Cell Line Development Market - Forecast(2025 - 2031)

Cell Line Development Market Overview

Cell Line Development Market size is forecast to reach US$ 12856.4 Million by 2030, after growing at a CAGR of 9.90% during 2024-2030. Cell line development has various applications in recombinant protein and antibody production, drug screening, and gene functional studies using stable cell lines. The process of developing stable cell lines involves transfecting selected host cells with desired plasmids; screening and quantification of high-expressing clones; and validation of the proteins. Reduced production costs of biopharmaceutical proteins as an outcome of development of recombinant cell lines that produce high levels of expressed protein products are influencing the growth of the cell line development market. The cell line development market is segmented by source, type, application, and geography. This report provides an exhaustive value chain analysis for the year 2017, and forecast up to 2024.

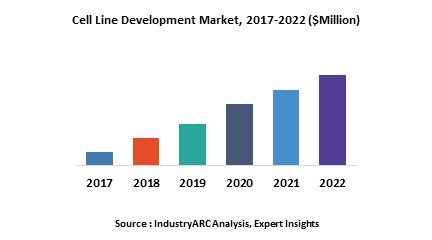

In 2017, the cell line development market was valued at $3269.1m. The market value is further estimated to reach $7274.7m by 2024, growing at a CAGR of 12.2% during the forecast period 2018–2024. North America generated 39% of the cell line development market revenue in 2017. The APAC market is expected to grow at a CAGR of 13.8% during the forecast period.

Cell Line Development Market Outlook

The primary objective of cell line development is to develop new clones that has important applications in drug screening and gene functional studies. The various analysis performed in this market include microbiology analysis and protein analysis. Newer technologies that are being used such as automated screening methods, cell line engineering, enhanced expression systems, improved process monitoring, and use of disposable apparatus are key factors that are contributing to the growth of the cell line development market. The market is consolidated with a few number of global players. The high capital and maintenance requirements associated with the protein of vectors, expression systems, and cell cultivation are restricting the entry of new players into the market.

Cell Line Development Market Growth Drivers

- Technological advancements in biologics and pharmaceutical industries

- Rising vaccine production, growing demand for biosimilars and monoclonal antibodies

- Recombinant cell lines are used to reduce the production costs of bio pharmaceutical proteins.

- Rising need for therapeutics to diagnose increasing incidences of cancer and auto immune disorders

- Increasing favorable governmental policies regarding health care infrastructure and the development of novel technologies in cell line development

Cell Line Development Market Challenges

One of the biggest challenges that the cell line development market faces is high capital costs. As the R&D of new drugs is capital expensive, only the major companies can afford to produce new drugs. The drugs derived from monoclonal antibodies (mAbs) for the treatment of diseases such as leukemia and lymphoma are expensive. These factors are hindering the growth of the cell line development market. Complexities in the development of stable cell lines and high risk of contamination, which leads to wastage of time and funds, are also hindering the market growth.

Cell Line Development Market Research Scope

The base year of the study is 2017, with forecast done up to 2024. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the cell line development market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats.

Cell Line Development Market Report: Industry Coverage

By Product: Equipment, Media & Reagents

By Source: Mammalian, Insect, and Amphibian

By Application: Bio Production, Tissue Engineering & Regenerative Medicine, Toxicity Testing, Research, and Drug discovery

The cell line development market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

- North America: The U.S., Canada, Mexico

- Europe: The U.K., Germany, Italy, France, Spain

- APAC: China, Japan, South Korea, India

- RoW: The Middle East, South America, Africa

Cell Line Development Market Key Players Perspective

In 2018, Denali Therapeutics entered into a partnership with Lonza to develop and produce biologic medicines using the latter’s cell line development technology GS Xceed.

In 2017, CBMG entered into a partnership with GE Healthcare for the manufacture of stem cells used in cell line development.

Cell Line Development Market Trends

- The cell line development market is emerging in the developing countries due to the increased awareness about cheaper medicine manufacturing and protein generation. The growth in this market is driven by increase in the demand for vaccinations and gene therapies in emerging economies.

Key Market Players:

The Top 5 companies in Cell Line Development Market are:

- Lonza

- Sartorius

- Thermo Fisher Scientific

- WuXi AppTec

- AstraZeneca

1. Cell Line Development Market – Market Overview

1.1. Definitions and Scope

2. Cell Line Development Market – Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Cell Line Development Market – Comparative Analysis

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Cell Line Development Market – Startup Companies Scenario

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Cell Line Development Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Cell Line Development Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Cell Line Development Market – Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Cell Line Development Market – By Product (Market Size – $Million/$Billion)

8.1. Market Size and Market Share Analysis

8.2. Product Segment Analysis

8.2.1. Cell Line Development Market, Equipment

8.2.1.1. Biosafety Cabinets

8.2.1.2. Cell Counters & Viability Analysis Systems

8.2.1.3. Incubators

8.2.1.4. Centrifuges

8.2.1.5. Bioreactors

8.2.1.6. Storage Equipment

8.2.1.7. Automation Systems

8.2.1.8. Microscopes

8.2.1.9. Filtration Systems

8.2.1.10. Other Equipment

8.2.2. Cell Line Development Market, Media & Reagents

8.2.2.1. Sera

8.2.2.2. Media

8.2.2.3. Reagents

9. Cell Line Development Market – By Source (Market Size – $Million/$Billion)

9.1. Mammalian

9.2. Insect

9.3. Amphibian

10. Cell Line Development Market– By Type (Market Size – $Million/$Billion)

10.1. Primary Cell Lines

10.2. Continuous Cell Lines

10.3. Hybridomas

10.4. Recombinant Cell Lines

11. Cell Line Development Market- By Application (Market Size – $Million/$Billion)

11.1. Bio production

11.2. Tissue Engineering & Regenerative Medicine

11.3. Toxicity Testing

11.4. Research

11.5. Drug Discovery

12. Cell Line Development Market – By Geography (Market Size – $Million/$Billion)

12.1. Cell Line Development Market – North America Segment Research

12.2. North America Market Research ($Million/$Billion)

12.2.1. Segment type Size and Market Size Analysis

12.2.2. Revenue and Trends

12.2.3. Application Revenue and Trends by type of Application

12.2.4. Company Revenue and Product Analysis

12.2.5. North America Product type and Application Market Size

12.2.5.1. U.S.

12.2.5.2. Canada

12.2.5.3. Mexico

12.3. Cell Line Development – Europe Segment Research

12.4. Europe Market Research ($Million/$Billion)

12.4.1. Segment Type Size and Market Size Analysis

12.4.2. Revenue and Trends

12.4.3. Application Revenue and Trends by type of Application

12.4.4. Company Revenue and Product Analysis

12.4.5. Europe Segment Product Type and Application Market Size

12.4.5.1. U.K.

12.4.5.2. Germany

12.4.5.3. Italy

12.4.5.4. France

12.4.5.5. Spain

12.4.5.6. Rest of Europe

12.5. Cell Line Development – APAC Segment Research

12.6. APAC Market Research ($Million/$Billion)

12.6.1. China

12.6.2. Japan

12.6.3. South Korea

12.6.4. India

12.7. Cell Line Development Market – RoW Segment Research

12.8. RoW Market Research ($Million/$Billion)

12.8.1. Segment Type Size and Market Size Analysis

12.8.2. Revenue and Trends

12.8.3. Application Revenue and Trends by type of Application

12.8.4. Company Revenue and Product Analysis

12.8.5. RoW Segment Product type and Application Market Size

12.8.5.1. Middle East

12.8.5.2. South America

12.8.5.3. Africa

13. Cell Line Development Market – Entropy

13.1. New Product Launches

13.2. M&As, Collaborations, JVs and Partnerships

14. Cell Line Development Market – Company Analysis

14.1. Market Share, Company Revenue, Products, M&As, Developments

14.2. American Type Culture Collection (ATCC)

14.3. Corning, Inc.

14.4. European Collection of Cell Culture (ECACC)

14.5. GE Healthcare

14.6. Lonza Group AG

14.7. Sartorius AG

14.8. Selexis SA

14.9. Sigma-Aldrich Corporation

14.10. Thermo Fisher Scientific, Inc.

14.11. Wuxi Apptec and More.

"*Financials of private companies would be provided on a best-efforts basis"

15. Cell Line Development Market – Appendix

15.1. Abbreviations

15.2. Sources

16. Cell Line Development Market – Research Methodology

16.1. Research Methodology

16.1.1. Company Expert Interviews

16.1.2. Industry Databases

16.1.3. Associations

16.1.4. Company News

16.1.5. Company Annual Reports

16.1.6. Application Trends

16.1.7. New Products and Product Database

16.1.8. Company Transcripts

16.1.9. R&D Trends

16.1.10. Key Opinion Leaders Interviews

16.1.11. Supply and Demand Trends

List of Tables:

Table 1: Cell Line Development Market Key Companies, 2016

Table 2: Global Cell Line Development Market, Competitor Benchmarking

Table 3: Global Cell Line Development Products Market Revenue, By Product Type, 2016-2024 ($Million)

Table 4: Global Cell Line Development Market Revenue, By Source, 2016-2024 ($Million)

Table 5: Global Cell Line Development Market Revenue, By Type, 2016-2024 ($Million)

Table 6: Cell Line Development Market Revenue, By Application, 2016-2024 ($Million)

Table 7: Cell Line Development Market Value, By Geography, 2016-2024($Million)

Table 8: Europe: Cell Line Development Products Market Value, By Product, 2016-2024 ($Million)

Table 9: Europe: Cell Line Development Market Value, By Source, 2016-2024 ($Million)

Table 10: Europe: Cell Line Development Market Value, By Type, 2016-2024 ($Million)

Table 11: Europe: Cell Line Development Market Value, By Application, 2016-2024 ($Million)

Table 12: Europe: Cell Line Development Market Value, By Country, 2016-2024 ($Million)

Table 13: Germany: GDP – Composition of 2015, By End Use

Table 14: France: GDP – Composition of 2015, By End Use

Table 15: U.K.: GDP – Composition of 2015, By End Use

Table 16: APAC Cell Line Development Products Market Revenue, By Product, 2016-2024 ($Million)

Table 17: APAC Cell Line Development Market Revenue, By Source, 2016-2024 ($Million)

Table 18: APAC Cell Line Development Market Revenue, By Type 2016-2024 ($Million)

Table 19: APAC Cell Line Development Market Revenue, By Application, 2016-2024 ($Million)

Table 20: APAC Cell Line Development Market Revenue, By Geography 2016-2024 ($Million)

Table 21: China: GDP – Composition of 2015, By End Use

Table 22: Japan: GDP – Composition of 2015, By End Use

Table 23: India: GDP – Composition of 2015, By End Use

Table 24: North America: Cell Line Development Products Market Value, By Product, 2016-2024 ($Million)

Table 25: North America: Cell Line Development Market Value, By Source, 2016-2024 ($Million)

Table 26: North America: Cell Line Development Market Value, By Type, 2016-2024 ($Million)

Table 27: North America: Cell Line Development Market Value, By Application, 2016-2024 ($Million)

Table 28: North America: Cell Line Development Market Value, By Country, 2016-2024 ($Million)

Table 29: U.S.: GDP – Composition of 2015, By End Use

Table 30: Canada : GDP – Composition of 2015, By End Use

Table 31: Mexico: GDP – Composition of 2015, By End Use

Table 32: ROW: Cell Line Development Products Market Revenue, By Product, 2016-2024 ($Million)

Table 33: ROW: Cell Line Development Market Revenue, By Source, 2016-2024 ($Million)

Table 34: ROW: Cell Line Development Market Revenue, By Type, 2016-2024 ($Million)

Table 35: ROW: Cell Line Development Market Revenue, By Application, 2016-2024 ($Million)

Table 36: ROW: Cell Line Development Market Revenue, By Geography, 2016-2024 ($Million)

Table 37: Cell Line Development Market: Product Portfolio

List of Figures:

Figure 1: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 2: Cell Line Development Products Market Value, By Product Type, 2016, 2024, ($Million)

Figure 3: Cell Line Development Market Value, By Source, 2016, 2024, ($Million)

Figure 4: Cell Line Development Market Value, By Type, 2016, 2024, ($Million)

Figure 5: Cell Line Development Market Value, By Application, 2016, 2024, ($Million)

Figure 6: Cell Line Development Market Share, By Region, 2016, 2024(%)

Figure 7: Cell Line Development Patents, By Year, 2013-2023

Figure 8: Cell Line Development Patents Share, By Applicant (%)

Figure 9: Cell Line Development Patents Share, By Geography (%)

Figure 10: Lonza Group

Figure 11: Catalent, Inc

Figure 12: Merck KGaA

Figure 13: EPS, By Company, ($)

Figure 14: Global Cell Line Development Market Lifecycle

Figure 15: Equipment: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 16: Biosafety Cabinets: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 17: Cell Counters & Viability Analysis Systems: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 18: Incubators: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 19: Centrifuges: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 20: Bioreactors: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 21: Storage Equipment: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 22: Automation Systems: Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 23: Microscopes: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 24: Filtration Systems: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 25: Other Equipment: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 26: Media & Reagents: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 27: Sera: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 28: Media: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 29: Reagents: Global Cell Line Development Products Market Revenue, 2016-2024 ($Million)

Figure 30: Mammalian: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 31: Insect: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 32: Amphibian: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 33: Primary Cell Lines: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 34: Continuous Cell Lines: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 35: Hybridomas: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 36: Recombinant Cell Lines: Global Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 37: Bioproduction: Cell Line Development Market, By Application, 2016-2024, ($Million)

Figure 38: Tissue Engineering & Regenerative Medicine: Cell Line Development Market, By Application, 2016-2024, ($Million)

Figure 39: Toxicity Texting: Cell Line Development Market, By Application, 2016-2024, ($Million)

Figure 40: Research: Cell Line Development Market, By Application, 2016-2024, ($Million)

Figure 41: Drug Discovery: Cell Line Development Market, By Application, 2016-2024, ($Million)

Figure 42: Germany: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 43: Germany: GDP – Composition of 2015, By Sector of Origin

Figure 44: Germany: Export and Import Value, 2012-2015 ($Billion)

Figure 45: France: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 46: France: GDP – Composition of 2015, By Sector of Origin

Figure 47: France: Export and Import Value, 2012-2015 ($Billion)

Figure 48: U.K.: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 49: U.K.: GDP – Composition of 2015, By Sector of Origin

Figure 50: U.K.: Export and Import Value, 2012-2015 ($Billion)

Figure 51: U.K. : Cell Line Development Market Value, 2016-2024 ($Million)

Figure 52: Italy: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 53: Germany: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 54: France: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 55: Spain: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 56: Russia: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 57: Rest of Europe Cell Line Development Market Value, 2016-2024 ($Million)

Figure 58: Europe: Cell Line Development Market CAGR, By Countries 2023-2024 (%)

Figure 59: China: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 60: China: GDP – Composition of 2015, By Sector of Origin

Figure 61: China: Export and Import Value, 2012-2015 ($Million)

Figure 62: Japan: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 63: Japan: GDP – Composition of 2015, By Sector of Origin

Figure 64: Japan: Export and Import Value, 2012-2015 ($Billion)

Figure 65: India: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 66: India: GDP – Composition of 2015, By Sector of Origin

Figure 67: India: Export and Import Value, 2012-2015 ($Million)

Figure 68: Rest of APAC: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 69: China: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 70: Japan: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 71: India: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 72: South Korea: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 73: APAC: Cell Line Development Market CAGR, By Countries, 2016-2024 (%)

Figure 74: U.S.: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 75: U.S.: GDP – Composition of 2015, By Sector of Origin

Figure 76: U.S.: Export and Import Value, 2012-2015 ($Trillion)

Figure 77: Canada: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 78: Canada: GDP – Composition of 2015, By Sector of Origin

Figure 79: Canada : Export and Import Value, 2012-2015 ($Billion)

Figure 80: Mexico: GDP and Population, 2012-2015 ($Trillion, Million)

Figure 81: Mexico: GDP – Composition of 2015, By Sector of Origin

Figure 82: Mexico: Export and Import Value, 2012-2015 ($Billion)

Figure 83: U.S. : Cell Line Development Market Value, 2016-2024 ($Million)

Figure 84: Mexico: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 85: Canada: Cell Line Development Market Value, 2016-2024 ($Million)

Figure 86: North America: Cell Line Development Market CAGR, By Countries, 2023-2024 (%)

Figure 87: South America: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 88: Middle East: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 89: Africa: Cell Line Development Market Revenue, 2016-2024 ($Million)

Figure 90: ROW: Cell Line Development Market CAGR, By Regions, 2016-2024 (%)

Figure 91: Cell Line Development Market Entropy Share, (%) By Approaches (2013-2023*)

Figure 92: Cell Line Development: Total Developments, By Year 2@013-2023*

Figure 93: Cell Line Development: Total Number of Developments, By Companies, 2013-2023*

Figure 94: Corning Incorporated, Revenue ($Billion), 2014-2023

Figure 95: Corning Incorporated, Revenue Share (%), By Business Segments, 2023

Figure 96: Corning Incorporated, Revenue Share (%), By Geography, 2023

Figure 97: General Electric Company, Revenue ($Billion), 2014-2023

Figure 98: General Electric Company, Revenue Share (%), By Business Segments, 2023

Figure 99: General Electric Company, Revenue Share (%), By Geography, 2023

Figure 100: Lonza, Revenue ($Billion), 2014-2023

Figure 101: Lonza, Revenue Share (%), By Business Segments, 2023

Figure 102: Lonza, Revenue Share (%), By Geography, 2023

Figure 103: Sartorius AG, Revenue ($Billion), 2014-2023

Figure 104: Sartorius AG, Revenue Share (%), By Business Segments, 2023

Figure 105: Sartorius AG, Revenue Share (%), By Geography, 2023

Figure 106: Merck KGaA, Revenue ($Million), 2013-2016

Figure 107: Merck KGaA, Revenue Share (%), By Business Segments, 2023

Figure 108: Merck KGaA, Revenue Share (%), By Geography, 2023

Figure 109: Thermo Fisher Scientific Inc, Revenue ($Million), 2013-2016

Figure 110: Thermo Fisher Scientific Inc, Revenue Share (%), By Business Segments, 2023

Figure 111: Thermo Fisher Scientific Inc, Revenue Share (%), By Geography, 2023

Figure 112: JSR Corporation, Revenue ($Billion), 2013-2016

Figure 113: JSR Corporation, Revenue Share (%), By Geography, 2023

Figure 114: JSR Corporation, Revenue Share (%), By Business Segments, 2023

Figure 115: Danaher, Revenue ($Billion), 2014-2023

Figure 116: Danaher, Revenue Share (%), By Business Segments, 2023

Figure 117: Danaher, Revenue Share (%), By Geography, 2023

Figure 118: Samsung Biologics, Revenue ($Billion), 2015-2023

Figure 119: Samsung Biologics, Revenue Share (%), By Business Segments, 2023

Figure 120: Catalent, Inc, Revenue ($Billion), 2014-2023

Figure 121: Catalent, Inc, Revenue Share (%), By Business Segments, 2023

Figure 122: Catalent, Inc, Revenue Share (%), By Geography, 2023

Email

Email Print

Print