Copper Clad Laminate Market Overview:

The Global Copper Clad Laminate Market size is estimated to reach $18 billion by 2030, growing at a CAGR of 5.4% during the forecast period 2024-2030. Increasing demand for semiconductor chips and wiring boards in a wide variety of electronic devices and technological shift in the automotive sector are propelling the copper-clad laminate Market growth during the forecast period.

Additionally, the significant investments by the government and private manufacturers in 5G infrastructure development and the technological shift in the automotive sector are creating substantial growth opportunities for the Copper Clad Laminate Market. In 2022, Panasonic developed Multi-Layer Circuit Board Materials (MEGTRON 8), which will reduce power consumption by lowering the transmission loss and will contribute to larger capability and high-speed data communication. Simultaneously, technological shifts in the automotive sector and high demand for PCBs with more thickness are some of the major

Copper Clad Laminate Market opportunities. These factors positively influence the copper-clad laminate industry outlook during the forecast period.

Copper Clad Laminate Market - Report Coverage:

The “Copper Clad Laminate Market Report - Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Copper Clad Market.

| Attribute |

Segment |

|

By Form

|

-

Rigid Sheets

-

Flexible Sheets

|

|

By Reinforcement Material

|

-

Glass Fiber

Paper Base

-

Others

|

|

By Resin Type

|

|

|

By Packaging

|

|

|

By Application

|

-

Television

-

Computers

-

Radar devices

-

Mobiles

-

Defence equipment

-

Others

|

|

By End Use Industry

|

-

Communication Systems

-

Computers

-

Consumer Applications

-

Automotive

-

Healthcare

-

Aerospace & Defence

-

Others

|

|

By Geography

|

-

North America (the US, Canada and Mexico)

-

Europe (Germany, France, the UK, Italy, Spain, Russia, Netherlands, Belgium, Rest of Europe),

-

Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and the Rest of Asia-Pacific),

-

South America (Brazil, Argentina, Chile, Colombia and the Rest of South America)

-

The Rest of the World (the Middle East and Africa).

|

COVID-19 / Ukraine Crisis - Impact Analysis:

● Due to the global economic crisis caused by the Covid-19, The demand for copper-clad laminates has fallen due to a decline in the demand for electrical and electronic devices. The market was severely hit by the global trade restrictions that prevented imports and exports and there is a shortage of raw materials, the rise in instrument and equipment prices. The pandemic caused demand slumps in industries that heavily rely on copper-clad laminates, such as automotive, consumer electronics, and aerospace. The pandemic led to an increase in production costs due to factors like supply chain disruptions, higher raw material prices, and stricter safety protocols. While the initial stages of the pandemic caused significant disruptions and declines, the market has shown signs of recovery in recent times.

●

Commodity prices are increasing due to the ongoing Ukraine-Russia war. Asia was the biggest manufacturing regions and its trade with Europe is in a complex position. The supply chain disruption due to the Russia-Ukraine war has impeded the

Copper Clad Laminate Market growth. The disruption has increased freight charges, created container shortages and lowered the availability of warehousing space. This has resulted in inflationary issues in the aftermarket. the long-term impact is still uncertain and will depend on various factors, including the duration and outcome of the war, the ability of manufacturers to adapt to changing supply chains, and the overall health of the global economy.

Key Takeaways:

● Asia-pacific is the fastest growing market

Geographically, in the global copper-clad laminate market, Asia-Pacific is analyzed to grow with the highest CAGR of 6.2% during the forecast period 2024-2030 as the electronic market is highly dominated by the Asia Pacific region. A high economic growth rate, abundant low-cost raw material availability, competitive manufacturing costs, and lower labour and transportation costs are driving the PCBs market in the region, which in turn is driving the market for copper-lad laminates. Asia Pacific is a global hub for electronics manufacturing, with countries like China, Taiwan, and Vietnam leading the way. This booming industry creates a massive demand for copper-lad laminates, which are essential components in printed circuit boards (PCBs) used in various electronic devices like smartphones, laptops, TVs, and more. These factors are all due to the expansion of the electronics and automotive industries.

● Epoxy to register the largest in Resin Type

According to the Copper Clad Laminate Market forecast, Epoxy held the largest market share of 46% in 2023 and is used to make epoxy phenolic glass cloth laminated sheet that is alkali free. Epoxy's exceptional performance, adaptability, and processing efficiency make it the top choice for resin type in the copper clad laminate market. Sectors like automotive, healthcare, and industrial automation rely heavily on PCBs. As these sectors experience substantial growth, the demand for epoxy-based copper clad laminates naturally rises. This has heat and humidity resistance, mechanical strength and dielectric qualities which can be used in insulating parts of various machines like generators and motors.

● Phenolic to register the fastest in Resin Type

According to the Copper Clad Laminate Market forecast, phenolic is the fastest growing resin type having CAGR of 6.5% during 2024 - 2030. Phenolic resins have historically been widely used in the production of copper-clad laminates due to their good electrical and mechanical properties, as well as cost-effectiveness. Phenolic resin is valued for its electrical insulation properties, making it suitable for use in PCBs where it helps prevent short circuits and ensures proper signal transmission. Owing to its cost efficiency and easy maintenance, Phenolic is used to make Alkali free E-glass fabric and phenolic panels are resistant to weather and sun.

● Growth in 5G infrastructure to boost up market demand

Copper Clad Laminates are utilised in PCB circuits of highest thickness to enhance durability and signal transmission and the usage of copper clad laminates in the 5G infrastructure increases demand for the product since they enhance signal transmission, avoid delamination, manage heat, reduce weight, regulate moisture, and are more cost-effective. The deployment of 5G networks often involves the use of advanced materials with specific characteristics, such as low dielectric loss, high thermal conductivity, and excellent signal integrity. CCLs with specialized resin systems and substrate materials are essential for meeting these requirements.

● Technological shift in the automotive sector creating the growth opportunities:

The growth of the worldwide copper clad laminates market is being impacted by the booming electrical and electronic industries in developing nations. Electronic assembly technology makes extensive use of copper clad in the automotive industry. Due to variable customer demands, rapid urbanisation, and rapid technological advancements most automotive manufacturers have started developing new models with the introduction of various technical aspects.

● Prices of raw materials hinder the market growth

Based on the lifestyle, income and inflation, the demand increases for various products such as mobiles, computers, television, etc. in which copper clad laminates are used. The raw materials

used for making copper clad laminate sheets such as copper foil, resin, glass fiber are too expensive mainly due to an insufficient supply capacity. Increases in the prices of copper and other substrate materials can put financial pressure on Copper Clad Laminate manufacturers. Copper is a key component in the production of Copper Clad Laminate, and any significant change in its price can directly affect the cost of manufacturing. The copper-clad laminate market may experience price volatility due to fluctuations in raw material prices. This can make it challenging for manufacturers to provide stable pricing to their customers, potentially affecting buying decisions and overall market growth.

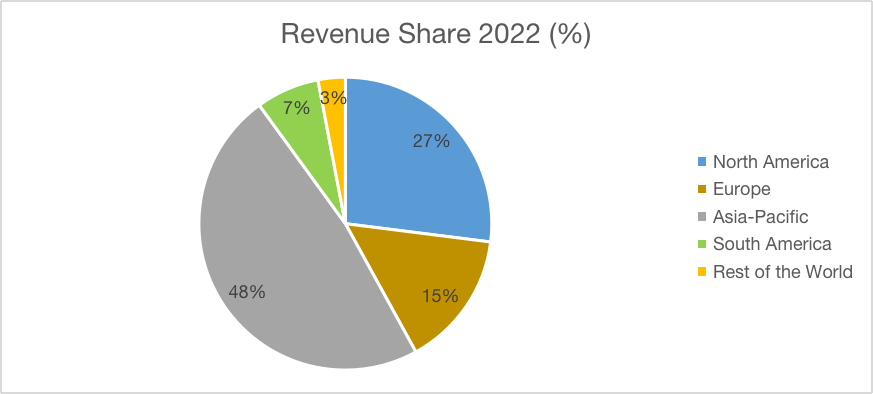

Copper Clad Laminate Market Share (%) By Region, 2022

For More Details on This Report - Request for Sample

Key Market Players:

Product launches, approvals, patents, acquisitions, partnerships and collaborations are key strategies adopted by players in the Copper Clad Laminate Market. The top companies in this market include:

1. NAN YA Plastics Corporation (NAN YA)

2. Taiwan Union Technology Corporation (PegaClad 300, PegaClad 2A, ThunderClad 4SR)

3. Panasonic Corporation (MEGTRON-6)

4. ITEQ Corporation

5. Sytech Technology

6. Cipel Italia (Cardel, UBE, CEDATEC)

7. Grace Electron (GA-680, GA-150-LL, GA-HF-PF7)

8. Union Technology Corporation (PegaClad 300, PegaClad 3A, ThunderClad 4SR)

9. Kingboard Laminates Holdings Ltd. (XPC, FR-1, 22F, CEM-1)

10. Shengyi Technology Co. Ltd. (S1150GH, Q360G, S1000)

Scope of the Report:

| Report Metric |

Details |

|

Base Year Considered

|

2023

|

|

Forecast Period

|

2024–2030

|

|

CAGR

|

5.4%

|

|

Market Size in 2030

|

$18 billion

|

|

Segments Covered

|

Form, Reinforcement Material, Resin Type, Packaging, Application, End Use Industry, Geography

|

Geographies Covered

|

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

|

Key Market Players

|

-

NAN YA Plastics Corporation

-

Taiwan Union Technology Corporation

-

Panasonic Corporation

-

ITEQ Corporation

-

Sytech Technology

-

Cipel Italia

-

Grace Electron

-

Union Technology Corporation

-

Kingboard Laminates Holdings Ltd.

-

Shengyi Technology Co. Ltd.

|

For more Chemicals and Materials Market reports, please Click Here

Email

Email Print

Print