Liquid Handling Systems Market- By Type; By Instruments; By Applications; By End-User industry & Geographic Analysis - Forecast (2024 - 2030)

Liquid Handling Systems Market Overview:

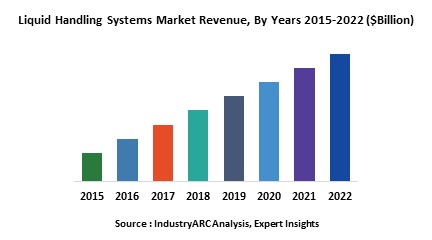

Liquid Handling Systems Market Size is forecast to reach $ 6,600 Million by 2030, at a CAGR of 4.90% during forecast period 2024-2030.Liquid handling systems are products that allows the dispensing of samples through them. In research organizations and laboratories, they mix solution of one type to other type. This solution has to be transferred at certain points of time in a repetitive manner to obtain the final solution. This proper timing in dispensing the solutions are taken by the liquid handling systems. Liquid handling systems are used in visualizing the synthetic genomics. The market for liquid handling systems was valued at $2.919 billion and is expected to reach $3.362 billion by 2023 at an estimated CAGR of 2.4%. North America holds the largest share in the liquid handling market with 41%. Automated pipetting systems holds the highest share in the market with a share of $817 million in 2017.

Liquid Handling Systems Market Outlook:

Liquid handling systems are of various types. There are electronic liquid handling systems, automated liquid handling systems and manual liquid handling systems. Electronic pipettes fall under the category of electronic liquid handling systems. The advantages over using the electronic pipettes are the time reduction and accuracy factors. These pipettes are programmed which can aspirate and dispense the liquid accurately. There are various types of liquid handling systems available in the market which include washers, pipettes, dispensers and many more. The washers provide a high throughput washing for ELISA, cellular assays and are also used in various other processes.

Liquid Handling Systems Market Growth drivers:

Electronic liquid handling systems provides much accuracy than the traditional dispensing systems which is the major driver for the liquid handling systems market. The electronic liquid handling systems are also time consuming when compared to the other devices.

The other driver for the liquid handling system is the assay miniaturization in drugs. The technique involves the increasing number of wells which helps the researchers to generate more data through these wells. Generation of these wells require the delivery of liquids, thereby increasing the demand for automated liquid handling systems.

Liquid Handling Systems Market Challenges:

One of the major challenges in this market are the prices of the electronic and automated liquid handling systems. The software used in the automated liquid handling systems are extravagant.

The other challenge is the integration of electronic components in the liquid handling system. When the integration of these materials increases then another major challenge arises which is the software interoperability.

Liquid Handling Systems Market Research Scope:

The base year of the study is 2017, with forecast done up to 2023. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Liquid Handling Systems Market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of plastics in the electric vehicle market, and their specific applications in different types of vehicles.

Liquid Handling Systems (SAP) Market Report: Industry Coverage

Liquid Handling Systems Market–By Type: Electronic liquid handling systems, Automated liquid handling systems and Manual liquid handling systems.

Liquid Handling Systems Market–By Product: Manual pipettes, electronic pipettes, dispensers, burettes, stackers, handlers, serological pipettes, pipette filters and others

Liquid Handling Systems Market– By Modality: Fixed tips, Disposable tips.

Liquid Handling Systems Market– By Application: Drug discovery, Forensics, Molecular biology, Clinical research and others.

Liquid Handling Systems Market – By End user: Lab solutions, Research organizations, Pharmaceutical industries and others.

The Liquid Handling Systems Market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

- North America: The U.S., Canada, Mexico

- South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

- Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

- APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

- Middle East and Africa: Israel, South Africa, Saudi Arabia

Liquid Handling Systems Market Key Players Perspective:

Some of the Key players in this market that have been studied for this report include: Thermofisher Inc., Hamilton Company, Agilent Technologies, Gilson, PerkinElmer Inc., Mettler-Toledo International Inc. and many others.

Market Research and Market Trends of Liquid Handling Systems Market

- Hudson Robotics has launched Hudson SOLO™ a high-resolution dispenser in the year 2018. It has a high-throughput which can perform the transformations of DNA. This product has also the ability to handle the reactions in an infertile environment. Softlinx, a software by the Hudson Control Group is used in it which can facilitate the robotic pipettor integration with the robots.

- Eppendorf has launched ep Motion® 5075t NGS solution which is the combination of automatic liquid handler and software with the accessories for reliable Next Generation Sequencing sample. NGS when automated eludes the risk of pipette errors which ultimately increases the productivity. This product provides better results than those of the manual preparation method.

- Formulatrix Inc. which provides automated laboratory solutions has created a platform called Rover Laboratory Automation Platform which has dispensing tools, NGS specific accessories and NGS specific consumables. This product carries the microplates from instrument to instrument in a laboratory and also has sensors incorporated in it. These automated sensors helps in sensing the liquid levels and labware geometries. This platform is configured with the Mantis liquid handler which is a microfluidic dispenser and helps in providing the highly reproducible solutions.

- TTP Labtech Ltd., a company that provides liquid handling solutions has created a liquid handling system called Mosquito. This instrument was used by the Ferrier Research Institute to analyze the structure of proteins. This instrument has high speed, accuracy, and high precision pipetting. This product when combined with a single use disposable pipette tips which prevents the cross-contamination.

Key Market Players:

The Top 5 companies in Liquid Handling Systems Market are:

- Thermo Fisher Scientific Inc.

- PerkinElmer, Inc.

- Beckman Coulter, Inc.

- Eppendorf SE

- Hamilton Company

1. Liquid Handling Systems Market - Overview

1.1. Definitions and Scope

2. Liquid Handling Systems Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Liquid Handling Systems Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Liquid Handling Systems Market Forces

4.1. Drivers

4.2. Constraints

4.3. Challenges

4.4. Porters five force model

4.4.1. Bargaining power of suppliers

4.4.2. Bargaining powers of customers

4.4.3. Threat of new entrants

4.4.4. Rivalry among existing players

4.4.5. Threat of substitutes

5. Liquid Handling Systems Market -Strategic analysis

5.1. Value chain analysis

5.2. Opportunities analysis

5.3. Product life cycle

6. Liquid Handling Systems Market– By Type (Market Size -$Million / $Billion)

6.1. Segment type Size and Market Share Analysis

6.2. Application Revenue and Trends by type of Application

6.3. Application Segment Analysis by Type

6.3.1. Electronic liquid handling systems

6.3.2. Automated liquid handling systems

6.3.3. Manual liquid handling systems

7. Liquid Handling Systems Market– By Products (Market Size -$Million / $Billion)

7.1. Segment type Size and Market Share Analysis

7.2. Application Revenue and Trends by type of Application

7.3. Application Segment Analysis by Type

7.3.1. Pipettes

7.3.1.1 Manual pipettes

7.3.1.2 Electronic pipettes

7.3.1.3 Automated pipettes

7.3.1.3.1 Stand-Alone systems

7.3.1.3.2 Bench-Top Workstations

7.3.1.3.3 Multi-channel systems

7.3.2. Burettes

7.3.3. Pipette controllers & pumps

7.3.4. Stackers

7.3.5. Handlers

7.3.6. Washers

7.3.7. Dispensers

7.3.6.1 Micro plate dispensers

7.3.6.2 Micro titer plate dispenser

7.3.6.3 Bottle top dispenser

7.3.8. Automated workstations

7.3.9. Vacuum aspiration systems

7.3.10. Others

8. Liquid Handling Systems Market– By Modality (Market Size -$Million / $Billion)

8.1. Fixed tips

8.2. Disposable tips

9. Liquid Handling Systems Market– By Application (Market Size -$Million / $Billion)

9.1. Drug discovery

9.2. Forensics

9.3. Materials science

9.4. Molecular Biology

9.5. Cell based assays

9.6. Protein crystallization

9.7. Proteomics

9.8. Others

10. Liquid Handling Systems Market– By End user (Market Size -$Million / $Billion)

10.1. Segment type Size and Market Share Analysis

10.2. Application Revenue and Trends by type of Application

10.3. Application Segment Analysis by Type

10.3.1. Lab solutions

10.3.2. Research organizations

10.3.3. Biotechnology

10.3.4. Pharmaceutical industries

10.3.5. Others

11. Liquid Handling Systems - By Geography (Market Size -$Million / $Billion)

11.1. Liquid Handling Systems Market - North America Segment Research

11.2. North America Market Research (Million / $Billion)

11.2.1. Segment type Size and Market Size Analysis

11.2.2. Revenue and Trends

11.2.3. Application Revenue and Trends by type of Application

11.2.4. Company Revenue and Product Analysis

11.2.5. North America Product type and Application Market Size

11.2.5.1. U.S.

11.2.5.2. Canada

11.2.5.3. Mexico

11.2.5.4. Rest of North America

11.3. Liquid Handling Systems - South America Segment Research

11.4. South America Market Research (Market Size -$Million / $Billion)

11.4.1. Segment type Size and Market Size Analysis

11.4.2. Revenue and Trends

11.4.3. Application Revenue and Trends by type of Application

11.4.4. Company Revenue and Product Analysis

11.4.5. South America Product type and Application Market Size

11.4.5.1. Brazil

11.4.5.2. Venezuela

11.4.5.3. Argentina

11.4.5.4. Ecuador

11.4.5.5. Peru

11.4.5.6. Colombia

11.4.5.7. Costa Rica

11.4.5.8. Rest of South America

11.5. Liquid Handling Systems - Europe Segment Research

11.6. Europe Market Research (Market Size -$Million / $Billion)

11.6.1. Segment type Size and Market Size Analysis

11.6.2. Revenue and Trends

11.6.3. Application Revenue and Trends by type of Application

11.6.4. Company Revenue and Product Analysis

11.6.5. Europe Segment Product type and Application Market Size

11.6.5.1. U.K

11.6.5.2. Germany

11.6.5.3. Italy

11.6.5.4. France

11.6.5.5. Netherlands

11.6.5.6. Belgium

11.6.5.7. Spain

11.6.5.8. Denmark

11.6.5.9. Rest of Europe

11.7. Liquid Handling Systems – APAC Segment Research

11.8. APAC Market Research (Market Size -$Million / $Billion)

11.8.1. Segment type Size and Market Size Analysis

11.8.2. Revenue and Trends

11.8.3. Application Revenue and Trends by type of Application

11.8.4. Company Revenue and Product Analysis

11.8.5. APAC Segment – Product type and Application Market Size

11.8.5.1. China

11.8.5.2. Australia

11.8.5.3. Japan

11.8.5.4. South Korea

11.8.5.5. India

11.8.5.6. Taiwan

11.8.5.7. Malaysia

12. Liquid Handling Systems Market - Entropy

12.1. New product launches

12.2. M&A's, collaborations, JVs and partnerships

13. Liquid Handling Systems Market – Industry / Segment Competition landscape Premium

13.1. Market Share Analysis

13.1.1. Market Share by Country- Top companies

13.1.2. Market Share by Region- Top 10 companies

13.1.3. Market Share by type of Application – Top 10 companies

13.1.4. Market Share by type of Product / Product category- Top 10 companies

13.1.5. Market Share at global level- Top 10 companies

13.1.6. Best Practises for companies

14. Liquid Handling Systems Market – Key Company List by Country Premium

15. Liquid Handling Systems Market Company Analysis

15.1. Market Share, Company Revenue, Products, M&A, Developments

15.2. Thermofisher Inc.

15.3. Hamilton Company

15.4. Agilent Technologies

15.5. Gilson

15.6. PerkinElmer Inc.

15.7. Mettler-Toledo International Inc.

15.8. Company 7

15.9. Company 8

15.10. Company 9

15.11. Company 10 and more

"*Financials would be provided on a best efforts basis for private companies"

16. Liquid Handling Systems Market -Appendix

16.1. Abbreviations

16.2. Sources

17. Liquid Handling Systems Market -Methodology Premium

17.1. Research Methodology

17.1.1. Company Expert Interviews

17.1.2. Industry Databases

17.1.3. Associations

17.1.4. Company News

17.1.5. Company Annual Reports

17.1.6. Application Trends

17.1.7. New Products and Product database

17.1.8. Company Transcripts

17.1.9. R&D Trends

17.1.10. Key Opinion Leaders Interviews

17.1.11. Supply and Demand Trends

List of Tables

Table 1: Liquid Handling Systems Market Overview 2023-2030

Table 2: Liquid Handling Systems Market Leader Analysis 2023-2024 (US$)

Table 3: Liquid Handling Systems Market Product Analysis 2023-2024 (US$)

Table 4: Liquid Handling Systems Market End User Analysis 2023-2024 (US$)

Table 5: Liquid Handling Systems Market Patent Analysis 2021-2023* (US$)

Table 6: Liquid Handling Systems Market Financial Analysis 2023-2024 (US$)

Table 7: Liquid Handling Systems Market Driver Analysis 2023-2024 (US$)

Table 8: Liquid Handling Systems Market Challenges Analysis 2023-2024 (US$)

Table 9: Liquid Handling Systems Market Constraint Analysis 2023-2024 (US$)

Table 10: Liquid Handling Systems Market Supplier Bargaining Power Analysis 2023-2024 (US$)

Table 11: Liquid Handling Systems Market Buyer Bargaining Power Analysis 2023-2024 (US$)

Table 12: Liquid Handling Systems Market Threat of Substitutes Analysis 2023-2024 (US$)

Table 13: Liquid Handling Systems Market Threat of New Entrants Analysis 2023-2024 (US$)

Table 14: Liquid Handling Systems Market Degree of Competition Analysis 2023-2024 (US$)

Table 15: Liquid Handling Systems Market Value Chain Analysis 2023-2024 (US$)

Table 16: Liquid Handling Systems Market Pricing Analysis 2023-2030 (US$)

Table 17: Liquid Handling Systems Market Opportunities Analysis 2023-2030 (US$)

Table 18: Liquid Handling Systems Market Product Life Cycle Analysis 2023-2030 (US$)

Table 19: Liquid Handling Systems Market Supplier Analysis 2023-2024 (US$)

Table 20: Liquid Handling Systems Market Distributor Analysis 2023-2024 (US$)

Table 21: Liquid Handling Systems Market Trend Analysis 2023-2024 (US$)

Table 22: Liquid Handling Systems Market Size 2023 (US$)

Table 23: Liquid Handling Systems Market Forecast Analysis 2023-2030 (US$)

Table 24: Liquid Handling Systems Market Sales Forecast Analysis 2023-2030 (Units)

Table 25: Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 26: Liquid Handling Systems Market By Instruments, Revenue & Volume, By Manual Pipettes, 2023-2030 ($)

Table 27: Liquid Handling Systems Market By Instruments, Revenue & Volume, By Electronic Pipettes, 2023-2030 ($)

Table 28: Liquid Handling Systems Market By Instruments, Revenue & Volume, By Automated Pipetting Systems, 2023-2030 ($)

Table 29: Liquid Handling Systems Market By Instruments, Revenue & Volume, By Pipette Tips, 2023-2030 ($)

Table 30: Liquid Handling Systems Market By Instruments, Revenue & Volume, By Dispensers, 2023-2030 ($)

Table 31: Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 32: Liquid Handling Systems Market By Application, Revenue & Volume, By Serial Dilution, 2023-2030 ($)

Table 33: Liquid Handling Systems Market By Application, Revenue & Volume, By Titration, 2023-2030 ($)

Table 34: Liquid Handling Systems Market By Application, Revenue & Volume, By Biological Sample Handling, 2023-2030 ($)

Table 35: Liquid Handling Systems Market By Application, Revenue & Volume, By Cell Based Assays, 2023-2030 ($)

Table 36: Liquid Handling Systems Market By Application, Revenue & Volume, By Next Generation Sequencing (NGS), 2023-2030 ($)

Table 37: Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 38: Liquid Handling Systems Market By End User Industry, Revenue & Volume, By Lab solutions, 2023-2030 ($)

Table 39: Liquid Handling Systems Market By End User Industry, Revenue & Volume, By Life sciences, 2023-2030 ($)

Table 40: Liquid Handling Systems Market By End User Industry, Revenue & Volume, By Industrial & applied, 2023-2030 ($)

Table 41: Liquid Handling Systems Market By End User Industry, Revenue & Volume, By Clinical & diagnostics, 2023-2030 ($)

Table 42: North America Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 43: North America Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 44: North America Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 45: South america Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 46: South america Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 47: South america Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 48: Europe Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 49: Europe Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 50: Europe Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 51: APAC Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 52: APAC Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 53: APAC Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 54: Middle East & Africa Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 55: Middle East & Africa Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 56: Middle East & Africa Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 57: Russia Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 58: Russia Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 59: Russia Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 60: Israel Liquid Handling Systems Market, Revenue & Volume, By Instruments, 2023-2030 ($)

Table 61: Israel Liquid Handling Systems Market, Revenue & Volume, By Application, 2023-2030 ($)

Table 62: Israel Liquid Handling Systems Market, Revenue & Volume, By End User Industry, 2023-2030 ($)

Table 63: Top Companies 2023 (US$)Liquid Handling Systems Market, Revenue & Volume

Table 64: Product Launch 2023-2024Liquid Handling Systems Market, Revenue & Volume

Table 65: Mergers & Acquistions 2023-2024Liquid Handling Systems Market, Revenue & Volume

List of Figures

Figure 1: Overview of Liquid Handling Systems Market 2023-2030

Figure 2: Market Share Analysis for Liquid Handling Systems Market 2023 (US$)

Figure 3: Product Comparison in Liquid Handling Systems Market 2023-2024 (US$)

Figure 4: End User Profile for Liquid Handling Systems Market 2023-2024 (US$)

Figure 5: Patent Application and Grant in Liquid Handling Systems Market 2021-2023* (US$)

Figure 6: Top 5 Companies Financial Analysis in Liquid Handling Systems Market 2023-2024 (US$)

Figure 7: Market Entry Strategy in Liquid Handling Systems Market 2023-2024

Figure 8: Ecosystem Analysis in Liquid Handling Systems Market 2023

Figure 9: Average Selling Price in Liquid Handling Systems Market 2023-2030

Figure 10: Top Opportunites in Liquid Handling Systems Market 2023-2024

Figure 11: Market Life Cycle Analysis in Liquid Handling Systems Market

Figure 12: GlobalBy InstrumentsLiquid Handling Systems Market Revenue, 2023-2030 ($)

Figure 13: GlobalBy ApplicationLiquid Handling Systems Market Revenue, 2023-2030 ($)

Figure 14: GlobalBy End User IndustryLiquid Handling Systems Market Revenue, 2023-2030 ($)

Figure 15: Global Liquid Handling Systems Market - By Geography

Figure 16: Global Liquid Handling Systems Market Value & Volume, By Geography, 2023-2030 ($)

Figure 17: Global Liquid Handling Systems Market CAGR, By Geography, 2023-2030 (%)

Figure 18: North America Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 19: US Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 20: US GDP and Population, 2023-2024 ($)

Figure 21: US GDP – Composition of 2023, By Sector of Origin

Figure 22: US Export and Import Value & Volume, 2023-2024 ($)

Figure 23: Canada Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 24: Canada GDP and Population, 2023-2024 ($)

Figure 25: Canada GDP – Composition of 2023, By Sector of Origin

Figure 26: Canada Export and Import Value & Volume, 2023-2024 ($)

Figure 27: Mexico Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 28: Mexico GDP and Population, 2023-2024 ($)

Figure 29: Mexico GDP – Composition of 2023, By Sector of Origin

Figure 30: Mexico Export and Import Value & Volume, 2023-2024 ($)

Figure 31: South America Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 32: Brazil Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 33: Brazil GDP and Population, 2023-2024 ($)

Figure 34: Brazil GDP – Composition of 2023, By Sector of Origin

Figure 35: Brazil Export and Import Value & Volume, 2023-2024 ($)

Figure 36: Venezuela Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 37: Venezuela GDP and Population, 2023-2024 ($)

Figure 38: Venezuela GDP – Composition of 2023, By Sector of Origin

Figure 39: Venezuela Export and Import Value & Volume, 2023-2024 ($)

Figure 40: Argentina Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 41: Argentina GDP and Population, 2023-2024 ($)

Figure 42: Argentina GDP – Composition of 2023, By Sector of Origin

Figure 43: Argentina Export and Import Value & Volume, 2023-2024 ($)

Figure 44: Ecuador Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 45: Ecuador GDP and Population, 2023-2024 ($)

Figure 46: Ecuador GDP – Composition of 2023, By Sector of Origin

Figure 47: Ecuador Export and Import Value & Volume, 2023-2024 ($)

Figure 48: Peru Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 49: Peru GDP and Population, 2023-2024 ($)

Figure 50: Peru GDP – Composition of 2023, By Sector of Origin

Figure 51: Peru Export and Import Value & Volume, 2023-2024 ($)

Figure 52: Colombia Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 53: Colombia GDP and Population, 2023-2024 ($)

Figure 54: Colombia GDP – Composition of 2023, By Sector of Origin

Figure 55: Colombia Export and Import Value & Volume, 2023-2024 ($)

Figure 56: Costa Rica Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 57: Costa Rica GDP and Population, 2023-2024 ($)

Figure 58: Costa Rica GDP – Composition of 2023, By Sector of Origin

Figure 59: Costa Rica Export and Import Value & Volume, 2023-2024 ($)

Figure 60: Europe Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 61: U.K Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 62: U.K GDP and Population, 2023-2024 ($)

Figure 63: U.K GDP – Composition of 2023, By Sector of Origin

Figure 64: U.K Export and Import Value & Volume, 2023-2024 ($)

Figure 65: Germany Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 66: Germany GDP and Population, 2023-2024 ($)

Figure 67: Germany GDP – Composition of 2023, By Sector of Origin

Figure 68: Germany Export and Import Value & Volume, 2023-2024 ($)

Figure 69: Italy Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 70: Italy GDP and Population, 2023-2024 ($)

Figure 71: Italy GDP – Composition of 2023, By Sector of Origin

Figure 72: Italy Export and Import Value & Volume, 2023-2024 ($)

Figure 73: France Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 74: France GDP and Population, 2023-2024 ($)

Figure 75: France GDP – Composition of 2023, By Sector of Origin

Figure 76: France Export and Import Value & Volume, 2023-2024 ($)

Figure 77: Netherlands Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 78: Netherlands GDP and Population, 2023-2024 ($)

Figure 79: Netherlands GDP – Composition of 2023, By Sector of Origin

Figure 80: Netherlands Export and Import Value & Volume, 2023-2024 ($)

Figure 81: Belgium Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 82: Belgium GDP and Population, 2023-2024 ($)

Figure 83: Belgium GDP – Composition of 2023, By Sector of Origin

Figure 84: Belgium Export and Import Value & Volume, 2023-2024 ($)

Figure 85: Spain Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 86: Spain GDP and Population, 2023-2024 ($)

Figure 87: Spain GDP – Composition of 2023, By Sector of Origin

Figure 88: Spain Export and Import Value & Volume, 2023-2024 ($)

Figure 89: Denmark Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 90: Denmark GDP and Population, 2023-2024 ($)

Figure 91: Denmark GDP – Composition of 2023, By Sector of Origin

Figure 92: Denmark Export and Import Value & Volume, 2023-2024 ($)

Figure 93: APAC Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 94: China Liquid Handling Systems Market Value & Volume, 2023-2030

Figure 95: China GDP and Population, 2023-2024 ($)

Figure 96: China GDP – Composition of 2023, By Sector of Origin

Figure 97: China Export and Import Value & Volume, 2023-2024 ($)Liquid Handling Systems Market China Export and Import Value & Volume, 2023-2024 ($)

Figure 98: Australia Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 99: Australia GDP and Population, 2023-2024 ($)

Figure 100: Australia GDP – Composition of 2023, By Sector of Origin

Figure 101: Australia Export and Import Value & Volume, 2023-2024 ($)

Figure 102: South Korea Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 103: South Korea GDP and Population, 2023-2024 ($)

Figure 104: South Korea GDP – Composition of 2023, By Sector of Origin

Figure 105: South Korea Export and Import Value & Volume, 2023-2024 ($)

Figure 106: India Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 107: India GDP and Population, 2023-2024 ($)

Figure 108: India GDP – Composition of 2023, By Sector of Origin

Figure 109: India Export and Import Value & Volume, 2023-2024 ($)

Figure 110: Taiwan Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 111: Taiwan GDP and Population, 2023-2024 ($)

Figure 112: Taiwan GDP – Composition of 2023, By Sector of Origin

Figure 113: Taiwan Export and Import Value & Volume, 2023-2024 ($)

Figure 114: Malaysia Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 115: Malaysia GDP and Population, 2023-2024 ($)

Figure 116: Malaysia GDP – Composition of 2023, By Sector of Origin

Figure 117: Malaysia Export and Import Value & Volume, 2023-2024 ($)

Figure 118: Hong Kong Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 119: Hong Kong GDP and Population, 2023-2024 ($)

Figure 120: Hong Kong GDP – Composition of 2023, By Sector of Origin

Figure 121: Hong Kong Export and Import Value & Volume, 2023-2024 ($)

Figure 122: Middle East & Africa Liquid Handling Systems Market Middle East & Africa 3D Printing Market Value & Volume, 2023-2030 ($)

Figure 123: Russia Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 124: Russia GDP and Population, 2023-2024 ($)

Figure 125: Russia GDP – Composition of 2023, By Sector of Origin

Figure 126: Russia Export and Import Value & Volume, 2023-2024 ($)

Figure 127: Israel Liquid Handling Systems Market Value & Volume, 2023-2030 ($)

Figure 128: Israel GDP and Population, 2023-2024 ($)

Figure 129: Israel GDP – Composition of 2023, By Sector of Origin

Figure 130: Israel Export and Import Value & Volume, 2023-2024 ($)

Figure 131: Entropy Share, By Strategies, 2023-2024* (%)Liquid Handling Systems Market

Figure 132: Developments, 2023-2024*Liquid Handling Systems Market

Figure 133: Company 1 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 134: Company 1 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 135: Company 1 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 136: Company 2 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 137: Company 2 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 138: Company 2 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 139: Company 3 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 140: Company 3 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 141: Company 3 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 142: Company 4 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 143: Company 4 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 144: Company 4 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 145: Company 5 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 146: Company 5 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 147: Company 5 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 148: Company 6 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 149: Company 6 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 150: Company 6 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 151: Company 7 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 152: Company 7 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 153: Company 7 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 154: Company 8 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 155: Company 8 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 156: Company 8 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 157: Company 9 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 158: Company 9 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 159: Company 9 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 160: Company 10 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 161: Company 10 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 162: Company 10 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 163: Company 11 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 164: Company 11 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 165: Company 11 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 166: Company 12 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 167: Company 12 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 168: Company 12 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 169: Company 13 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 170: Company 13 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 171: Company 13 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 172: Company 14 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 173: Company 14 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 174: Company 14 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Figure 175: Company 15 Liquid Handling Systems Market Net Revenue, By Years, 2023-2024* ($)

Figure 176: Company 15 Liquid Handling Systems Market Net Revenue Share, By Business segments, 2023 (%)

Figure 177: Company 15 Liquid Handling Systems Market Net Sales Share, By Geography, 2023 (%)

Email

Email Print

Print