Next Generation Crystal Oscillators Market - Forecast(2025 - 2031)

Next Generation Crystal Oscillators Market Overview:

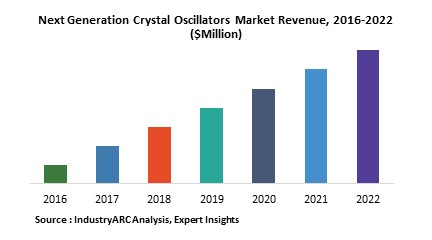

Next Generation Crystal Oscillators Market Size is forecast to reach $2264.8 Million by 2030, at a CAGR of 6.7% during forecast period 2024-2030.The penetration of smartphones in the world is a well-known phenomenon, and their production is catapulting at a rapid rate. According to the Global Systems for Mobile Communications Association (GSMA), there were 4.6 billion mobile subscribers, and by 2020, around 5.7 billion people will have a mobile phone[1]. This happens to be a major factor stroking the next generation crystal oscillators market which had a market size of 2 billion to 2.5 billion in the year 2018 according to IndustryARC’s market analyst. Moreover, based on the well-marshaled facts and market statistics, the analyst estimates that the next generation crystal oscillators market will grow at a considerable CAGR of more than 6% during the forecast period of 2019 to 2025.

China and other Asian countries such as Taiwan, India, and Indonesia have been dominant in the consumer electronics sector with incremented production each year. Now, consumer electronics utilize the next generation crystal oscillators for function. Additionally, APAC leading the race in other commercial electronics products makes the region triumph the next generation crystal oscillators with a significant 30% to 33% market share.

Next Generation Crystal Oscillators Market Outlook:

The next generation crystal oscillators are electronic oscillators that are imbibed with crystals of piezoelectric material such as quartz crystal which are bestowed with mechanical resonance and used in signal generators. These are typically used in wristwatches, clocks, radios, computers, and cellphones. The next generation crystal oscillators are used in microcontrollers, disk drives, sensors, clocks, radio systems, video games, instrumentation, measuring instruments, computers, cellular phones, timers, radios, engine controlling, measuring instruments, medical devices, global positioning systems (GPS), cable television systems, and some others. Predominantly, they are used in consumer electronics products in which their application will grow at a CAGR of a progressive 8% to 9% according to the electronics market analyst.

Next Generation Crystal Oscillators Market Growth Drivers:

- The Prevalent Application of GPS in the Automotive Sector & Smartphones –

In the contemporary world, each of the consumer electronics products such as smartphones and tablets along with cars, and commercial vehicles are incorporated with GPS. Now, GPS requires crystal oscillators which happens to be one of the driving factors for the next generation crystal oscillators’ market growth.

- The Application of Crystal Oscillators in the Test and Measurement Industry –

The growth has perpetuated in the test and measurement market which already had a market size of $25 billion in 2018 is forecasted to grow at a CAGR of 4% through to 2025. Now, these instruments utilize crystal oscillators for operation. “The sustainable demand for test and measurement instruments in various sectors such as industrial, healthcare, education, aerospace, and others will propel the sales of the next generation crystal oscillators”; marks the market analyst in the market research report.

- Crystal Oscillators: Apt for Military and Defense –

The next generation crystal oscillators act as accurate signal sources for military communications and instrumentation applications. Now, military and defense will never seize to exist. Furthermore, with advancing technology, the communication modes and the need for instrumentation in the military and defense sector is only going to increase which will largely support the next generation crystal oscillators market.

Next Generation Crystal Oscillators Market Challenges:

The overwhelming challenge dwarfing the prospects in the next generation crystal oscillators market is that it warrants a heavy investment. Additionally, the diversified market of consumer electronics has led to peculiar demands for crystal oscillators as per the requirement which needs intermittent customization. This becomes a challenge for the vendors in streamlining the operations. However, substantial investment in R&D and reinvention of modus operandi is helping manufacturers overcome the challenge.

Next Generation Crystal Oscillators Market Key Players Perspective:

One of the leading players in the market is Daishinku Corp. which generated a net profit of $66.9 million in 2017.

Other key players in the next generation crystal oscillators market are Kyocera, TXC, Epson, Vectron, Rakon, Nihon Dempa Kogyo, CTS, Murata, Ecliptek, Abracon, Axtal, Jauch, and Hosonic.

Next Generation Crystal Oscillators Market Research Scope:

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the next generation crystal oscillators market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of next generation crystal oscillators market, and their specific applications in military & defense, research & management, industrial, automotive, and consumer devices.

Next Generation Crystal Oscillators Market Report: Industry Coverage

The report analyses the product demands on the bases of type of product – SPXO, TCXO, VCXO, FCXO, OCXO, disciplined, multi-crystal, colpitts, and armstrong. Next generation crystal oscillators market can be further segmented on the basis of the type of mounting incorporated that mainly includes surface-mount and thru-hole) or on the basis of technology used which can be either AT Cut, BT Cut or SC Cut.

The next generation crystal oscillators market report also analyzes the major geographic regions as well as the major countries in these regions. The regions and countries covered in the study include:

- North America: The U.S., Canada, Mexico

- South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

- Europe: The U.K., Germany, Italy, France, the Netherlands, Belgium, Spain, Denmark

- APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

- Middle East and Africa: Israel, South Africa, Saudi Arabia

Key Market Players:

The Top 5 companies in the Next Generation Crystal Oscillators Market are:

- Seiko Epson Corporation

- Jauch Quartz GmbH

- TXC Corporation

- KYOCERA Corporation

- Nihon Dempa Kogyo Co.

Reference:

https://www.gsmaintelligence.com/research/?file=9e927fd6896724e7b26f33f61db5b9d5&download

For more Electronics related reports, please click here

1. Next Generation Crystal Oscillators Market - Overview

1.1. Definitions and Scope

2. Next Generation Crystal Oscillators Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Next Generation Crystal Oscillators Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Next Generation Crystal Oscillators Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Next Generation Crystal Oscillators Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Next Generation Crystal Oscillators Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Next Generation Crystal Oscillators Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Next Generation Crystal Oscillators Market – By Type (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Simple packaged crystal oscillator(SPXO)

8.3.2. Temperature compensated crystal oscillator(TCXO)

8.3.2.1. Voltage-controlled temperature-compensated crystal oscillator(VCTCXO)

8.3.3. Voltage controlled crystal oscillator(VCXO)

8.3.3.1. Temperature-Compensated Voltage-Controlled Crystal Oscillator (Tcvcxo)

8.3.3.2. Oven Controlled Voltage-Controlled Crystal Oscillator (Ocvcxo)

8.3.4. Frequency controlled crystal oscillator(FCXO)

8.3.5. Oven controlled crystal oscillator(OCXO)

8.3.5.1. Double Oven-Controlled Crystal Oscillator (Docxo)

8.3.5.2. Evacuated Miniature Crystal Oscillator (Emxo)

8.3.6. Disciplined crystal oscillator

8.3.7. Multi-crystal oscillator

8.3.8. Colpitts crystal oscillator

8.3.9. Armstrong crystal oscillator

9. Next Generation Crystal Oscillators Market – By Mounting type (Market Size -$Million / $Billion)

9.1. Surface mount

9.2. Thru hole

10. Next Generation Crystal Oscillators Market – By technology (Market Size -$Million / $Billion)

10.1. At cut

10.2. Bt cut

10.3. Sc cut

10.4. Others

11. Next Generation Crystal Oscillators Market – By Application (Market Size -$Million / $Billion)

11.1. Military and aerospace

11.1.1. Communication system

11.1.2. Navigation purpose

11.1.3. Electronic warfare

11.1.4. Guidance systems

11.1.5. Others

11.2. Research & management

11.2.1. Space tracking purpose

11.2.2. Measuring instruments

11.2.3. Medical devices

11.3. Industrial

11.3.1. Digital systems

11.3.2. Instrumentation

11.3.3. Phase locked loop systems

11.3.4. Marine

11.3.5. Modems

11.3.6. Sensors

11.3.7. Disk drives

11.3.8. Telecommunications

11.4. Automotive

11.4.1. Engine controlling

11.4.2. Stereo

11.4.3. GPS systems

11.5. Consumer devices

11.5.1. Clocks/wristwatches

11.5.2. Radios

11.5.3. Cellphones

11.5.4. Computers

11.5.5. Video games

12. Next Generation Crystal Oscillators - By Geography (Market Size -$Million / $Billion)

12.1. Next Generation Crystal Oscillators Market - North America Segment Research

12.2. North America Market Research (Million / $Billion)

12.2.1. Segment type Size and Market Size Analysis

12.2.2. Revenue and Trends

12.2.3. Application Revenue and Trends by type of Application

12.2.4. Company Revenue and Product Analysis

12.2.5. North America Product type and Application Market Size

12.2.5.1. U.S.

12.2.5.2. Canada

12.2.5.3. Mexico

12.2.5.4. Rest of North America

12.3. Next Generation Crystal Oscillators - South America Segment Research

12.4. South America Market Research (Market Size -$Million / $Billion)

12.4.1. Segment type Size and Market Size Analysis

12.4.2. Revenue and Trends

12.4.3. Application Revenue and Trends by type of Application

12.4.4. Company Revenue and Product Analysis

12.4.5. South America Product type and Application Market Size

12.4.5.1. Brazil

12.4.5.2. Venezuela

12.4.5.3. Argentina

12.4.5.4. Ecuador

12.4.5.5. Peru

12.4.5.6. Colombia

12.4.5.7. Costa Rica

12.4.5.8. Rest of South America

12.5. Next Generation Crystal Oscillators - Europe Segment Research

12.6. Europe Market Research (Market Size -$Million / $Billion)

12.6.1. Segment type Size and Market Size Analysis

12.6.2. Revenue and Trends

12.6.3. Application Revenue and Trends by type of Application

12.6.4. Company Revenue and Product Analysis

12.6.5. Europe Segment Product type and Application Market Size

12.6.5.1. U.K

12.6.5.2. Germany

12.6.5.3. Italy

12.6.5.4. France

12.6.5.5. Netherlands

12.6.5.6. Belgium

12.6.5.7. Spain

12.6.5.8. Denmark

12.6.5.9. Rest of Europe

12.7. Next Generation Crystal Oscillators – APAC Segment Research

12.8. APAC Market Research (Market Size -$Million / $Billion)

12.8.1. Segment type Size and Market Size Analysis

12.8.2. Revenue and Trends

12.8.3. Application Revenue and Trends by type of Application

12.8.4. Company Revenue and Product Analysis

12.8.5. APAC Segment – Product type and Application Market Size

12.8.5.1. China

12.8.5.2. Australia

12.8.5.3. Japan

12.8.5.4. South Korea

12.8.5.5. India

12.8.5.6. Taiwan

12.8.5.7. Malaysia

13. Next Generation Crystal Oscillators Market - Entropy

13.1. New product launches

13.2. M&A's, collaborations, JVs and partnerships

14. Next Generation Crystal Oscillators Market – Industry / Segment Competition landscape Premium

14.1. Market Share Analysis

14.1.1. Market Share by Country- Top companies

14.1.2. Market Share by Region- Top 10 companies

14.1.3. Market Share by type of Application – Top 10 companies

14.1.4. Market Share by type of Product / Product category- Top 10 companies

14.1.5. Market Share at global level- Top 10 companies

14.1.6. Best Practises for companies

15. Next Generation Crystal Oscillators Market – Key Company List by Country Premium

16. Next Generation Crystal Oscillators Market Company Analysis

16.1. Market Share, Company Revenue, Products, M&A, Developments

16.2. vectron international

16.3. Jauch group

16.4. Epson corporation

16.5. TXC corporation

16.6. KDS

16.7. Kyocera crystal devices

16.8. Nihon dempa cogyo ltd

16.9. CTS corporation

16.10. Company 9

16.11. Company 10

16.12. Company 10 and more

"*Financials would be provided on a best efforts basis for private companies"

17. Next Generation Crystal Oscillators Market -Appendix

17.1. Abbreviations

17.2. Sources

18. Next Generation Crystal Oscillators Market -Methodology Premium

18.1. Research Methodology

18.1.1. Company Expert Interviews

18.1.2. Industry Databases

18.1.3. Associations

18.1.4. Company News

18.1.5. Company Annual Reports

18.1.6. Application Trends

18.1.7. New Products and Product database

18.1.8. Company Transcripts

18.1.9. R&D Trends

18.1.10. Key Opinion Leaders Interviews

18.1.11. Supply and Demand Trends

List of Tables

Table 1. Product Benchmarking for The Top Five Companies in Crystal Oscillator (Temperature Compensated Crystal Oscillator) Market

Table 2. Crystal Oscillator, Top Five Financial Analysis, 2014 ($Million), (Eps in $)

Table 3. Next Generation Crystal Oscillators Market, By Types, 2014-2020 ($Million)

Table 4. Consumer Electronics Crystal Oscillator Market, By Types, 2014-2020 ($Million)

Table 5. Industrial Crystal Oscillator Market, By Types, 2014-2020 ($Million)

Table 6. Automotive Crystal Oscillator Market, By Types, 2014-2020 ($Million)

Table 7. Telecommunications Crystal Oscillator Market, By Types, 2014-2020 ($Million)

Table 8. Healthcare Crystal Oscillator Market, By Types, 2014-2020 ($Million)

Table 9. Global Military, Aerospace and Defense Crystal Oscillator Market,By Application, 2014-2020 ($Million)

Table 10. Global Military, Aerospace and Defense Crystal Oscillator Market,By Type, 2014 - 2020 ($Million)

Table 11. Global Other Crystal Oscillator Market,By Type, 2014-2020 ($Million)

Table 12. Global Crystal Oscillator Market, By Region, 2014-2020 ($Million)

Table 13. Americas Crystal Oscillator Market, By Type, 2014-2020 ($Million)

Table 14. Americas Crystal Oscillator Market, By Application, 2014-2020 ($Million)

Table 15. Europe Crystal Oscillator Market, By Type, 2014-2020 ($Million)

Table 16. Europe Crystal Oscillator Market, By Application, 2014-2020 ($Million)

Table 17. APAC Crystal Oscillator Market, By Type, 2014-2020 ($Million)

Table 18. APAC Crystal Oscillator Market, By Application, 2014-2020 ($Million)

Table 19. Row Crystal Oscillator Market, By Application, 2014-2020 ($Million)

Table 20. Row Crystal Oscillator Market, By Application, 2014-2020 ($Million)

Table 21. Crystal Oscillator Market, Product Developments (2011-2015)

Table 22. Crystal Oscillator, Mergers and Acquisitions, 2011-2015

Table 23. Crystal Oscillator, Partnership and Collaborations, 2011-2015

Table 24. Kyocera Group: Revenue By Geography 2014-2015 ($Billion)

Table 25. Nihon: Total Sales, By Geography, 2013 - 2015 ($Million)

Table 26. PERICOM: Total Sales, By Geography, 2013 - 2015 ($000’)

Table 27. RAKON Ltd, Revenue, 2013-2015 ($Million)

Table 28. RAKON Limited, Revenue By Geography, 2015 – 2013 ($Millionn)

Table 29. SIWARD Crystal Technology Co., Ltd –Total Revenue, 2013 - 2014 ($Million)

Table 30. SIWARD Crystal Technology Co., Ltd Crystal Oscillator Products and Applications

Table 31. Tai-Saw Technology Co., Ltd. - Revenue, 2013 - 2014 ($Million)

Table 32. Tai-Saw Technology Co., Ltd. Crystal Oscillator Products and Applications

Table 33. TXC Corporation, Revenue, 2013-2014 ($Million)

Table 34. VECTRON: Products & Their Applications

List of Figures

Figure 1 Crystal Oscillator Market – Classification – By Type

Figure 2 Crystal Oscillator Market – Classification – By Application

Figure 3 Crystal Oscillator Market – Classification – By Geography

Figure 4 Global Crystal Oscillator Market Share, By Type, 2014 (%)

Figure 5 Global Crystal Oscillator Market Share, By Region, 2014 (%)

Figure 6 Crystal Oscillator Market Share Analysis, 2014 (%)

Figure 7 Crystal Oscillator Market, By End Use Industry, 2014 (%)

Figure 8 Next Generation Crystal Oscillators Market- Patent Analysis, By Year, 2011-2015 (Number of Patents)

Figure 9 Next Generation Crystal Oscillators Market- Patent Analysis, By Company, 2011-2015 (Percentage)

Figure 10 Crystal Oscillator Industry, Porters Analysis

Figure 11 Crystal Oscillator Value Chain Analysis

Figure 12 Global Next Generation Crystal Oscillators Market, Pricing Analysis, 2014 - 2020 (in $/Unit)

Figure 13 Crystal Oscillator Industry Life Cycle Analysis, 2010-2040 ($Billion)

Figure 14 Crystal Oscillator Product Life Cycle Analysis

Figure 15 Simple Packaged Crystal Oscillator (Xo) Market, 2014-2020 ($Million)

Figure 16 Temperature Compensated Crystal Oscillator Market, 2014-2020 ($Million)

Figure 17 Voltage Controlled Crystal Oscillator Market, 2014-2020 ($Million)

Figure 18 Frequency Controlled Crystal Oscillator Market, 2014-2020 ($Million)

Figure 19 Microcomputer Compensated Crystal Oscillator Market, 2014-2020 ($Million)

Figure 20 Oven Controlled Crystal Oscillator Market, 2014-2020 ($Million)

Figure 21 Evacuated Miniature Crystal Oscillator Market, 2014-2020 ($Million)

Figure 22 Consumer Electronics Crystal Oscillator Market, 2014-2020 ($Million)

Figure 23 Industrial Crystal Oscillator Market, 2014-2020 ($Million)

Figure 24 Automotive Crystal Oscillator Market, 2014-2020 ($Million)

Figure 25 Telecommunications Crystal Oscillator Market, 2014-2020 ($Million)

Figure 26 Healthcare Crystal Oscillator Market, 2014-2020 ($Million)

Figure 27 Global Space and Hi-Reliability Crystal Oscillator Market, 2014-2020 ($Million)

Figure 28 Global Radar Crystal Oscillator Market, 2014-2020 ($Million)

Figure 29 Global Radio Communications Crystal Oscillator Market, 2014-2020 ($Million)

Figure 30 Global Avionics Crystal Oscillator Market, 2014-2020 ($Million)

Figure 31 Global Command and Control Crystal Oscillator Market, 2014-2020 ($Million)

Figure 32 Global Missiles and Precision Guided Munitions Crystal Oscillator Market, 2014-2020 ($Million)

Figure 33 Global Others Crystal Oscillator Market, 2014-2020 ($Million)

Figure 34 North America Crystal Oscillator Market, 2014-2020 ($Million)

Figure 35 Brazil Crystal Oscillator Market, 2014-2020 ($Million)

Figure 36 Argentina Crystal Oscillator Market, 2014-2020 ($Million)

Figure 37 U.K Crystal Oscillator Market, 2014-2020 ($Million)

Figure 38 France Crystal Oscillator Market, 2014-2020 ($Million)

Figure 39 Germany Crystal Oscillator Market, 2014-2020 ($Million)

Figure 40 China Crystal Oscillator Market, 2014-2020 ($Million)

Figure 41 Japan Crystal Oscillator Market, 2014-2020 ($Million)

Figure 42 South Korea Crystal Oscillator Market, 2014-2020 ($Million)

Figure 43 Row Crystal Oscillator Market, 2014-2020 ($Million)

Figure 44 Next Generation Crystal Oscillators Market Strategy Share, 2011-2015 (%)

Figure 45 Crystal Oscillator Market Developments, By Company, 2011-2015(%)

Figure 46 Crystal Oscillator Market, Products Launch, 2011-2015

Figure 47 Crystal Oscillator Market Product Launch, By Key Players, 2011-2015 (%)

Figure 48 Aker Technology Co. Ltd., Revenue, 2012-2014($Million)

Figure 49 CTS Corporation, Revenue, 2012-2014($Million)

Figure 50 CTS Corporation, Revenue, By Segment, 2014(%)

Figure 51 Zhejiang East Crystal Electronic Co., Ltd, Annual Revenue, 2011 - 2014 ($Million)

Figure 52 SIEKO Epson Corporation, Revenue, 2012-2014($Million)

Figure 53 SIEKO Epson Corporation, Total Revenue, 2014, By Segment (%)

Figure 54 Integrated Device Technology, Inc., Annual Revenue, 2011 - 2014, (in $Million)

Figure 55 Integrated Device Technology, Inc., Market Share, By Region 2014, (in %)

Figure 56 Harmony Electronics Corp., Revenue, 2012-2014($Million)

Figure 57 KDS Group, Total Revenue, 2012-2014($Million)

Figure 58 KDS Group, Total Revenue, By Product, 2014 (%)

Figure 59 Kyocera Group: Revenue for 2012-2014($Billion)

Figure 60 Kyocera Group: Revenue By Segments (%)

Figure 61 Swatch Group, Revenue, 2012-2014($Million)

Figure 62 Swatch Group, Total Revenue, By Segment, 2014 (%)

Figure 63 Nihon Dempa Kogyo Co., Ltd. (NDK), Net Sales, 2013-2015 ($Million)

Figure 64 Nihon: Total Sales, By Business Segment, 2015 (%)

Figure 65 RAKON, Revenue By Segmentation, 2015 (%)

Figure 66 TXC Corporation, Revenue By Segmentation, 2014 (%)

Email

Email Print

Print