Piezoelectric Sensor Market - By Application , By End-user , By Energy Source & By Geography - Forecast (2024 - 2030)

Piezoelectric Sensor Market Size is forecast to reach $ 3250 Million by 2030, at a CAGR of 6.87% during forecast period 2024-2030.Increasing demand for miniaturization gives rise to advance models of computing as small and integrated devices working collaboratively with communication capabilities, thus enhancing the growth of piezoelectric sensors market across the various industries. Moreover, surging wireless sensing networks and IOT deployment are further proliferating the demand for piezoelectric sensor across the globe.

What is Piezoelectric Sensor?

Piezoelectric sensors measure the electrical charge by utilizing piezoelectric materials that include Barium titanate, Lead zirconate titanate, and many others. Piezoelectric sensor are being developed to be immune to dust, dirt, grime, and liquids, and can work in high temperatures and humidity levels. Therefore, growing applications in semiconductor industry acts as one of the major driver for position sensor market. Piezoelectric sensor market is experiencing a healthy growth rate over the few years due to increasing demand for the smart devices.

In aerospace industry, the flight environment is quite harsh due to changes in humidity, temperature, pressure, speed, & loading conditions and these effects cause a lot of stress to the aircraft frame. Piezoelectric sensors are being employed to measures variables such as strains and other mechanical changes to the structure, thus creating opportunities for the growth of market.

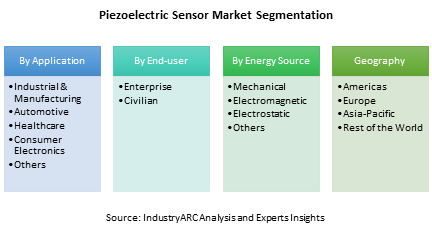

This report incorporates an in-depth assessment of piezoelectric sensor market by applications, end user industry, energy source, and geography. The major types of applications encompassed in the scope includes aerospace & defense, industrial & manufacturing, automotive, healthcare, telecommunication, consumer electronics, and others.

What are the major applications for piezoelectric sensors?

Currently, measuring parameters of the solid particles present in a gas or liquid flow in an industrial process are rapidly increasingly due to regulatory requirements for the quality check of process efficiency, pollutant emissions and product quality. Therefore, industrial and manufacturing segment is considered one of the major application of piezoelectric sensors and utilized for various appliances that include smart metering, smart transportation, smart grid, smart traffic, and others.

Market Research and Market Trends of Piezoelectric Sensors

- The huge potential market for wireless sensors that run on power derived from mechanical energy source is set to significantly boost the demand for piezoelectric sensors over the next few years. Furthermore, these sensors are gaining momentum due to rising power densities and higher feasibility for practical applications.

- According to AECOM statistics, APAC is the major region with rising number of cities with more than 50,000 population. The growing urbanization makes it inevitable for the government to increase the rate of construction in various countries, this highly influences the growth of these piezoelectric sensors for home automation applications.

- In 2017, researchers from MIT have built flexible sensors made up of piezoelectric materials which are found to detect movement in gastrointestinal tract. This is widely anticipated to be adopted into the healthcare sector as it could help doctors identify and diagnose gastrointestinal disorders, thus creating a huge opportunity for the growth of market.

- According to U.S. Energy Information Administration, about 21.23% of the total U.S. energy consumption was consumed by the residential sector as of year 2016. Therefore, increasing emphasis power consumption coupled with the rising concerns on the maintenance of the electronic components will surely escalate the demand for piezoelectric sensors over the next few years.

Who are the Major Players in Piezoelectric Sensors Market?

The major companies referred in the market research report includes TE Connectivity (U.S.), CTS Corporation (U.S.), Spectris (U.K.), First Sensor AG (Germany), Parker Hannifin Corporation (U.S.) and others.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2024-2030.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

Key Market Players:

The Top 5 companies in the Piezoelectric Sensor Market are:

- Honeywell International Inc.

- CTS Corp.

- Kistler Group

- Physik Instrumente GmbH & Co.

- Morgan Advanced Materials PLC

For more Automation and Instrumentation Market reports, please click here

1. Piezoelectric Sensor Market - Overview

1.1. Definitions and Scope

2. Piezoelectric Sensor Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Piezoelectric Sensor Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Piezoelectric Sensor Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Piezoelectric Sensor Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Piezoelectric Sensor Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Piezoelectric Sensor Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Piezoelectric Sensor Market – By Application (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Industrial

8.3.2. Manufacturing & Engineering

8.3.3. Automotive

8.3.4. Healthcare

8.3.5. Telecom

8.3.6. Aerospace

8.3.7. Oil & Gas

8.3.8. Others

9. Piezoelectric Sensor Market – By Energy Source (Market Size -$Million / $Billion)

9.1. Mechanical

9.2. Electromagnetic

9.3. Thermal

9.4. Chemical

9.5. Optical

10. Piezoelectric Sensor – By End Use Industry(Market Size -$Million / $Billion)

10.1. Segment type Size and Market Share Analysis

10.2. Application Revenue and Trends by type of Application

10.3. Application Segment Analysis by Type

10.3.1. End user

Enterprise

Civilian

10.3.2. Material

10.3.2.1. Quartz

10.3.2.2. Silicon

10.3.2.3. Piezo-Ceramic

10.3.2.4. Others

11. Piezoelectric Sensor - By Geography (Market Size -$Million / $Billion)

11.1. Piezoelectric Sensor Market - North America Segment Research

11.2. North America Market Research (Million / $Billion)

11.2.1. Segment type Size and Market Size Analysis

11.2.2. Revenue and Trends

11.2.3. Application Revenue and Trends by type of Application

11.2.4. Company Revenue and Product Analysis

11.2.5. North America Product type and Application Market Size

11.2.5.1. U.S.

11.2.5.2. Canada

11.2.5.3. Mexico

11.2.5.4. Rest of North America

11.3. Piezoelectric Sensor - South America Segment Research

11.4. South America Market Research (Market Size -$Million / $Billion)

11.4.1. Segment type Size and Market Size Analysis

11.4.2. Revenue and Trends

11.4.3. Application Revenue and Trends by type of Application

11.4.4. Company Revenue and Product Analysis

11.4.5. South America Product type and Application Market Size

11.4.5.1. Brazil

11.4.5.2. Venezuela

11.4.5.3. Argentina

11.4.5.4. Ecuador

11.4.5.5. Peru

11.4.5.6. Colombia

11.4.5.7. Costa Rica

11.4.5.8. Rest of South America

11.5. Piezoelectric Sensor - Europe Segment Research

11.6. Europe Market Research (Market Size -$Million / $Billion)

11.6.1. Segment type Size and Market Size Analysis

11.6.2. Revenue and Trends

11.6.3. Application Revenue and Trends by type of Application

11.6.4. Company Revenue and Product Analysis

11.6.5. Europe Segment Product type and Application Market Size

11.6.5.1. U.K

11.6.5.2. Germany

11.6.5.3. Italy

11.6.5.4. France

11.6.5.5. Netherlands

11.6.5.6. Belgium

11.6.5.7. Spain

11.6.5.8. Denmark

11.6.5.9. Rest of Europe

11.7. Piezoelectric Sensor – APAC Segment Research

11.8. APAC Market Research (Market Size -$Million / $Billion)

11.8.1. Segment type Size and Market Size Analysis

11.8.2. Revenue and Trends

11.8.3. Application Revenue and Trends by type of Application

11.8.4. Company Revenue and Product Analysis

11.8.5. APAC Segment – Product type and Application Market Size

11.8.5.1. China

11.8.5.2. Australia

11.8.5.3. Japan

11.8.5.4. South Korea

11.8.5.5. India

11.8.5.6. Taiwan

11.8.5.7. Malaysia

12. Piezoelectric Sensor Market - Entropy

12.1. New product launches

12.2. M&A's, collaborations, JVs and partnerships

13. Piezoelectric Sensor Market – Industry / Segment Competition landscape Premium

13.1. Market Share Analysis

13.1.1. Market Share by Country- Top companies

13.1.2. Market Share by Region- Top 10 companies

13.1.3. Market Share by type of Application – Top 10 companies

13.1.4. Market Share by type of Product / Product category- Top 10 companies

13.1.5. Market Share at global level- Top 10 companies

13.1.6. Best Practises for companies

14. Piezoelectric Sensor Market – Key Company List by Country Premium

15. Piezoelectric Sensor Market Company Analysis

15.1. Market Share, Company Revenue, Products, M&A, Developments

15.2. APC International Ltd

15.3. Ceramtec GmbH

15.4. Exelis, Inc

15.5. MAD City Labs Inc

15.6. Morgan Advanced Materials

15.7. Physik Instrumente

15.8. Piezo Solutions

15.9. Piezomechanik GmbH

15.10. Piezosystem Jena GmbH

15.11. US Eurotek, Inc

15.12. Kistler and More

"*Financials would be provided on a best efforts basis for private companies"

16. Piezoelectric Sensor Market -Appendix

16.1. Abbreviations

16.2. Sources

17. Piezoelectric Sensor Market -Methodology Premium

17.1. Research Methodology

17.1.1. Company Expert Interviews

17.1.2. Industry Databases

17.1.3. Associations

17.1.4. Company News

17.1.5. Company Annual Reports

17.1.6. Application Trends

17.1.7. New Products and Product database

17.1.8. Company Transcripts

17.1.9. R&D Trends

17.1.10. Key Opinion Leaders Interviews

17.1.11. Supply and Demand Trends

LIST OF TABLES:

Table 1: Key Company Products, Piezoelectric Sensor Market

Table 2: Piezoelectric Sensor Market Value, By Application, 2016-2023 ($Million)

Table 3: Global Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Table 4: Piezoelectric Sensor Market Value, By Region, 2016-2023 ($Millionillion)

Table 5: Americas: Piezoelectric Sensor Market Value, By Application, 2016-2023 ($Million)

Table 6: Americas: Piezoelectric Sensor Market Value, By Country, 2016-2023 ($Million)

Table 7: Americas: Piezoelectric Sensor Market Value, By End-User, 2016-2023 ($Million)

Table 8: Americas: Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Table 9: U.S.: GDP – Composition of 2015, By End Use

Table 10: Canada: GDP – Composition of 2015, By End Use

Table 11: Mexico: GDP – Composition of 2015, By End Use

Table 12: Brazil: GDP – Composition of 2015, By End Use

Table 13: Europe: Piezoelectric Sensor Market Value, By Application, 2016-2023 ($Million)

Table 14: Europe: Piezoelectric Sensor Market Value, By Country, 2016-2023 ($Million)

Table 15: Europe: Piezoelectric Sensor Market Value, By End-User, 2016-2023 ($Million)

Table 16: Europe: Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Table 17: U.K.: GDP – Composition of 2015, By End Use

Table 18: Germany: GDP – Composition of 2015, By End Use

Table 19: France: GDP – Composition of 2015, By End Use

Table 20: China: GDP – Composition of 2015, By End Use

Table 21: Japan: GDP – Composition of 2015, By End Use

Table 22: India: GDP – Composition of 2015, By End Use

Table 23: South Korea: GDP – Composition of 2015, By End Use

Table 24: Asia-Pacific: Piezoelectric Sensor Market Value, By Application, (2016-2023), $Million

Table 25: Asia-Pacific: Piezoelectric Sensor Market Value, By End-User, (2016-2023), $Million

Table 26: Asia-Pacific: Piezoelectric Sensor Market Value, By Energy Source, (2016-2023), $Million

Table 27: Asia-Pacific: Piezoelectric Sensor Market Value, By Country, (2016-2023), $Million

Table 28: RoW: Piezoelectric Sensor Market Value, By Application, (2016-2023), $Million

Table 29: RoW: Piezoelectric Sensor Market Value, By End-User, (2016-2023), $Million

Table 30: RoW: Piezoelectric Sensor Market Value, By Energy Source, (2016-2023), $Million

Table 31: Piezoelectric Sensor Market Value, By Country, (2016-2023), $Million

LIST OF FIGURES:

Figure 1: Global Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 2: Global Piezoelectric Sensor Market Value Share, By Application, 2023 (%)

Figure 3: Global Piezoelectric Sensor Market Value Share, By Geography, 2023 (%)

Figure 4: Global Piezoelectric Sensor Market Value Share, By Energy Source, 2023 (%)

Figure 5: Global Piezoelectric Sensor Market Value Share, By Energy Source, 2023 (%)

Figure 6: Piezoelectric Sensor Market Share Analysis, By Major Company, 2016 (%)

Figure 7: Global Piezoelectric Sensor Market Share, By Industry Verticals, 2023 (%)

Figure 8: First Sensor AG. Financials, 2012-2016, ($Million)

Figure 9: TE Connectivity Ltd. Financials, 2013-2023, ($Million)

Figure 10: CTS Corporation Financials, 2012-2016, ($Million)

Figure 11: Parker Hannifin Corp Financials, 2013-2023, ($Million)

Figure 12: Spectris* Financials, 2012-2016, ($Million)

Figure 13: Piezoelectric Sensor Market, Pricing Analysis, 2023 ($)

Figure 14: Piezoelectric Market Life Cycle Analysis

Figure 15: Industrial Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 16: Automotive Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 17: Healthcare Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 18: Telecommunication Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 19: Aerospace & Defense Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 20: Consumer electronics Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 21: Others Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 22: Enterprise Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 23: Civilian Piezoelectric Sensor Market Value, 2016-2023 ($Million)

Figure 24: Sources of Mechanical Energy that can be Harvested for Electricity

Figure 25: Mechanical: Global Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Figure 26: U.S.: End-Use Sector Energy Consumption, January to July (Trillion thermal units)

Figure 27: Electromagnetic: Global Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Figure 28: Electrostatic: Global Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Figure 29: Others: Global Piezoelectric Sensor Market Value, By Energy Source, 2016-2023 ($Million)

Figure 30: U.S.: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 31: U.S.: GDP – Composition of 2015, By Sector of Origin

Figure 32: U.S.: Export and Import Value, 2012-2015 ($Trillion)

Figure 33: Canada: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 34: Canada: GDP – Composition of 2015, By Sector of Origin

Figure 35: Canada: Export and Import Value, 2012-2015 ($Billion)

Figure 36: Mexico: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 37: Mexico: GDP – Composition of 2015, By Sector of Origin

Figure 38: Mexico: Export and Import Value, 2012-2015 ($Billion)

Figure 39: Brazil: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 40: Brazil: GDP – Composition of 2015, By Sector of Origin

Figure 41: Brazil: Export and Import Value, 2012-2015 ($Billion)

Figure 42: U.S..: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 43: Canada: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 44: Mexico: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 45: Brazil: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 46: Rest of Americas: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 47: Americas: Piezoelectric Sensor Market CAGR, By Country, 2023-2030 (%)

Figure 48: U.K.: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 49: U.K.: GDP – Composition of 2015, By Sector of Origin

Figure 50: U.K.: Export and Import Value, 2012-2015 ($Billion)

Figure 51: Germany: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 52: Germany: GDP – Composition of 2015, By Sector of Origin

Figure 53: Germany: Export and Import Value, 2012-2015 ($Billion)

Figure 54: France: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 55: France: GDP – Composition of 2015, By Sector of Origin

Figure 56: France: Export and Import Value, 2012-2015 ($Billion)

Figure 57: Germany: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 58: U.K: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 59: France: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 60: Rest of Europe: Piezoelectric Sensor Market Value, 2016 -2023 ($Million)

Figure 61: Europe: Piezoelectric Sensor Market CAGR, By Country, 2023 -2023 (%)

Figure 62: China: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 63: China: GDP – Composition of 2015, By Sector of Origin

Figure 64: China: Export and Import Value, 2012-2015 ($Billion)

Figure 65: Japan: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 66: Japan: GDP – Composition of 2015, By Sector of Origin

Figure 67: Japan: Export and Import Value, 2012-2015 ($Billion)

Figure 68: India: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 69: India: GDP – Composition of 2015, By Sector of Origin

Figure 70: India: Export and Import Value, 2012-2015 ($Billion)

Figure 71: South Korea: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 72: South Korea: GDP – Composition of 2015, By Sector of Origin

Figure 73: South Korea: Export and Import Value, 2012-2015 ($Billion)

Figure 74: China: Piezoelectric Sensor Market Value, (2016-2023), $Million

Figure 75: Japan: Piezoelectric Sensor Market Value, (2016-2023), $Million

Figure 76: India: Piezoelectric Sensor Market Value, (2016-2023), $Million

Figure 77: Others: Piezoelectric Sensor Market Value, (2016-2023), $Million

Figure 78: Asia-Pacific: Piezoelectric Sensor Market CAGR, By Country, (%)

Figure 79: Middle East: Piezoelectric Sensor Market Value, (2016-2023), $Million

Figure 80: Africa: Piezoelectric Sensor Market Value, (2016-2023), $Million

Figure 81: Piezoelectric Sensor Market CAGR, By Country (%)

Figure 82: Piezoelectric Sensor Market Entropy Share, By Strategies, 2013-2023 (%)

Figure 83: Piezoelectric Sensor Market Entropy, By Total Number of Developments, 2013-2023

Figure 84: CeramTec GmbH, Revenue ($Billion), 2014-2016

Figure 85: CeramTec GmbH, Revenue Share (%), By Geography, 2016

Figure 86: CeramTec GmbH, Revenue Share (%), By Business Segment, 2016

Figure 87: Parker Hannifin Corporation, Revenue ($Million), 2013-2016

Figure 88: Parker Hannifin Corporation, Revenue Share (%), By Geography, 2016

Figure 89: Parker Hannifin Corporation, Revenue Share (%), By Business Segment, 2016

Figure 90: Kistler Group, Revenue ($Billion), 2015-2023

Figure 91: Spectris Plc, Revenue ($Billion), 2013-2016

Figure 92: Spectris Plc, Revenue Share (%), By Geography, 2016

Figure 93: Spectris Plc, Revenue Share (%), By Business Segment, 2016

Figure 94: CTS Corp., Sales share ($Million), By Geography, 2013-2016

Figure 95: CTS Corp., Sales share (%), By Geography, 2016

Figure 96: CTS Corp., Sales share (%), By Business Segment, 2016

Figure 97: First Sensor, Sales Share ($Million),2013-2016

Figure 98: First Sensor, Sales Share (%), By Segments, 2016

Figure 99: First Sensor, Sales Share (%), By Geography,2016

Figure 100: TE Connectivity, Sales Share ($Billion), 2014-2023

Figure 101: TE Connectivity, Sales Share (%), By Segments, 2023

Figure 102: TE Connectivity, Sales Share (%), By Geography,2023

Figure 103: Spectris Plc, Revenue ($Billion), 2013-2016

Figure 104: Spectris Plc, Revenue Share (%), By Business Segment, 2016

Figure 105: Spectris Plc, Revenue Share (%), By Geography, 2016

Email

Email Print

Print