Processed Poultry & Meat Market- By Product Type; By Meat type; By Packaging Film; By Packaging Technique; By End Use Industry; By Geography - Forecast (2024 - 2030)

Processed Poultry and Meat Market Overview

Processed Poultry & Meat Market Size is forecast to reach $884920.2 Million by 2030, at a 2.90% during forecast period 2024-2030.The rising awareness about animal protein rich diet and growing demand for processed and convenience goods are the major drivers for the global processed poultry and meat market. Concern about health and changing lifestyle of people are also reasons for the increased demand in the processed poultry and meat market and various companies are trying to satisfy these demands from the consumer. Processing automation and better packaging techniques improve product quality and its shelf life. The global processed poultry and meat market is estimated to grow at a CAGR of 7.35% during the forecast period 2024–2030. Asia is the fastest growing market with a CAGR of 9.32%, which can be mainly attributed to the rising population, increase in their disposable income both in urban and rural areas and changing lifestyle.

Processed Poultry and Meat Market Outlook

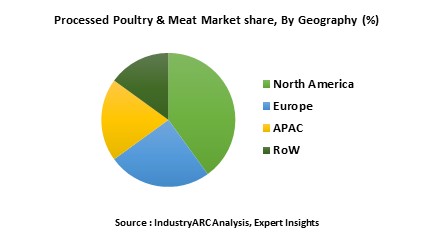

The global market of processed poultry and meat has been displaying a sharp growth. Producers in this market are involved in the production of better and efficient quality processed poultry and meat. At the same time, new players are coming up with innovative technologies in producing processed meat, resulting in increased competition in the global market. While North America holds a larger market share, faster growth rate is observed by Asia Pacific region. Processed meat market has a major market share compared to processed poultry market segment.

The global processed poultry and meat market was valued at $747.5bn in 2018 and is estimated to reach $1065.7bn by 2023, growing at a CAGR of 7.35% during the forecast period. It is estimated that North America dominated the global processed poultry and meat market in 2018 with 38% of the total market share due to the rising demand for low calorie meat and rise of research and development in the production of processed poultry and meat industry.

Processed Poultry and Meat Growth Drivers

The global processed poultry and meat market is driven by various factors, such as rising awareness about animal protein rich diet and growing demand for processed and convenience goods. Automated technology in poultry processing also complements the growth of the processed poultry and meat market. Various packaging techniques improve shelf life of the product is expected to further drive the market. Asia Pacific region is expected to show a high growth rate due to its rising demand for processed meat and poultry products and this is caused by the changing lifestyle and increase in disposable income of the consumers. Increase is also factored to consumers’ need for convenience and quality processed food.

Processed Poultry and Meat Market Challenges

Processed Poultry & Meat is facing challenges with health concerns due to consumer’s fear of diseases such as bird flu spreading on its consumption. Also, in some countries the high feed price and low domestic consumption are restraining the poultry industry which in turn affects the processed poultry industry. Another challenge faced by the market is contamination of food and its quality deterioration. Increase in the number of regulations related to safety of poultry and meat is further increasing the price and restraining the market.

Processed Poultry and Meat Market Research Scope

The base year of the study is 2017, with forecast done up to 2023. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. These provide the key market participants with the necessary business intelligence and help them understand the future of processed poultry and meat market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the type of processed poultry and meat product and its specific end users.

Processed Poultry and Meat Market Report: Industry Coverage

By Product Type: Raw-Cooked, Raw Fermented Sausages, Cured, Fresh Processed, Dried, Precooked-cooked

By Meat Type: Processed Poultry, Processed Meat

By Packaging Film: Single layer, Multiple layer

By Packaging technique: Vacuum packing, Intelligent packing, Skin packing, Modified atmosphere packing, Active packing and others

By End user Industry: Restaurants, Food manufacturers, Retail, and others.

The global processed poultry and meat market report also analyzes the major geographic regions as well as the major countries for the market in these regions. The regions and countries covered in the study include:

- North America: The U.S., Canada and Mexico

- South America:, Brazil, Argentina, Ecuador, Chile, Peru, Cost Rica, and other South American countries

- Europe: The U.K., France, Italy, Germany, Spain, Belgium, The Netherlands, Denmark, and Rest of Europe

- Asia: China, Japan, South Korea, India, Taiwan, Malaysia, and Rest of Asia

- ROW: Africa and Middle East

Processed Poultry and Meat Market Trends

- Increase in the demand for antibiotic free and preservative free meat requires the production companies to find alternatives to ensure shelf life along with quality.

- The growth of world consumption of poultry and meat market has been increasing consistently from years with the increase in awareness among the people. Processed Meat is of highest consumption in the North America.

- With the use of automation technology in production procedure and better packing techniques more demand is created for the poultry. As increase in automation will reduce the risk of contamination risks possessed by human intervention.

Key Questions Addressed in the Processed Poultry and Meat Market Report

1. Is the global processed poultry and meat market growing? How long will it continue to grow and at what rate?

2. Which type of global processed poultry and meat presents the major growth opportunities?

3. Is there a possibility for change in the market structure over time?

4. Are additional developments needed for the existing product or services offerings or do the existing products meet the customer demands?

5. Do the key vendors look for partnerships to expand their businesses with respect to geography or product?

6. What is the current status of global processed poultry and meat in different countries?

7. Which type of service will witness heavy adoption of global processed poultry and meat in the near future?

8. What are the short-term, long-term, and medium-term growth drivers for the market?

9. What are the short-term, medium-term, and long-term challenges for the market?

10. What are the short-term, medium-term, and long-term opportunities for the market?

11. Who are the top players/companies of the market?

12. What are the recent innovations in the market?

13. How many patents have been filed by the leading players?

14. What are the types of patents filed by the leading players?

15. What is the futuristic scenario for the adoption of global processed poultry and meat?

16. What is our Vision 2030 for the global processed poultry and meat market?

A few focus points of this Research are given below:

- Give a deep-dive analysis of the key operational strategies with focus on the corporate structure, R&D strategies, localization strategies, production capabilities, and sales performance of various companies.

- Provide an overview of the product portfolio, including product planning, development, and positioning.

- Discuss the role of technology companies in partnerships.

- Explore the regional sales activities.

- Analyze the market size and giving the forecast for current and future global processed poultry and meat market during the forecast period 2018–2023.

- Analyze the competitive factors, competitors’ market shares, product capabilities, and supply chain structures.

IndustryARC Research Best Practices

The global processed poultry and meat market size is evaluated based on the number of products per organization type along with the varying price points pertaining to specific applications. These were identified as key informational conjectures for market estimation in 2017.

The global processed poultry and meat market share is thoroughly checked against all data points that have been incorporated and rechecked against various data sources. Various C-level executives and key opinion leaders are contacted for verification of the data.

The global processed poultry and meat market forecast and growth rate are achieved by applying the time series forecasting methodology on the various factors. The market forecast and growth rate are further backed with historical trends of the market along with a regressive mathematical model that assesses the value based on factors such as capital expenditure, equipment lifespan, R&D investments, and so on.

The global processed poultry and meat market demand has been researched taking into account the prominent economies across the different geographic regions to understand their corresponding impact on the market.

The global processed poultry and meat market drivers are evaluated for short-term, medium-term, and long-term based on the different market dynamics impacting the market.

The global processed poultry and meat market challenges are evaluated for short-term, medium-term, and long-term based on the different market dynamics impacting the market.

The global processed poultry and meat market trends have been analyzed taking into consideration the micro and macro trends prevalent in various geographies.

The global processed poultry and meat market outlook provides a brief overview of the market performance and anticipated change in market dynamics.

The global processed poultry and meat market analysis also involves the identification of new companies that have entered the market scenario and their impact on the market dynamics in the future.

Key Market Players:

The Top 5 companies in the Processed Poultry & Meat Market are:

- Hormel Foods

- BRF SA

- Tyson Foods

- Cargill

- JBS SA

For more Food and Beverages related reports, please click here

1. Processed Poultry and Meat Market - Market Overview

1.1 Definitions and Scope

2. Processed Poultry and Meat Market - Executive Summary

2.1 Market Revenue, Market Size and Key Trends by Company

2.2 Key trends by Product Type

2.3 Key trends segmented by Geography

3. Processed Poultry and Meat Market – Industry Market Entry Scenario Premium

3.1 Regulatory Framework Overview

3.2 New Business and Ease of Doing business index

3.3 Case studies of successful ventures

4. Processed Poultry and Meat Market - Market Forces

4.1 Market Drivers

4.2 Market Constraints/Challenges

4.3 Market Opportunities

4.4 Porters five force model

4.4.1 Bargaining power of suppliers

4.4.2 Bargaining powers of customers

4.4.3 Threat of new entrants

4.4.4 Rivalry among existing players

4.4.5 Threat of substitutes

5. Processed Poultry and Meat Market – By Product Type (Market Size -$Million/$Billion)

5.1 Raw Cooked

5.2 Raw Fermented

5.3 Cured

5.4 Fresh Processed

5.5 Dried

5.6 Precooked-Cooked

5.7 Others

6. Processed Poultry and Meat Market – By Type (Market Size -$Million/$Billion)

6.1 Processed Poultry

6.1.1 Chicken and Duck

6.1.2 Turkey and Others

6.2 Processed Meat

6.2.1 Processed Pork

6.2.2 Mutton, Beef and Others

7. Processed Poultry and Meat Market - By Packaging Film (Market Size - Million/$Billion)

7.1 Single Layer

7.2 Multi-Layer

8. Processed Poultry and Meat Market - By Packaging Technique (Market Size - Million/$Billion)

8.1 Vacuum Packing

8.2 Intelligent Packing

8.3 Skin Packing

8.4 Modified Atmosphere Packaging

8.5 Active Packaging

8.6 Others

9. Processed Poultry and Meat Market – By End Use Industry (Market Size -$Million/$Billion)

9.1 Restaurants

9.2 Retail Markets

9.3 Food manufacturers

9.4 Others

10. Processed Poultry and Meat Market - By Geography (Market Size -$Million/$Billion)

10.1 North America

10.1.1 U.S.

10.1.2 Canada

10.1.3 Mexico

10.2 South America

10.2.1 Brazil

10.2.2 Argentina

10.2.3 Chile

10.2.4 Ecuador

10.2.5 Peru

10.2.6 Colombia

10.2.7 Costa Rica

10.2.8 Rest of South America

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Russia

10.3.7 Netherlands

10.3.8 Belgium

10.3.9 Denmark

10.3.10 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Australia

10.4.3 Japan

10.4.4 South Korea

10.4.5 India

10.4.6 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Middle East

10.5.2 Africa

11. Processed Poultry and Meat Market - Entropy

12. Processed Poultry and Meat Market Company Analysis

12.1 Market Share, Company Revenue, Products, M&A, Developments

12.2 Sanderson Farms Inc.

12.3 Marfrig Group

12.4 Tyson Foods Inc.

12.5 Vion Food Group

12.6 Cargill Inc.

12.7 Company 6

12.8 Company 7

12.9 Company 8

12.10 Company 9

12.11 Company 10 and more

"*Financials of the private companies would be provided on a best efforts basis”

List of Tables

Table 1: Processed Poultry & Meat Market Overview 2023-2030

Table 2: Processed Poultry & Meat Market Leader Analysis 2023-2024 (US$)

Table 3: Processed Poultry & Meat Market Product Analysis 2023-2024 (US$)

Table 4: Processed Poultry & Meat Market End User Analysis 2023-2024 (US$)

Table 5: Processed Poultry & Meat Market Patent Analysis 2021-2023* (US$)

Table 6: Processed Poultry & Meat Market Financial Analysis 2023-2024 (US$)

Table 7: Processed Poultry & Meat Market Driver Analysis 2023-2024 (US$)

Table 8: Processed Poultry & Meat Market Challenges Analysis 2023-2024 (US$)

Table 9: Processed Poultry & Meat Market Constraint Analysis 2023-2024 (US$)

Table 10: Processed Poultry & Meat Market Supplier Bargaining Power Analysis 2023-2024 (US$)

Table 11: Processed Poultry & Meat Market Buyer Bargaining Power Analysis 2023-2024 (US$)

Table 12: Processed Poultry & Meat Market Threat of Substitutes Analysis 2023-2024 (US$)

Table 13: Processed Poultry & Meat Market Threat of New Entrants Analysis 2023-2024 (US$)

Table 14: Processed Poultry & Meat Market Degree of Competition Analysis 2023-2024 (US$)

Table 15: Processed Poultry & Meat Market Value Chain Analysis 2023-2024 (US$)

Table 16: Processed Poultry & Meat Market Pricing Analysis 2023-2030 (US$)

Table 17: Processed Poultry & Meat Market Opportunities Analysis 2023-2030 (US$)

Table 18: Processed Poultry & Meat Market Product Life Cycle Analysis 2023-2030 (US$)

Table 19: Processed Poultry & Meat Market Supplier Analysis 2023-2024 (US$)

Table 20: Processed Poultry & Meat Market Distributor Analysis 2023-2024 (US$)

Table 21: Processed Poultry & Meat Market Trend Analysis 2023-2024 (US$)

Table 22: Processed Poultry & Meat Market Size 2023 (US$)

Table 23: Processed Poultry & Meat Market Forecast Analysis 2023-2030 (US$)

Table 24: Processed Poultry & Meat Market Sales Forecast Analysis 2023-2030 (Units)

Table 25: Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 26: Processed Poultry & Meat Market By Type, Revenue & Volume, By Processed Poultry, 2023-2030 ($)

Table 27: Processed Poultry & Meat Market By Type, Revenue & Volume, By Processed Meat, 2023-2030 ($)

Table 28: Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 29: Processed Poultry & Meat Market By Product, Revenue & Volume, By Raw - Cooked, 2023-2030 ($)

Table 30: Processed Poultry & Meat Market By Product, Revenue & Volume, By Raw Fermented Sausages, 2023-2030 ($)

Table 31: Processed Poultry & Meat Market By Product, Revenue & Volume, By Cured, 2023-2030 ($)

Table 32: Processed Poultry & Meat Market By Product, Revenue & Volume, By Fresh Processed, 2023-2030 ($)

Table 33: Processed Poultry & Meat Market By Product, Revenue & Volume, By Dried, 2023-2030 ($)

Table 34: Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 35: Processed Poultry & Meat Market By Types of Packaging Film, Revenue & Volume, By Single Layer Films, 2023-2030 ($)

Table 36: Processed Poultry & Meat Market By Types of Packaging Film, Revenue & Volume, By Multi-Layer Films, 2023-2030 ($)

Table 37: Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 38: Processed Poultry & Meat Market By Packaging Type, Revenue & Volume, By Vacuum Packaging, 2023-2030 ($)

Table 39: Processed Poultry & Meat Market By Packaging Type, Revenue & Volume, By Skin Packaging, 2023-2030 ($)

Table 40: Processed Poultry & Meat Market By Packaging Type, Revenue & Volume, By Modified Atmosphere Packaging, 2023-2030 ($)

Table 41: Processed Poultry & Meat Market By Packaging Type, Revenue & Volume, By Controlled Atmosphere Packaging, 2023-2030 ($)

Table 42: Processed Poultry & Meat Market By Packaging Type, Revenue & Volume, By Active Packaging, 2023-2030 ($)

Table 43: Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 44: Processed Poultry & Meat Market By End User, Revenue & Volume, By Retail Market, 2023-2030 ($)

Table 45: Processed Poultry & Meat Market By End User, Revenue & Volume, By Food Service, 2023-2030 ($)

Table 46: North America Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 47: North America Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 48: North America Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 49: North America Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 50: North America Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 51: South america Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 52: South america Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 53: South america Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 54: South america Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 55: South america Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 56: Europe Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 57: Europe Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 58: Europe Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 59: Europe Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 60: Europe Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 61: APAC Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 62: APAC Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 63: APAC Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 64: APAC Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 65: APAC Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 66: Middle East & Africa Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 67: Middle East & Africa Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 68: Middle East & Africa Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 69: Middle East & Africa Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 70: Middle East & Africa Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 71: Russia Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 72: Russia Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 73: Russia Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 74: Russia Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 75: Russia Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 76: Israel Processed Poultry & Meat Market, Revenue & Volume, By Type, 2023-2030 ($)

Table 77: Israel Processed Poultry & Meat Market, Revenue & Volume, By Product, 2023-2030 ($)

Table 78: Israel Processed Poultry & Meat Market, Revenue & Volume, By Types of Packaging Film, 2023-2030 ($)

Table 79: Israel Processed Poultry & Meat Market, Revenue & Volume, By Packaging Type, 2023-2030 ($)

Table 80: Israel Processed Poultry & Meat Market, Revenue & Volume, By End User, 2023-2030 ($)

Table 81: Top Companies 2023 (US$)Processed Poultry & Meat Market, Revenue & Volume

Table 82: Product Launch 2023-2024Processed Poultry & Meat Market, Revenue & Volume

Table 83: Mergers & Acquistions 2023-2024Processed Poultry & Meat Market, Revenue & Volume

List of Figures

Figure 1: Overview of Processed Poultry & Meat Market 2023-2030

Figure 2: Market Share Analysis for Processed Poultry & Meat Market 2023 (US$)

Figure 3: Product Comparison in Processed Poultry & Meat Market 2023-2024 (US$)

Figure 4: End User Profile for Processed Poultry & Meat Market 2023-2024 (US$)

Figure 5: Patent Application and Grant in Processed Poultry & Meat Market 2021-2023* (US$)

Figure 6: Top 5 Companies Financial Analysis in Processed Poultry & Meat Market 2023-2024 (US$)

Figure 7: Market Entry Strategy in Processed Poultry & Meat Market 2023-2024

Figure 8: Ecosystem Analysis in Processed Poultry & Meat Market 2023

Figure 9: Average Selling Price in Processed Poultry & Meat Market 2023-2030

Figure 10: Top Opportunites in Processed Poultry & Meat Market 2023-2024

Figure 11: Market Life Cycle Analysis in Processed Poultry & Meat Market

Figure 12: GlobalBy TypeProcessed Poultry & Meat Market Revenue, 2023-2030 ($)

Figure 13: GlobalBy ProductProcessed Poultry & Meat Market Revenue, 2023-2030 ($)

Figure 14: GlobalBy Types of Packaging FilmProcessed Poultry & Meat Market Revenue, 2023-2030 ($)

Figure 15: GlobalBy Packaging TypeProcessed Poultry & Meat Market Revenue, 2023-2030 ($)

Figure 16: GlobalBy End UserProcessed Poultry & Meat Market Revenue, 2023-2030 ($)

Figure 17: Global Processed Poultry & Meat Market - By Geography

Figure 18: Global Processed Poultry & Meat Market Value & Volume, By Geography, 2023-2030 ($)

Figure 19: Global Processed Poultry & Meat Market CAGR, By Geography, 2023-2030 (%)

Figure 20: North America Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 21: US Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 22: US GDP and Population, 2023-2024 ($)

Figure 23: US GDP – Composition of 2023, By Sector of Origin

Figure 24: US Export and Import Value & Volume, 2023-2024 ($)

Figure 25: Canada Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 26: Canada GDP and Population, 2023-2024 ($)

Figure 27: Canada GDP – Composition of 2023, By Sector of Origin

Figure 28: Canada Export and Import Value & Volume, 2023-2024 ($)

Figure 29: Mexico Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 30: Mexico GDP and Population, 2023-2024 ($)

Figure 31: Mexico GDP – Composition of 2023, By Sector of Origin

Figure 32: Mexico Export and Import Value & Volume, 2023-2024 ($)

Figure 33: South America Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 34: Brazil Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 35: Brazil GDP and Population, 2023-2024 ($)

Figure 36: Brazil GDP – Composition of 2023, By Sector of Origin

Figure 37: Brazil Export and Import Value & Volume, 2023-2024 ($)

Figure 38: Venezuela Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 39: Venezuela GDP and Population, 2023-2024 ($)

Figure 40: Venezuela GDP – Composition of 2023, By Sector of Origin

Figure 41: Venezuela Export and Import Value & Volume, 2023-2024 ($)

Figure 42: Argentina Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 43: Argentina GDP and Population, 2023-2024 ($)

Figure 44: Argentina GDP – Composition of 2023, By Sector of Origin

Figure 45: Argentina Export and Import Value & Volume, 2023-2024 ($)

Figure 46: Ecuador Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 47: Ecuador GDP and Population, 2023-2024 ($)

Figure 48: Ecuador GDP – Composition of 2023, By Sector of Origin

Figure 49: Ecuador Export and Import Value & Volume, 2023-2024 ($)

Figure 50: Peru Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 51: Peru GDP and Population, 2023-2024 ($)

Figure 52: Peru GDP – Composition of 2023, By Sector of Origin

Figure 53: Peru Export and Import Value & Volume, 2023-2024 ($)

Figure 54: Colombia Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 55: Colombia GDP and Population, 2023-2024 ($)

Figure 56: Colombia GDP – Composition of 2023, By Sector of Origin

Figure 57: Colombia Export and Import Value & Volume, 2023-2024 ($)

Figure 58: Costa Rica Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 59: Costa Rica GDP and Population, 2023-2024 ($)

Figure 60: Costa Rica GDP – Composition of 2023, By Sector of Origin

Figure 61: Costa Rica Export and Import Value & Volume, 2023-2024 ($)

Figure 62: Europe Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 63: U.K Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 64: U.K GDP and Population, 2023-2024 ($)

Figure 65: U.K GDP – Composition of 2023, By Sector of Origin

Figure 66: U.K Export and Import Value & Volume, 2023-2024 ($)

Figure 67: Germany Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 68: Germany GDP and Population, 2023-2024 ($)

Figure 69: Germany GDP – Composition of 2023, By Sector of Origin

Figure 70: Germany Export and Import Value & Volume, 2023-2024 ($)

Figure 71: Italy Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 72: Italy GDP and Population, 2023-2024 ($)

Figure 73: Italy GDP – Composition of 2023, By Sector of Origin

Figure 74: Italy Export and Import Value & Volume, 2023-2024 ($)

Figure 75: France Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 76: France GDP and Population, 2023-2024 ($)

Figure 77: France GDP – Composition of 2023, By Sector of Origin

Figure 78: France Export and Import Value & Volume, 2023-2024 ($)

Figure 79: Netherlands Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 80: Netherlands GDP and Population, 2023-2024 ($)

Figure 81: Netherlands GDP – Composition of 2023, By Sector of Origin

Figure 82: Netherlands Export and Import Value & Volume, 2023-2024 ($)

Figure 83: Belgium Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 84: Belgium GDP and Population, 2023-2024 ($)

Figure 85: Belgium GDP – Composition of 2023, By Sector of Origin

Figure 86: Belgium Export and Import Value & Volume, 2023-2024 ($)

Figure 87: Spain Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 88: Spain GDP and Population, 2023-2024 ($)

Figure 89: Spain GDP – Composition of 2023, By Sector of Origin

Figure 90: Spain Export and Import Value & Volume, 2023-2024 ($)

Figure 91: Denmark Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 92: Denmark GDP and Population, 2023-2024 ($)

Figure 93: Denmark GDP – Composition of 2023, By Sector of Origin

Figure 94: Denmark Export and Import Value & Volume, 2023-2024 ($)

Figure 95: APAC Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 96: China Processed Poultry & Meat Market Value & Volume, 2023-2030

Figure 97: China GDP and Population, 2023-2024 ($)

Figure 98: China GDP – Composition of 2023, By Sector of Origin

Figure 99: China Export and Import Value & Volume, 2023-2024 ($)Processed Poultry & Meat Market China Export and Import Value & Volume, 2023-2024 ($)

Figure 100: Australia Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 101: Australia GDP and Population, 2023-2024 ($)

Figure 102: Australia GDP – Composition of 2023, By Sector of Origin

Figure 103: Australia Export and Import Value & Volume, 2023-2024 ($)

Figure 104: South Korea Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 105: South Korea GDP and Population, 2023-2024 ($)

Figure 106: South Korea GDP – Composition of 2023, By Sector of Origin

Figure 107: South Korea Export and Import Value & Volume, 2023-2024 ($)

Figure 108: India Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 109: India GDP and Population, 2023-2024 ($)

Figure 110: India GDP – Composition of 2023, By Sector of Origin

Figure 111: India Export and Import Value & Volume, 2023-2024 ($)

Figure 112: Taiwan Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 113: Taiwan GDP and Population, 2023-2024 ($)

Figure 114: Taiwan GDP – Composition of 2023, By Sector of Origin

Figure 115: Taiwan Export and Import Value & Volume, 2023-2024 ($)

Figure 116: Malaysia Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 117: Malaysia GDP and Population, 2023-2024 ($)

Figure 118: Malaysia GDP – Composition of 2023, By Sector of Origin

Figure 119: Malaysia Export and Import Value & Volume, 2023-2024 ($)

Figure 120: Hong Kong Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 121: Hong Kong GDP and Population, 2023-2024 ($)

Figure 122: Hong Kong GDP – Composition of 2023, By Sector of Origin

Figure 123: Hong Kong Export and Import Value & Volume, 2023-2024 ($)

Figure 124: Middle East & Africa Processed Poultry & Meat Market Middle East & Africa 3D Printing Market Value & Volume, 2023-2030 ($)

Figure 125: Russia Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 126: Russia GDP and Population, 2023-2024 ($)

Figure 127: Russia GDP – Composition of 2023, By Sector of Origin

Figure 128: Russia Export and Import Value & Volume, 2023-2024 ($)

Figure 129: Israel Processed Poultry & Meat Market Value & Volume, 2023-2030 ($)

Figure 130: Israel GDP and Population, 2023-2024 ($)

Figure 131: Israel GDP – Composition of 2023, By Sector of Origin

Figure 132: Israel Export and Import Value & Volume, 2023-2024 ($)

Figure 133: Entropy Share, By Strategies, 2023-2024* (%)Processed Poultry & Meat Market

Figure 134: Developments, 2023-2024*Processed Poultry & Meat Market

Figure 135: Company 1 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 136: Company 1 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 137: Company 1 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 138: Company 2 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 139: Company 2 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 140: Company 2 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 141: Company 3 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 142: Company 3 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 143: Company 3 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 144: Company 4 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 145: Company 4 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 146: Company 4 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 147: Company 5 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 148: Company 5 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 149: Company 5 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 150: Company 6 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 151: Company 6 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 152: Company 6 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 153: Company 7 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 154: Company 7 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 155: Company 7 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 156: Company 8 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 157: Company 8 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 158: Company 8 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 159: Company 9 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 160: Company 9 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 161: Company 9 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 162: Company 10 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 163: Company 10 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 164: Company 10 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 165: Company 11 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 166: Company 11 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 167: Company 11 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 168: Company 12 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 169: Company 12 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 170: Company 12 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 171: Company 13 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 172: Company 13 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 173: Company 13 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 174: Company 14 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 175: Company 14 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 176: Company 14 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Figure 177: Company 15 Processed Poultry & Meat Market Net Revenue, By Years, 2023-2024* ($)

Figure 178: Company 15 Processed Poultry & Meat Market Net Revenue Share, By Business segments, 2023 (%)

Figure 179: Company 15 Processed Poultry & Meat Market Net Sales Share, By Geography, 2023 (%)

Email

Email Print

Print