- The exploitation of crude oil has become very expensive due to the depletion of sources. This opens doors for the use of alternative, cost effective and bio based feed stocks for the production of olefins. The olefin market is focusing on the use of biomass, a carbon- rich material, as a feedstock. The manufacturers are aiming to make the best use of bio based products with high efficiency so that the production becomes cost effective.

- Due to the technological advancements and refinements in fracking process, the methane production has increased enormously and the price of methane has dropped significantly. This has drawn the attention of several olefin manufacturing companies in the United States. Due to the large availability of shale gas, manufacturers are finding routes for valorizing methane in the form of olefins either directly or indirectly.

- LyondellBasell Industries has acquired A. Schulman Inc. for $2.25 billion. This acquisition will allow the company to gain high growth markets such as agriculture, electronics and construction. This merger indicates how the abundance and affordability of U.S. shale natural gas, combined with pro-growth public policies, is making a real difference in the growth of America's economy.

- Companies are investing in the development of new olefin producing technologies to improve the way plastics and chemical precursors are produced and separated by saving energy and creating less waste. The main focus of the companies creating new value from existing streams, all while capturing energy savings and reducing carbon footprint.

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

Key Market Players:

The Top 5 companies in the U.S. Olefins Market are:

- The Dow Chemical Company

- BASF SE

- Shell plc

- ExxonMobil Corporation

- Chevron Phillips Chemical

1. U.S Olefins Market Overview

2. U.S Olefins Market Executive Summary

3. U.S Olefins Market Landscape

3.1. Market share Analysis

3.2. Comparative Analysis

3.2.1. Product Benchmarking

3.2.2. Product Share Analysis

3.2.3. Top 5 Financials Analysis

3.2.4. End-Users Analysis

4. U.S Olefins Market Forces

4.1. Market Drivers

4.2. Market Challenges

4.3. Market Restraints

4.4. Attractiveness of Oilfield Biocides and Bio Solvents Industry

4.4.1. Power of Suppliers

4.4.2. Power of Customers

4.4.3. Threats of Substitution

4.4.4. Degree of Competition

4.4.5. Threats of New Entrants

5. U.S Olefins Market - Strategic Analysis

5.1. Value Chain Analysis

5.2. Suppliers and Distributors

5.3. Pricing Analysis

5.4. Product/Market life Cycle Analysis

5.5. Regulation Analysis

6. U.S Olefins Market – By Type

6.1. Monoolefins

6.2. Diolefins

6.3. Triolefins

6.4. Others

7. U.S Olefins Market – By Feedstock

7.1. Gaseous Feeds

7.1.1. Ethane

7.1.2. Propane

7.1.3. Butane

7.1.4. Others

7.2. Liquid Feeds

7.2.1. Condensates from natural gas

7.2.2. Crude Oil

7.2.3. Atmospheric gas oil

7.2.4. Hydrogenated vacuum gas oil

7.2.5. Others

8. U.S Olefins Market – By Production Technique

8.1. Thermal Steam Cracking (TCS)

8.2. Fluid Catalytic Cracking (FCC)

8.3. Refinery Process

8.4. Others

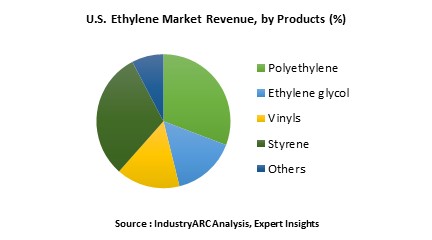

9. U.S Olefins Market – By Product

9.1. Ethylene products

9.1.1. Polyethylene

9.1.2. Ethylene glycol

9.1.3. Vinyl

9.1.4. Styrene

9.1.5. Others

9.2. Propylene products

9.2.1. Polypropylene

9.2.2. Cumene

9.2.3. Acrylonitrile

9.2.4. Others

10. U.S Olefins Market – By End User

10.1. Polymer Industry

10.1.1. Polyethlene

10.1.2. Gaskets

10.1.3. Plastic Gloves

10.1.4. Fibers

10.1.5. Crates

10.1.6. Others

10.2. Food Industry

10.2.1. Bottles

10.2.2. Food packaging

10.2.3. Others

10.3. Chemical Industry

10.3.1. Antifreeze

10.3.2. Solvent

10.3.3. Surfactant

10.3.4. Detergent

10.3.5. Others

10.4. Building and Constructing

10.4.1. Tiles

10.4.2. Flooring

10.4.3. Others

10.5. Manufacturing Industry

10.5.1. Welding

10.5.2. Cutting

10.6. Oil and Gas

10.6.1. Refrigerant

10.6.2. Lubricants

10.6.3. Oil field chemicals

10.6.4. Others

10.7. Automotive Industry

10.7.1. Seat construction

10.7.2. Truck liners

10.7.3. Load decks

10.7.4. Package shelf

10.7.5. Others

10.8. Others

11. U.S Olefins Market Entropy

11.1. New Product Launches

11.2. M&As, Collaborations, JVs and Partnerships

12. U.S Olefins Market Company Profiles

12.1. Dow Chemical Company

12.2. BASF SE

12.3. Royal Dutch Shell plc

12.4. ExxonMobil Corporation

12.5. Chevron Phillips Chemical

12.6. Company 6

12.7. Company 7

12.8. Company 8

12.9. Company 9

12.10. Company 10

*More than 10 Companies are profiled in this Research Report*

"*Financials would be provided on a best efforts basis for private companies"

13. Appendix

13.1. Abbreviations

13.2. Sources

13.3. Research Methodology

13.4. Bibliography

13.5. Compilation of Expert Insights

13.6. Disclaimer

Email

Email Print

Print