Global Masterbatch Market: Product Analysis

Masterbatch is a solid or liquid additive for plastic. Additive masterbatch prevents the products from UV rays. Masterbatch market players offer products that are advanced and have specific concentrations of pigments and additives encapsulated by a polymer. Generally, the masterbatch market growth is observed in the South East Asia region. According to Hitech Masterbatch, a manufacturer and supplier, the market for masterbatches will grow up to 12 billion in the next 4 years. The process of masterbatch is an amazing way in which to color plastics as well as add strengthen. In terms of pricing, masterbatch are lower when compared with other conventional coloring methods because masterbatch leaves little waste and saves time in the creation process. Using masterbatch is cleaner than using powders or pigments as there is no dust, health, or safety issues. It is an easy and convenient way of adding colors to products. When using the process of masterbatch one can add performance enhancing additives.

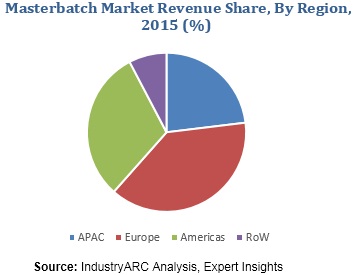

As per the IndustryARC report, APAC is the leading region in the global masterbatch market, with 48% market share as of 2018. The same year, the analyst of the report has estimated the global masterbatch market size of around $10,850 million, projecting the value to increment at an exuberant CAGR of approximately 10.23% during the forecast period of 2019 to 2025. The market research report pinpoints Asia Pacific as the most lucrative region, generating more than 48% of the total demand in 2018. On the other hand, the food and beverage industry is tipped as the foremost end use industry, exhibiting a CAGR of 10.8% during the aforementioned forecast period.

Masterbatch Market: Use of Polycarbonates and Corrosion Inhibitors in Various Industries

According to Americhem, a leading designer and manufacturer of Masterbatches, when the businesses are looking for a performance plastic that is durable, polycarbonates offer a strong, easily molded option for production. Polycarbonates are thermoplastic polymers that are particularly useful in industrial applications. Polycarbonate's toughness makes it an ideal fit for the automotive, construction, and other industries that require its plastics to be tough and durable. Asia has the largest consumption and production of polycarbonates. In developing countries, it is going to be a mainstream product and in developed countries, many companies will start to produce polycarbonates. The masterbatch market in Europe and North America are not much as compared to Asia’s growing demand.

The growing packaging demand from the food and beverage packaging industry is creating strong revenue avenues in the masterbatch market. With enhanced coloring, industry players make an impression on the end users as the product sits with them. The competition is fierce in the food and beverage industry, with strong challenges coming from local players. Therefore, the global players with deep pockets are leveraging masterbatches to differentiate their products and stay ahead of the curve.

There is a strong growing demand for masterbatches in the automotive industry as well. The industry is now switching to metals parts with plastic components, which enables them achieve greater fuel efficiency and match regulations regarding greenhouse gas emissions. Additionally, among the various methods to avoid or prevent destruction or degradation of metal surface, the corrosion inhibitor is one of the best know methods of corrosion protection and one of the most useful on the automotive industry. To improve the durability of reinforced concrete structures, which are impaired due the high alkalinity, corrosion inhibitors are mixed with cement or concrete paste.

Scope of Masterbatch Market

The carrier material of the masterbatch can be based on wax or on a specific polymer, identical or compatible with the natural polymer used. Masterbatches can be used in most of the process, except rotational molding and plastisol and other liquid resin systems. Increased usage of plastic products and packaged products are the main drivers for the growth of masterbatch market. There has been a good growth due to the growing manufacturing industries. The increasing use of plastics in the automotive, consumer goods, building and construction industry is yet another driving factor for the growing demand of masterbatches. Rapid growth in industrialization with the developments and innovations in the industry results in the positive market growth.

Masterbatch Market: Trends

- Political Aspect- Masterbatch market is impacted due to Brexit in European market and United Kingdom. But since the exit of UK, the plastic and packaging industry is bolstering smoothly and the entire revenue generation structure for the companies have changed. A number of companies are now investing on expansion beyond their traditional territories in order to fetch new demands.

- Environmental Aspect- According to Americhem, an increasing desire for companies to reduce their environmental impact has led to many breakthrough technologies in the masterbatch market, including nBalance from Americhem. The company’s nbalance sustainable solutions are comprised of color and additive masterbatches that help reduce the impact on the environment. balance sustains many solutions like lower environmental impact, reduced consumption of natural resources, and minimal energy used in manufacturing and distribution. Ampacet Corporation, has released its new Cell-Struct line of special effects that visually interprets today’s intersection of technology with and organic elements in an engaging dimensional look for rigid packaging.

- Health Aspects- Increasing ethical and health conscious demands of consumers is driving new quality standards and has inspired Gabriel-Chemie Group to introduce a new range of products to answer the demand for Halal and Vegan-compliant products.

- Ferro and Zschimmer & Schwarz are working on optimizing water-based ink, eco-friendly digital ceramic inks, and formulations for efficient application with current-day digital printing machinery print heads.

Masterbatch Market: Competitive Landscape

- On 23 Jan 2019, BASF SE opened first phase of the new antioxidants manufacturing plant in Shanghai, the plant will produce antioxidants and associated forms and blends for the plastic additives market.

- Recently, LyondellBasell, one of the largest plastics, chemicals, and refining companies in the world, has completed acquisition of A. Schulman, Inc.

- On 18 Jan 2019, European Union has granted conditional clearance for BASF SA to acquire Solvay’s polyamide business.

- Americhem Inc. announces that it has acquired Prescient Color Limited, a wholly owned subsidiary of Sudarshan Chemical Industries Limited, an Indian based company on 1st June 2018.

There is a rapid growth that has been seen in the masterbatch market, especially in APAC as compared with the other Europe and North America. The major growth is seen in South East Asia. Masterbatch Market is observing a progress because of the increased demand of plastic in various industries like food and beverage packaging industries, automotive, metal, building and construction industries. Many manufacturers are expanding their presence in Asian countries to benefit from the low cost structure and the growing demand for plastics.

1. Masterbatch Market - Overview

1.1. Definitions and Scope

2. Masterbatch Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Masterbatch Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Masterbatch Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Masterbatch Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Masterbatch Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Masterbatch Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Masterbatch Market – By Type (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Standard Color

8.3.2. White

8.3.3. Additive

8.3.4. Black

8.3.5. Special Effect

8.3.6. Filler

9. Masterbatch Market – By Process (Market Size -$Million / $Billion)

9.1. Extrusion

9.2. Molding

10. Masterbatch Market – By Carrier Resins (Market Size -$Million / $Billion)

10.1. Polyethylene (PE)

10.2. Polyethylene Terephthalate (PET)

10.3. Polystyrene (PS)

10.4. Acrylonitrile Butadiene Styrene (ABS)

10.5. Ethylene-Vinyl Acetate (EVA)

10.6. Polypropylene (PP)

10.7. Polybutylene Terephthalate (PBT)

10.8. Polyvinylchloride (PVC)

10.9. Others

11. Masterbatch Market – Applications (Market Size -$Million / $Billion)

11.1. Flame Retardant

11.2. Antifouling agent

11.3. Antistatic agent

11.4. Lubricant

11.5. anti-fog agent

11.6. extrusion aids

11.7. Ultraviolet resistance

11.8. Corrosion Inhibitor

11.9. Phosphorescence

11.10. Anti-microbial

11.11. Anti-oxidant

11.11. Others

12. Masterbatch Market – By End Use Industry(Market Size -$Million / $Billion)

12.1. Segment type Size and Market Share Analysis

12.2. Application Revenue and Trends by type of Application

12.3. Application Segment Analysis by Type

12.3.1. Food & Beverage

12.3.2. Automotive, Electrical & Electronics

12.3.3. Building & Construction

12.3.4. Fast-Moving Consumer Goods (FMCG)

12.3.5. Textiles

12.3.6. Health Care

12.3.7. Pharmaceutical

12.3.8. Others

13. Masterbatch Market - By Geography (Market Size -$Million / $Billion)

13.1. Masterbatch Market Market - North America Segment Research

13.2. North America Market Research (Million / $Billion)

13.2.1. Segment type Size and Market Size Analysis

13.2.2. Revenue and Trends

13.2.3. Application Revenue and Trends by type of Application

13.2.4. Company Revenue and Product Analysis

13.2.5. North America Product type and Application Market Size

13.2.5.1. U.S.

13.2.5.2. Canada

13.2.5.3. Mexico

13.2.5.4. Rest of North America

13.3. Masterbatch Market - South America Segment Research

13.4. South America Market Research (Market Size -$Million / $Billion)

13.4.1. Segment type Size and Market Size Analysis

13.4.2. Revenue and Trends

13.4.3. Application Revenue and Trends by type of Application

13.4.4. Company Revenue and Product Analysis

13.4.5. South America Product type and Application Market Size

13.4.5.1. Brazil

13.4.5.2. Venezuela

13.4.5.3. Argentina

13.4.5.4. Ecuador

13.4.5.5. Peru

13.4.5.6. Colombia

13.4.5.7. Costa Rica

13.4.5.8. Rest of South America

13.5. Masterbatch Market - Europe Segment Research

13.6. Europe Market Research (Market Size -$Million / $Billion)

13.6.1. Segment type Size and Market Size Analysis

13.6.2. Revenue and Trends

13.6.3. Application Revenue and Trends by type of Application

13.6.4. Company Revenue and Product Analysis

13.6.5. Europe Segment Product type and Application Market Size

13.6.5.1. U.K

13.6.5.2. Germany

13.6.5.3. Italy

13.6.5.4. France

13.6.5.5. Netherlands

13.6.5.6. Belgium

13.6.5.7. Spain

13.6.5.8. Denmark

13.6.5.9. Rest of Europe

13.7. Masterbatch Market – APAC Segment Research

13.8. APAC Market Research (Market Size -$Million / $Billion)

13.8.1. Segment type Size and Market Size Analysis

13.8.2. Revenue and Trends

13.8.3. Application Revenue and Trends by type of Application

13.8.4. Company Revenue and Product Analysis

13.8.5. APAC Segment – Product type and Application Market Size

13.8.5.1. China

13.8.5.2. Australia

13.8.5.3. Japan

13.8.5.4. South Korea

13.8.5.5. India

13.8.5.6. Taiwan

13.8.5.7. Malaysia

14. Masterbatch Market - Entropy

14.1. New product launches

14.2. M&A's, collaborations, JVs and partnerships

15. Masterbatch Market – Industry / Segment Competition landscape Premium

15.1. Market Share Analysis

15.1.1. Market Share by Country- Top companies

15.1.2. Market Share by Region- Top 10 companies

15.1.3. Market Share by type of Application – Top 10 companies

15.1.4. Market Share by type of Product / Product category- Top 10 companies

15.1.5. Market Share at global level- Top 10 companies

15.1.6. Best Practises for companies

16. Masterbatch Market – Key Company List by Country Premium

17. Masterbatch Market Company Analysis

17.1. Market Share, Company Revenue, Products, M&A, Developments

17.2. A. Schulman

17.3. Ampacet Corp.

17.4. Clariant AG

17.5. Cabot Corp.

17.6. Cabot Corp.

17.7. Munzing Chemie GmbH

17.8. Hubron International

17.9. Hubron International

17.10. DIC Corp.,

17.11. Ferro Corp

17.12. Company 11

17.11. Company 12

17.14. Company 13 and more

"*Financials would be provided on a best efforts basis for private companies"

18. Masterbatch Market -Appendix

18.1. Abbreviations

18.2. Sources

19. Masterbatch Market -Methodology Premium

19.1. Research Methodology

19.1.1. Company Expert Interviews

19.1.2. Industry Databases

19.1.3. Associations

19.1.4. Company News

19.1.5. Company Annual Reports

19.1.6. Application Trends

19.1.7. New Products and Product database

19.1.8. Company Transcripts

19.1.9. R&D Trends

19.1.10. Key Opinion Leaders Interviews

19.1.11. Supply and Demand Trends

List of Tables

Table 1 Masterbatch Market Overview 2021-2026

Table 2 Masterbatch Market Leader Analysis 2018-2019 (US$)

Table 3 Masterbatch Market Product Analysis 2018-2019 (US$)

Table 4 Masterbatch Market End User Analysis 2018-2019 (US$)

Table 5 Masterbatch Market Patent Analysis 2013-2018* (US$)

Table 6 Masterbatch Market Financial Analysis 2018-2019 (US$)

Table 7 Masterbatch Market Driver Analysis 2018-2019 (US$)

Table 8 Masterbatch Market Challenges Analysis 2018-2019 (US$)

Table 9 Masterbatch Market Constraint Analysis 2018-2019 (US$)

Table 10 Masterbatch Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11 Masterbatch Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12 Masterbatch Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13 Masterbatch Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14 Masterbatch Market Degree of Competition Analysis 2018-2019 (US$)

Table 15 Masterbatch Market Value Chain Analysis 2018-2019 (US$)

Table 16 Masterbatch Market Pricing Analysis 2021-2026 (US$)

Table 17 Masterbatch Market Opportunities Analysis 2021-2026 (US$)

Table 18 Masterbatch Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19 Masterbatch Market Supplier Analysis 2018-2019 (US$)

Table 20 Masterbatch Market Distributor Analysis 2018-2019 (US$)

Table 21 Masterbatch Market Trend Analysis 2018-2019 (US$)

Table 22 Masterbatch Market Size 2018 (US$)

Table 23 Masterbatch Market Forecast Analysis 2021-2026 (US$)

Table 24 Masterbatch Market Sales Forecast Analysis 2021-2026 (Units)

Table 25 Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26 Masterbatch Market By Type, Revenue & Volume, By Standard Color Masterbatch, 2021-2026 ($)

Table 27 Masterbatch Market By Type, Revenue & Volume, By Additive Masterbatch, 2021-2026 ($)

Table 28 Masterbatch Market By Type, Revenue & Volume, By White Masterbatch, 2021-2026 ($)

Table 29 Masterbatch Market By Type, Revenue & Volume, By Black Masterbatch, 2021-2026 ($)

Table 30 Masterbatch Market By Type, Revenue & Volume, By Special Effect Masterbatch, 2021-2026 ($)

Table 31 Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 32 Masterbatch Market By Carrier Resin, Revenue & Volume, By Polyethylene (PE), 2021-2026 ($)

Table 33 Masterbatch Market By Carrier Resin, Revenue & Volume, By Polystyrene(PS), 2021-2026 ($)

Table 34 Masterbatch Market By Carrier Resin, Revenue & Volume, By Acrylonitrile Butadiene Styrene(ABS), 2021-2026 ($)

Table 35 Masterbatch Market By Carrier Resin, Revenue & Volume, By Ethylene-vinyl acetate (EVA), 2021-2026 ($)

Table 36 Masterbatch Market By Carrier Resin, Revenue & Volume, By Polypropylene (PP), 2021-2026 ($)

Table 37 Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 38 Masterbatch Market By Application, Revenue & Volume, By Molding, 2021-2026 ($)

Table 39 Masterbatch Market By Application, Revenue & Volume, By Extrusion, 2021-2026 ($)

Table 40 Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 41 Masterbatch Market By End User, Revenue & Volume, By Automotive, 2021-2026 ($)

Table 42 Masterbatch Market By End User, Revenue & Volume, By Electronic Appliances, 2021-2026 ($)

Table 43 Masterbatch Market By End User, Revenue & Volume, By Building & Construction, 2021-2026 ($)

Table 44 Masterbatch Market By End User, Revenue & Volume, By Consumer Goods, 2021-2026 ($)

Table 45 Masterbatch Market By End User, Revenue & Volume, By Textiles, 2021-2026 ($)

Table 46 North America Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 47 North America Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 48 North America Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 49 North America Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 50 South america Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 51 South america Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 52 South america Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 53 South america Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 54 Europe Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 55 Europe Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 56 Europe Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 57 Europe Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 58 APAC Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 59 APAC Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 60 APAC Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 61 APAC Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 62 Middle East & Africa Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 63 Middle East & Africa Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 64 Middle East & Africa Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 65 Middle East & Africa Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 66 Russia Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 67 Russia Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 68 Russia Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 69 Russia Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 70 Israel Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 71 Israel Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 72 Israel Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 73 Israel Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 74 Top Companies 2018 (US$)Masterbatch Market, Revenue & Volume

Table 75 Product Launch 2018-2019Masterbatch Market, Revenue & Volume

Table 76 Mergers & Acquistions 2018-2019Masterbatch Market, Revenue & Volume

List of Figures

Figure 1 Overview of Masterbatch Market 2021-2026

Figure 2 Market Share Analysis for Masterbatch Market 2018 (US$)

Figure 3 Product Comparison in Masterbatch Market 2018-2019 (US$)

Figure 4 End User Profile for Masterbatch Market 2018-2019 (US$)

Figure 5 Patent Application and Grant in Masterbatch Market 2013-2018* (US$)

Figure 6 Top 5 Companies Financial Analysis in Masterbatch Market 2018-2019 (US$)

Figure 7 Market Entry Strategy in Masterbatch Market 2018-2019

Figure 8 Ecosystem Analysis in Masterbatch Market 2018

Figure 9 Average Selling Price in Masterbatch Market 2021-2026

Figure 10 Top Opportunites in Masterbatch Market 2018-2019

Figure 11 Market Life Cycle Analysis in Masterbatch Market

Figure 12 GlobalBy TypeMasterbatch Market Revenue, 2021-2026 ($)

Figure 13 GlobalBy Carrier ResinMasterbatch Market Revenue, 2021-2026 ($)

Figure 14 GlobalBy ApplicationMasterbatch Market Revenue, 2021-2026 ($)

Figure 15 GlobalBy End UserMasterbatch Market Revenue, 2021-2026 ($)

Figure 16 Global Masterbatch Market - By Geography

Figure 17 Global Masterbatch Market Value & Volume, By Geography, 2021-2026 ($)

Figure 18 Global Masterbatch Market CAGR, By Geography, 2021-2026 (%)

Figure 19 North America Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 20 US Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 21 US GDP and Population, 2018-2019 ($)

Figure 22 US GDP – Composition of 2018, By Sector of Origin

Figure 23 US Export and Import Value & Volume, 2018-2019 ($)

Figure 24 Canada Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 25 Canada GDP and Population, 2018-2019 ($)

Figure 26 Canada GDP – Composition of 2018, By Sector of Origin

Figure 27 Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 28 Mexico Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 29 Mexico GDP and Population, 2018-2019 ($)

Figure 30 Mexico GDP – Composition of 2018, By Sector of Origin

Figure 31 Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 32 South America Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 33 Brazil Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 34 Brazil GDP and Population, 2018-2019 ($)

Figure 35 Brazil GDP – Composition of 2018, By Sector of Origin

Figure 36 Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 37 Venezuela Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 38 Venezuela GDP and Population, 2018-2019 ($)

Figure 39 Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 40 Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 41 Argentina Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 42 Argentina GDP and Population, 2018-2019 ($)

Figure 43 Argentina GDP – Composition of 2018, By Sector of Origin

Figure 44 Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 45 Ecuador Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 46 Ecuador GDP and Population, 2018-2019 ($)

Figure 47 Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 48 Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 49 Peru Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 50 Peru GDP and Population, 2018-2019 ($)

Figure 51 Peru GDP – Composition of 2018, By Sector of Origin

Figure 52 Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 53 Colombia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 54 Colombia GDP and Population, 2018-2019 ($)

Figure 55 Colombia GDP – Composition of 2018, By Sector of Origin

Figure 56 Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 57 Costa Rica Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 58 Costa Rica GDP and Population, 2018-2019 ($)

Figure 59 Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 60 Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 61 Europe Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 62 U.K Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 63 U.K GDP and Population, 2018-2019 ($)

Figure 64 U.K GDP – Composition of 2018, By Sector of Origin

Figure 65 U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 66 Germany Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 67 Germany GDP and Population, 2018-2019 ($)

Figure 68 Germany GDP – Composition of 2018, By Sector of Origin

Figure 69 Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 70 Italy Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 71 Italy GDP and Population, 2018-2019 ($)

Figure 72 Italy GDP – Composition of 2018, By Sector of Origin

Figure 73 Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 74 France Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 75 France GDP and Population, 2018-2019 ($)

Figure 76 France GDP – Composition of 2018, By Sector of Origin

Figure 77 France Export and Import Value & Volume, 2018-2019 ($)

Figure 78 Netherlands Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 79 Netherlands GDP and Population, 2018-2019 ($)

Figure 80 Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 81 Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 82 Belgium Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 83 Belgium GDP and Population, 2018-2019 ($)

Figure 84 Belgium GDP – Composition of 2018, By Sector of Origin

Figure 85 Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 86 Spain Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 87 Spain GDP and Population, 2018-2019 ($)

Figure 88 Spain GDP – Composition of 2018, By Sector of Origin

Figure 89 Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 90 Denmark Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 91 Denmark GDP and Population, 2018-2019 ($)

Figure 92 Denmark GDP – Composition of 2018, By Sector of Origin

Figure 93 Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 94 APAC Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 95 China Masterbatch Market Value & Volume, 2021-2026

Figure 96 China GDP and Population, 2018-2019 ($)

Figure 97 China GDP – Composition of 2018, By Sector of Origin

Figure 98 China Export and Import Value & Volume, 2018-2019 ($)Masterbatch Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 99 Australia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 100 Australia GDP and Population, 2018-2019 ($)

Figure 101 Australia GDP – Composition of 2018, By Sector of Origin

Figure 102 Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 103 South Korea Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 104 South Korea GDP and Population, 2018-2019 ($)

Figure 105 South Korea GDP – Composition of 2018, By Sector of Origin

Figure 106 South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 107 India Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 108 India GDP and Population, 2018-2019 ($)

Figure 109 India GDP – Composition of 2018, By Sector of Origin

Figure 110 India Export and Import Value & Volume, 2018-2019 ($)

Figure 111 Taiwan Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 112 Taiwan GDP and Population, 2018-2019 ($)

Figure 113 Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 114 Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 115 Malaysia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 116 Malaysia GDP and Population, 2018-2019 ($)

Figure 117 Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 118 Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 119 Hong Kong Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 120 Hong Kong GDP and Population, 2018-2019 ($)

Figure 121 Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 122 Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 123 Middle East & Africa Masterbatch Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 124 Russia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 125 Russia GDP and Population, 2018-2019 ($)

Figure 126 Russia GDP – Composition of 2018, By Sector of Origin

Figure 127 Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 128 Israel Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 129 Israel GDP and Population, 2018-2019 ($)

Figure 130 Israel GDP – Composition of 2018, By Sector of Origin

Figure 131 Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 132 Entropy Share, By Strategies, 2018-2019* (%)Masterbatch Market

Figure 133 Developments, 2018-2019*Masterbatch Market

Figure 134 Company 1 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 135 Company 1 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 136 Company 1 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 137 Company 2 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 138 Company 2 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 139 Company 2 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 140 Company 3 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 141 Company 3 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 142 Company 3 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 143 Company 4 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 144 Company 4 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 145 Company 4 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 146 Company 5 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 147 Company 5 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 148 Company 5 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 149 Company 6 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 150 Company 6 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 151 Company 6 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 152 Company 7 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 153 Company 7 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 154 Company 7 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 155 Company 8 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 156 Company 8 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 157 Company 8 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 158 Company 9 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 159 Company 9 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 160 Company 9 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 161 Company 10 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 162 Company 10 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 163 Company 10 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 164 Company 11 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 165 Company 11 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 166 Company 11 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 167 Company 12 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 168 Company 12 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 169 Company 12 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 170 Company 13 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 171 Company 13 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 172 Company 13 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 173 Company 14 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 174 Company 14 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 175 Company 14 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 176 Company 15 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 177 Company 15 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 178 Company 15 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Table 1 Masterbatch Market Overview 2021-2026

Table 2 Masterbatch Market Leader Analysis 2018-2019 (US$)

Table 3 Masterbatch Market Product Analysis 2018-2019 (US$)

Table 4 Masterbatch Market End User Analysis 2018-2019 (US$)

Table 5 Masterbatch Market Patent Analysis 2013-2018* (US$)

Table 6 Masterbatch Market Financial Analysis 2018-2019 (US$)

Table 7 Masterbatch Market Driver Analysis 2018-2019 (US$)

Table 8 Masterbatch Market Challenges Analysis 2018-2019 (US$)

Table 9 Masterbatch Market Constraint Analysis 2018-2019 (US$)

Table 10 Masterbatch Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11 Masterbatch Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12 Masterbatch Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13 Masterbatch Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14 Masterbatch Market Degree of Competition Analysis 2018-2019 (US$)

Table 15 Masterbatch Market Value Chain Analysis 2018-2019 (US$)

Table 16 Masterbatch Market Pricing Analysis 2021-2026 (US$)

Table 17 Masterbatch Market Opportunities Analysis 2021-2026 (US$)

Table 18 Masterbatch Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19 Masterbatch Market Supplier Analysis 2018-2019 (US$)

Table 20 Masterbatch Market Distributor Analysis 2018-2019 (US$)

Table 21 Masterbatch Market Trend Analysis 2018-2019 (US$)

Table 22 Masterbatch Market Size 2018 (US$)

Table 23 Masterbatch Market Forecast Analysis 2021-2026 (US$)

Table 24 Masterbatch Market Sales Forecast Analysis 2021-2026 (Units)

Table 25 Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26 Masterbatch Market By Type, Revenue & Volume, By Standard Color Masterbatch, 2021-2026 ($)

Table 27 Masterbatch Market By Type, Revenue & Volume, By Additive Masterbatch, 2021-2026 ($)

Table 28 Masterbatch Market By Type, Revenue & Volume, By White Masterbatch, 2021-2026 ($)

Table 29 Masterbatch Market By Type, Revenue & Volume, By Black Masterbatch, 2021-2026 ($)

Table 30 Masterbatch Market By Type, Revenue & Volume, By Special Effect Masterbatch, 2021-2026 ($)

Table 31 Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 32 Masterbatch Market By Carrier Resin, Revenue & Volume, By Polyethylene (PE), 2021-2026 ($)

Table 33 Masterbatch Market By Carrier Resin, Revenue & Volume, By Polystyrene(PS), 2021-2026 ($)

Table 34 Masterbatch Market By Carrier Resin, Revenue & Volume, By Acrylonitrile Butadiene Styrene(ABS), 2021-2026 ($)

Table 35 Masterbatch Market By Carrier Resin, Revenue & Volume, By Ethylene-vinyl acetate (EVA), 2021-2026 ($)

Table 36 Masterbatch Market By Carrier Resin, Revenue & Volume, By Polypropylene (PP), 2021-2026 ($)

Table 37 Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 38 Masterbatch Market By Application, Revenue & Volume, By Molding, 2021-2026 ($)

Table 39 Masterbatch Market By Application, Revenue & Volume, By Extrusion, 2021-2026 ($)

Table 40 Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 41 Masterbatch Market By End User, Revenue & Volume, By Automotive, 2021-2026 ($)

Table 42 Masterbatch Market By End User, Revenue & Volume, By Electronic Appliances, 2021-2026 ($)

Table 43 Masterbatch Market By End User, Revenue & Volume, By Building & Construction, 2021-2026 ($)

Table 44 Masterbatch Market By End User, Revenue & Volume, By Consumer Goods, 2021-2026 ($)

Table 45 Masterbatch Market By End User, Revenue & Volume, By Textiles, 2021-2026 ($)

Table 46 North America Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 47 North America Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 48 North America Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 49 North America Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 50 South america Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 51 South america Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 52 South america Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 53 South america Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 54 Europe Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 55 Europe Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 56 Europe Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 57 Europe Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 58 APAC Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 59 APAC Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 60 APAC Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 61 APAC Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 62 Middle East & Africa Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 63 Middle East & Africa Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 64 Middle East & Africa Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 65 Middle East & Africa Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 66 Russia Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 67 Russia Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 68 Russia Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 69 Russia Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 70 Israel Masterbatch Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 71 Israel Masterbatch Market, Revenue & Volume, By Carrier Resin, 2021-2026 ($)

Table 72 Israel Masterbatch Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 73 Israel Masterbatch Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 74 Top Companies 2018 (US$)Masterbatch Market, Revenue & Volume

Table 75 Product Launch 2018-2019Masterbatch Market, Revenue & Volume

Table 76 Mergers & Acquistions 2018-2019Masterbatch Market, Revenue & Volume

List of Figures

Figure 1 Overview of Masterbatch Market 2021-2026

Figure 2 Market Share Analysis for Masterbatch Market 2018 (US$)

Figure 3 Product Comparison in Masterbatch Market 2018-2019 (US$)

Figure 4 End User Profile for Masterbatch Market 2018-2019 (US$)

Figure 5 Patent Application and Grant in Masterbatch Market 2013-2018* (US$)

Figure 6 Top 5 Companies Financial Analysis in Masterbatch Market 2018-2019 (US$)

Figure 7 Market Entry Strategy in Masterbatch Market 2018-2019

Figure 8 Ecosystem Analysis in Masterbatch Market 2018

Figure 9 Average Selling Price in Masterbatch Market 2021-2026

Figure 10 Top Opportunites in Masterbatch Market 2018-2019

Figure 11 Market Life Cycle Analysis in Masterbatch Market

Figure 12 GlobalBy TypeMasterbatch Market Revenue, 2021-2026 ($)

Figure 13 GlobalBy Carrier ResinMasterbatch Market Revenue, 2021-2026 ($)

Figure 14 GlobalBy ApplicationMasterbatch Market Revenue, 2021-2026 ($)

Figure 15 GlobalBy End UserMasterbatch Market Revenue, 2021-2026 ($)

Figure 16 Global Masterbatch Market - By Geography

Figure 17 Global Masterbatch Market Value & Volume, By Geography, 2021-2026 ($)

Figure 18 Global Masterbatch Market CAGR, By Geography, 2021-2026 (%)

Figure 19 North America Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 20 US Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 21 US GDP and Population, 2018-2019 ($)

Figure 22 US GDP – Composition of 2018, By Sector of Origin

Figure 23 US Export and Import Value & Volume, 2018-2019 ($)

Figure 24 Canada Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 25 Canada GDP and Population, 2018-2019 ($)

Figure 26 Canada GDP – Composition of 2018, By Sector of Origin

Figure 27 Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 28 Mexico Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 29 Mexico GDP and Population, 2018-2019 ($)

Figure 30 Mexico GDP – Composition of 2018, By Sector of Origin

Figure 31 Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 32 South America Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 33 Brazil Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 34 Brazil GDP and Population, 2018-2019 ($)

Figure 35 Brazil GDP – Composition of 2018, By Sector of Origin

Figure 36 Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 37 Venezuela Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 38 Venezuela GDP and Population, 2018-2019 ($)

Figure 39 Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 40 Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 41 Argentina Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 42 Argentina GDP and Population, 2018-2019 ($)

Figure 43 Argentina GDP – Composition of 2018, By Sector of Origin

Figure 44 Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 45 Ecuador Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 46 Ecuador GDP and Population, 2018-2019 ($)

Figure 47 Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 48 Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 49 Peru Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 50 Peru GDP and Population, 2018-2019 ($)

Figure 51 Peru GDP – Composition of 2018, By Sector of Origin

Figure 52 Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 53 Colombia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 54 Colombia GDP and Population, 2018-2019 ($)

Figure 55 Colombia GDP – Composition of 2018, By Sector of Origin

Figure 56 Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 57 Costa Rica Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 58 Costa Rica GDP and Population, 2018-2019 ($)

Figure 59 Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 60 Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 61 Europe Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 62 U.K Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 63 U.K GDP and Population, 2018-2019 ($)

Figure 64 U.K GDP – Composition of 2018, By Sector of Origin

Figure 65 U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 66 Germany Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 67 Germany GDP and Population, 2018-2019 ($)

Figure 68 Germany GDP – Composition of 2018, By Sector of Origin

Figure 69 Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 70 Italy Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 71 Italy GDP and Population, 2018-2019 ($)

Figure 72 Italy GDP – Composition of 2018, By Sector of Origin

Figure 73 Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 74 France Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 75 France GDP and Population, 2018-2019 ($)

Figure 76 France GDP – Composition of 2018, By Sector of Origin

Figure 77 France Export and Import Value & Volume, 2018-2019 ($)

Figure 78 Netherlands Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 79 Netherlands GDP and Population, 2018-2019 ($)

Figure 80 Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 81 Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 82 Belgium Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 83 Belgium GDP and Population, 2018-2019 ($)

Figure 84 Belgium GDP – Composition of 2018, By Sector of Origin

Figure 85 Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 86 Spain Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 87 Spain GDP and Population, 2018-2019 ($)

Figure 88 Spain GDP – Composition of 2018, By Sector of Origin

Figure 89 Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 90 Denmark Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 91 Denmark GDP and Population, 2018-2019 ($)

Figure 92 Denmark GDP – Composition of 2018, By Sector of Origin

Figure 93 Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 94 APAC Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 95 China Masterbatch Market Value & Volume, 2021-2026

Figure 96 China GDP and Population, 2018-2019 ($)

Figure 97 China GDP – Composition of 2018, By Sector of Origin

Figure 98 China Export and Import Value & Volume, 2018-2019 ($)Masterbatch Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 99 Australia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 100 Australia GDP and Population, 2018-2019 ($)

Figure 101 Australia GDP – Composition of 2018, By Sector of Origin

Figure 102 Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 103 South Korea Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 104 South Korea GDP and Population, 2018-2019 ($)

Figure 105 South Korea GDP – Composition of 2018, By Sector of Origin

Figure 106 South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 107 India Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 108 India GDP and Population, 2018-2019 ($)

Figure 109 India GDP – Composition of 2018, By Sector of Origin

Figure 110 India Export and Import Value & Volume, 2018-2019 ($)

Figure 111 Taiwan Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 112 Taiwan GDP and Population, 2018-2019 ($)

Figure 113 Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 114 Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 115 Malaysia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 116 Malaysia GDP and Population, 2018-2019 ($)

Figure 117 Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 118 Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 119 Hong Kong Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 120 Hong Kong GDP and Population, 2018-2019 ($)

Figure 121 Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 122 Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 123 Middle East & Africa Masterbatch Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 124 Russia Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 125 Russia GDP and Population, 2018-2019 ($)

Figure 126 Russia GDP – Composition of 2018, By Sector of Origin

Figure 127 Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 128 Israel Masterbatch Market Value & Volume, 2021-2026 ($)

Figure 129 Israel GDP and Population, 2018-2019 ($)

Figure 130 Israel GDP – Composition of 2018, By Sector of Origin

Figure 131 Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 132 Entropy Share, By Strategies, 2018-2019* (%)Masterbatch Market

Figure 133 Developments, 2018-2019*Masterbatch Market

Figure 134 Company 1 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 135 Company 1 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 136 Company 1 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 137 Company 2 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 138 Company 2 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 139 Company 2 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 140 Company 3 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 141 Company 3 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 142 Company 3 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 143 Company 4 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 144 Company 4 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 145 Company 4 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 146 Company 5 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 147 Company 5 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 148 Company 5 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 149 Company 6 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 150 Company 6 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 151 Company 6 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 152 Company 7 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 153 Company 7 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 154 Company 7 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 155 Company 8 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 156 Company 8 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 157 Company 8 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 158 Company 9 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 159 Company 9 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 160 Company 9 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 161 Company 10 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 162 Company 10 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 163 Company 10 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 164 Company 11 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 165 Company 11 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 166 Company 11 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 167 Company 12 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 168 Company 12 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 169 Company 12 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 170 Company 13 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 171 Company 13 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 172 Company 13 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 173 Company 14 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 174 Company 14 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 175 Company 14 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Figure 176 Company 15 Masterbatch Market Net Revenue, By Years, 2018-2019* ($)

Figure 177 Company 15 Masterbatch Market Net Revenue Share, By Business segments, 2018 (%)

Figure 178 Company 15 Masterbatch Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print