Worldwide increasing demand for biodegradable products and sustainable solutions are influencing the demand in the global oleochemicals market. Oleochemicals is defined as a chemical compound derived from natural sources such as plants and animal fats. It is readily available in the world and mainly used in the formulation and production of industrial, personal care, and household products, which include surface cleaners, softeners, fabric cleaners, dishwashing, automotive cleaners, industrial cleaners, degreasers, and hygiene products. These products offer significant diversification opportunity for chemical companies as they are effective and high-quality substitutes for petroleum-based products. Oleochemicals also act as an intermediary in rubber, pharmaceutical, plastic, paint and lubricant industries. The changing industrial structure of plastics, rubber and surface active agent industries coupled with transformation in the mode of development are fueling the fatty acids market.

IndustryARC’s analyst has estimated the global oleochemicals market to have had a value of $26.57 billion in 2018. And, as per the oleochemicals market analysis conducted by the report, the market demand is projected to grow at a CAGR of 4.9% during the forecast period (2019-2025).

Oleochemicals Market Outlook:

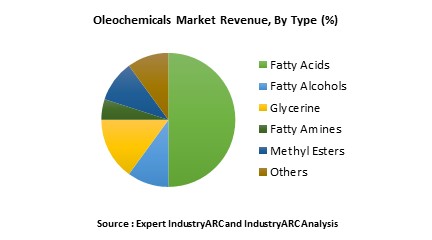

Various basic oleochemical substances such as fatty acids, fatty acid methyl esters, fatty alcohols, fatty amines, and glycerols are formed through chemical and enzymatic reactions. Intermediate chemical substances are also obtained from these chemicals namely alcohol ethoxylates, alcohol sulfates, alcohol ether sulfates, glycerols, and monoacylglycerols. Fatty acids are the major application of oleochemicals that have a noticeable demand from pharmaceutical, food and beverage industries, soap and laundry detergent, waxes, lubricant, candles, and paints and coatings. Surfactants, dispersing agents, wetting agents, emulsifying agents, solvents, and adjuvants are some of the vital inert ingredients produced by using these oleochemicals. Surfactants preparation is one of the prominent end use application of oleochemicals which is utilized in the making of detergents and household cleaning products as well.

Oleochemicals Market Segment Analysis:

Soaps and detergents application is dominating among diverse applications; it is estimated to grow with a CAGR of 4.8% during the forecast period 2019-2025. Massive developments associated with the largest plantations of oil palms in Southeast Asia marked the boom of the oleochemical industry. Southeast Asian countries such as Malaysia, Indonesia, and Thailand are spurring the oleochemical industry in the Asia-Pacific region. In Malaysia, there were 19 oleochemical plants with an annual processing capacity of 2.67 million tonnes in 2017. Its utilization rate increased to 94.9% from 85.2% compared to the previous year. In 2017, more palm based oleochemical products are exported from Malaysia to China and the U.S. due to the increasing demand from these countries, out of which fatty acids were majorly exported that is 0.99 million tonnes which holds a share of 35.1% among other types. Asia-Pacific is depicted by the analyst of the report as the largest oleochemicals producing region which holds a major share of about 41% in the global oleochemicals market size as of the year 2018.

Oleochemicals Market Trends and Drivers:

- The continued push to replace petrochemical-based solutions; new uses, and applications based on green chemicals are driving the growth of oleochemicals market revenue.

- Oleochemicals investment opportunities within and beyond Asia-Pacific region and stronger vertical integration offered by raw material based companies are fuelling the rationalization opportunities.

- Rapid growth in the production of palm oil and kernel oil is one of major factors in oleochemicals market growth. Reliable, efficient, and cost effective oleochemical plants are poised to cater to incrementing demands.

- There is an increase in the adoption of bio-based lubricants which are replacing synthetic and traditional lubricants in order to improve the efficiency of vehicles. This has bolstered the oleochemicals market size by many folds.

- Recent advancements in these chemicals lead to new applications in polymers and bio-surfactants in addition to soaps and detergents.

- There are growing number of investments from global companies such as Emery Oleo, Wilmar, and BASF in the oleochemicals market.

- Adoption of oleochemicals is increasing from diverse range of industries as they want to avoid environment pollution.

Oleochemicals Market: Competitive Analysis

- Emery Natural Oleochemical, Oleon, Wilmar International, Kuala Lumpur Kepong Berhad, and IOI Oleo GmbH are the key players holding major oleochemicals market shares. On the other hand, Clariant AG, BASF SE, Croda International, P&G Chemicals, Dow Chemials, and Vanatge Specialty Chemicals Inc. are major derivative manufacturing companies.

- In 2017, BASF SE experienced a 7% increase in sales of care chemicals. Increased prices of oleochemical surfactants and fatty alcohols reflected a positive effect on sales growth for the same year.

- Oleon opened a new isostearic acid unit in 2018, which is a significant piece of oleochemical technology and it enables an innovative solution for high-end applications namely cosmetics.

- In 2018, Wilmar implemented Inventure Supercritical Technology in China. This technology is aimed to produce fatty acid methyl esters for oleochemicals and also to manufacture bio-based oleochemicals.

- P&G Chemicals provide oleochemicals, which are used as inerts and adjuvants in agrochemical applications. These oleochemicals products are widely used in lubricants, metal works, and textile applications

- Emery Natural Oleochemical’s new product innovation named as EMEROX Polyols. It provides increased efficiencies and sustainability with improved performance properties to the end users. It also acts as an effective raw material in the manufacturing process of polyurethane products which is a significant material used in the automobile and construction industry to make foams.

Oleochemicals are the chemicals which are extracted from plants and animal fats or oils. Growing demand for biodegradable products is making a positive impact on the adoption rate of these chemicals. They have wide range of applications in soaps and detergents, food and beverage, household and personal care products, agriculture, automotive, and construction industries. These factors altogether are propelling the market growth in the near future.

For more Chemical and Materials related reports, please click here

1. Oleochemicals Market - Overview

1.1. Definitions and Scope

2. Oleochemicals Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Oleochemicals Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Oleochemicals Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Oleochemicals Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Oleochemicals Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Oleochemicals Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

8. Oleochemicals Market– By Type (Market Size -$Million / $Billion)

8.1. Segment type Size and Market Share Analysis

8.2. Application Revenue and Trends by type of Application

8.3. Application Segment Analysis by Type

8.3.1. Fatty Acid

8.3.2. Fatty Alcohol

8.3.3. Fatty Acid Methyl Esters (FAME)

8.3.4. Fatty Amines

8.3.5. Glycerin

8.3.6. Others

9. Oleochemicals Market– By Form (Market Size -$Million / $Billion)

9.1. Liquid

9.2. Solid

9.2.1. Flakes

9.2.2. Pellets

9.2.3. Beads

9.2.4. Others

10. Oleochemicals Market– By Raw Material (Market Size -$Million / $Billion)

10.1. Natural

10.1.1. Vegetable Oil

10.1.1.1. Coconut Oil

10.1.1.2. Palm Kernel Oil

10.1.1.3. Palm Oil

10.1.1.4. Soybean Oil

10.1.1.5. Sunflower Oil

10.1.1.6. Linseed Oil

10.1.1.7. Castor Oil

10.1.1.8. Rapeseed Oil

10.1.1.9. Others

10.1.2. Animal Fats

10.1.2.1. Tallow

10.1.2.2. Lard

10.1.2.3. Fish Oil

10.1.2.4. Poultry

10.1.2.5. Others

10.2. Synthetic

10.2.1. Ethylene

10.2.2. Propylene

10.2.3. Olefins

10.3. Others

11. Oleochemicals Market– By Refining Methods (Market Size -$Million / $Billion)

11.1. Splitting

11.2. Distillation

11.3. Fractionation

11.4. Separation

11.5. Hydrogenation

11.6. Methylation

11.7. Deionization

11.8. Others

12. Oleochemicals Market – By Post Production Processes (Market Size -$Million / $Billion)

12.1. Amidation

12.2. Chlorination

12.3. Dimerization

12.4. Epoxidation

12.5. Ethoxylation

12.6. Quarternization

12.7. Sulfation

12.8. Sulfonation Transesterifications

12.9. Esterification

12.10. Saponification

13. Oleochemicals Market – By Derivatives (Market Size -$Million / $Billion)

13.1. Amides

13.2. Dimer and Trimer Acid

13.3. Epoxidized Oils and Esters

13.4. Ethoxylates

13.5. Fatty Acid Sulphates

13.6. Fatty Acid Sulphonates

13.7. Fatty Esters

13.8. Soaps and Salts

13.9. Others

14. Oleochemicals Market– By Application Areas (Market Size -$Million / $Billion)

14.1. Candles

14.2. Soaps and Shampoos

14.3. Creams and Lotions

14.4. Detergents

14.5. Cosmetics

14.6. Paints and Coatings

14.7. Inks and Dyes

14.8. Pesticides

14.9. Food Additive

14.10. Emulsifiers

14.11. Coolants

14.12. Insulation

14.13. Lubricants

14.14. Paper

14.15. Chemical Intermediates

14.16. Vulcanizing Agents

14.17. Softeners

14.18. Mould Releasing Agents

14.19. Plasticizer and stabilizer

14.20. Polymerization Emulsifiers

14.21. Antistatic and Antifogging Aid

14.22. Fire Extinguisher

14.23. Building Auxiliaries

14.24. Textile

14.25. Tires

14.26. Leather

14.27. Others

15. Oleochemicals Market – By End User Industry (Market Size -$Million / $Billion)

15.1. Market Size and Market Share Analysis

15.2. Application Revenue and Trend Research

15.3. Product Segment Analysis

15.3.1. Food and Beverage Industry

15.3.2. Textile Industry

15.3.3. Oil and Gas Industry

15.3.4. Cosmetic Industry

15.3.5. Medical and Health care Industry

15.3.6. Manufacturing Industries

15.3.7. Electronics Industry

15.3.8. Mining Industry

15.3.9. Paints and Coating Industry

15.3.10. Plastics and rubber Industry

15.3.11. Paper and Pulp Industry

15.3.12. Agricultural Industry

15.3.13. Fertilizer and Pesticide Industry

15.3.14. Pharmaceutical Industry

15.3.15. Others

16. Oleochemicals Market - By Geography (Market Size -$Million / $Billion)

16.1. Oleochemicals Market Market - North America Segment Research

16.2. North America Market Research (Million / $Billion)

16.2.1. Segment type Size and Market Size Analysis

16.2.2. Revenue and Trends

16.2.3. Application Revenue and Trends by type of Application

16.2.4. Company Revenue and Product Analysis

16.2.5. North America Product type and Application Market Size

16.2.5.1. U.S.

16.2.5.2. Canada

16.2.5.3. Mexico

16.2.5.4. Rest of North America

16.3. Oleochemicals Market - South America Segment Research

16.4. South America Market Research (Market Size -$Million / $Billion)

16.4.1. Segment type Size and Market Size Analysis

16.4.2. Revenue and Trends

16.4.3. Application Revenue and Trends by type of Application

16.4.4. Company Revenue and Product Analysis

16.4.5. South America Product type and Application Market Size

16.4.5.1. Brazil

16.4.5.2. Venezuela

16.4.5.3. Argentina

16.4.5.4. Ecuador

16.4.5.5. Peru

16.4.5.6. Colombia

16.4.5.7. Costa Rica

16.4.5.8. Rest of South America

16.5. Oleochemicals Market - Europe Segment Research

16.6. Europe Market Research (Market Size -$Million / $Billion)

16.6.1. Segment type Size and Market Size Analysis

16.6.2. Revenue and Trends

16.6.3. Application Revenue and Trends by type of Application

16.6.4. Company Revenue and Product Analysis

16.6.5. Europe Segment Product type and Application Market Size

16.6.5.1. U.K

16.6.5.2. Germany

16.6.5.3. Italy

16.6.5.4. France

16.6.5.5. Netherlands

16.6.5.6. Belgium

16.6.5.7. Spain

16.6.5.8. Denmark

16.6.5.9. Rest of Europe

16.7. Oleochemicals Market – APAC Segment Research

16.8. APAC Market Research (Market Size -$Million / $Billion)

16.8.1. Segment type Size and Market Size Analysis

16.8.2. Revenue and Trends

16.8.3. Application Revenue and Trends by type of Application

16.8.4. Company Revenue and Product Analysis

16.8.5. APAC Segment – Product type and Application Market Size

16.8.5.1. China

16.8.5.2. Australia

16.8.5.3. Japan

16.8.5.4. South Korea

16.8.5.5. India

16.8.5.6. Taiwan

16.8.5.7. Malaysia

17. Oleochemicals Market Market - Entropy

17.1. New product launches

17.2. M&A's, collaborations, JVs and partnerships

18. Oleochemicals Market Market – Industry / Segment Competition landscape Premium

18.1. Market Share Analysis

18.1.1. Market Share by Country- Top companies

18.1.2. Market Share by Region- Top 10 companies

18.1.3. Market Share by type of Application – Top 10 companies

18.1.4. Market Share by type of Product / Product category- Top 10 companies

18.1.5. Market Share at global level- Top 10 companies

18.1.6. Best Practises for companies

19. Oleochemicals Market Market – Key Company List by Country Premium

20. Oleochemicals Market Market Company Analysis

20.1. Market Share, Company Revenue, Products, M&A, Developments

20.2. Wilmar International

20.3. Croda

20.4. Emery Oleochemicals

20.5. Fairchem

20.6. BakrieSumatera Plantations

20.7. VVF Ltd

20.8. Smart Agribusiness and food

20.9. 3F Industries

20.10.Agarwal group of Industries

20.11. Unilever

20.12. Company 11

20.13. Company 12

20.14. Company 13 and more

"*Financials would be provided on a best efforts basis for private companies"

21. Oleochemicals Market Market -Appendix

21.1. Abbreviations

21.2. Sources

22. Oleochemicals Market Market -Methodology Premium

22.1. Research Methodology

22.1.1. Company Expert Interviews

22.1.2. Industry Databases

22.1.3. Associations

22.1.4. Company News

22.1.5. Company Annual Reports

22.1.6. Application Trends

22.1.7. New Products and Product database

22.1.8. Company Transcripts

22.1.9. R&D Trends

22.1.10. Key Opinion Leaders Interviews

22.1.11. Supply and Demand Trends

List of Tables:

Table 1. Global Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 2. Global Oleochemicals Market Volume, By Region, 2015-2021 (KT)

Table 3. Global Oleochemicals Market,TOP Players Financials Analysis: By Companies, 2015 ($Million)

Table 4. Global Oleochemicals Market Revenue By Type (2015-2021) ($Billion)

Table 5. Global Oleochemicals Market Volume By Type (2015-2021) (Kt)

Table 6. Global Fatty Acids Market Revenue, By Application, 2015 -2021 ($Billion)

Table 7. Global Fatty Acids Market Revenue, By Region, 2015 -2021 ($Billion)

Table 8. Global Fatty Alcohols Market Revenue, By Application, 2015 -2021 ($Billion)

Table 9. Global Fatty Alcohols Market Revenue, By Region, 2015 -2021 ($Billion)

Table 10. Global Fatty Amines Market Revenue, By Application, 2015 -2021 ($Billion)

Table 11. Global Fatty Amines Market Revenue, By Region, 2015 -2021 ($Billion)

Table 12. Global Fatty Acid Methyl Esters Market Revenue, By Application, 2015 -2021 ($Billion)

Table 13. Global Fatty Acid Methyl Esters Market Revenue, By Region, 2015 -2021 ($Billion)

Table 14. Global Glycerine Market Revenue, By Application, 2015 -2021 ($Billion)

Table 15. Global Glycerine Market Revenue, By Region, 2015 -2021 ($Billion)

Table 16. Global Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 17. Global Oleochemicals Market Volume, By Application, 2015-2021 (KT)

Table 18. Global Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 19. Global Oleochemicals Market Volume, By Region, 2015-2021 (KT)

Table 20. Americas Oleochemicals Market Revenue, By Type, 2015-2021 ($Billion)

Table 21. Americas Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 22. Americas Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 23. Americas Oleochemicals Market Volume, By Country, 2015-2021 (KT)

Table 24. Europe Oleochemicals Market Revenue, By Type, 2015-2021 ($Billion)

Table 25. Europe Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 26. Europe Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 27. Europe Oleochemicals Market Volume, By Country, 2015-2021 (KT)

Table 28. APAC Oleochemicals Market Revenue, By Type, 2015-2021 ($Billion)

Table 29. APAC Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 30. APAC Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 31. APAC Oleochemicals Market Volume, By Country, 2015-2021 (KT)

Table 32. RoW Oleochemicals Market Revenue, By Type, 2015-2021 ($Million)

Table 33. RoW Oleochemicals Market Revenue, By Application, 2015-2021 ($Million)

Table 34. RoW Oleochemicals Market Revenue, By Country, 2015-2021 ($Million)

List of Figures:

Figure 1. Global Oleochemicals Market, By Type

Figure 2. Global Oleochemicals Market, By Application

Figure 3. Global Oleochemicals Market, By Region

Figure 4. Global Oleochemicals Market, Industry Breakdown Analysis

Figure 5. Global Oleochemicals Market Share, By Type, 2015 (%)

Figure 6. Global Oleochemicals Market Share, By Segmentation, 2015 (%)

Figure 7. Basic Oleochemicals Market Share Analysis, By Company 2015 (%)

Figure 8. Global Oleochemicals Market End-user Profiling- 2015

Figure 9. Global Oleochemicals Market, Market Impact Of Drivers

Figure 10. Global Oleochemicals Market, Market Impact Of Constraints

Figure 11. Global Oleochemicals market, Value Chain Analysis

Figure 12. Global Oleochemicals Market Opportunity Analysis in Value Chain, 2015-2021

Figure 13. Global Oleochemicals Market Prices, By Type, 2015-2021 ($/ KT)

Figure 14. Global Oleochemicals Market Life Cycle, 2015-2021

Figure 15. Global Oleochemicals Market, Regulation Analysis, by Country

Figure 16. Global Oleochemical Market, Value Added to the Value Chain

Figure 17. Global Fatty Acids Market Revenue and Volume ,By Application, 2015 (%)

Figure 18. Global Fatty Acids Market Volume, By Region, 2015-2021 (KT)

Figure 19. Global Fatty Acids Capacity, By Region2015 (%)

Figure 20. Global Fatty Alcohols Market Revenue and Volume ,By Application, 2015 (%)

Figure 21. Global Fatty Alcohols Market Volume, By Region, 2015-2021 (KT)

Figure 22. Global Fatty Amines Market Revenue and Volume ,By Application, 2015 (%)

Figure 23. Global Fatty Amines Market Volume, By Region, 2015-2021 (KT)

Figure 24. Global Fatty Acid Methyl Esters Market Revenue and Volume ,By Application, 2015 (%)

Figure 25. Global Fatty Acid Methyl Esters Market Volume, By Region, 2015-2021 (KT)

Figure 26. Global Glycerine Market Revenue and Volume ,By Application, 2015 (%)

Figure 27. Global Glycerine Market Volume, By Region, 2015-2021 (KT)

Figure 28. Global Oleochemicals Market Revenue Share, By Application, 2015 (%)

Figure 29. Hospitals, By Country, 2015 (Units)

Figure 30. Revenue Of Cosmetic Industry In U.S., 2006-2016 ($Billion)

Figure 31. Global Oleochemicals Market Revenue, By Soaps and Detergents, 2015-2021 ($Billion)

Figure 32. Global Oleochemicals Market Revenue, By Lubricants and Greases, 2015-2021 ($Billion)

Figure 33. Global Oleochemicals Market Revenue, By Intermediates, 2015-2021 ($Billion)

Figure 34. Global Oleochemicals Market Revenue, By Paints and Surface Coatings, . 2015-2021 ($Billion)

Figure 35. Global Oleochemicals Market : Access To Potential CPO (Crude Palm Oil) World Market By 2020

Figure 36. Global Palm Oil Prices, 2010-2020 ($/ton)

Figure 37. Global Oleochemicals Market Revenue and Volume, By Region, 2015 (%)

Figure 38. Americas Oleochemicals Market Volume, By Type, 2015-2021 (KT)

Figure 39. Americas Oleochemicals Market Volume, By Application, 2015 (%)

Figure 40. Europe Oleochemicals Market Volume, By Type, 2015-2021 (KT)

Figure 41. Europe Oleochemicals Market Volume, By Application, 2015 (%)

Figure 42. APAC Oleochemicals Market Volume, By Type, 2015-2021 (KT)

Figure 43. APAC Oleochemicals Market Volume, By Application, 2015 (%)

Figure 44. Global Oleochemicals Market, Capacities, By Region 2014 (%)

Table 1. Global Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 2. Global Oleochemicals Market Volume, By Region, 2015-2021 (KT)

Table 3. Global Oleochemicals Market,TOP Players Financials Analysis: By Companies, 2015 ($Million)

Table 4. Global Oleochemicals Market Revenue By Type (2015-2021) ($Billion)

Table 5. Global Oleochemicals Market Volume By Type (2015-2021) (Kt)

Table 6. Global Fatty Acids Market Revenue, By Application, 2015 -2021 ($Billion)

Table 7. Global Fatty Acids Market Revenue, By Region, 2015 -2021 ($Billion)

Table 8. Global Fatty Alcohols Market Revenue, By Application, 2015 -2021 ($Billion)

Table 9. Global Fatty Alcohols Market Revenue, By Region, 2015 -2021 ($Billion)

Table 10. Global Fatty Amines Market Revenue, By Application, 2015 -2021 ($Billion)

Table 11. Global Fatty Amines Market Revenue, By Region, 2015 -2021 ($Billion)

Table 12. Global Fatty Acid Methyl Esters Market Revenue, By Application, 2015 -2021 ($Billion)

Table 13. Global Fatty Acid Methyl Esters Market Revenue, By Region, 2015 -2021 ($Billion)

Table 14. Global Glycerine Market Revenue, By Application, 2015 -2021 ($Billion)

Table 15. Global Glycerine Market Revenue, By Region, 2015 -2021 ($Billion)

Table 16. Global Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 17. Global Oleochemicals Market Volume, By Application, 2015-2021 (KT)

Table 18. Global Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 19. Global Oleochemicals Market Volume, By Region, 2015-2021 (KT)

Table 20. Americas Oleochemicals Market Revenue, By Type, 2015-2021 ($Billion)

Table 21. Americas Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 22. Americas Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 23. Americas Oleochemicals Market Volume, By Country, 2015-2021 (KT)

Table 24. Europe Oleochemicals Market Revenue, By Type, 2015-2021 ($Billion)

Table 25. Europe Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 26. Europe Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 27. Europe Oleochemicals Market Volume, By Country, 2015-2021 (KT)

Table 28. APAC Oleochemicals Market Revenue, By Type, 2015-2021 ($Billion)

Table 29. APAC Oleochemicals Market Revenue, By Application, 2015-2021 ($Billion)

Table 30. APAC Oleochemicals Market Revenue, By Region, 2015-2021 ($Billion)

Table 31. APAC Oleochemicals Market Volume, By Country, 2015-2021 (KT)

Table 32. RoW Oleochemicals Market Revenue, By Type, 2015-2021 ($Million)

Table 33. RoW Oleochemicals Market Revenue, By Application, 2015-2021 ($Million)

Table 34. RoW Oleochemicals Market Revenue, By Country, 2015-2021 ($Million)

List of Figures:

Figure 1. Global Oleochemicals Market, By Type

Figure 2. Global Oleochemicals Market, By Application

Figure 3. Global Oleochemicals Market, By Region

Figure 4. Global Oleochemicals Market, Industry Breakdown Analysis

Figure 5. Global Oleochemicals Market Share, By Type, 2015 (%)

Figure 6. Global Oleochemicals Market Share, By Segmentation, 2015 (%)

Figure 7. Basic Oleochemicals Market Share Analysis, By Company 2015 (%)

Figure 8. Global Oleochemicals Market End-user Profiling- 2015

Figure 9. Global Oleochemicals Market, Market Impact Of Drivers

Figure 10. Global Oleochemicals Market, Market Impact Of Constraints

Figure 11. Global Oleochemicals market, Value Chain Analysis

Figure 12. Global Oleochemicals Market Opportunity Analysis in Value Chain, 2015-2021

Figure 13. Global Oleochemicals Market Prices, By Type, 2015-2021 ($/ KT)

Figure 14. Global Oleochemicals Market Life Cycle, 2015-2021

Figure 15. Global Oleochemicals Market, Regulation Analysis, by Country

Figure 16. Global Oleochemical Market, Value Added to the Value Chain

Figure 17. Global Fatty Acids Market Revenue and Volume ,By Application, 2015 (%)

Figure 18. Global Fatty Acids Market Volume, By Region, 2015-2021 (KT)

Figure 19. Global Fatty Acids Capacity, By Region2015 (%)

Figure 20. Global Fatty Alcohols Market Revenue and Volume ,By Application, 2015 (%)

Figure 21. Global Fatty Alcohols Market Volume, By Region, 2015-2021 (KT)

Figure 22. Global Fatty Amines Market Revenue and Volume ,By Application, 2015 (%)

Figure 23. Global Fatty Amines Market Volume, By Region, 2015-2021 (KT)

Figure 24. Global Fatty Acid Methyl Esters Market Revenue and Volume ,By Application, 2015 (%)

Figure 25. Global Fatty Acid Methyl Esters Market Volume, By Region, 2015-2021 (KT)

Figure 26. Global Glycerine Market Revenue and Volume ,By Application, 2015 (%)

Figure 27. Global Glycerine Market Volume, By Region, 2015-2021 (KT)

Figure 28. Global Oleochemicals Market Revenue Share, By Application, 2015 (%)

Figure 29. Hospitals, By Country, 2015 (Units)

Figure 30. Revenue Of Cosmetic Industry In U.S., 2006-2016 ($Billion)

Figure 31. Global Oleochemicals Market Revenue, By Soaps and Detergents, 2015-2021 ($Billion)

Figure 32. Global Oleochemicals Market Revenue, By Lubricants and Greases, 2015-2021 ($Billion)

Figure 33. Global Oleochemicals Market Revenue, By Intermediates, 2015-2021 ($Billion)

Figure 34. Global Oleochemicals Market Revenue, By Paints and Surface Coatings, . 2015-2021 ($Billion)

Figure 35. Global Oleochemicals Market : Access To Potential CPO (Crude Palm Oil) World Market By 2020

Figure 36. Global Palm Oil Prices, 2010-2020 ($/ton)

Figure 37. Global Oleochemicals Market Revenue and Volume, By Region, 2015 (%)

Figure 38. Americas Oleochemicals Market Volume, By Type, 2015-2021 (KT)

Figure 39. Americas Oleochemicals Market Volume, By Application, 2015 (%)

Figure 40. Europe Oleochemicals Market Volume, By Type, 2015-2021 (KT)

Figure 41. Europe Oleochemicals Market Volume, By Application, 2015 (%)

Figure 42. APAC Oleochemicals Market Volume, By Type, 2015-2021 (KT)

Figure 43. APAC Oleochemicals Market Volume, By Application, 2015 (%)

Figure 44. Global Oleochemicals Market, Capacities, By Region 2014 (%)

Email

Email Print

Print