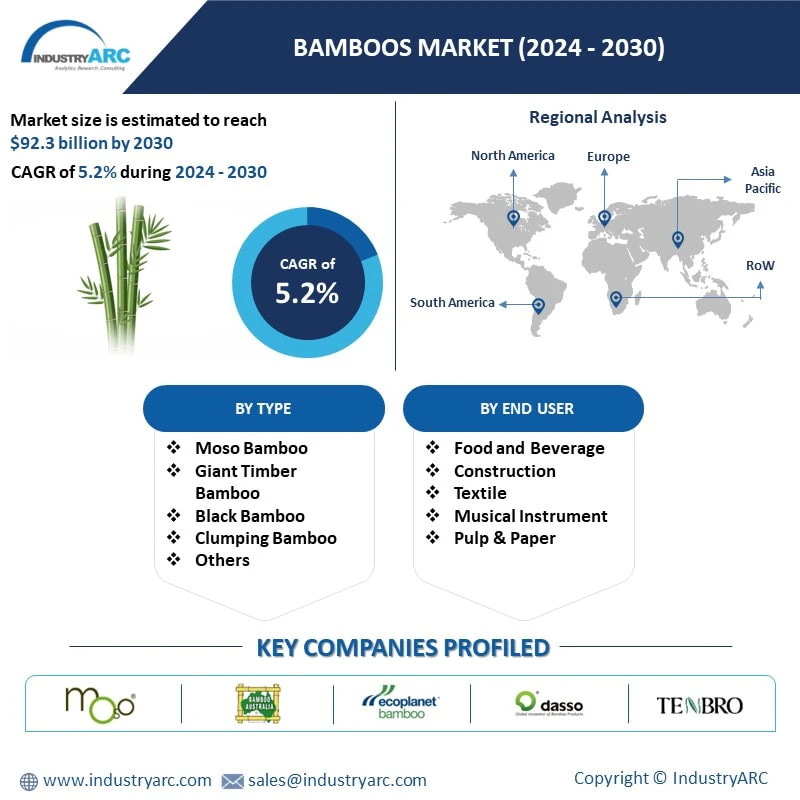

Bamboos Market Overview:

The bamboos market size is forecast to reach

US$92.3 billion by 2030 after growing at a

CAGR of 5.2% during 2024-2030. Bamboos are herbaceous or woody grass found under diverse climatic conditions, ranging from cold mountains to hot tropical regions. The demand for bamboo catapulted in a wide range of industries owing to its excellent durability and eco-friendly properties. Bamboos are implemented extensively in the construction of houses, scaffoldings, floors, roofs, bridges, roads, and many other structures. The construction sector is booming globally and this will contribute to the market’s growth in the forecast market. For instance, according to the January 2021 stats by India Brand Equity Foundation, demand for residential properties has increased owing to increased urbanization. Furthermore, bamboos are an integral part of the production of several

furniture products such as chairs, tables, mat boards,

plywood, among others. The furniture industry is expanding globally and this will contribute to the growth of the market in the forecast period. For instance, as per the CEIC Data report, furniture data was reported 372.218 in February 2021 which was an increase compared to the number of 371.172 in January 2021. Other industries such as pulp & paper, and agriculture will drive the growth of the market significantly in the forecast period. The high operation cost associated with bamboo might affect the growth of the market in the forecast period

Market Trends:

Expanding Applications in Textiles and Fashion:

A significant trend in the bamboo market is its expanding applications in textiles and fashion. Bamboo fibers, derived from the pulp of bamboo plants, are increasingly used in the textile industry to create soft, breathable, and sustainable fabrics. The trend towards eco-friendly and ethical fashion has led to the popularity of bamboo-based clothing, including activewear, loungewear, and undergarments. Bamboo textiles offer natural moisture-wicking properties and antimicrobial features, making them a preferred choice for consumers seeking comfortable and environmentally conscious apparel. The market is witnessing collaborations between fashion brands and bamboo suppliers to introduce innovative and sustainable clothing lines. As the demand for sustainable fashion continues to grow, bamboo's presence in the textile industry is expected to expand, contributing to a more sustainable and circular fashion ecosystem.

Rising Popularity of Bamboo-Based Consumer Products:

A noteworthy trend in the bamboo market is the rising popularity of bamboo-based consumer products. Bamboo's natural and eco-friendly characteristics have led to the development of a wide range of everyday items, such as kitchenware, cutlery, toothbrushes, and packaging materials. Consumers are increasingly drawn to bamboo products as viable alternatives to single-use plastics and other materials with higher environmental footprints. The market is witnessing a surge in the availability of bamboo-based alternatives in retail stores and e-commerce platforms. Bamboo's rapid growth and biodegradability contribute to its appeal as a sustainable material for various consumer goods. The trend aligns with the global shift towards conscious consumerism, where individuals prioritize products that minimize environmental impact. As awareness of plastic pollution and resource depletion grows, the bamboo market is poised to continue its expansion, offering consumers sustainable choices across a broad spectrum of everyday products.

Market Snapshot:

Bamboos Market - Report Coverage:

The “Bamboos Market Report - Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Adhesive Bandages Market.

| Attribute |

Segment |

|

By Type

|

● Moso Bamboo

● Giant Timber Bamboo

● Black Bamboo

● Clumping Bamboo

● Others

|

|

By End-User

|

● Food and Beverage

● Construction

o Bridges

o Houses

o Scaffolding

o Falls

o Floors

o Roofs

o Roads

● Textile

● Musical Instrument

o Flutes

o Rattle

o Drums

o Others

● Pulp & Paper

● Healthcare

● Jewellery

● Furniture

o Beds

o Chairs

o Tables

o Lamps

o Mat Boards

o Plywood

o Others

● Fishing

● Sports and Recreation

● Electronics

● Personal Care and Cosmetics

● Agriculture

● Others

|

|

By Geography

|

● North America (U.S., Canada and Mexico)

● Europe (Germany, France, UK, Italy, Spain, Netherlands and Rest of Europe),

● Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

● South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

● Rest of the World (Middle East and Africa).

|

COVID-19 / Ukraine Crisis - Impact Analysis:

● The bamboo market was impacted deeply due to the COVID-19 pandemic. Challenges in the form of disruption in the supply chain and idling of factories surfaced amid the pandemic, making the business movements critical. Market players came up with modified working patterns to maintain a standard business operation during the pandemic. However, the business in the bamboo market was still affected owing to the severity of the pandemic. As per the March 2022 report by Swicofil AG, the company faced difficulty in providing services to its business partners and customers. The market witnessed decent growth towards the end of 2022 with the increase in the demand for bamboo in several end-use industries. Going forward, the market is projected to witness significant demand in the forecast period owing to expansion in end-use industries such as construction, furniture, and paper, among others.

● The geopolitical conflicts and disruptions in global trade can have indirect effects on various markets, including those for natural resources and commodities like bamboo. Factors such as trade restrictions, supply chain interruptions, and economic uncertainties can influence the production, distribution, and pricing of goods, including bamboo and bamboo-based products.

Key Takeaways:

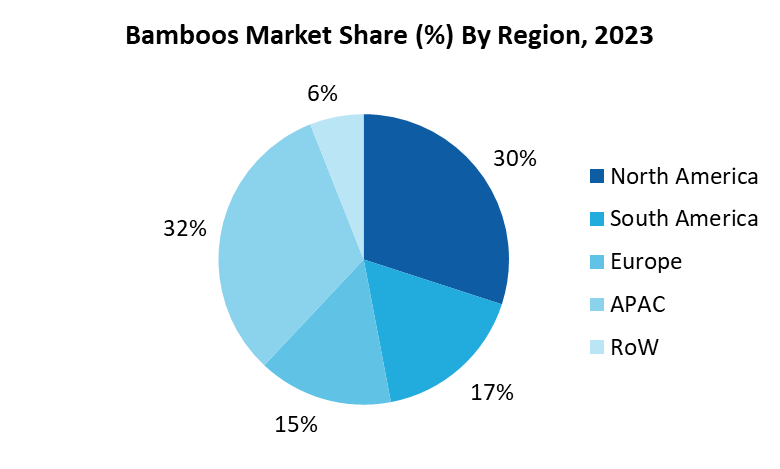

Dominance of Asia-Pacific

The Asia-Pacific region held the largest market share in the bamboos market in 2023 with a market share of up to 32%. The high demand for bamboos in the region is attributed to the growing construction industry. Bamboos are massively used in the construction of scaffoldings, floors, and roofs in the region’s emerging economies such as China, India, and Japan. The construction sector is booming in the region with increasing construction activities and this will increase the higher implementation of bamboos in the forecast period. For instance, according to the stats by India Brand Equity Foundation, India is anticipated to become the third-largest construction market by 2023 globally. Similarly, as per the report by trade.gov, the construction industry revenue value in China is expected to reach US$ 1.1 trillion in 2021 which was US$ 968 billion in 2019. Such massive growth in the region’s construction sector will augment the higher uses of bamboos in the forecast period. The North American region will witness significant demand for bamboos owing to the expanding furniture sector in the region.

Construction segment held the largest market share

The construction industry dominated the bamboos market in 2023 and is growing at a CAGR of 5.2% in the forecast period. Owing to its flexibility and combined strength, bamboo is used massively in the construction of several structures that includes roads, bridges, floors, scaffoldings, etc. The construction industry is booming globally with increasing constructional activities and this will contribute to the growth of the market in the forecast period. For instance, as per the 2021 Statistical Report by European Construction Industry Federation, Germany witnessed a growth of 1.5% in real terms in total investment in construction. Similarly, according to the August 2021 report by Eurostat, the building construction sector in the European Union and Euro Area increased by 3.8% and 3.1% respectively in June 2021. Such a massive boost in the global construction industry will stimulate the higher implementation of bamboos in the construction of various structures which in turn will drive the growth of the market in the forecast period. The furniture industry is projected to drive the growth of the market robustly in the forecast period. Other end-use industries such as pulp & paper, and agriculture will drive the growth of the market significantly in the forecast period.

Moso Bamboo segment to Hold Largest Market Share

Moso Bamboo segment has been the primary market for Bamboos for many years at a CAGR of 7.3% in 2023. Renowned for its rapid growth and towering culms, Moso Bamboo stands out as one of the largest bamboo species, making it a valuable resource for various industries. Its accelerated growth rate allows for efficient harvesting, contributing to a sustainable and renewable supply chain. In the construction sector, Moso Bamboo is widely utilized for structural purposes, flooring, and other architectural elements, leveraging its strength and durability. Moreover, the textile industry benefits from Moso Bamboo as its fibers are used to create soft and breathable fabrics, catering to the growing demand for sustainable and comfortable clothing.

The popularity of Moso Bamboo extends to the furniture industry, where it serves as a preferred material for crafting eco-friendly and aesthetically pleasing furniture pieces. Additionally, Moso Bamboo contributes to environmental conservation efforts by acting as a carbon sink, absorbing more carbon dioxide than traditional hardwoods. Its widespread cultivation and applications across diverse sectors contribute significantly to the economic viability of the bamboo market.

Booming construction industry will drive the market’s growth

Bamboo finds its massive uses in the construction of roads, scaffoldings, falls, among others. The construction industry is booming globally with the increasing construction activity and this will contribute to the growth of the market in the forecast period. For instance, as per the stats by European Construction Industry Federation, net investment in new construction works accounted for US$ 13.46 billion in 2020 which was 9.3% higher than 2019. Similarly, according to the data by India Brand Equity Foundation, the residential sector in India is projected to grow significantly as the central government announced to build 20 million affordable houses throughout the country by 2022. This massive growth in the construction industry globally will augment the demand for bamboos in various construction activities and, in turn, this will contribute to the growth of the market in the forecast period.

Expanding furniture industry will drive the growth of the market

Bamboos are widely utilized in the production of several furniture products that includes chairs, lamps, mat boards, plywood, among others. The furniture industry is expanding globally and this will drive the growth of the market in the forecast period. For instance, as per the 2020-2021 report by Crescendo Worldwide, the Indian furniture market is projected to garner US$ 61.09 billion by 2023. Similarly, as per the data by census.gov, imports of furniture in the US accounted for US$ 50,277 million in 2021 which was US$ 39,446 million in 2020. Such massive expansion in the global furniture industry will amplify the uses of bamboos in various furniture products and this will contribute to the growth of the market in the forecast period.

High operation cost associated with bamboos might affect the market’s growth

The operation cost of bamboo is relatively high which has been a major challenge in the market and this might affect the growth of the market in the forecast period. Bamboo is used in grid packing which involves bamboo slivers, polypropylene piping, and rods. The use of bamboo grid packing has increased in industrial use in the last few years. However, its expensive operation cost restricts it from reaching its full potential. For instance, as per the data by International Network for Bamboo and Rattan (INBAR), the operation cost of bamboo grid packing is higher compared to PVC packing. Furthermore, the process for suppliers for proving a bamboo product’s legality is also costly. Such high operating costs associated with bamboos might hamper the growth of the market in the forecast period.

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Adhesive Bandages Market. The top 10 companies in this industry are listed below:

- MOSO International B.V.

- Bamboo Australia Pty. Ltd.

- EcoPlanet Bamboo

- Dasso Group

- Shanghai Tenbro Bamboo Textile Co.,Ltd.

- Swicofil AG

- CFF GmbH & Co. KG

- Liahren (Beijing) Tech Co., Limited

- Smith & Fong Co Inc.

- BambooVision

Scope of Report:

| Report Metric |

Details |

|

Base Year Considered

|

2023

|

|

Forecast Period

|

2024–2030

|

|

CAGR

|

5.2%

|

|

Market Size in 2030

|

$92.3 billion

|

|

Segments Covered

|

Availability, Distribution Channel, Type of Categoy, Source, Synthesis Method and Region

|

|

Geographies Covered

|

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Netherlands and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

|

|

Key Market Players

|

- MOSO International B.V.

- Bamboo Australia Pty. Ltd.

- EcoPlanet Bamboo

- Dasso Group

- Shanghai Tenbro Bamboo Textile Co.,Ltd.

- Swicofil AG

- CFF GmbH & Co. KG

- Liahren (Beijing) Tech Co., Limited

- Smith & Fong Co Inc.

- BambooVision

|

For more Chemicals and Materials related reports, please click here

Email

Email Print

Print