Steel Rebar Market Overview:

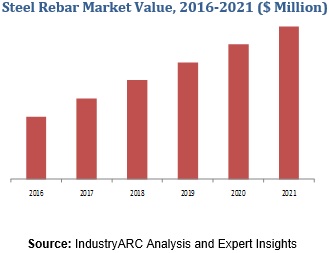

Steel Rebar Market Size is forecast to reach $316314 Million by 2030, at a CAGR of 4.40% during forecast period 2024-2030.The iron and steel industry, which is the parent industry of steel rebar, witnessed lucrative trade amounting to $428.6 trillion in 2018 with a growth rate of 13% between 2017 and 2018, according to the International Trade Centre (ITC).A significant fraction of this trade is due to growing demand predominantly from the construction industry for steel rebar or reinforced steel bar. The steel rebar market size was evaluated to be $133 billion in 2018, and the demand for steel rebar is poised to grow at a CAGR of 5.4% during the forecast period 2019-2025.

APAC had the maximum steel rebar market share of 66% in 2018. This is due to the growing construction industry in countries such as China and India. Increasing urbanization and economic growth are driving the residential real estate sector in India, and government initiatives such as “Housing For All By 2022” are aiding growth of the sector. This is leading to an increase in construction activities across the country which is significantly supporting the steel rebar market. Additionally, Indonesia, Malaysia, and Japan are observing increased infrastructural development, which is boosting the APAC steel rebar market. Population growth in countries such as China and India is also creating growth prospects for the real estate industry in these countries, which in turn is creating opportunities for the APAC steel rebar market in 2018.

Steel Rebar Market Outlook:

Steel rebar is also known as concrete reinforcement steel bar or reinforcing steel that are used as tension device in reinforced concrete. The product finds applications in infrastructure, manufacture, and oil & gas industries.

The key application of steel rebar is found in infrastructure, and the segment will grow at a substantial CAGR of 6.2% over the forecast period. The sustainable development goals (SDGs) by the United Nations is a creating a rapid need for infrastructure in upcoming years. According to the World Bank, the infrastructure investment gap attributable to roads only is estimated to be $8 trillion. In coming years, there will be augmented road development across the world, and steel rebar is commonplace in road development projects as it is used to reinforce concrete. Increasing infrastructural development will create lucrative prospects for the steel rebar market.

Steel Rebar Market Growth Drivers:

· The Global Construction Industry Driving the Steel Rebar Market –

According to the World Bank, the construction industry contributed a significant share of 25.39% to the global GDP in 2016. The industry, which is another major steel rebar marketplace, will play an important role in fulfilling the SDGs of the UN. Increase in construction activities worldwide will further create opportunities for the steel rebar market over the forecast period.

· The Growth Prospects in the Oil & Gas Industry –

Oil and gas industry presents one of the most lucrative opportunities for the steel rebar market as the industry needs non-corrosive conduits made of steel rebar. There will be an increase in production of oil & gas over the forecast period as the Organization of Petroleum Exporting Countries (OPEC) projects the demand for oil & gas to collectively reach from 145.7 mboe/d in 2015 to 177.8 mboe/d in 2030.This will lead to an increase in the capacity of refineries across the globe, and these refineries will generate a demand for steel rebar for use in conduits. Steel rebar used in the oil and gas, and other manufacturing industries such as pharmaceuticals and fertilizer plants are generally epoxy coated in order to resist corrosion. The epoxy-coated steel rebar market is poised to witness growth in coming years.

Steel Rebar Market Trends –

· In January 2018, North-American steel producer Commercial Metals Company (CMC) acquired a number of steel rebar mills in the U.S. The company also acquired a steel rebar fabrication company called Gerdau S.A. for a sum of $600m. The acquisitions of steel rebar mills and fabrication units will help the organization capitalize on the demand influx in the North America steel rebar market.

Steel Rebar Market Key Players Perspective –

The major players in the steel rebar market are Gerdau, Nippon Steel Corporation, Steel Authority of India Ltd., Tata Steel Ltd., Essar Steel, EVRAZ Plc, Jindal Steel & Power Ltd., Steel Dynamics, Inc., Acerinox S.A., and Hyundai Steel Co. Ltd.

Steel Rebar Market Research Scope:

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the steel rebar market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The steel rebar market research report also analyses the application of steel rebar in various sectors such as construction, infrastructure, oil & gas, and manufacturing industries.

Steel Rebar Market Report: Industry Coverage

The steel rebar market report identified the current trends, opportunities, and challenges in the industry along with a detailed depiction of strategies by the existing market players.

The report also provides facts, figures, and statistics about different types of steel rebar and their use in various sectors.

Key Market Players:

The Top 5 companies in the Steel Rebar Market are:

- ArcelorMittal

- Nippon Steel Corporation

- Gerdau S.A.

- Tata Steel

- Steel Authority of India Limited (SAIL)

For more Chemical and Materials related reports, please click here

1. Steel Rebar Market – Market Overview

2. Executive Summary

3. Market Landscape

3.1. Market Share Analysis

3.2. Comparative Analysis

3.3. Product Benchmarking

3.4. End User Profiling

3.5. Top 5 Financials Analysis

4. Steel Rebar Market– Market Forces

4.1. Drivers

4.1.1. Rapid infrastructure developments in developing nations

4.2. Restraints

4.2.1. Environmental regulations

4.3. Opportunities

4.4. Challenges

4.5. Porter’s Five Forces Analysis

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Power of Buyers

4.5.3. Threat of New Entrants

4.5.4. Threat of Substitutes

4.5.5. Degree of Competition

5. Steel Rebar Market– Strategic Analysis

5.1. Value Chain Analysis

5.2. Pricing Analysis

5.3. Opportunities Analysis

5.4. Product/Market Life Cycle Analysis

5.5. Suppliers and Distributors

6. Steel Rebar Market, By Finishing Type

6.1. Black Rebar

6.2. Epoxy Coated Rebar

6.3. Fabricated Rebar

6.4. Others

7. Steel Rebar Market, By End-Use Industry

7.1. Construction & Infrastructure

7.2. Manufacturing

7.3. Oil and Gas

8. Steel Rebar Market, By Geography

8.1. Europe

8.1.1. Germany

8.1.2. France

8.1.3. Italy

8.1.4. Spain

8.1.5. Russia

8.1.6. U.K.

8.1.7. Rest of Europe

8.2. Asia Pacific

8.2.1. China

8.2.2. India

8.2.3. Japan

8.2.4. South Korea

8.2.5. Rest of Asia-Pacific

8.3. North America

8.3.1. U.S.

8.3.2. Canada

8.3.3. Mexico

8.4. Rest of the World (RoW)

8.4.1. Brazil

8.4.2. Rest of RoW

9. Steel Rebar Market – Market Entropy

9.1. Expansion

9.2. Technological Developments

9.3. Merger & Acquisitions, and Joint Ventures

9.4. Supply- Contract

10. Company Profiles (Overview, Financials, SWOT Analysis, Developments, Product Portfolio)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

*More than 40 Companies are profiled in this Research Report, Complete List available on Request*

"*Financials would be provided on a best efforts basis for private companies"

11. Appendix

11.1. Abbreviations

11.2. Sources

11.3. Research Methodology

11.4. Bibliography

11.5. Compilation of Expert Insights

11.6. Disclaimer

Email

Email Print

Print