The global Slewing Bearings market is estimated to surpass $4,105.9 million by 2024, growing at CAGR 3.03% during the forecast period 2018-2024, majorly driven by the increasing focus on renewable energy and growing infrastructure sector. Urbanization in emerging economies has also led to an increase in commercial and office construction market which is driving the global slewing bearings market.

What is Slewing Bearings?

Slewing bearing is a rotational bearing component which is usually used in machines that require heavy and bulk handling. These bearings help in developing to and fro movements as well as rotational movements. They are used for simple applications such as to facilitate the movement of winches to complex applications such as in drilling and excavator machines and offshore machines. They work based on the axial and radical forces which results in tilting moments. Slewing bearing has many advantageous over traditional bearings such as the ability to support both horizontal and vertical arrangements.

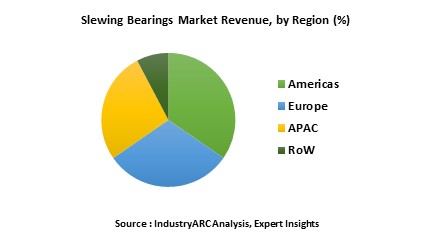

The market for slewing bearings is huge in APAC, particularly in countries such as Japan, South Korea and China where it is being used extensively. The market for slewing bearings in China has been increasing rapidly due to the numerous solar investments made by the government as well as the growing medical sector. This report incorporates an in-depth assessment of slewing bearings market by gear type, rolling element, construction/design, application and geography. The major gear types of slewing bearings encompassed in the scope include ungeared, external and internal gear.

What are the major applications of Slewing Bearings?

Slewing Bearings is mostly used for various applications such as wind & solar energy, robotic equipment, medical equipment, packaging, mining, marine vessels, material handling equipment, water treatment, military, communication equipment and others. These slewing bearings are present in almost all the industries where the process demands the control and handling of materials and goods. The other applications where slewing bearings are used include offshore crane and drilling equipment in oil & gas, amusement park rides and steering gears. The growth in infrastructure and construction industries is expected to drive the market of slewing bearings.

Market Research and Market Trends of Slewing Bearings

- Currently, slewing bearings are witnessing a significant demand due to its increasing applications in the infrastructure industry and renewable energy. The global cumulative installed wind power capacity has increased from 371,317 megawatts in 2014 to 539.291 megawatts in 2017 and the trend is expected to continue in the near future due to the significant investments made by various governments in this sector. Slewing bearings are one of the main components of a wind mill turbine and hence the market for slewing bearings is also expected to grow in the near future.

- Companies’ partnerships and joint venture activities have an important significance with respect to the growth of the slewing bearings market. One among the pioneer companies in turbine manufacturers, Vestas Wind systems, has entered into an agreement with Liebherr on May, 2018. According to which all the turbines systems manufactured by Vestas wind systems at Liebherr plant location in Russia will be equipped with Liebherr hydraulic cylinders, slewing bearings and drives

- The importance of infrastructure industry is being recognized by governments all over the world. This industry requires material handling equipment such as cranes and forklifts of which slewing bearings are one of the main important components. Hence the slewing bearings market is expected to grow with increased investments in the infrastructure industry

Who are the Major Players in the Slewing Bearings Market?

The companies referred to in the market research report include Schaeffler AG (Germany), SKF Group (Sweden), NSK Ltd (Japan), Thyssenkrupp Group (Germany), The Timken Company (U.S.) and many others

What is our report scope?

The report incorporates in depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on, to gauge the impact forces and potential opportunities of the market. Apart from this, the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on, to comprehend the prevailing market dynamics at present and its impact during the forecast period 2018-2024.

All our reports are customizable to as per the company needs, to a certain extent; we do provide 20 free consulting hours along with the purchase of each report, this which will allow you to request any additional data to customize the report to as per your needs.

Key Takeaways from this Report

- Evaluate market potential by analyzing growth rates (CAGR %), Volume (Units) and Value ($Million) of the data given at country level – for product types, end use applications and for different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor’s performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and to increase the efficiency your processes.

- Get a quick outlook of the market entropy – M&As, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics, and regulatory landscape for more than top 20 countries globally, for the market.

1. Slewing Bearings – Market Overview

2. Executive Summary

3. Slewing Bearings Market – Market Landscape

3.1. Market Share Analysis

3.2. Comparative Analysis

3.2.1. Product Benchmarking

3.2.2. End-User profiling

3.2.3. Patent Analysis

3.2.4. Top 5 Financials Analysis

4. Slewing Bearings Market – Market Forces

4.1. Market Drivers

4.2. Market Constraints & Challenges

4.3. Attractiveness of the Slewing Bearings Market

4.3.1. Power of Suppliers

4.3.2. Power of Customers

4.3.3. Threat of New entrants

4.3.4. Threat of Substitution

4.3.5. Degree of Competition

5. Slewing Bearings Market – Strategic Analysis

5.1. Value Chain Analysis

5.2. Pricing Analysis

5.3. Threat and Opportunities Analysis

5.4. Product/Market Life Cycle Analysis

6. Slewing Bearings Market- By Gear Types

6.1. Introduction

6.2. Ungeared

6.3. External Gear

6.4. Internal Gear

7. Slewing Bearings Market- By Construction/Design

7.1. Introduction

7.2. Single-row Four Point Contact Ball Slewing Bearings

7.3. Double-row Four Point Contact Ball Slewing Bearings

7.4. Cross Roller Slewing Bearings

7.5. Three-row Roller Slewing Bearings

7.6. Others

7.6.1. Roller/Ball Combination Bearings

7.6.2. Bi-Angular Roller Cylindrical or Taper Slewing Bearings

8. Slewing Bearings Market- By Rolling Element

8.1. Introduction

8.2. Ball

8.3. Roller

9. Slewing Bearings Market- By Application

9.1. Introduction

9.2. Wind & Solar Energy

9.3. Robotic Equipment

9.4. Medical Equipment

9.5. Packaging

9.6. Mining

9.7. Marine Vessels

9.8. Material Handling Equipment

9.9. Water Treatment

9.10. Military

9.11. Communication Equipment

9.12. Others

10. Slewing Bearings Market- By Geography

10.1. Introduction

10.2. Americas

10.2.1. U.S.

10.2.2. Canada

10.2.3. Brazil

10.2.4. Mexico

10.2.5. Rest of Americas

10.3. Europe

10.3.1. U.K.

10.3.2. Germany

10.3.3. France

10.3.4. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. South Korea

10.4.4. Rest of APAC

10.5. Rest of the World (RoW)

10.5.1. Middle East

10.5.2. Africa

11. Slewing Bearings Market Entropy

11.1. Introduction

11.2. New Product Launches

12. Company Profiles

12.1. Thyssenkrupp Group

12.2. IMO Group

12.3. Schaeffler AG

12.4. SKF Group

12.5. Antex Corporation

12.6. Kaydon Corporation

12.7. NSK LTD

12.8. PSL, A.S.

12.9. LYC North America Inc

12.10. Roballo Engineering Co Ltd

13. Appendix

13.1. Abbreviations

13.2. Sources

13.3. Research Methodology

13.4. Bibliography

13.5. Compilation of Expert Insights

13.6. Disclaimer

List of Tables

Table 1: Slewing Bearings Market Overview 2021-2026

Table 2: Slewing Bearings Market Leader Analysis 2018-2019 (US$)

Table 3: Slewing Bearings Market Product Analysis 2018-2019 (US$)

Table 4: Slewing Bearings Market End User Analysis 2018-2019 (US$)

Table 5: Slewing Bearings Market Patent Analysis 2013-2018* (US$)

Table 6: Slewing Bearings Market Financial Analysis 2018-2019 (US$)

Table 7: Slewing Bearings Market Driver Analysis 2018-2019 (US$)

Table 8: Slewing Bearings Market Challenges Analysis 2018-2019 (US$)

Table 9: Slewing Bearings Market Constraint Analysis 2018-2019 (US$)

Table 10: Slewing Bearings Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Slewing Bearings Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Slewing Bearings Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Slewing Bearings Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Slewing Bearings Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Slewing Bearings Market Value Chain Analysis 2018-2019 (US$)

Table 16: Slewing Bearings Market Pricing Analysis 2021-2026 (US$)

Table 17: Slewing Bearings Market Opportunities Analysis 2021-2026 (US$)

Table 18: Slewing Bearings Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Slewing Bearings Market Supplier Analysis 2018-2019 (US$)

Table 20: Slewing Bearings Market Distributor Analysis 2018-2019 (US$)

Table 21: Slewing Bearings Market Trend Analysis 2018-2019 (US$)

Table 22: Slewing Bearings Market Size 2018 (US$)

Table 23: Slewing Bearings Market Forecast Analysis 2021-2026 (US$)

Table 24: Slewing Bearings Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26: Slewing Bearings Market By Type, Revenue & Volume, By Plain bearing, 2021-2026 ($)

Table 27: Slewing Bearings Market By Type, Revenue & Volume, By Rolling-element bearing, 2021-2026 ($)

Table 28: Slewing Bearings Market By Type, Revenue & Volume, By Jewel bearing, 2021-2026 ($)

Table 29: Slewing Bearings Market By Type, Revenue & Volume, By Fluid bearing, 2021-2026 ($)

Table 30: Slewing Bearings Market By Type, Revenue & Volume, By Magnetic bearing, 2021-2026 ($)

Table 31: Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 32: Slewing Bearings Market By Components, Revenue & Volume, By Inner Ring and Outer Ring, 2021-2026 ($)

Table 33: Slewing Bearings Market By Components, Revenue & Volume, By Rolling Elements, 2021-2026 ($)

Table 34: Slewing Bearings Market By Components, Revenue & Volume, By Mounting Holes, 2021-2026 ($)

Table 35: Slewing Bearings Market By Components, Revenue & Volume, By Spacers, Spacer Balls & Separators, 2021-2026 ($)

Table 36: Slewing Bearings Market By Components, Revenue & Volume, By Grease Fitting, 2021-2026 ($)

Table 37: Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 38: Slewing Bearings Market By Construction, Revenue & Volume, By Single-row Four Point Contact Ball Slewing Ring Bearing, 2021-2026 ($)

Table 39: Slewing Bearings Market By Construction, Revenue & Volume, By Cross Roller Slewing Ring Bearing, 2021-2026 ($)

Table 40: Slewing Bearings Market By Construction, Revenue & Volume, By Double-row Ball Slewing Ring Bearings, 2021-2026 ($)

Table 41: Slewing Bearings Market By Construction, Revenue & Volume, By Three-row Roller Slewing Ring Bearings, 2021-2026 ($)

Table 42: Slewing Bearings Market By Construction, Revenue & Volume, By Four and eight point contact ball, 2021-2026 ($)

Table 43: Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 44: Slewing Bearings Market By Application, Revenue & Volume, By Excavators, 2021-2026 ($)

Table 45: Slewing Bearings Market By Application, Revenue & Volume, By Felling machines, 2021-2026 ($)

Table 46: Slewing Bearings Market By Application, Revenue & Volume, By Loaders, 2021-2026 ($)

Table 47: Slewing Bearings Market By Application, Revenue & Volume, By Universal earth machines, 2021-2026 ($)

Table 48: Slewing Bearings Market By Application, Revenue & Volume, By Axles and undercarriages, 2021-2026 ($)

Table 49: Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 50: Slewing Bearings Market By End User, Revenue & Volume, By Construction Industry, 2021-2026 ($)

Table 51: Slewing Bearings Market By End User, Revenue & Volume, By Excavation Industry, 2021-2026 ($)

Table 52: Slewing Bearings Market By End User, Revenue & Volume, By Wind Turbines, 2021-2026 ($)

Table 53: Slewing Bearings Market By End User, Revenue & Volume, By Medical Equipment, 2021-2026 ($)

Table 54: Slewing Bearings Market By End User, Revenue & Volume, By Radar, 2021-2026 ($)

Table 55: North America Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 56: North America Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 57: North America Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 58: North America Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 59: North America Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 60: South america Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 61: South america Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 62: South america Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 63: South america Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 64: South america Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 65: Europe Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 66: Europe Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 67: Europe Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 68: Europe Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 69: Europe Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 70: APAC Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 71: APAC Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 72: APAC Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 73: APAC Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 74: APAC Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 75: Middle East & Africa Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 76: Middle East & Africa Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 77: Middle East & Africa Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 78: Middle East & Africa Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 79: Middle East & Africa Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 80: Russia Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 81: Russia Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 82: Russia Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 83: Russia Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 84: Russia Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 85: Israel Slewing Bearings Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 86: Israel Slewing Bearings Market, Revenue & Volume, By Components, 2021-2026 ($)

Table 87: Israel Slewing Bearings Market, Revenue & Volume, By Construction, 2021-2026 ($)

Table 88: Israel Slewing Bearings Market, Revenue & Volume, By Application, 2021-2026 ($)

Table 89: Israel Slewing Bearings Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 90: Top Companies 2018 (US$)Slewing Bearings Market, Revenue & Volume

Table 91: Product Launch 2018-2019Slewing Bearings Market, Revenue & Volume

Table 92: Mergers & Acquistions 2018-2019Slewing Bearings Market, Revenue & Volume

List of Figures

Figure 1: Overview of Slewing Bearings Market 2021-2026

Figure 2: Market Share Analysis for Slewing Bearings Market 2018 (US$)

Figure 3: Product Comparison in Slewing Bearings Market 2018-2019 (US$)

Figure 4: End User Profile for Slewing Bearings Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Slewing Bearings Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Slewing Bearings Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Slewing Bearings Market 2018-2019

Figure 8: Ecosystem Analysis in Slewing Bearings Market 2018

Figure 9: Average Selling Price in Slewing Bearings Market 2021-2026

Figure 10: Top Opportunites in Slewing Bearings Market 2018-2019

Figure 11: Market Life Cycle Analysis in Slewing Bearings Market

Figure 12: GlobalBy TypeSlewing Bearings Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy ComponentsSlewing Bearings Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy ConstructionSlewing Bearings Market Revenue, 2021-2026 ($)

Figure 15: GlobalBy ApplicationSlewing Bearings Market Revenue, 2021-2026 ($)

Figure 16: GlobalBy End UserSlewing Bearings Market Revenue, 2021-2026 ($)

Figure 17: Global Slewing Bearings Market - By Geography

Figure 18: Global Slewing Bearings Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19: Global Slewing Bearings Market CAGR, By Geography, 2021-2026 (%)

Figure 20: North America Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 21: US Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 22: US GDP and Population, 2018-2019 ($)

Figure 23: US GDP – Composition of 2018, By Sector of Origin

Figure 24: US Export and Import Value & Volume, 2018-2019 ($)

Figure 25: Canada Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 26: Canada GDP and Population, 2018-2019 ($)

Figure 27: Canada GDP – Composition of 2018, By Sector of Origin

Figure 28: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29: Mexico Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 30: Mexico GDP and Population, 2018-2019 ($)

Figure 31: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33: South America Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 34: Brazil Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 35: Brazil GDP and Population, 2018-2019 ($)

Figure 36: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38: Venezuela Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 39: Venezuela GDP and Population, 2018-2019 ($)

Figure 40: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42: Argentina Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 43: Argentina GDP and Population, 2018-2019 ($)

Figure 44: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46: Ecuador Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 47: Ecuador GDP and Population, 2018-2019 ($)

Figure 48: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50: Peru Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 51: Peru GDP and Population, 2018-2019 ($)

Figure 52: Peru GDP – Composition of 2018, By Sector of Origin

Figure 53: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54: Colombia Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 55: Colombia GDP and Population, 2018-2019 ($)

Figure 56: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58: Costa Rica Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 59: Costa Rica GDP and Population, 2018-2019 ($)

Figure 60: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62: Europe Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 63: U.K Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 64: U.K GDP and Population, 2018-2019 ($)

Figure 65: U.K GDP – Composition of 2018, By Sector of Origin

Figure 66: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67: Germany Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 68: Germany GDP and Population, 2018-2019 ($)

Figure 69: Germany GDP – Composition of 2018, By Sector of Origin

Figure 70: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71: Italy Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 72: Italy GDP and Population, 2018-2019 ($)

Figure 73: Italy GDP – Composition of 2018, By Sector of Origin

Figure 74: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75: France Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 76: France GDP and Population, 2018-2019 ($)

Figure 77: France GDP – Composition of 2018, By Sector of Origin

Figure 78: France Export and Import Value & Volume, 2018-2019 ($)

Figure 79: Netherlands Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 80: Netherlands GDP and Population, 2018-2019 ($)

Figure 81: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83: Belgium Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 84: Belgium GDP and Population, 2018-2019 ($)

Figure 85: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87: Spain Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 88: Spain GDP and Population, 2018-2019 ($)

Figure 89: Spain GDP – Composition of 2018, By Sector of Origin

Figure 90: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91: Denmark Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 92: Denmark GDP and Population, 2018-2019 ($)

Figure 93: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95: APAC Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 96: China Slewing Bearings Market Value & Volume, 2021-2026

Figure 97: China GDP and Population, 2018-2019 ($)

Figure 98: China GDP – Composition of 2018, By Sector of Origin

Figure 99: China Export and Import Value & Volume, 2018-2019 ($)Slewing Bearings Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100: Australia Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 101: Australia GDP and Population, 2018-2019 ($)

Figure 102: Australia GDP – Composition of 2018, By Sector of Origin

Figure 103: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104: South Korea Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 105: South Korea GDP and Population, 2018-2019 ($)

Figure 106: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108: India Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 109: India GDP and Population, 2018-2019 ($)

Figure 110: India GDP – Composition of 2018, By Sector of Origin

Figure 111: India Export and Import Value & Volume, 2018-2019 ($)

Figure 112: Taiwan Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 113: Taiwan GDP and Population, 2018-2019 ($)

Figure 114: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116: Malaysia Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 117: Malaysia GDP and Population, 2018-2019 ($)

Figure 118: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120: Hong Kong Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 121: Hong Kong GDP and Population, 2018-2019 ($)

Figure 122: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124: Middle East & Africa Slewing Bearings Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125: Russia Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 126: Russia GDP and Population, 2018-2019 ($)

Figure 127: Russia GDP – Composition of 2018, By Sector of Origin

Figure 128: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129: Israel Slewing Bearings Market Value & Volume, 2021-2026 ($)

Figure 130: Israel GDP and Population, 2018-2019 ($)

Figure 131: Israel GDP – Composition of 2018, By Sector of Origin

Figure 132: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133: Entropy Share, By Strategies, 2018-2019* (%)Slewing Bearings Market

Figure 134: Developments, 2018-2019*Slewing Bearings Market

Figure 135: Company 1 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 136: Company 1 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137: Company 1 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 138: Company 2 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 139: Company 2 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140: Company 2 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 141: Company 3 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 142: Company 3 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143: Company 3 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 144: Company 4 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 145: Company 4 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146: Company 4 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 147: Company 5 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 148: Company 5 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149: Company 5 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 150: Company 6 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 151: Company 6 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152: Company 6 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 153: Company 7 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 154: Company 7 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155: Company 7 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 156: Company 8 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 157: Company 8 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158: Company 8 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 159: Company 9 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 160: Company 9 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161: Company 9 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 162: Company 10 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 163: Company 10 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164: Company 10 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 165: Company 11 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 166: Company 11 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167: Company 11 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 168: Company 12 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 169: Company 12 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170: Company 12 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 171: Company 13 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 172: Company 13 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173: Company 13 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 174: Company 14 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 175: Company 14 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176: Company 14 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Figure 177: Company 15 Slewing Bearings Market Net Revenue, By Years, 2018-2019* ($)

Figure 178: Company 15 Slewing Bearings Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179: Company 15 Slewing Bearings Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print