Open Banking Market Overview:

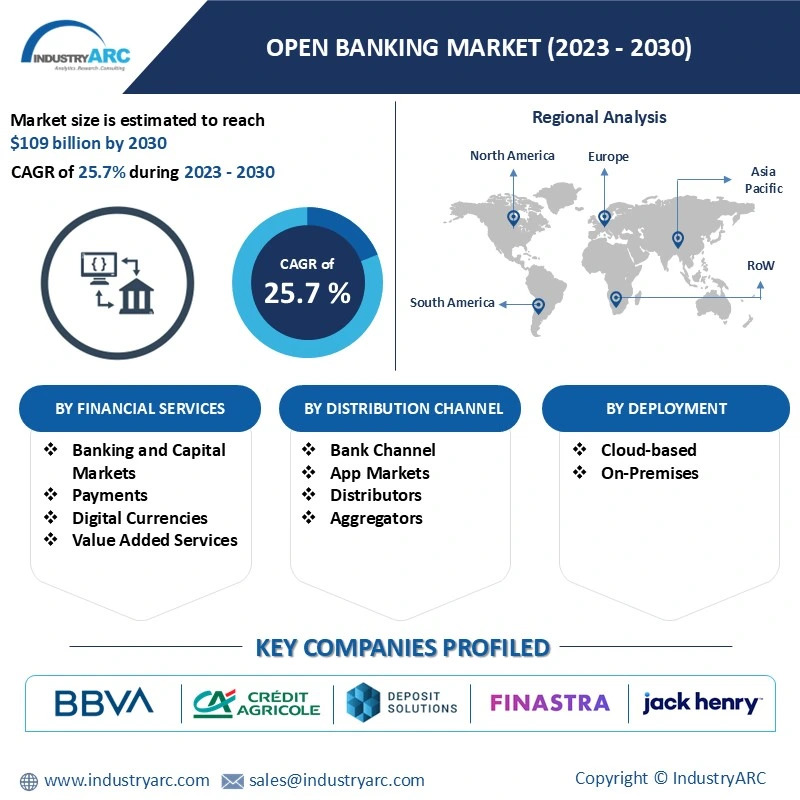

The global Open Banking Market size is estimated to reach $109 billion by 2030, growing at a CAGR of 25.7% during the forecast period 2023-2030. An increase in the number of individuals utilizing new wave applications and services is a key element contributing to the expansion of the open banking sector. Furthermore, the shifting payment ecosystem, increased use of e-commerce platforms, improved broadband access, and greater adoption of Application Programming Interfaces (APIs) are driving market expansion. Furthermore, an open banking platform has numerous benefits, including improved accessibility of financial operations, service centralization, and improved customer experience. This combined with increased customer retention and customer-centric solutions are expected to drive industry growth.

Technical improvements and the resulting growth in the usage of big data analytics and Artificial Intelligence (AI) are likely to boost the use of open banking systems. In the open banking sector, big data analytics are used to customize services and improve the user experience, which is expected to attract more clients. Rising consumer awareness of Open Banking solutions has resulted in increased demand for Open Banking platforms. Furthermore, the growing use of digital payments and mobile wallets is propelling the Open Banking market forward. A consumer in the financial services industry gains access to improved banking services as well as cutting-edge and personalized financial products because of the sector's embrace of open banking.

Market Snapshot:

Open Banking market - Report Coverage:

The “Open Banking market - Forecast (2023-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Open Banking Market.

| Attribute |

Segment |

|

By Financial Services

|

|

|

By Distribution Channel

|

-

Bank Channel

-

App Markets

-

Distributors

-

Aggregators

|

|

By Deployment

|

|

|

By Geography

|

-

North America (U.S., Canada and Mexico)

-

Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

-

Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

-

South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

-

Rest of the World (Middle East and Africa).

|

COVID-19 / Ukraine Crisis - Impact Analysis:

● The COVID-19 pandemic has had a significant influence in driving market growth throughout the forecast period. The epidemic raised demand for contactless payments, resulting in an expansion of the worldwide market for open banking. Several fintech businesses collaborated with market leaders to create cutting-edge digital solutions, resulting in market development. For example, in June 2022, Mastercard enabled startups to build and expand their user base through its Start Path Open Banking initiative, letting them to use resources, tools, and knowledge.

● The Russia-Ukraine war prompted regulatory changes in the region's banking business, which hampered the development and uptake of open banking services. Open banking is based on financial data exchange between banks and third-party suppliers, which raises issues about data safety and privacy. The debate resulted in stricter data protection legislation, which impacted financial data exchange and, as a result, the rise of the open banking industry. The Russia- Ukraine conflict has worsened and led to economic sanctions or other regulatory changes. This has impacted the way that open banking operates in the affected countries. Open banking is often used to facilitate cross-border transactions, which could be impacted if there are restrictions on the movement of goods and services between Russia and Ukraine.

Key Takeaways:

● Fastest Growth of Asia Pacific Region

Geographically, in the global Open Banking market share, Asia Pacific is analyzed to grow with the highest CAGR of 26.5% during the forecast period 2023-2030. The expansion of the Asia Pacific market can be attributed to the increasing awareness of the advantages provided by open banking systems in countries like China, India, and Japan. Additionally, the rapid advancements in digital payment services within the region are also expected to drive market growth. For example, Google Pay, an online payment platform, successfully processed 1.5 billion transactions in India in August 2022.

● Increased overall consumer involvement with open banking APIs

Open banking API provides a unique opportunity to improve consumer demands by making banking services easily accessible to customers. The banking and financial organization provides its own application programming interfaces (APIs) that enable other parties and banks to create innovative services, resulting in predicted financial income growth. Furthermore, an open banking application platform invites clients to interact with their financial data in novel ways. Furthermore, banks are realizing the promise of open banking and improving offerings that provide a positive client experience and engagement. As a result, open banking necessitates novel techniques to drive user involvement. This, in turn, is expected to propel the open banking industry forward.

● Increasing implementation of big data analytics

The market is projected to be driven due to the open banking sector's increased use of big data analytics to tailor services and improve user experience. The key element driving open banking growth is an increase in the number of individuals adopting new wave applications and services. Additionally, the collaboration of conventional banking and financial service providers has offered attractive chances for expansion, favorably impacting industry growth. Furthermore, open banking makes use of various APIs to access consumer banking activities and transactions from banks and NBFCs and build novel products and services to improve the customer experience.

● Increasing instances of online fraud and data vulnerability may limit industry expansion.

Open banking entails exchanging financial data with third-party providers, and there is always the possibility that this data might be obtained by unwanted people. This might result in identity theft, fraud, or other security violations. Financial data is extremely sensitive, and any compromise might have serious ramifications. Data breaches can cause severe financial losses, reputational harm, and legal ramifications. Giving third-party providers access to financial data through open banking might make it difficult for individuals to control their data. This has limited adoption of open banking standards.

● Resistance from Incumbent Banks may hamper market expansion.

Traditional banks may be reluctant to embrace open banking fully, as it can challenge their established business models and competitive advantage. Adapting to the open banking ecosystem might require significant investments in technology and a shift in organizational mindset. Thus the adoption of open banking standards are relatively limited in the short term.

Open Banking Market Share (%) By Region, 2022

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in Open Banking Market. The top 10 companies in this industry are listed below:

1. BBVA, S.A. (BBVA Compass, BBVA Continental)

2. Credit Agricole S.A. (Consumer Finance, LCL, Eurofactor)

3. Deposit Solutions GmbH (ZINSPILOT, Savedo, Raisin)

4. Finastra Group Holdings Ltd. (Fusion Fabric.cloud, Fusion invest, Fusion Risk)

5. Jack Henry & Associates, Inc. (Symitar, Profit Stars, Banno, ipay solutions)

6. Nordigen Solutions SIA (PFM, Data Enrichment, Data API)

7. Revolut Ltd. (Revolut Junior, Revolut Metal, Revolut Wealth)

8. MineralTree, Inc. (Multipay, AP Workflow+)

9. Yapily Ltd. (Yapily Pay, Yapily Auth, Yapily insights)

10. SocieteGenerale, S.A. (ALD Automotive, SocieteGenerale Retail Banking)

Scope of Report:

| Report Metric |

Details |

|

Base Year Considered

|

2022

|

|

Forecast Period

|

2023–2030

|

|

CAGR

|

25.7%

|

|

Market Size in 2030

|

$109 billion

|

|

Segments Covered

|

Financial Services, By Distribution Channel, By Deployment, By Geography

|

|

Geographies Covered

|

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

|

|

Key Market Players

|

-

BBVA, S.A.

-

Credit Agricole S.A.

-

Deposit Solutions GmbH.

-

Finastra Group Holdings Ltd.

-

Jack Henry & Associates, Inc.

-

Nordigen Solutions SIA

-

Revolut Ltd.

-

MineralTree, Inc.

-

Yapily Ltd.

-

SocieteGenerale, S.A

|

For more Information and Communications Technology related reports, please click here

Report Code: ITR 0160

Report Code: ITR 28984

Report Code: HCR 0459

Email

Email Print

Print