiac Implant Devices Market – Industry / Segment Competition landscape Premium

13.1. Market Share Analysis

13.1.1. Market Share by Country- Top companies

13.1.2. Market Share by Region- Top 10 companies

13.1.3. Market Share by type of Application – Top 10 companies

13.1.4. Market Share by type of Product / Product category- Top 10 companies

13.1.5. Market Share at global level- Top 10 companies

13.1.6. Best Practises for companies

14. Cardiac Implant Devices Market – Key Company List by Country Premium

15. Cardiac Implant Devices Market Company Analysis

15.1. Market Share, Company Revenue, Products, M&A, Developments

15.2. Abbott Vascular Inc.

15.3. Medtronic, Inc.

15.4. Biotronik, Inc.

15.5. Bentley InnoMed GmbH

15.6. Elestim-Cardio

15.7. Cardioelectronica GmbH

15.8. Qualimed Innovative Medizinprodukte Gmbh

15.9. Medico S.p.A

15.10. Lepu Medical Technology

15.11. Boston Scientific Corporation

15.12. Company 11

15.13. Company 12

15.14. Company 13 and more

"*Financials would be provided on a best efforts basis for private companies"

16. Cardiac Implant Devices Market -Appendix

16.1. Abbreviations

16.2. Sources

17. Cardiac Implant Devices Market -Methodology Premium

17.1. Research Methodology

17.1.1. Company Expert Interviews

17.1.2. Industry Databases

17.1.3. Associations

17.1.4. Company News

17.1.5. Company Annual Reports

17.1.6. Application Trends

17.1.7. New Products and Product database

17.1.8. Company Transcripts

17.1.9. R&D Trends

17.1.10. Key Opinion Leaders Interviews

17.1.11. Supply and Demand Trends

List of Tables

Table 1: Cardiac Implant Devices Market Overview 2021-2026

Table 2: Cardiac Implant Devices Market Leader Analysis 2018-2019 (US$)

Table 3: Cardiac Implant Devices Market Product Analysis 2018-2019 (US$)

Table 4: Cardiac Implant Devices Market End User Analysis 2018-2019 (US$)

Table 5: Cardiac Implant Devices Market Patent Analysis 2013-2018* (US$)

Table 6: Cardiac Implant Devices Market Financial Analysis 2018-2019 (US$)

Table 7: Cardiac Implant Devices Market Driver Analysis 2018-2019 (US$)

Table 8: Cardiac Implant Devices Market Challenges Analysis 2018-2019 (US$)

Table 9: Cardiac Implant Devices Market Constraint Analysis 2018-2019 (US$)

Table 10: Cardiac Implant Devices Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Cardiac Implant Devices Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Cardiac Implant Devices Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Cardiac Implant Devices Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Cardiac Implant Devices Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Cardiac Implant Devices Market Value Chain Analysis 2018-2019 (US$)

Table 16: Cardiac Implant Devices Market Pricing Analysis 2021-2026 (US$)

Table 17: Cardiac Implant Devices Market Opportunities Analysis 2021-2026 (US$)

Table 18: Cardiac Implant Devices Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Cardiac Implant Devices Market Supplier Analysis 2018-2019 (US$)

Table 20: Cardiac Implant Devices Market Distributor Analysis 2018-2019 (US$)

Table 21: Cardiac Implant Devices Market Trend Analysis 2018-2019 (US$)

Table 22: Cardiac Implant Devices Market Size 2018 (US$)

Table 23: Cardiac Implant Devices Market Forecast Analysis 2021-2026 (US$)

Table 24: Cardiac Implant Devices Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 26: Cardiac Implant Devices Market By Devices, Revenue & Volume, By Cardiac Resynchronization Therapy Devices, 2021-2026 ($)

Table 27: Cardiac Implant Devices Market By Devices, Revenue & Volume, By ImplanTableCardioverter Defibrillators, 2021-2026 ($)

Table 28: Cardiac Implant Devices Market By Devices, Revenue & Volume, By ImplanTableCardiac Pacemakers, 2021-2026 ($)

Table 29: Cardiac Implant Devices Market By Devices, Revenue & Volume, By Coronary Stents, 2021-2026 ($)

Table 30: Cardiac Implant Devices Market By Devices, Revenue & Volume, By Heart value Replacement/ Repair Devices, 2021-2026 ($)

Table 31: Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 32: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Myocardial Ischemia, 2021-2026 ($)

Table 33: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Arrhythmias, 2021-2026 ($)

Table 34: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Congestive Heart Failure, 2021-2026 ($)

Table 35: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Angina Pectoris, 2021-2026 ($)

Table 36: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Cardiomyopathy, 2021-2026 ($)

Table 37: Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 38: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Introduction, 2021-2026 ($)

Table 39: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Cardiac Resynchronization Therapy, 2021-2026 ($)

Table 40: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Open heart surgery, 2021-2026 ($)

Table 41: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Angioplasty, 2021-2026 ($)

Table 42: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Bypass, 2021-2026 ($)

Table 43: North America Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 44: North America Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 45: North America Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 46: South america Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 47: South america Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 48: South america Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 49: Europe Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 50: Europe Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 51: Europe Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 52: APACCardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 53: APACCardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 54: APACCardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 55: Middle East & Africa Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 56: Middle East & Africa Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 57: Middle East & Africa Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 58: Russia Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 59: Russia Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 60: Russia Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 61: Israel Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 62: Israel Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 63: Israel Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 64: Top Companies 2018 (US$)Cardiac Implant Devices Market, Revenue & Volume

Table 65: Product Launch 2018-2019Cardiac Implant Devices Market, Revenue & Volume

Table 66: Mergers & Acquistions 2018-2019Cardiac Implant Devices Market, Revenue & Volume

List of Figures

Figure 1: Overview of Cardiac Implant Devices Market 2021-2026

Figure 2: Market Share Analysis for Cardiac Implant Devices Market 2018 (US$)

Figure 3: Product Comparison in Cardiac Implant Devices Market 2018-2019 (US$)

Figure 4: End User Profile for Cardiac Implant Devices Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Cardiac Implant Devices Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Cardiac Implant Devices Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Cardiac Implant Devices Market 2018-2019

Figure 8: Ecosystem Analysis in Cardiac Implant Devices Market 2018

Figure 9: Average Selling Price in Cardiac Implant Devices Market 2021-2026

Figure 10: Top Opportunites in Cardiac Implant Devices Market 2018-2019

Figure 11: Market Life Cycle Analysis in Cardiac Implant Devices Market

Figure 12: GlobalBy DevicesCardiac Implant Devices Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy Disease ConditionsCardiac Implant Devices Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy ProcedureCardiac Implant Devices Market Revenue, 2021-2026 ($)

Figure 15: Global Cardiac Implant Devices Market - By Geography

Figure 16: Global Cardiac Implant Devices Market Value & Volume, By Geography, 2021-2026 ($)

Figure 17: Global Cardiac Implant Devices Market CAGR, By Geography, 2021-2026 (%)

Figure 18: North America Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 19: US Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 20: US GDP and Population, 2018-2019 ($)

Figure 21: US GDP – Composition of 2018, By Sector of Origin

Figure 22: US Export and Import Value & Volume, 2018-2019 ($)

Figure 23: Canada Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 24: Canada GDP and Population, 2018-2019 ($)

Figure 25: Canada GDP – Composition of 2018, By Sector of Origin

Figure 26: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 27: Mexico Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 28: Mexico GDP and Population, 2018-2019 ($)

Figure 29: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 30: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 31: South America Cardiac Implant Devices Market South America 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 32: Brazil Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 33: Brazil GDP and Population, 2018-2019 ($)

Figure 34: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 35: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 36: Venezuela Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 37: Venezuela GDP and Population, 2018-2019 ($)

Figure 38: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 39: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 40: Argentina Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 41: Argentina GDP and Population, 2018-2019 ($)

Figure 42: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 43: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 44: Ecuador Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 45: Ecuador GDP and Population, 2018-2019 ($)

Figure 46: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 47: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 48: Peru Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 49: Peru GDP and Population, 2018-2019 ($)

Figure 50: Peru GDP – Composition of 2018, By Sector of Origin

Figure 51: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 52: Colombia Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 53: Colombia GDP and Population, 2018-2019 ($)

Figure 54: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 55: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 56: Costa Rica Cardiac Implant Devices Market Costa Rica 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 57: Costa Rica GDP and Population, 2018-2019 ($)

Figure 58: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 59: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 60: Europe Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 61: U.K Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 62: U.K GDP and Population, 2018-2019 ($)

Figure 63: U.K GDP – Composition of 2018, By Sector of Origin

Figure 64: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 65: Germany Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 66: Germany GDP and Population, 2018-2019 ($)

Figure 67: Germany GDP – Composition of 2018, By Sector of Origin

Figure 68: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 69: Italy Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 70: Italy GDP and Population, 2018-2019 ($)

Figure 71: Italy GDP – Composition of 2018, By Sector of Origin

Figure 72: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 73: France Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 74: France GDP and Population, 2018-2019 ($)

Figure 75: France GDP – Composition of 2018, By Sector of Origin

Figure 76: France Export and Import Value & Volume, 2018-2019 ($)

Figure 77: Netherlands Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 78: Netherlands GDP and Population, 2018-2019 ($)

Figure 79: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 80: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 81: Belgium Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 82: Belgium GDP and Population, 2018-2019 ($)

Figure 83: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 84: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 85: Spain Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 86: Spain GDP and Population, 2018-2019 ($)

Figure 87: Spain GDP – Composition of 2018, By Sector of Origin

Figure 88: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 89: Denmark Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 90: Denmark GDP and Population, 2018-2019 ($)

Figure 91: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 92: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 93: APAC Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 94: China Cardiac Implant Devices Market Value & Volume, 2021-2026

Figure 95: China GDP and Population, 2018-2019 ($)

Figure 96: China GDP – Composition of 2018, By Sector of Origin

Figure 97: China Export and Import Value & Volume, 2018-2019 ($)Cardiac Implant Devices Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 98: Australia Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 99: Australia GDP and Population, 2018-2019 ($)

Figure 100: Australia GDP – Composition of 2018, By Sector of Origin

Figure 101: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 102: South Korea Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 103: South Korea GDP and Population, 2018-2019 ($)

Figure 104: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 105: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 106: India Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 107: India GDP and Population, 2018-2019 ($)

Figure 108: India GDP – Composition of 2018, By Sector of Origin

Figure 109: India Export and Import Value & Volume, 2018-2019 ($)

Figure 110: Taiwan Cardiac Implant Devices Market Taiwan 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 111: Taiwan GDP and Population, 2018-2019 ($)

Figure 112: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 113: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 114: Malaysia Cardiac Implant Devices Market Malaysia 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 115: Malaysia GDP and Population, 2018-2019 ($)

Figure 116: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 117: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 118: Hong Kong Cardiac Implant Devices Market Hong Kong 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 119: Hong Kong GDP and Population, 2018-2019 ($)

Figure 120: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 121: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 122: Middle East & Africa Cardiac Implant Devices Market Middle East & Africa 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 123: Russia Cardiac Implant Devices Market Russia 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 124: Russia GDP and Population, 2018-2019 ($)

Figure 125: Russia GDP – Composition of 2018, By Sector of Origin

Figure 126: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 127: Israel Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 128: Israel GDP and Population, 2018-2019 ($)

Figure 129: Israel GDP – Composition of 2018, By Sector of Origin

Figure 130: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 131 Entropy Share, By Strategies, 2018-2019* (%)Cardiac Implant Devices Market

Figure 132 Developments, 2018-2019*Cardiac Implant Devices Market

Figure 133: Company 1 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 134: Company 1 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 135: Company 1 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 136: Company 2 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 137: Company 2 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 138: Company 2 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 139: Company 3 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 140: Company 3 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 141: Company 3 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 142: Company 4 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 143: Company 4 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 144: Company 4 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 145: Company 5 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 146: Company 5 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 147: Company 5 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 148: Company 6 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 149: Company 6 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 150: Company 6 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 151: Company 7 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 152: Company 7 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 153: Company 7 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 154: Company 8 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 155: Company 8 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 156: Company 8 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 157: Company 9 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 158: Company 9 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 159: Company 9 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 160: Company 10 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 161: Company 10 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 162: Company 10 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 163: Company 11 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 164: Company 11 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 165: Company 11 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 166: Company 12 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 167: Company 12 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 168: Company 12 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 169: Company 13 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 170: Company 13 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 171: Company 13 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 172: Company 14 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 173: Company 14 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 174: Company 14 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 175: Company 15 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 176: Company 15 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 177: Company 15 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Table 1: Cardiac Implant Devices Market Overview 2021-2026

Table 2: Cardiac Implant Devices Market Leader Analysis 2018-2019 (US$)

Table 3: Cardiac Implant Devices Market Product Analysis 2018-2019 (US$)

Table 4: Cardiac Implant Devices Market End User Analysis 2018-2019 (US$)

Table 5: Cardiac Implant Devices Market Patent Analysis 2013-2018* (US$)

Table 6: Cardiac Implant Devices Market Financial Analysis 2018-2019 (US$)

Table 7: Cardiac Implant Devices Market Driver Analysis 2018-2019 (US$)

Table 8: Cardiac Implant Devices Market Challenges Analysis 2018-2019 (US$)

Table 9: Cardiac Implant Devices Market Constraint Analysis 2018-2019 (US$)

Table 10: Cardiac Implant Devices Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Cardiac Implant Devices Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Cardiac Implant Devices Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Cardiac Implant Devices Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Cardiac Implant Devices Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Cardiac Implant Devices Market Value Chain Analysis 2018-2019 (US$)

Table 16: Cardiac Implant Devices Market Pricing Analysis 2021-2026 (US$)

Table 17: Cardiac Implant Devices Market Opportunities Analysis 2021-2026 (US$)

Table 18: Cardiac Implant Devices Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Cardiac Implant Devices Market Supplier Analysis 2018-2019 (US$)

Table 20: Cardiac Implant Devices Market Distributor Analysis 2018-2019 (US$)

Table 21: Cardiac Implant Devices Market Trend Analysis 2018-2019 (US$)

Table 22: Cardiac Implant Devices Market Size 2018 (US$)

Table 23: Cardiac Implant Devices Market Forecast Analysis 2021-2026 (US$)

Table 24: Cardiac Implant Devices Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 26: Cardiac Implant Devices Market By Devices, Revenue & Volume, By Cardiac Resynchronization Therapy Devices, 2021-2026 ($)

Table 27: Cardiac Implant Devices Market By Devices, Revenue & Volume, By ImplanTableCardioverter Defibrillators, 2021-2026 ($)

Table 28: Cardiac Implant Devices Market By Devices, Revenue & Volume, By ImplanTableCardiac Pacemakers, 2021-2026 ($)

Table 29: Cardiac Implant Devices Market By Devices, Revenue & Volume, By Coronary Stents, 2021-2026 ($)

Table 30: Cardiac Implant Devices Market By Devices, Revenue & Volume, By Heart value Replacement/ Repair Devices, 2021-2026 ($)

Table 31: Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 32: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Myocardial Ischemia, 2021-2026 ($)

Table 33: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Arrhythmias, 2021-2026 ($)

Table 34: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Congestive Heart Failure, 2021-2026 ($)

Table 35: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Angina Pectoris, 2021-2026 ($)

Table 36: Cardiac Implant Devices Market By Disease Conditions, Revenue & Volume, By Cardiomyopathy, 2021-2026 ($)

Table 37: Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 38: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Introduction, 2021-2026 ($)

Table 39: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Cardiac Resynchronization Therapy, 2021-2026 ($)

Table 40: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Open heart surgery, 2021-2026 ($)

Table 41: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Angioplasty, 2021-2026 ($)

Table 42: Cardiac Implant Devices Market By Procedure, Revenue & Volume, By Bypass, 2021-2026 ($)

Table 43: North America Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 44: North America Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 45: North America Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 46: South america Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 47: South america Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 48: South america Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 49: Europe Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 50: Europe Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 51: Europe Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 52: APACCardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 53: APACCardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 54: APACCardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 55: Middle East & Africa Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 56: Middle East & Africa Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 57: Middle East & Africa Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 58: Russia Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 59: Russia Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 60: Russia Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 61: Israel Cardiac Implant Devices Market, Revenue & Volume, By Devices, 2021-2026 ($)

Table 62: Israel Cardiac Implant Devices Market, Revenue & Volume, By Disease Conditions, 2021-2026 ($)

Table 63: Israel Cardiac Implant Devices Market, Revenue & Volume, By Procedure, 2021-2026 ($)

Table 64: Top Companies 2018 (US$)Cardiac Implant Devices Market, Revenue & Volume

Table 65: Product Launch 2018-2019Cardiac Implant Devices Market, Revenue & Volume

Table 66: Mergers & Acquistions 2018-2019Cardiac Implant Devices Market, Revenue & Volume

List of Figures

Figure 1: Overview of Cardiac Implant Devices Market 2021-2026

Figure 2: Market Share Analysis for Cardiac Implant Devices Market 2018 (US$)

Figure 3: Product Comparison in Cardiac Implant Devices Market 2018-2019 (US$)

Figure 4: End User Profile for Cardiac Implant Devices Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Cardiac Implant Devices Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Cardiac Implant Devices Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Cardiac Implant Devices Market 2018-2019

Figure 8: Ecosystem Analysis in Cardiac Implant Devices Market 2018

Figure 9: Average Selling Price in Cardiac Implant Devices Market 2021-2026

Figure 10: Top Opportunites in Cardiac Implant Devices Market 2018-2019

Figure 11: Market Life Cycle Analysis in Cardiac Implant Devices Market

Figure 12: GlobalBy DevicesCardiac Implant Devices Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy Disease ConditionsCardiac Implant Devices Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy ProcedureCardiac Implant Devices Market Revenue, 2021-2026 ($)

Figure 15: Global Cardiac Implant Devices Market - By Geography

Figure 16: Global Cardiac Implant Devices Market Value & Volume, By Geography, 2021-2026 ($)

Figure 17: Global Cardiac Implant Devices Market CAGR, By Geography, 2021-2026 (%)

Figure 18: North America Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 19: US Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 20: US GDP and Population, 2018-2019 ($)

Figure 21: US GDP – Composition of 2018, By Sector of Origin

Figure 22: US Export and Import Value & Volume, 2018-2019 ($)

Figure 23: Canada Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 24: Canada GDP and Population, 2018-2019 ($)

Figure 25: Canada GDP – Composition of 2018, By Sector of Origin

Figure 26: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 27: Mexico Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 28: Mexico GDP and Population, 2018-2019 ($)

Figure 29: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 30: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 31: South America Cardiac Implant Devices Market South America 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 32: Brazil Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 33: Brazil GDP and Population, 2018-2019 ($)

Figure 34: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 35: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 36: Venezuela Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 37: Venezuela GDP and Population, 2018-2019 ($)

Figure 38: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 39: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 40: Argentina Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 41: Argentina GDP and Population, 2018-2019 ($)

Figure 42: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 43: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 44: Ecuador Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 45: Ecuador GDP and Population, 2018-2019 ($)

Figure 46: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 47: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 48: Peru Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 49: Peru GDP and Population, 2018-2019 ($)

Figure 50: Peru GDP – Composition of 2018, By Sector of Origin

Figure 51: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 52: Colombia Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 53: Colombia GDP and Population, 2018-2019 ($)

Figure 54: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 55: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 56: Costa Rica Cardiac Implant Devices Market Costa Rica 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 57: Costa Rica GDP and Population, 2018-2019 ($)

Figure 58: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 59: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 60: Europe Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 61: U.K Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 62: U.K GDP and Population, 2018-2019 ($)

Figure 63: U.K GDP – Composition of 2018, By Sector of Origin

Figure 64: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 65: Germany Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 66: Germany GDP and Population, 2018-2019 ($)

Figure 67: Germany GDP – Composition of 2018, By Sector of Origin

Figure 68: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 69: Italy Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 70: Italy GDP and Population, 2018-2019 ($)

Figure 71: Italy GDP – Composition of 2018, By Sector of Origin

Figure 72: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 73: France Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 74: France GDP and Population, 2018-2019 ($)

Figure 75: France GDP – Composition of 2018, By Sector of Origin

Figure 76: France Export and Import Value & Volume, 2018-2019 ($)

Figure 77: Netherlands Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 78: Netherlands GDP and Population, 2018-2019 ($)

Figure 79: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 80: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 81: Belgium Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 82: Belgium GDP and Population, 2018-2019 ($)

Figure 83: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 84: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 85: Spain Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 86: Spain GDP and Population, 2018-2019 ($)

Figure 87: Spain GDP – Composition of 2018, By Sector of Origin

Figure 88: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 89: Denmark Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 90: Denmark GDP and Population, 2018-2019 ($)

Figure 91: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 92: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 93: APAC Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 94: China Cardiac Implant Devices Market Value & Volume, 2021-2026

Figure 95: China GDP and Population, 2018-2019 ($)

Figure 96: China GDP – Composition of 2018, By Sector of Origin

Figure 97: China Export and Import Value & Volume, 2018-2019 ($)Cardiac Implant Devices Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 98: Australia Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 99: Australia GDP and Population, 2018-2019 ($)

Figure 100: Australia GDP – Composition of 2018, By Sector of Origin

Figure 101: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 102: South Korea Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 103: South Korea GDP and Population, 2018-2019 ($)

Figure 104: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 105: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 106: India Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 107: India GDP and Population, 2018-2019 ($)

Figure 108: India GDP – Composition of 2018, By Sector of Origin

Figure 109: India Export and Import Value & Volume, 2018-2019 ($)

Figure 110: Taiwan Cardiac Implant Devices Market Taiwan 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 111: Taiwan GDP and Population, 2018-2019 ($)

Figure 112: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 113: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 114: Malaysia Cardiac Implant Devices Market Malaysia 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 115: Malaysia GDP and Population, 2018-2019 ($)

Figure 116: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 117: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 118: Hong Kong Cardiac Implant Devices Market Hong Kong 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 119: Hong Kong GDP and Population, 2018-2019 ($)

Figure 120: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 121: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 122: Middle East & Africa Cardiac Implant Devices Market Middle East & Africa 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 123: Russia Cardiac Implant Devices Market Russia 3D PrintingMarket Value & Volume, 2021-2026 ($)

Figure 124: Russia GDP and Population, 2018-2019 ($)

Figure 125: Russia GDP – Composition of 2018, By Sector of Origin

Figure 126: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 127: Israel Cardiac Implant Devices Market Value & Volume, 2021-2026 ($)

Figure 128: Israel GDP and Population, 2018-2019 ($)

Figure 129: Israel GDP – Composition of 2018, By Sector of Origin

Figure 130: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 131 Entropy Share, By Strategies, 2018-2019* (%)Cardiac Implant Devices Market

Figure 132 Developments, 2018-2019*Cardiac Implant Devices Market

Figure 133: Company 1 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 134: Company 1 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 135: Company 1 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 136: Company 2 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 137: Company 2 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 138: Company 2 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 139: Company 3 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 140: Company 3 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 141: Company 3 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 142: Company 4 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 143: Company 4 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 144: Company 4 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 145: Company 5 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 146: Company 5 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 147: Company 5 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 148: Company 6 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 149: Company 6 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 150: Company 6 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 151: Company 7 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 152: Company 7 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 153: Company 7 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 154: Company 8 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 155: Company 8 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 156: Company 8 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 157: Company 9 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 158: Company 9 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 159: Company 9 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 160: Company 10 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 161: Company 10 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 162: Company 10 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 163: Company 11 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 164: Company 11 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 165: Company 11 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 166: Company 12 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 167: Company 12 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 168: Company 12 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 169: Company 13 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 170: Company 13 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 171: Company 13 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 172: Company 14 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 173: Company 14 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 174: Company 14 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Figure 175: Company 15 Cardiac Implant Devices Market Net Revenue, By Years, 2018-2019* ($)

Figure 176: Company 15 Cardiac Implant Devices Market Net Revenue Share, By Business segments, 2018 (%)

Figure 177: Company 15 Cardiac Implant Devices Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print