LIST OF TABLES:

Table 1: Global Natural Fragrance Ingredients Market Revenue, By Type, 2016-2022 ($Million)

Table 2: Global Natural Fragrance Ingredients Market Revenue, By Form, 2016-2022 ($Million)

Table 3: Global Natural Fragrance Ingredients Market Revenue, By Application, 2016-2022 ($Million)

Table 4: Natural Fragrance Ingredients Market Ranking, By Company 2023

Table 5: Natural Fragrance Ingredients Market Value, By Type, 2016-2022 ($Million)

Table 6: Natural Fragrance Ingredients Market Value- Essential Oils, 2016-2022 ($Million)

Table 7: Natural Fragrance Ingredients Market Value- Isolates, 2016-2022 ($Million)

Table 8: Natural Fragrance Ingredients Market Revenue, By Form, 2016-2022 ($Million)

Table 9: Global Natural Fragrance Ingredients Market Revenue, By Application, 2016-2022 ($Million)

Table 10: Global Natural Fragrance Ingredients Market Value, By Region, 2016-2022 ($Million)

Table 11: North Americas Natural Fragrance Ingredients Market Revenue, By Type, 2016-2022 ($Million)

Table 12: North Americas Natural Fragrance Ingredients Market Revenue, By Form, 2016-2022 ($Million)

Table 13: North Americas Natural Fragrance Ingredients Market Revenue, By Application, 2016-2022 ($Million)

Table 14: North Americas Natural Fragrance Ingredients Market Revenue, By Country, 2016-2022 ($Million)

Table 15: Europe Natural Fragrance Ingredients Market Revenue, By Type, 2016-2022 ($Million)

Table 16: Europe Natural Fragrance Ingredients Market Revenue, By Form, 2016-2022 ($Million)

Table 17: Europe Natural Fragrance Ingredients Market Revenue, By Application, 2016-2022 ($Million)

Table 18: Europe Natural Fragrance Ingredients Market Revenue, By Country, 2016-2022 ($Million)

Table 19: Asia-Pacific: Natural Fragrance Ingredients Market Value, By Type, 2016-2022 ($Million)

Table 20: Asia-Pacific: Natural Fragrance Ingredients Market Value, By Form, 2016-2022 ($Million)

Table 21: Asia-Pacific: Natural Fragrance Ingredients Market Value, By Application, 2016-2022 ($Million)

Table 22: Asia-Pacific: Natural Fragrance Ingredients Market Value, By Country, 2016-2022 ($Million)

Table 23: RoW: Natural Fragrance Ingredients Market Value, By Type, 2016-2022 ($Million)

Table 24: RoW: Natural Fragrance Ingredients Market Value, By Form, 2016-2022 ($Million)

Table 25: RoW: Natural Fragrance Ingredients Market Value, By Application, 2016-2022 ($Million)

Table 26: RoW: Natural Fragrance Ingredients Market Value, By Region, 2016-2022 ($Million)

LIST OF FIGURES:

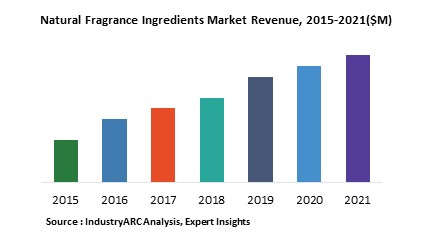

Figure 1: Natural Fragrance Ingredients Market Revenue, By Years, 2016-2022 ($Million)

Figure 2: Natural Fragrance Ingredients Market Revenue, By Region, 2016 and 2022 (%)

Figure 3: Givaudan SA

Figure 4: International Flavors & Fragrances Inc.

Figure 5: Symrise AG

Figure 6: Takasago International Corporation

Figure 7: Natural Fragrance Ingredients: Earnings Per Share, By Company ($), 2016-2022

Figure 8: Natural Fragrance Ingredients Published Patents, 2012-2023*

Figure 9: Natural Fragrance Ingredients Patents Share, By Countries, 2012-2023* (%)

Figure 10: Natural Fragrance Ingredients Share, By Company 1976-2023* (%)

Figure 11: Fragrance Industry Value Chain

Figure 12: Natural Fragrance Ingredients Market Life Cycle Analysis

Figure 13: Natural Fragrance Ingredients Market- Type

Figure 14: Natural Fragrance Ingredients Market- Essential Oils

Figure 15: Natural Fragrance Ingredients Market Value- Orange, 2016-2022 ($Million)

Figure 16: Natural Fragrance Ingredients Market Value- Mentha Arvensis, 2016-2022 ($Million)

Figure 17: Natural Fragrance Ingredients Market Value- Eucalyptus, 2016-2022 ($Million)

Figure 18: Natural Fragrance Ingredients Market Value- Citronella, 2016-2022 ($Million)

Figure 19: Natural Fragrance Ingredients Market Value- Others, 2016-2022 ($Million)

Figure 20: Natural Fragrance Ingredients Market- Isolates

Figure 21: Natural Fragrance Ingredients Market Value- Flowers, 2016-2022 ($Million)

Figure 22: Natural Fragrance Ingredients Market Value- Leaves, 2016-2022 ($Million)

Figure 23: Natural Fragrance Ingredients Market Value- Fruits, 2016-2022 ($Million)

Figure 24: Natural Fragrance Ingredients Market Value- Others, 2016-2022 ($Million)

Figure 25: Liquid: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 26: Powder & Crystalline: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 27: Households: Global Natural Fragrance Ingredients Market Revenue, By Application, 2016-2022 ($Million)

Figure 28: Cosmetics: Global Natural Fragrance Ingredients Market Revenue, By Application, 2016-2022 ($Million)

Figure 29: Global Natural Fragrance Ingredients Market - By Geography

Figure 30: U.S.: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 31: U.S.: GDP – Composition of 2015, By Sector of Origin

Figure 32: U.S.: Export and Import Value, 2012-2015 ($Trillion)

Figure 33: Canada: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 34: Canada: GDP – Composition of 2015, By Sector of Origin

Figure 35: Canada: Export and Import Value, 2012-2015 ($Billion)

Figure 36: Mexico: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 37: Mexico: GDP – Composition of 2015, By Sector of Origin

Figure 38: Mexico: Export and Import Value, 2012-2015 ($Billion)

Figure 39: U.S.: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 40: Canada: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 41: Mexico: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 42: North America: Natural Fragrance Ingredients Market CAGR, By Country, 2023-2022 (%)

Figure 43: U.K.: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 44: U.K.: GDP – Composition of 2015, By Sector of Origin

Figure 45: U.K.: Export and Import Value, 2012-2015 ($Billion)

Figure 46: Germany: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 47: Germany: GDP – Composition of 2015, By Sector of Origin

Figure 48: Germany: Export and Import Value, 2012-2015 ($Billion)

Figure 49: France: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 50: France: GDP – Composition of 2015, By Sector of Origin

Figure 51: France: Export and Import Value, 2012-2015 ($Billion)

Figure 52: Spain: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 53: Spain: GDP – Composition of 2015, By Sector of Origin

Figure 54: Spain: Export and Import Value, 2012-2015 ($Billion)

Figure 55: Italy: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 56: Italy: GDP – Composition of 2015, By Sector of Origin

Figure 57: Italy: Export and Import Value, 2012-2015 ($Billion)

Figure 58: Germany: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 59: U.K.: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 60: Spain: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 61: France: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 62: Italy: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 63: Rest of Europe: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 64: Europe: Natural Fragrance Ingredients Market CAGR, By Country, 2023-2022 (%)

Figure 65: China: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 66: China: GDP – Composition of 2015, By Sector of Origin

Figure 67: China: Export and Import Value, 2012-2015 ($Billion)

Figure 68: Japan: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 69: Japan: GDP – Composition of 2015, By Sector of Origin

Figure 70: Japan: Export and Import Value, 2012-2015 ($Billion)

Figure 71: South Korea: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 72: South Korea: GDP – Composition of 2015, By Sector of Origin

Figure 73: South Korea: Export and Import Value, 2012-2015 ($Billion)

Figure 74: India: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 75: India: GDP – Composition of 2015, By Sector of Origin

Figure 76: India: Export and Import Value, 2012-2015 ($Billion)

Figure 77: China: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 78: Japan: Natural Fragrance Ingredients Market Revenue 2016-2022 ($Million)

Figure 79: India: Natural Fragrance Ingredients Market Revenue 2016-2022 ($Million)

Figure 80: South Korea: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 81: Australia & New Zealand: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 82: Rest of APAC: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 83: APAC: Natural Fragrance Ingredients Market CAGR, By Country, 2023-2022 (%)

Figure 84: Middle East: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 85: Africa: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 86: South America: Natural Fragrance Ingredients Market Revenue, 2016-2022 ($Million)

Figure 87: RoW: Natural Fragrance Ingredients Market CAGR, By Country 2023-2022 (%)

Figure 88: Global Natural Fragrance Ingredients Market Entropy Share, By Strategies, 2014-2023* (%)

Figure 89: Global Natural Fragrance Ingredients Market Entropy, By Total Number of Developments, 2014-2023*

Figure 90: Givaudan: Net Revenue, 2015-2016 ($Billion)

Figure 91: Givaudan Market Share, By Segment, 2016 (%)

Figure 92: Givaudan Market Share, By Geography, 2016 (%)

Figure 93: International Flavors and Fragrances: Net Sales, 2013-2016 ($Billion)

Figure 94: International Flavors and Fragrances Market Share, By Segment, 2016 (%)

Figure 95: International Flavors & Fragrances Market Share, By Geography, 2016 (%)

Figure 96: Symrise AG: Net Sales, 2013-2016 ($Billion)

Figure 97: Symrise Market Share, By Segment, 2016 (%)

Figure 98: Takasago International Corporation: Net Sales, 2015-2016 ($Billion)

Figure 99: Takasago Inernational Corporation Market Share, By Geography, 2016 (%)

Figure 100: FRUTAROM, Sales, 2013-2016 ($Million)

Figure 101: FRUTAROM, Sales, By Segments, 2016 (%)

Figure 102: FRUTAROM, Sales, By Geography, 2016 (%)

Figure 103: Sensient Technologies Corporation, Sales, 2013-2016 ($Million)

Figure 104: Sensient Technologies Corporation, Sales, By Segments, 2016 (%)

Figure 105: Sensient Technologies Corporation, Sales, By Geography, 2016 (%)

Figure 106: BASF SE, Sales ($Billion), 2013-2016

Figure 107: BASF SE, Sales, By Segments, 2016 (%)

Figure 108: BASF SE, Sales, By Geography,2016 (%)

Email

Email Print

Print