Solid-State Car Battery Market Overview:

Solid-State Car Battery Market size is estimated to reach $1.8 billion by 2030, growing at a CAGR of 46% over the forecast period 2024-2030. Increased EV range leads to higher demand which drives the growth of the market. The market is anticipated to grow as a result of rising two-wheeler electric vehicle implementation rates and rising demand for long-range electric automobiles. This trend is expected to boost the growth of the Solid-State Car Battery Market over the forecast period.

Lithium-ion or lithium polymer batteries typically utilize liquid electrolytes, whereas solid-state batteries employ solid electrodes and solid electrolytes. RFID technology, pacemakers, and wearable electronics all employ solid-state batteries. Their expansion is being fueled by the increasing use of solid-state

batteries in wearables, healthcare, and drones. Solid state battery demand in electric vehicles is driving the global market's expansion.

Solid-State Car Battery Market - Report Coverage:

The “Solid-State Car Battery Market Report - Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Solid-State Car Battery Market.

| Attribute |

Segment |

|

By Vehicle Type

|

- Passenger Car

- Commercial Vehicle

|

|

By Battery Energy Density

|

- Less than 450 Wh/kg

- More than 450 Wh/kg

|

|

By Propulsion

|

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

|

|

By Component

|

- Cathode

- Anode

- Electrolyte

|

|

By Geography

|

- North America (U.S., Canada and Mexico)

- Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

- Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

- South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

- Rest of the World (Middle East and Africa).

|

COVID-19 / Ukraine Crisis - Impact Analysis:

● The COVID-19 pandemic lockdown led to a temporary ban on import and export as well as manufacturing and processing activities across a number of battery-related industries. This reduced consumer demand for solid-state rechargeable batteries, which is particularly relevant for portable electronics and

electric vehicles. Additionally, a stop in the production of renewable energy plants, automobiles, and consumer electronics due to a labour shortage and a widening supply-demand imbalance hinders the growth of the solid-state battery business during the pandemic. The market growth in 2020's second, third, and fourth quarters decreased as a result. However, the COVID-19 vaccination campaign started in several economies around the world in the second quarter of 2021, which helped the global economy. As a result, the solid-state battery industry revived.

● The growth of the solid-state automobile battery sector has been impacted by the conflict between Russia and Ukraine, both directly and indirectly. The disruption of the global supply chain for essential materials and components needed in the production of batteries is one of the most prominent immediate effects. Russia and Ukraine are major producers of metals and minerals, including nickel, cobalt, and rare earth elements, that are utilized in the production of batteries. The cost structure and production capacity of solid-state vehicle batteries have been impacted by the conflict's effects on the pricing and availability of these necessary materials.

Key Takeaways:

● Fastest Growth of Asia-Pacific Region

Geographically, in the global Solid-State Car Battery market share, Asia-Pacific is analyzed to grow with the highest CAGR of 59% over the forecast period 2024-2030. Over the forecast period, the solid-state vehicle battery market with the biggest size will be found in Asia Pacific. China, Japan, and South Korea will be the market leaders in the Asia-Pacific region. Through incentives, regulations that favour EVs, and campaigns to discourage petrol consumption, the governments of these nations have contributed to the expansion of the EV market. When solid-state automobile batteries are introduced to the market, this will cause the demand for them in the area to grow quickly.

China and Japan will be the first countries to introduce premium EVs with solid-state batteries, with South Korea and I Growth will pick up speed after 2026 after initially slowing down. The region's fastest-growing market will be India because of the present and future EV policies. Because of the efforts of battery makers and leading OEMs like Nissan, Mitsubishi, and Toyota in developing solid-state batteries, Japan is expected to have one of the fastest expanding economies in the area.

● BEV’s Segment to Register the Fastest Growth

In the Solid-State Car Battery Market analysis, the BEV’s segment is estimated to grow with the fastest over the forecast period. In comparison to PHEVs, solid-state batteries for BEVs are anticipated to be more in demand in the upcoming years. This is largely because there is a high demand for high-end BEVs with better features such more powerful batteries, quicker charging times, and more safety measures. As the batteries begin larger-scale mass production and are incorporated into other lower-end BEVs, their prices will decrease. North America is predicted to have the fastest-growing solid-state battery market for BEVs because the region is home to some of the major OEMs and businesses developing solid-state battery technology, such as QuantumScape and Solid Power.

● An increase in EV range due to better capacity solid-state batteries drives more demand

The shorter range of EVs on a single charge is a big worry for their consumers. This problem has significantly slowed the market's expansion. Solid-state EVs are anticipated to have a substantially longer range than EVs equipped with traditional lithium-ion batteries because of their higher battery density. Theoretically, solid-state batteries have twice the energy storage capacity of lithium-ion batteries.

As a result, a number of leading EV manufacturers are funding this technology. Several industry experts estimate that an electric vehicle (EV) equipped with a solid-state battery can have an electric range of more than 600 miles.

● Growing acceptance of EV’s

The solid-state car battery market is expanding mostly due to the increasing popularity of electric cars (EVs). There is a greater need than ever for high-performance, safe, and efficient energy storage devices as the globe moves towards more environmentally friendly and sustainable modes of transportation. Solid-state auto batteries have drawn more interest and funding due to its potential to completely transform the EV industry. Improved safety features are a well-known characteristic of solid-state batteries. They are less vulnerable to thermal runaway, overheating, and other safety issues that come with using traditional lithium-ion batteries. Concerns regarding battery safety have grown in importance as EVs are becoming more and more popular, making solid-state batteries' dependability and safety an appealing feature for both manufacturers and customers. The extended range and improved performance, safety and reliability, and fast charging are the factors that drive the growing acceptance of EVs in the Solid-State Car Battery Market.

● Higher cost compared to conventional lithium-ion batteries to impede to market growth

Compared to conventional lithium-ion batteries, the process of creating solid-state batteries is more intricate. Tight quality control is necessary due to the complex production processes in order to guarantee performance and safety. Higher production costs are generally the outcome of complex manufacturing procedures. Although solid-state batteries can lessen the need for some costly and rare materials that are used in conventional lithium-ion batteries, they might also need other, less accessible components. These components may add to the battery's overall cost as they can be expensive.

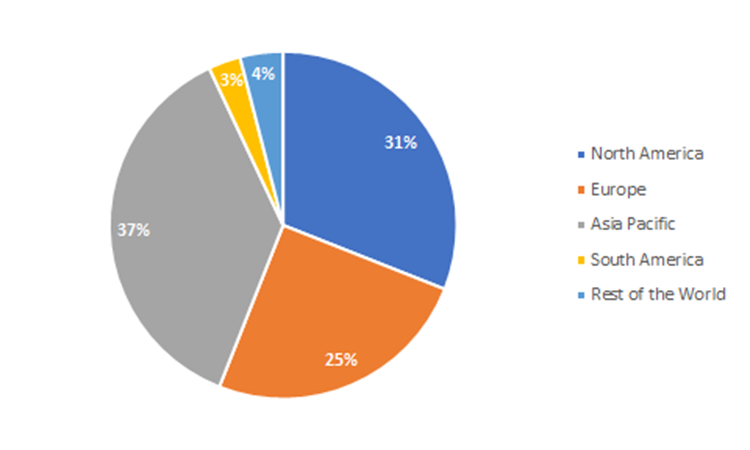

Solid-State Car Battery Market Share (%) By Region, 2023

For More Details On this report - Request For Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Solid-State Car Battery Market. The top 10 companies in this industry are listed below:

- Toyota Motor Corporation

- Solid Power

- QuantumScape

- Samsung SDI

- Prieto Battery

- Battrixx

- LG Chem

- Contemporary Amperex Technology Co., Ltd. (CATL)

- Panasonic.

- BrightVolt

Scope of Report:

| Report Metric |

Details |

|

Base Year Considered

|

2023

|

|

Forecast Period

|

2024–2030

|

|

CAGR

|

46%

|

|

Market Size in 2030

|

$1.8 billion

|

|

Segments Covered

|

Vehicle Type, Battery Energy Density, Propulsion, Component, and Region

|

|

Geographies Covered

|

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

|

|

Key Market Players

|

-

Toyota Motor Corporation

-

Solid Power

-

QuantumScape

-

Samsung SDI

-

Prieto Battery

-

Battrixx

-

LG Chem

-

Contemporary Amperex Technology Co., Ltd. (CATL)

-

Panasonic.

-

BrightVolt

|

For more Automative Market Research Report, please Click Here

Email

Email Print

Print