Food Enzymes Market Overview:

To capitalize over the growing demand for convenience food, the F&B sector added an additional front into its product portfolio with the advent of frozen, packaged, and processed food. Packaged foods items are comprised of complex molecules, which are difficult to digest naturally. With the growth in uptake of packaged foods globally, application of food enzymes developed as an inevitability for F&B companies. Food enzymes are generally used as food additives to enrich digestibility, texture, and shelf life of food and beverages. Flourishing packaged food industry combined with increased awareness among consumers regarding nutritional and health benefits of natural food enzymes has boosted the global food enzymes market size to $1,610 million as of 2018.

Food Enzymes Market Outlook:

The food enzymes market is bifurcated by type into variants such as carbohydrates, lipases, and proteases. Innovation has enabled the players to exploit several end-user industries such as bakery, dairy, beverages, meat products, and confectionery, consequently triggering the opportunities in the food enzymes market to be progressing at a compound annual growth rate (CAGR) of 5.90% during the forecast period 2019-2025.

Globally, top 50 groups made $92.66 billion in total confectionery products and bakery revenue in 2017 (+5.9% from 2016), 57% of which was generated by companies from America, Mexico, or Japan.[2] An in-depth business analysis of various application in industry highlights bakery products to be holding the top rank progressing with an application CAGR of 5.70% through 2025.

A short description of operational properties of different food enzymes in bakery is-

· Amylase- Escalates the fermentation process in its highest capacity to acquire an even crumb structure and high loaf volume.

· Maltogenic alpha-amylases- Improves shelf-life of bread and cakes.

· Protease- Weakens the gluten to give plastic properties required in doughs for biscuits.

Bakery product segment of food enzymes market is leveraging the trend of fast moving consumer goods (FMCG). According to India Brand Equity Foundation, food and beverages, including bakery, account for 19% of Indian FMCG industry valued at $52.75 billion in 2017-18, and is progressing with an impeccable CAGR of 27.86% towards the mark of $103.70 billion by 2020.[3] Similar settings are prevailing across the globe with bakery products gaining traction owing to rising urban population with increasing disposable income.

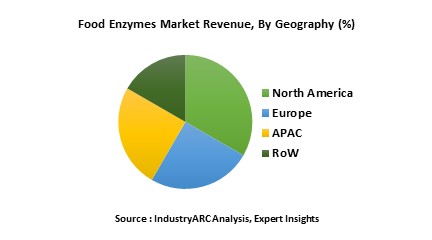

After an acute analysis of the regional market insights, North America is calculated to be the leading hub in terms of food enzyme market demand with 34% global share in 2018. The sheer affluence is attributable to emerging economies including the U.S. and Canada, and their working population assimilating packaged, frozen and processed food as their staple diet.

The booming trend of fast-food in North America has augmented the trade of cheese, indirectly impacting the market of protease food enzyme. According to the Centers for Disease Control and Prevention, in 2016, one out of three Americans (36%) consumed a meal at fast-food eateries on any given day.[4] Some of the leading fast-food chains across the U.S are McDonald’s, KFC, Pizza Hut, Domino’s Pizza and Burger Kings. Application of cheese in these F&B giants can be indicated by the fact that Leprino Foods, a leading market player, often rated as America’s all-time monopolist, manages to converge an annual revenue of $3 billion by supplying mozzarella cheese to Pizza Hut, Domino's, and Papa John's.

Similarly, McDonald’s for their buns claims to apply enzymes such as amylases. And KFC, the world’s most popular chicken restaurant chain is now operating in 135 countries with more than 22,000 restaurants globally.[5] Hence, the trend of processed food supplemented by retail outlets in North America is projecting the food enzyme market towards exponential growth.

Food Enzymes Market Trends and Growth Drivers:

· A major trend disrupting food enzyme market is technological developments for the production of enzymes from genetically engineered organisms. Rapid developments in biotechnology have generated numerous enzymes operational for the baking industry. Increasing range of products is augmenting the exploitation of numerous untapped sectors, augmenting opportunities to be capitalized upon by the food enzymes market.

· The subject of genetic engineering may play a critical role in providing future innovation to supplement industry. Enzymes, as proteins, are not genetically engineered as their host organism but the industry is expected to shift towards genetically manufactured enzymes. The tools available from the biotechnology studies can have a tremendous impact on cost, specificity of an enzyme and manufacturing efficiency in future. Research is being done to find the new applications of prevailing enzymes for detailed nutritional benefits. A lipase has been shown to diminish serum triglycerides in individuals and is under advance examination, as cited by the U.S. Patent 9,555,083. Many of the nutritional deficit concerns could be addressed with enzymes.

· With demand for natural products pacing up, the imperatives of food enzymes is probable to increase outpacing chemical additives. The importance of enzymes is likely to increase as consumers are opting for more natural products. For instance, enzymes can be employed to substitute potassium bromate, a chemical additive that has been banned in various countries.

· Increasing consumption of beer is a mega-trend on which the food enzyme market is profitably capitalizing. All of the principal enzymes such as amylases, proteases, glucanase, and cellulase are crucial for beer production process. According to the Brewers Association, the overall beer market of the U.S. worth $114.2 billion as of 2018. Enzymes being an integral part of production is set to capitalize over increasing beer consumption pattern tailored by trend such as ‘weekends’ and ‘party-culture’.

· Robustly growing retail chains such as Walmart and Reliance Fresh supplemented by virtual retail shelves by Amazon and Costco has uplifted the sales of packaged food items, delivering undying demand to food enzyme market globally. Food enzymes enhances the appealing appearance of food and shelf life of products.

Food Enzyme Market Challenges:

The health associated adverse effects of certain enzymes is prevailing as a major challenge for the food enzymes market growth. The European Union recently enforced a guideline concerning about health risks linked with enzymes in F&B sector. However, with influx of investments into R&D, the manufacturing companies are focusing on developing products with regulated adverse effects.

Food Enzyme Market Players Perspective:

Some of the key players operating in the global food enzyme market are Royal DSM N.V, EI DuPont DE Nemours & Co., Novozymes A/S, Chr Hansen A/S, Biocatalyst limited, AB enzymes GMBH, Kerry group PLCAum Enzymes, Amano Enzyme Inc., and Enmex SA DE CV.

Food Enzyme Market Research Scope:

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the food enzyme market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the various types of application industry in global food enzyme market, and their specific advantages.

The food enzyme market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

• North America: The U.S., Canada, Mexico

• South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

• Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

• APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

• Middle East and Africa: Israel, South Africa, Saudi Arabia

Key Questions Addressed in the Food Enzyme Market Report

1. Is the market for the food enzyme growing? How long will it continue to grow and at what rate?

2. Which type of systems presents the major growth opportunities?

3. Is there a possibility for change in the market structure over time?

4. Are additional developments needed for the existing product or services offerings or do the existing products meet the customer demands?

5. Do the key vendors look for partnerships to expand their businesses with respect to geography or product?

6. What are the short-term, long-term, and medium-term growth drivers for the market?

7. What are the short-term, medium-term, and long-term challenges for the market?

8. What are the short-term, medium-term, and long-term opportunities for the market

9. Who are the top players/companies of the market?

10. What are the recent innovations in the market?

11. How many patents have been filed by the leading players?

12. What are the types of patents filed by the leading players?

13. What is our Vision 2030 food enzyme market?

A few focus points of this Research are given below:

• Give a deep-dive analysis of the key operational strategies with focus on the corporate structure, R&D strategies, localization strategies, production capabilities, and sales performance of various companies

• Provide an overview of the product portfolio, including product planning, development, and positioning

• Discuss the role of technology companies in partnerships

• Explore the regional sales activities

• Analyze the market size and giving the forecast for current and future food enzyme market during the forecast 2019–2025

• Analyze the competitive factors, competitors’ market shares, product capabilities, and supply chain structures.

Reference:

[1] https://www.aimcal.org/uploads/4/6/6/9/46695933/keane_presentation.pdf

[2] https://www.unigrains.fr/wp-content/uploads/2019/01/190123-Unigrains-in-Brief-BVP-World-Rankings.pdf

[3] https://www.ibef.org/download/FMCG-Report-July-2018.pdf

[4] https://www.forbes.com/sites/garystern/2018/10/25/a-third-of-americans-dine-out-nightly-at-fast-food-restaurants-a-nutritionist-speaks-out/#1a014607fee3

[5] http://www.yum.com/company/our-brands/kfc/

Table 1: Food Enzymes Market Overview 2023-2030

Table 2: Food Enzymes Market Leader Analysis 2023-2024 (US$)

Table 3: Food Enzymes Market Product Analysis 2023-2024 (US$)

Table 4: Food Enzymes Market End User Analysis 2023-2024 (US$)

Table 5: Food Enzymes Market Patent Analysis 2021-2023* (US$)

Table 6: Food Enzymes Market Financial Analysis 2023-2024 (US$)

Table 7: Food Enzymes Market Driver Analysis 2023-2024 (US$)

Table 8: Food Enzymes Market Challenges Analysis 2023-2024 (US$)

Table 9: Food Enzymes Market Constraint Analysis 2023-2024 (US$)

Table 10: Food Enzymes Market Supplier Bargaining Power Analysis 2023-2024 (US$)

Table 11: Food Enzymes Market Buyer Bargaining Power Analysis 2023-2024 (US$)

Table 12: Food Enzymes Market Threat of Substitutes Analysis 2023-2024 (US$)

Table 13: Food Enzymes Market Threat of New Entrants Analysis 2023-2024 (US$)

Table 14: Food Enzymes Market Degree of Competition Analysis 2023-2024 (US$)

Table 15: Food Enzymes Market Value Chain Analysis 2023-2024 (US$)

Table 16: Food Enzymes Market Pricing Analysis 2023-2030 (US$)

Table 17: Food Enzymes Market Opportunities Analysis 2023-2030 (US$)

Table 18: Food Enzymes Market Product Life Cycle Analysis 2023-2030 (US$)

Table 19: Food Enzymes Market Supplier Analysis 2023-2024 (US$)

Table 20: Food Enzymes Market Distributor Analysis 2023-2024 (US$)

Table 21: Food Enzymes Market Trend Analysis 2023-2024 (US$)

Table 22: Food Enzymes Market Size 2023 (US$)

Table 23: Food Enzymes Market Forecast Analysis 2023-2030 (US$)

Table 24: Food Enzymes Market Sales Forecast Analysis 2023-2030 (Units)

Table 25: Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 26: Food Enzymes Market By Type, Revenue & Volume, By Amylases, 2023-2030 ($)

Table 27: Food Enzymes Market By Type, Revenue & Volume, By Catalases, 2023-2030 ($)

Table 28: Food Enzymes Market By Type, Revenue & Volume, By Lactases, 2023-2030 ($)

Table 29: Food Enzymes Market By Type, Revenue & Volume, By Proteases, 2023-2030 ($)

Table 30: Food Enzymes Market By Type, Revenue & Volume, By Lipases, 2023-2030 ($)

Table 31: Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 32: Food Enzymes Market By Source, Revenue & Volume, By Plant-Based Enzymes, 2023-2030 ($)

Table 33: Food Enzymes Market By Source, Revenue & Volume, By Animal-Based Enzymes, 2023-2030 ($)

Table 34: Food Enzymes Market By Source, Revenue & Volume, By Microorganism-Based Enzymes, 2023-2030 ($)

Table 35: North America Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 36: North America Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 37: South america Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 38: South america Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 39: Europe Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 40: Europe Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 41: APAC Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 42: APAC Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 43: Middle East & Africa Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 44: Middle East & Africa Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 45: Russia Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 46: Russia Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 47: Israel Food Enzymes Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 48: Israel Food Enzymes Market, Revenue & Volume, By Source, 2023-2030 ($)

Table 49: Top Companies 2023 (US$) Food Enzymes Market, Revenue & Volume

Table 50: Product Launch 2023-2024 Food Enzymes Market, Revenue & Volume

Table 51: Mergers & Acquistions 2023-2024 Food Enzymes Market, Revenue & Volume

List of Figures:

Figure 1: Overview of Food Enzymes Market 2023-2030

Figure 2: Market Share Analysis for Food Enzymes Market 2023 (US$)

Figure 3: Product Comparison in Food Enzymes Market 2023-2024 (US$)

Figure 4: End User Profile for Food Enzymes Market 2023-2024 (US$)

Figure 5: Patent Application and Grant in Food Enzymes Market 2021-2023* (US$)

Figure 6: Top 5 Companies Financial Analysis in Food Enzymes Market 2023-2024 (US$)

Figure 7: Market Entry Strategy in Food Enzymes Market 2023-2024

Figure 8: Ecosystem Analysis in Food Enzymes Market 2023

Figure 9: Average Selling Price in Food Enzymes Market 2023-2030

Figure 10: Top Opportunites in Food Enzymes Market 2023-2024

Figure 11: Market Life Cycle Analysis in Food Enzymes Market

Figure 12: GlobalBy Type Food Enzymes Market Revenue, 2023-2030 ($)

Figure 13: GlobalBy Source Food Enzymes Market Revenue, 2023-2030 ($)

Figure 14: Global Food Enzymes Market - By Geography

Figure 15: Global Food Enzymes Market Value & Volume, By Geography, 2023-2030 ($)

Figure 16: Global Food Enzymes Market CAGR, By Geography, 2023-2030 (%)

Figure 17: North America Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 18: US Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 19: US GDP and Population, 2023-2024 ($)

Figure 20: US GDP – Composition of 2023, By Sector of Origin

Figure 21: US Export and Import Value & Volume, 2023-2024 ($)

Figure 22: Canada Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 23: Canada GDP and Population, 2023-2024 ($)

Figure 24: Canada GDP – Composition of 2023, By Sector of Origin

Figure 25: Canada Export and Import Value & Volume, 2023-2024 ($)

Figure 26: Mexico Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 27: Mexico GDP and Population, 2023-2024 ($)

Figure 28: Mexico GDP – Composition of 2023, By Sector of Origin

Figure 29: Mexico Export and Import Value & Volume, 2023-2024 ($)

Figure 30: South America Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 31: Brazil Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 32: Brazil GDP and Population, 2023-2024 ($)

Figure 33: Brazil GDP – Composition of 2023, By Sector of Origin

Figure 34: Brazil Export and Import Value & Volume, 2023-2024 ($)

Figure 35: Venezuela Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 36: Venezuela GDP and Population, 2023-2024 ($)

Figure 37: Venezuela GDP – Composition of 2023, By Sector of Origin

Figure 38: Venezuela Export and Import Value & Volume, 2023-2024 ($)

Figure 39: Argentina Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 40: Argentina GDP and Population, 2023-2024 ($)

Figure 41: Argentina GDP – Composition of 2023, By Sector of Origin

Figure 42: Argentina Export and Import Value & Volume, 2023-2024 ($)

Figure 43: Ecuador Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 44: Ecuador GDP and Population, 2023-2024 ($)

Figure 45: Ecuador GDP – Composition of 2023, By Sector of Origin

Figure 46: Ecuador Export and Import Value & Volume, 2023-2024 ($)

Figure 47: Peru Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 48: Peru GDP and Population, 2023-2024 ($)

Figure 49: Peru GDP – Composition of 2023, By Sector of Origin

Figure 50: Peru Export and Import Value & Volume, 2023-2024 ($)

Figure 51: Colombia Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 52: Colombia GDP and Population, 2023-2024 ($)

Figure 53: Colombia GDP – Composition of 2023, By Sector of Origin

Figure 54: Colombia Export and Import Value & Volume, 2023-2024 ($)

Figure 55: Costa Rica Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 56: Costa Rica GDP and Population, 2023-2024 ($)

Figure 57: Costa Rica GDP – Composition of 2023, By Sector of Origin

Figure 58: Costa Rica Export and Import Value & Volume, 2023-2024 ($)

Figure 59: Europe Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 60: U.K Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 61: U.K GDP and Population, 2023-2024 ($)

Figure 62: U.K GDP – Composition of 2023, By Sector of Origin

Figure 63: U.K Export and Import Value & Volume, 2023-2024 ($)

Figure 64: Germany Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 65: Germany GDP and Population, 2023-2024 ($)

Figure 66: Germany GDP – Composition of 2023, By Sector of Origin

Figure 67: Germany Export and Import Value & Volume, 2023-2024 ($)

Figure 68: Italy Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 69: Italy GDP and Population, 2023-2024 ($)

Figure 70: Italy GDP – Composition of 2023, By Sector of Origin

Figure 71: Italy Export and Import Value & Volume, 2023-2024 ($)

Figure 72: France Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 73: France GDP and Population, 2023-2024 ($)

Figure 74: France GDP – Composition of 2023, By Sector of Origin

Figure 75: France Export and Import Value & Volume, 2023-2024 ($)

Figure 76: Netherlands Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 77: Netherlands GDP and Population, 2023-2024 ($)

Figure 78: Netherlands GDP – Composition of 2023, By Sector of Origin

Figure 79: Netherlands Export and Import Value & Volume, 2023-2024 ($)

Figure 80: Belgium Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 81: Belgium GDP and Population, 2023-2024 ($)

Figure 82: Belgium GDP – Composition of 2023, By Sector of Origin

Figure 83: Belgium Export and Import Value & Volume, 2023-2024 ($)

Figure 84: Spain Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 85: Spain GDP and Population, 2023-2024 ($)

Figure 86: Spain GDP – Composition of 2023, By Sector of Origin

Figure 87: Spain Export and Import Value & Volume, 2023-2024 ($)

Figure 88: Denmark Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 89: Denmark GDP and Population, 2023-2024 ($)

Figure 90: Denmark GDP – Composition of 2023, By Sector of Origin

Figure 91: Denmark Export and Import Value & Volume, 2023-2024 ($)

Figure 92: APAC Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 93: China Food Enzymes Market Value & Volume, 2023-2030

Figure 94: China GDP and Population, 2023-2024 ($)

Figure 95: China GDP – Composition of 2023, By Sector of Origin

Figure 96: China Export and Import Value & Volume, 2023-2024 ($) Food Enzymes Market China Export and Import Value & Volume, 2023-2024 ($)

Figure 97: Australia Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 98: Australia GDP and Population, 2023-2024 ($)

Figure 99: Australia GDP – Composition of 2023, By Sector of Origin

Figure 100: Australia Export and Import Value & Volume, 2023-2024 ($)

Figure 101: South Korea Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 102: South Korea GDP and Population, 2023-2024 ($)

Figure 103: South Korea GDP – Composition of 2023, By Sector of Origin

Figure 104: South Korea Export and Import Value & Volume, 2023-2024 ($)

Figure 105: India Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 106: India GDP and Population, 2023-2024 ($)

Figure 107: India GDP – Composition of 2023, By Sector of Origin

Figure 108: India Export and Import Value & Volume, 2023-2024 ($)

Figure 109: Taiwan Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 110: Taiwan GDP and Population, 2023-2024 ($)

Figure 111: Taiwan GDP – Composition of 2023, By Sector of Origin

Figure 112: Taiwan Export and Import Value & Volume, 2023-2024 ($)

Figure 113: Malaysia Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 114: Malaysia GDP and Population, 2023-2024 ($)

Figure 115: Malaysia GDP – Composition of 2023, By Sector of Origin

Figure 116: Malaysia Export and Import Value & Volume, 2023-2024 ($)

Figure 117: Hong Kong Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 118: Hong Kong GDP and Population, 2023-2024 ($)

Figure 119: Hong Kong GDP – Composition of 2023, By Sector of Origin

Figure 120: Hong Kong Export and Import Value & Volume, 2023-2024 ($)

Figure 121: Middle East & Africa Food Enzymes Market Middle East & Africa 3D Printing Market Value & Volume, 2023-2030 ($)

Figure 122: Russia Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 123: Russia GDP and Population, 2023-2024 ($)

Figure 124: Russia GDP – Composition of 2023, By Sector of Origin

Figure 125: Russia Export and Import Value & Volume, 2023-2024 ($)

Figure 126: Israel Food Enzymes Market Value & Volume, 2023-2030 ($)

Figure 127: Israel GDP and Population, 2023-2024 ($)

Figure 128: Israel GDP – Composition of 2023, By Sector of Origin

Figure 129: Israel Export and Import Value & Volume, 2023-2024 ($)

Figure 130: Entropy Share, By Strategies, 2023-2024* (%) Food Enzymes Market

Figure 131: Developments, 2023-2024* Food Enzymes Market

Figure 132: Company 1 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 133: Company 1 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 134: Company 1 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 135: Company 2 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 136: Company 2 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 137: Company 2 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 138: Company 3 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 139: Company 3 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 140: Company 3 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 141: Company 4 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 142: Company 4 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 143: Company 4 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 144: Company 5 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 145: Company 5 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 146: Company 5 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 147: Company 6 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 148: Company 6 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 149: Company 6 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 150: Company 7 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 151: Company 7 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 152: Company 7 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 153: Company 8 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 154: Company 8 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 155: Company 8 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 156: Company 9 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 157: Company 9 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 158: Company 9 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 159: Company 10 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 160: Company 10 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 161: Company 10 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 162: Company 11 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 163: Company 11 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 164: Company 11 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 165: Company 12 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 166: Company 12 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 167: Company 12 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 168: Company 13 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 169: Company 13 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 170: Company 13 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 171: Company 14 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 172: Company 14 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 173: Company 14 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Figure 174: Company 15 Food Enzymes Market Net Revenue, By Years, 2023-2024* ($)

Figure 175: Company 15 Food Enzymes Market Net Revenue Share, By Business segments, 2023 (%)

Figure 176: Company 15 Food Enzymes Market Net Sales Share, By Geography, 2023 (%)

Email

Email Print

Print