Oilfield Drilling Fluid Additives Market - Forecast(2024 - 2030)

The report predicts the Oilfields Drilling Fluids Additives Market to grow with a CAGR of 2.56 % over the forecast period of 2018 - 2023. The Global Oilfields Drilling Fluids Additives Market size at $1575.10 million in 2017 is anticipated to grow extensively in 2023. The Global Oilfield Drilling Fluid Additives Market Industry Analysis states, oil production and exploration activities in the past decade have increased due to the rapid growth of the global economy that is highly based oil & gas sector to meet its energy demands.

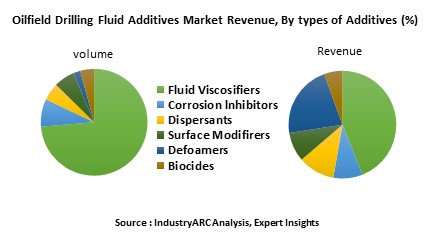

The chemical formulation has resulted in growing demand for Oil field drilling fluids used in the exploration process. Fluid viscosifiers hold the largest market share of about 81% followed by corrosion inhibitors, which accounted for about 6%. North America has witnessed significant growth in the market with a global share rising to more than 50% of the market in 2017 due to growing offshore drilling activities in the Gulf of Mexico.

What are the major applications of Oilfields Drilling Fluids Additives?

Oilfield Fluids Additives play an important role in oil and gas industry. The drilling fuel additives are most used by the industry are organic chemicals and solvents, surfactants, transition metal compounds, and inorganic salts. These drilling fluid additives majorly applied as a supporting agent for drilling holes on the surface of the earth, typically in oil and natural gas mining.

Apart from this major application, drilling fluid additives are also used in simple bore wells. The influencing factor for using drilling mud additives in oil mining is that it dispense hydrostatic pressure to obstruct formation fluids which will infiltrate into the bore well and always maintains the drill bit in a cooling condition, effectively finishing drill cutting, and postponing the cutting of drill when drilling is halted and when the drilling assembly in moving in to the hole. This drilling mud additives are applied to get rid of formation damage and to prevent from corrosion. The other functions include wetting agents to maintain usability capacity, dispersant, and clay stabilization.

Market Research and Market Trends of Oilfields Drilling fluids Additives

- Nanotechnology in Drilling Fluids: Nanoparticle has been in a prominent use in almost all the industry operation and requirement in oil and gas mining industry in order to minimize the environmental factors connected with recovery of oil is perilous. Many research studies have also concluded that nanoparticles introducing into drilling lubricant can increase its thermal stability. R&D from major players have reported that nano-additives are capable to increase the strength of well bore, reduce the loss of fluid, friction reduction at the time drilling to a maximum extent.

- Integrated Drilling Fluid System: There is always a demand for an integrated system which provides multiple solution in single unit and the customer requires it to be available across the regions. These integrated solution systems available across the region can make possible by means of acquisition and merger. Whole in One is an integrated drilling fluid system which is a combination of more than one component can be used for multi directional drills, provides flexible lubricity and provides performance and speed of an OB drilling lubricant in a favored water based system.

- Exploration in offshore drilling: The Oil and Gas Industry move its exploration efforts towards offshore oil mining with a remarkable project along the coastal sides of South America and West Africa. Nanofiltrate membrane is a sodium chloride permeability which is capable to reject more than 50% sodium chloride components, barium and sorium sulphate when operating under sea water. GE’s recent launch, seawater sulphate removal (SWSR) which filters all sulphate composites from the water that has been injected for offshore drilling production.

Who are the Major Players in market?

The key players operating in the Oilfields drilling fluids additives market are Akzo Nobel, BASF SE, Chevron Phillips, DoW Chemical, Innospec Inc., Tetra Technologies and other 10 more companies.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2017-2023.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

1. Oilfield Drilling Fluid Additives Market - Overview

1.1. Definitions and Scope

2. Oilfield Drilling Fluid Additives Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Oilfield Drilling Fluid Additives Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Oilfield Drilling Fluid Additives Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Oilfield Drilling Fluid Additives Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Oilfield Drilling Fluid Additives Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Oilfield Drilling Fluid Additives Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Oilfield Drilling Fluid Additives Market – By Type (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Fluid Viscosities

8.3.2. Alkalinity Control

8.3.2.1. Soda Ash

8.3.2.2. Citric Acid

8.3.2.3. Lime

8.3.3. Emulsifiers

8.3.3.1. Primary Emulsifier

8.3.3.2. Secondary Emulsifier

8.3.4. Pipe Freeing Agent/Spotting Fluid

8.3.4.1. Non-Weighted Spotting Fluid

8.3.4.2. Weighted Spotting Fluid

8.3.5. Scavengers

8.3.5.1. Zinc Oxide

8.3.5.2. Zinc Carbonate

8.3.6. Corrosion Inhibitors

8.3.7. Dispersants

8.3.7.1. Ionic

8.3.7.2. Non-Ionic

8.3.8. Surface Modifiers

8.3.9. Defoamers

8.3.9.1. Water

8.3.9.2. Alcohol

8.3.9.3. Polyglycol

8.3.9.4. Stearate

8.3.9.5. Oil

8.3.9.6. Silicon

8.3.9.7. Polymer

8.3.9.8. Alkyl Polyacrylates

8.3.10. Biocides

8.3.10.1. Gluteraldehyde

8.3.10.2. Chlorine

8.3.10.3. Tetrakis Hydroxymathyl Phosphonium Sulfate

8.3.10.4. Others

9. Oilfield Drilling Fluid Additives Market – By Fluid Formation (Market Size -$Million / $Billion)

9.1. Water Based

9.1.1. Dispersed

9.1.2. Non-Dispersed

9.1.3. Salt Water drilling fluids

9.1.4. Polymer drilling fluids

9.2. Oil Based

9.3. Synthetic Based

10. Oilfield Drilling Fluid Additives - By Geography (Market Size -$Million / $Billion)

10.1. Oilfield Drilling Fluid Additives Market - North America Segment Research

10.2. North America Market Research (Million / $Billion)

10.2.1. Segment type Size and Market Size Analysis

10.2.2. Revenue and Trends

10.2.3. Application Revenue and Trends by type of Application

10.2.4. Company Revenue and Product Analysis

10.2.5. North America Product type and Application Market Size

10.2.5.1. U.S.

10.2.5.2. Canada

10.2.5.3. Mexico

10.2.5.4. Rest of North America

10.3. Oilfield Drilling Fluid Additives - South America Segment Research

10.4. South America Market Research (Market Size -$Million / $Billion)

10.4.1. Segment type Size and Market Size Analysis

10.4.2. Revenue and Trends

10.4.3. Application Revenue and Trends by type of Application

10.4.4. Company Revenue and Product Analysis

10.4.5. South America Product type and Application Market Size

10.4.5.1. Brazil

10.4.5.2. Venezuela

10.4.5.3. Argentina

10.4.5.4. Ecuador

10.4.5.5. Peru

10.4.5.6. Colombia

10.4.5.7. Costa Rica

10.4.5.8. Rest of South America

10.5. Oilfield Drilling Fluid Additives - Europe Segment Research

10.6. Europe Market Research (Market Size -$Million / $Billion)

10.6.1. Segment type Size and Market Size Analysis

10.6.2. Revenue and Trends

10.6.3. Application Revenue and Trends by type of Application

10.6.4. Company Revenue and Product Analysis

10.6.5. Europe Segment Product type and Application Market Size

10.6.5.1. U.K

10.6.5.2. Germany

10.6.5.3. Italy

10.6.5.4. France

10.6.5.5. Netherlands

10.6.5.6. Belgium

10.6.5.7. Spain

10.6.5.8. Denmark

10.6.5.9. Rest of Europe

10.7. Oilfield Drilling Fluid Additives – APAC Segment Research

10.8. APAC Market Research (Market Size -$Million / $Billion)

10.8.1. Segment type Size and Market Size Analysis

10.8.2. Revenue and Trends

10.8.3. Application Revenue and Trends by type of Application

10.8.4. Company Revenue and Product Analysis

10.8.5. APAC Segment – Product type and Application Market Size

10.8.5.1. China

10.8.5.2. Australia

10.8.5.3. Japan

10.8.5.4. South Korea

10.8.5.5. India

10.8.5.6. Taiwan

10.8.5.7. Malaysia

11. Oilfield Drilling Fluid Additives Market - Entropy

11.1. New product launches

11.2. M&A's, collaborations, JVs and partnerships

12. Oilfield Drilling Fluid Additives Market – Industry / Segment Competition landscape Premium

12.1. Market Share Analysis

12.1.1. Market Share by Country- Top companies

12.1.2. Market Share by Region- Top 10 companies

12.1.3. Market Share by type of Application – Top 10 companies

12.1.4. Market Share by type of Product / Product category- Top 10 companies

12.1.5. Market Share at global level- Top 10 companies

12.1.6. Best Practises for companies

13. Oilfield Drilling Fluid Additives Market – Key Company List by Country Premium

14. Oilfield Drilling Fluid Additives Market Company Analysis

14.1. Market Share, Company Revenue, Products, M&A, Developments

14.2. Akzo Nobel

14.3. BASF SE

14.4. Chevron Phillips

14.5. DoW Chemical

14.6. Innospec Inc.

14.7. Tetra Technologies

14.8. Company 7

14.9. Company 8

14.10. Company 9

14.11. Company 10 and more

"*Financials would be provided on a best efforts basis for private companies"

15. Oilfield Drilling Fluid Additives Market -Appendix

15.1. Abbreviations

15.2. Sources

16. Oilfield Drilling Fluid Additives Market -Methodology Premium

16.1. Research Methodology

16.1.1. Company Expert Interviews

16.1.2. Industry Databases

16.1.3. Associations

16.1.4. Company News

16.1.5. Company Annual Reports

16.1.6. Application Trends

16.1.7. New Products and Product database

16.1.8. Company Transcripts

16.1.9. R&D Trends

16.1.10. Key Opinion Leaders Interviews

16.1.11. Supply and Demand Trends

LIST OF TABLES

Table 1. Global Oilfield Drilling Fluid Additives Market, by Geography, 2014-2020 ($Million)

Table 2. Product Benchmarking For Viscosifier Oilfield Da, by Company

Table 3. Financials Analysis, by Top 5 Companies, 2014 ($Billion)

Table 4. Shale Projects Inaugurated In China, 2014

Table 5. The U.S.: New Well Oil Production PER RIG, May 2015 Vs. June 2015 (Barrels/Day)

Table 6. Global Oilfield Drilling Fluid Additive Market Revenue, by Formulation, 2014-2020 ($Million) Table 7. Global Oilfield Drilling Fluid Additive Market Volume, by Formulation, 2014-2020 (KT)

Table 8. Global Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 9. Global Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 10. Global Fluid Viscosifier Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 11. Global Fluid Viscosifiers Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 12. Global Fluid Viscosifier Oilfield Drilling Fluid Additive Market Revenue, by Formulation, 2014-2020 ($Million)

Table 13. Global Corrosion Inhibitor Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 14. Global Corrosion Inhibitor Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 15. Global Corrosion Inhibitors Oilfield Drilling Fluid Additive Market Revenue, by Formulation, 2014-2020 ($Million)

Table 16. Global Dispersant Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 17. Global Dispersant Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 18. Global Dispersants Oilfield Drilling Fluid Additives Industry Revenue, by Formulation, 2014-2020 ($Million) Table 19. Global Surface Modifiers Oilfield Drilling Fluid Additives Industry Revenue, by Formulation, 2014-2020 ($Million)

Table 20. Global Defoamer Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 21. Global Defoamer Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 22. Global Defoamer Oilfield Drilling Fluid Additives Market Revenue, by Formulation, 2014-2020 ($Million)

Table 23. Global Biocide Oilfield Drilling Fluid Additives Market Revenue, by Type, 2014-2020 ($Million)

Table 24. Global Biocide Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 25. Global Oilfield Drilling Fluid Additives Market Volume, by Region, 2014-2020 (KT)

Table 26. Global Oilfield Drilling Fluid Additives Market Revenue, by Region, 2014-2020 ($Million)

Table 27. North America Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 28. North America Oilfield Drilling Fluid Additives Market Revenue, by Type, 2014-2020 ($Million)

Table 29. North America Oilfield Drilling Fluid Additives Market Volume, by Country, 2014-2020 (KT) Table 30. North America Oilfield Drilling Fluid Additives Industry Revenue, by Country, 2014-2020 ($Million)

Table 31. U.S. Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 32. Canada Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 33. Mexico Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 34. Europe Oilfield Drilling Fluid Additives Industry Volume, by Type, 2014-2020 (KT)

Table 35. Europe Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 36. Europe Oilfield Drilling Fluid Additives Industry Volume, by Country, 2014-2020 (KT)

Table 37. Europe Oilfield Drilling Fluid Additives Industry Revenue, by Country, 2014-2020 ($Million)

Table 38. Russia Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 39. U.K. Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 40. France Oilfield Drilling Fluid Additives Market Revenue, by Type, 2014-2020 ($Million)

Table 41. Roe Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million) Table 42. APAC Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 43. APAC Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 44. APAC Oilfield Drilling Fluid Additive Market Volume, by Country, 2014-2020 (KT)

Table 45. APAC Oilfield Drilling Fluid Additive Market Revenue, by Country, 2014-2020 ($Million)

Table 46. China Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 47. India Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 48. Middle East Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 49. Middle East Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 50. Middle East Oilfield Drilling Fluid Additive Market Volume, by Country, 2014-2020 (KT) Table 51. Middle East Oilfield Drilling Fluid Additives Industry Revenue, by Country, 2014-2020 ($Million)

Table 52. Saudi Arabia Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 53. Row Oilfield Drilling Fluid Additives Industry Volume, by Type, 2014-2020 (KT)

Table 54. Row Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 55. Chevron Phillips Chemical Company- Total Revenue, 2014 – 2013 ($Billion)

Table 56. Chevron Phillips Chemical Company: Oilfield Drilling Fluid Products and Applications

Table 57. CP KELCO: Products & Their Applications

Table 58. AKZONOBEL: Total revenue, 2013-2014 ($Billion)

Table 59. AKZONOBEL N.V.: Products & Their Applications

Table 60. Ashland Inc: Total revenue, 2013-2014 ($Billion)

Table 61. Ashland Specialty Chemicals: Revenue, by Geography, 2013-2014($Billion)

Table 62. Ashland Inc.: Products & Applications

Table 63. Cargill Inc. : Total Revenue, 2013-2014 ($Billion)

Table 64. Cargill Inc. : Products & Applications

Table 65. CHEMIPHASE: Products & Applications

Table 66. BASF Se: Total Revenue, 2012 - 2014 ($Billion)

Table 67. BASF Se: Total Sales, by Geography, 2012 - 2014 ($Billion)

Table 68. BASF Se: Products and Applications

Table 69. CLARIANT: Total Sales, 2012 - 2014 ($Billion)

Table 70. CLARIANT: Total Sales, by Geography, 2013-2014 ($Billion)

Table 71. CLARIANT: Products and Applications

Table 72. Georgia-Pacific: Products & Their Application

Table 73. IMERYS Oilfield Solutions: Products & Their Applications

Table 74. CRODA: Second Quarter Revenue, 2014-2015 ($Million)

Table 75. CRODA: Total Revenue, 2013–2014 ($Million)

Table 76. CRODA: Revenue by Geography, 2013-2014 ($Million)

Table 77. CRODA: Products and Their Applications

Table 78. DUPONT: Third Quarter Revenue, 2014–2015 ($Billion)

Table 79. DUPONT: Total Revenue, 2013–2014 ($Billion)

Table 80. DUPONT: Revenue, by Geography, 2013 - 2014($Billion)

Table 81. Oilfield Chemical Company: Da Products and Their Functions

Table 82. WESTROCK: Da Products and Their Applications

Table 83. Lubrizol: Da Products and Their Applications

Table 84. DOW:Total Revenue,2013-2014($Billion)

Table 85. Dow: Total Revenue, by Geography 2013-2014($Billion)

Table 86. Dow: Da Products and Its Applications

Table 87. STEPAN: Net Sales, 2013-2014 ($Billion)

Table 88. STEPAN: Da Products & Applications

Table 89. Mineral Technologies: Total Revenue, 2013–2014 ($Million)

Table 90. Mineral Technologies: Revenue by Geography, 2013-2014 ($Million)

LIST OF FIGURES

Figure 1 Oilfield Drilling Fluid Additives Classification by Type

Figure 2 Oilfield Drilling Fluid Additives Classification by Fluid Formulation

Figure 3 Global Oilfield Drilling Fluid Additives, by Region

Figure 4 Oilfield Drilling Fluid Additives Market Revenue, by Types of Additives, 2014 (%)

Figure 5 Oilfield Drilling Additive Market Share, by Key Players, 2014

Figure 6 Shale Gas Reserves by Country, 2014 (Trillion Cubic Feet)

Figure 7 Saudi Arabia Oil Production, (October 2014 - September 2015) BL/Day

Figure 8 Production of Oil by Co2 Injection, U.S, 2010-2020 (‘000 Units)

Figure 9 Oilfield Drilling Fluids Market: Porters Five Force Analysis

Figure 10 Oilfield Drilling Fluid Additives Value Chain Analysis

Figure 11 Bentonite Pricing Analysis, 2014 – 2020 ($/Ton)

Figure 12 Industry Life Cycle – Oilfield Drilling Fluid Additives

Figure 13 Worldwide Rig Counts, January- September, 2015

Figure 14 North America Rig Counts, by Country, June 2014 vs. June 2015

Figure 15 U.S. Rig Counts, Januray - September, 2015

Figure 16 Middle-East Oil Production, by Country, 2006-2014 (BBL/D/1k)

Figure 17 Middle-East Rig Count, January-September, 2015

Figure 18 Chevron Phillips Chemical Company: Total Sales, by Business Segment, 2014 (%)

Figure 19 AKZONOBEL: Total Revenue, by Segments, 2014(%)

Figure 20 Ashland: Total Revenue, by Segments, 2014 (%)

Figure 21 CARGILL Inc.: Total Revenue, by Region, 2014 (%)

Figure 22 BASF Se: Total Revenue Share, by Business Segment, 2014 (%)

Figure 23 CLARIANT: Total Sales, by Business Segment 2014 (%)

Figure 24 CRODA: Revenue Share by Segment, 2014(%)

Figure 25 DUPONT: Revenue, by Segment, 2014(%)

Figure 26 Dow: Revenue Share, by Operating Segments, 2014 (%)

Figure 27 STEPAN: Total Revenue, by Segment, 2014 (%)

Figure 28 Mineral Technologies: Revenue Share by Segment, 2014(%)

Email

Email Print

Print