Hemostats are instruments used to reduce or halt bleeding during a surgery. These can be enabled by the use of smearing pressure, stitching the bleeding or using thermal energy devices. Hemostats generally are used to clot the blood during surgical procedures. Technical advancements have increased the usage of topical hemostatic agents in an extensive variety of surgical situations. Make it into a different sentence. New tissue sealants and hemostats in the market have addressed issue related to tissue contamination with previous sealants. How the new tissue sealants are addressing the previous sealant. New tissue sealants helps in reducing tissue contamination. Global hemostatic agents market is estimated to grow at a CAGR of 7.1% to reach $8,347.9m by 2022.

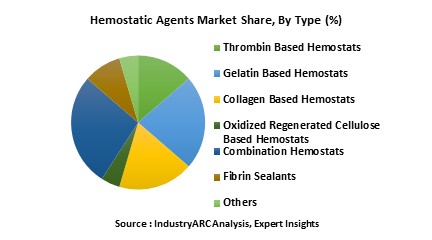

The report analyzes the hemostatic agents market by type, by treatment and by end user. The market by types covered in the report are thrombin, gelatin, collagen, oxidized regenerated, fibrin sealants and combination hemostats. Fibrin Sealants are estimated to be the fastest growing hemostatic agents during the forecast period 2017-2022. The hemostatic agents market is also segmented by treatment which includes cardio vascular, general surgery, digestive and neuro-surgery. This report highlights the end users of hemostatic agents such as hospitals, surgery centers and nursing homes. The report estimates the size of the global market in value terms ($million).

The report provides market size and forecast for APAC, Europe, Americas and RoW. A detailed qualitative analysis of the factors responsible to driving and restraining growth of the hemostatic agents market and future opportunities are provided in the report. The report profiles thirteen key players of the hemostatic agents market.

Sample Companies Profiled in this Report are:

- Johnson & Johnson Services, Inc. (U.S.)

- Baxter International Incorporation (U.S.)

- C.R. Bard Incorporation (U.S.)

- B.Braun Melsungen AG (Germany)

- Advanced Medical Solutions Group (U.K.)

- 10+.

For more Lifesciences and Healthcare related reports, please click here

1. Hemostatic Agents Market Overview

2. Hemostatic Agents Market Executive Summary

3. Hemostatic Agents Market Landscape

3.1. Market Share Analysis

3.2. Financial Analysis

3.3. End User Profiling

3.4. Product Benchmarking

3.5. Patent Analysis

4. Hemostatic Agents Market Forces

4.1. Market Drivers

4.2. Market Constraints & Challenges

4.3. Attractiveness of Hemostatic Agents Market

4.3.1. Power of Suppliers

4.3.2. Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New entrants

4.3.5. Degree of Competitive Rivalry

5. Hemostatic Agents Market– Strategic Analysis

5.1. Value Chain Analysis

5.2. Opportunities Analysis

5.3. Market Life Cycle Analysis

5.4. Pricing Analysis

6. Hemostatic Agents Market – By Type

6.1. Introduction

6.2. Thrombin Based Hemostats

6.3. Gelatin Based Hemostats

6.4. Collagen Based Hemostats

6.5. Oxidized Regenerated Cellulose Based Hemostats

6.6. Combination Hemostats

6.7. Fibrin Sealants

6.8. Others

7. Hemostatic Agents Market – By Treatment

7.1. Introduction

7.2. Cardiovascular

7.3. General Surgery

7.4. Digestive Surgery

7.5. Neurosurgery

7.6. Others

8. Hemostatic Agents Market – By End User

8.1. Introduction

8.2. Hospitals

8.3. Surgery Centers

8.4. Nursing Homes

8.5. Others

9. Hemostatic Agents Market -Geographic Analysis

9.1. Introduction

9.2. Americas

9.2.1. U.S

9.2.2. Canada

9.2.3. Mexico

9.2.4. Brazil

9.2.5. Rest of Americas

9.3. Europe

9.3.1. U.K.

9.3.2. Germany

9.3.3. France

9.3.4. Italy

9.3.5. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Australia & New Zealand

9.4.5. South Korea

9.4.6. Rest of APAC

9.5. RoW

9.5.1. Africa

9.5.2. Middle East

10. Hemostatic Agents Market Entropy

11. Hemostatic Agents Market Company Profiles

11.1. Baxter International Incorporation (U.S.)

11.2. C.R. Bard Incorporation (U.S.)

11.3. B.Braun Melsungen AG (Germany)

11.4. Integra Life Sciences Corporation (U.S.)

11.5. Equimedical (Netherlands)

11.6. Marine Polymer Technologies (U.S.)

11.7. Gelita GmbH (Germany)

11.8. Johnson and Johnson Services Inc (U.S.)

11.9. Pfizer Inc (U.S.)

11.10. Advanced Medical Solutions Group (U.K.)

11.11. Vascular Solutions, Inc (U.S.)

11.12. Z-Medica LLC (U.S.)

11.13. Mallinckrodt Plc (U.S.)

*More than 10 Companies are profiled in this Research Report*

"*Financials would be provided on a best efforts basis for private companies"

12. Appendix

12.1. Abbreviations

12.2. Sources

12.3. Research Methodology

12.4. Bibliography

12.5. Compilation of Expert Insights

12.6. Disclaimer

List of Tables:

Table 1 Global Hemostatic Agents Market Revenue, By Type, 2015-2022 ($Million)

Table 2 Global Hemostatic Agents Market Value, By Type, 2015-2022 ($Million)

Table 3 The U.S. Population Over 65 Years (Millions) (2015-2050)

Table 4 The U.S. and Global Diabetic Population Over 65 Years (Millions) (2014-2034)

Table 5 Hemostatic Agents Market Revenue, By End User, 2015-2022 ($Million)

Table 6 Global: Hemostatic Agents Market Revenue, By Geography, 2015-2022 ($Million)

Table 7 Americas: Hemostatic Agents Market Revenue, By Country, 2015-2022 ($Million)

Table 8 Americas: Hemostatic Agents Market Revenue, By Type, 2015-2022 ($Million)

Table 9 Americas: Hemostatic Agents Market Revenue, By Treatment, 2015-2022 ($Million)

Table 10 Americas: Hemostatic Agents Market Revenue, By End User, 2015-2022 ($Million)

Table 11 Europe: Hemostatic Agents Market Revenue, By Country, 2015-2022 ($Million)

Table 12 Europe: Hemostatic Agents Market Revenue, By Type, 2015-2022 ($Million)

Table 13 Europe: Hemostatic Agents Market Revenue, By Treatment, 2015-2022 ($Million)

Table 14 Europe: Hemostatic Agents Market Revenue, By End User, 2015-2022 ($Million)

Table 15 APAC: Hemostatic Agents Market Revenue, By Country 2015-2022 ($Million)

Table 16 APAC: Hemostatic Agents Market Revenue, By Type, 2015-2022 ($Million)

Table 17 APAC: Hemostatic Agents Market Revenue, By Treatment, 2015-2022 ($Million)

Table 18 APAC: Hemostatic Agents Market Revenue, By End User, 2015-2022 ($Million)

Table 19 RoW: Hemostatic Agents Market Revenue, By Region, 2015-2022 ($Million)

Table 20 RoW: Hemostatic Agents Market Revenue, By End User, 2015-2022 ($Million)

Table 21 RoW: Hemostatic Agents Market Revenue, By Type, 2015-2022 ($Million)

Table 22 RoW: Hemostatic Agents Market Revenue, By Treatment, 2015-2022 ($Million)

List of Figures:

Figure 1 Global Hemostatic Agents Market Revenue, By Region, 2015 and 2022 (%)

Figure 2 Global Hemostatic Agents Market Revenue, By Treatment, 2015-2022 ($Million)

Figure 3 HEMOSTATS MARKET SHARE ANALYSIS, BY COMPANY 2015 (%)

Figure 4 Earnings Per Share (EPS –Hemostats Manufacturers), By Company

Figure 5 Hemostats Market Revenue Share, By End-User, 2015 (%)

Figure 6 Hemostats Granted Patents, 2011-2016*

Figure 7 Bargaining Power of Suppliers – Hemostats Market

Figure 8 Thrombin Based Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 9 Gelatin Based Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 10 Collagen Based Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 11 Oxidized Regenerated Cellulose Based Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 12 Combination Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 13 Fibrin Sealants: Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 14 Other Hemostatic Agents Market Value, 2015-2022 ($Million)

Figure 15 Hemostatic Agents Market, By Treatment, 2015 & 2022 ($Million)

Figure 16 Hemostatic Agents for Vascular Surgery

Figure 17 Cardiovascular Diseases, Deaths Per 100,000 Population

Figure 18 Cardiovascular: Hemostatic Agents Market, 2015-2022 ($Million)

Figure 19 Need of Surgical Procedures (Millions)

Figure 20 General Surgery: Hemostatic Agents Market, 2015-2022 ($Million)

Figure 21 Number of Surgeries per 100,000 U.S. Population (2012-2015)

Figure 22 Digestive Hemostat Market Value, 2015-2022 ($Million)

Figure 23 Neurosurgery Hemostat Market Value, 2015-2022 ($Million)

Figure 24 Number of Cosmetic Surgeries, Key Countries, (2015)

Figure 25 Others Hemostat Market Value, 2015-2022 ($Million)

Figure 26 Selection of local hemostatic agent by extent of bleeding for management of postpartum hemorrhage (PPH)

Figure 27 Public and private hospitals in Australia, 2014 -2015

Figure 28 Hospitals: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 29 Surgery Centers: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 30 Nursing Homes: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 31 Others: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 32 U.S.: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 33 Canada: Total Health Expenditure, 2008-2013 ($Billion)

Figure 34 Canada: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 35 Mexico: Annual Health Spending Growth, 2010-2013 (%)

Figure 36 Mexico: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 37 General Government Expenditure on Health, 2002 & 2012 (%)

Figure 38 Brazil: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 39 Rest of Americas: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 40 Prevalence Of Obesity Among Adults Aged 16+ Years, 2010-2014 (%)

Figure 41 U.K.: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 42 Germany: Total Expenditure On Health, 2012-2014 ($Million)

Figure 43 Germany: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 44 France: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 45 Annual growth of pharmaceutical spending, 2010-2013 (%)

Figure 46 Italy: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 47 Rest of Europe: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 48 APAC: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 49 China: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 50 Australia Healthcare Services Funding Expenditure (%)

Figure 51 Australia & New Zealand: Hemostatic Agents Market, 2015-2022 ($Million)

Figure 52 Japan: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 53 India: Hemostatic Agents Market, 2015-2022 ($Million)

Figure 54 South Korea: Hemostatic Agents Market, 2015-2022 ($Million)

Figure 55 Rest Of APAC: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 56 RoW: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 57 Middle East: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 58 Africa: Hemostatic Agents Market Revenue, 2015-2022 ($Million)

Figure 59 Hemostatic Agents Market Developments, By Type, 2012-2016 (%)

Figure 60 Hemostatic Agents Market Developments, 2012-2016 (Till November)

Figure 61 Baxter International Incorporation, Net Sales, 2013-2015 ($Billion)

Figure 62 Baxter International Incorporation, Net Sales Share, By Business Segment, 2015 (%)

Figure 63 Baxter International Incorporation, Net Sales Share, By Region, 2015 (%)

Figure 64 C.R. Bard, Inc., Net Sales, 2013-2015 ($Billion)

Figure 65 C.R. Bard, Inc., Net Sales Share, By Business Segment, 2015 (%)

Figure 66 B.Braun Melsungen AG Revenue, 2013-2015 ($Billion)

Figure 67 B.Braun Melsungen AG Revenue Share, By Business Segment, 2015 (%)

Figure 68 B.Braun Melsungen AG Revenue Share, By Geography, 2015 (%)

Figure 69 Integra Life Sciences Corporation Revenue, 2013-2015 ($Million)

Figure 70 Integra Life Sciences Corporation Revenue Share, By Business Segment, 2015 (%)

Figure 71 Integra Life Sciences Corporation Revenue Share, By Geography, 2015 (%)

Figure 72 Johnson and Johnson Services Inc.: Net Sales, 2012-2015 ($Billion)

Figure 73 Johnson and Johnson Services Inc.: Net Sales Share, By Business Segment, 2015 (%)

Figure 74 Johnson and Johnson Services Inc.: Net Sales Share, By Geography, 2015 (%)

Figure 75 Pfizer Inc. Revenue, 2013-2015 ($Million)

Figure 76 Pfizer Inc. Revenue Share, By Geography, 2015 (%)

Figure 77 Pfizer Inc. Revenue Share, By Business Segment, 2015 (%)

Figure 78 Advanced Medical Solutions Group: Net Sales, 2013-2015 ($Million)

Figure 79 Advanced Medical Solutions Group: Net Sales Share, By Business Segment, 2015 (%)

Figure 80 Advanced Medical Solutions Group: Net Sales Share, By Geography, 2015 (%)

Figure 81 Vascular Solutions, Inc.: Net Sales, 2012-2015 ($Million)

Figure 82 Vascular Solutions, Inc.: Net Sales Share, By Business Segment, 2015 (%)

Figure 83 Vascular Solutions, Inc. Net Sales Share, By Geography, 2015 (%)

Figure 84 Mallinckrodt Plc, Net Sales, 2012-2015 ($Billion)

Figure 85 Mallinckrodt Plc, Net Sales Share, By Business Segment, 2015 (%)

Figure 86 Mallinckrodt Plc, Net Sales Share, By Region, 2015 (%)

Email

Email Print

Print