Oilfield Surfactants Market - Forecast(2025 - 2031)

Oilfield Surfactants Market Overview:

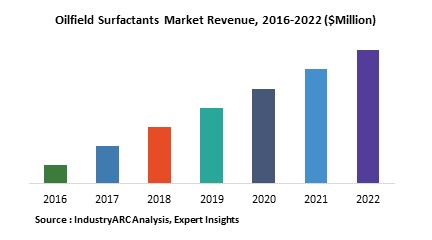

Oilfield Surfactants Market Size is forecast to reach $2044.1 Million by 2030, at a CAGR of 4.5% during forecast period 2024-2030.The global market for Oilfield Surfactants was estimated at $2044.1 million in 2030 and is predicted to witness robust and accelerated growth in the coming years, especially in the oil producing countries such the US, China and members of the OPEC. Demand for oilfield surfactants has grown since the need for chemicals in sustainable oil exploration, extraction and production has skyrocketed as witnessed in the rigorous EOR (Enhanced Oil Recovery) activities. Furthermore, there has been a growing interest in the bio-based oil surfactants, although being a niche market, for its environment friendly effects that can counter-act the wide environmental concerns about the oil and gas industries.

Oilfield Surfactants Market Outlook:

Oilfield surfactants are chemicals that effectively lower the surface tension between a fluid and a solid or between various fluids. Oilfield surfactants have various physical and chemical properties that can be exploited in the stages of drilling, production, refining, enhanced oil recovery and stimulation. Its applications vary from asphaltene dispersants, corrosion inhibition, emulsifiers, demulsifier intermediates, oil-wetters, paraffin inhibitors, water-wetters, foamers and defoamers. The type of surfactant behavior is dictated by the chemical structure, specifically the structural groups on the molecule). The oilfield surfactant market is segmented based on the stage of application such as drilling, production and stimulation as well as its applications as mentioned above.

Oilfield Surfactants Market Growth drivers:

Global oil and natural gas production has been increasing steadily since the last decade with oil production recording 92.6 million barrels per day (BPD) with US being the largest oil producing country in the world. These statistics imply that as oil production, extraction and exploration activities increase, there is clearly a huge growth potential for oilfield surfactants to meet this large demand capacity. Surfactants such as emulsifiers, demulsifiers, biocides etc. would highly in demand at various stages of drilling, production and stimulation in oilfields. In addition, as the world plans to move towards a more sustainable and environment friendly future, bio-based oilfield surfactants would be in high demand. Enhanced Oil Recovery (EOR) is gaining increasing popularity in the oil industry as it cuts costs and maximizes yield, and thus this could clearly boost the Oil Surfactants market as EOR is only possible due to the usage of such surfactants.

Oilfield Surfactants Market Challenges:

The prime challenge faced by the Oilfield Surfactants market is the dangerous carbon footprint that the oil and gas industries leave behind in the world’s atmosphere. The use of fossil fuels has always been criticized and many developed countries in the EU planning to phase out their energy dependence on oil and natural gas. Growing environmental concerns about oilfield production levels coupled with massive oil spills are the major challenges to the Oilfield Surfactant market.

Oilfield Surfactants Market Research Scope:

The base year of the study is 2017, with forecast done up to 2023. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Oilfield Surfactants market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of plastics in the Oilfield Surfactants market, and their specific applications in different types of vehicles.

Oilfield Surfactants Market Report: Industry Coverage

Oilfield Surfactants–By Class of Substrate: Synthetic and Bio-based

Oilfield Surfactants– By Application: Drilling, Stimulation and Stimulation

Oilfield Surfactants– By Surfactant Class: Non-Ionic, Anionic, Cationic, Polymeric, Amphoteric and others

The Oilfield Surfactants market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

- North America: The U.S., Canada, Mexico

- South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

- Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

- APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

- Middle East and Africa: Israel, South Africa, Saudi Arabia

Oilfield Surfactants Market Key Players Perspective:

Some of the Key players in this market that have been studied for this report include: CP Kelco Oil Field Group, Huntsman Corporation, Croda International PLC, Weatherford International, Stepan Company, Enviro Fluid, Rimpro-India, Evonik Industries AG, Flotek Industries and others

Market Research and Market Trends of Oilfield Surfactants Market

- Researchers at the University of Houston discovered an innovative technique using nanotechnology to maximize oil recovery from oil wells, as oilfields yield only 30-35% on average. The researchers have developed a graphene amphilic nanosheet designed from Janus nanoparticles that could aid in tertiary oil recovery. If producers can unlock this untapped potential, the crude oil supply could be boosted and could drive the selling price lower.

- According to the 2018 BP Statistical Review of World Energy global oil production hit a record of 92.6 million barrels per day (BPD). This large increase in oil production levels would indicate a large demand for oilfield surfactants in the oil and gas industries.

- Based in Texas, U.S, Huntsman Corporation is a global key player with a significant market share in the oilfield surfactant market. Huntsman Corporation recently acquired Nanocomp Technologies Inc., a company specialized in manufacturing advanced carbon materials based in New Hampshire, USA. Its popular product is an advanced carbon-based material branded as Miralon, which could have potential use in corrosion inhibition and can lead to a new class of nanomaterial based oilfield surfactant.

Key Market Players:

The Top 5 companies in the Oilfield Surfactants Market are:

- Exxon Mobil

- Arlanxeo

- Sibur International

- Reliance Industries

- BRP Manufacturing

1. Oilfield Surfactants Market - Overview

1.1. Definitions and Scope

2. Oilfield Surfactants Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Oilfield Surfactants Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Oilfield Surfactants Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Oilfield Surfactants Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Oilfield Surfactants Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Oilfield Surfactants Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Oilfield Surfactants Market – By Class of Substrate (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Synthetic

8.3.1.1. Fatty Alcohol Ethoxylate

8.3.1.2. Fatty Acid Ethoxylate

8.3.1.3. Fatty Amines Ethoxylate

8.3.1.4. Alkylphenol Ethoxylate

8.3.1.5. Polyethylene Glycols

8.3.1.6. Silicon Oil Emulsifier

8.3.1.7. Paraffin Wax Emulsifier

8.3.1.8. Castor Oil Ethoxylates

8.3.1.9. Glycerine Ethoxylates

8.3.1.10. Others

8.3.2. Bio-based

9. Oilfield Surfactants Market – By Application (Market Size -$Million / $Billion)

9.1. Drilling

9.1.1. Corrosion Inhibitors

9.1.2. Foaming Agent

9.1.3. Emulsifiers

9.1.4. Compatibilization

9.2. Production

9.2.1. Corrosion Control

9.2.2. Foaming Agent

9.2.3. Scale Control

9.2.4. Paraffin Dispersants

9.2.5. Asphaltene Control

9.2.6. Demulsifiers

9.3. Stimulation

9.3.1. Wetting and suspending agents

9.3.2. Biocides

9.3.3. Lubricating Agent

9.3.4. Emulsifiers

10. Oilfield Surfactants Market – By Surfactant Class (Market Size -$Million / $Billion)

10.1. Non-Ionic

10.2. Anionic

10.3. Cationic

10.4. Polymeric

10.5. Amphoteric

10.6. Others

11. Oilfield Surfactants - By Geography (Market Size -$Million / $Billion)

11.1. Oilfield Surfactants Market - North America Segment Research

11.2. North America Market Research (Million / $Billion)

11.2.1. Segment type Size and Market Size Analysis

11.2.2. Revenue and Trends

11.2.3. Application Revenue and Trends by type of Application

11.2.4. Company Revenue and Product Analysis

11.2.5. North America Product type and Application Market Size

11.2.5.1. U.S.

11.2.5.2. Canada

11.2.5.3. Mexico

11.2.5.4. Rest of North America

11.3. Oilfield Surfactants - South America Segment Research

11.4. South America Market Research (Market Size -$Million / $Billion)

11.4.1. Segment type Size and Market Size Analysis

11.4.2. Revenue and Trends

11.4.3. Application Revenue and Trends by type of Application

11.4.4. Company Revenue and Product Analysis

11.4.5. South America Product type and Application Market Size

11.4.5.1. Brazil

11.4.5.2. Venezuela

11.4.5.3. Argentina

11.4.5.4. Ecuador

11.4.5.5. Peru

11.4.5.6. Colombia

11.4.5.7. Costa Rica

11.4.5.8. Rest of South America

11.5. Oilfield Surfactants - Europe Segment Research

11.6. Europe Market Research (Market Size -$Million / $Billion)

11.6.1. Segment type Size and Market Size Analysis

11.6.2. Revenue and Trends

11.6.3. Application Revenue and Trends by type of Application

11.6.4. Company Revenue and Product Analysis

11.6.5. Europe Segment Product type and Application Market Size

11.6.5.1. U.K

11.6.5.2. Germany

11.6.5.3. Italy

11.6.5.4. France

11.6.5.5. Netherlands

11.6.5.6. Belgium

11.6.5.7. Spain

11.6.5.8. Denmark

11.6.5.9. Rest of Europe

11.7. Oilfield Surfactants – APAC Segment Research

11.8. APAC Market Research (Market Size -$Million / $Billion)

11.8.1. Segment type Size and Market Size Analysis

11.8.2. Revenue and Trends

11.8.3. Application Revenue and Trends by type of Application

11.8.4. Company Revenue and Product Analysis

11.8.5. APAC Segment – Product type and Application Market Size

11.8.5.1. China

11.8.5.2. Australia

11.8.5.3. Japan

11.8.5.4. South Korea

11.8.5.5. India

11.8.5.6. Taiwan

11.8.5.7. Malaysia

12. Oilfield Surfactants Market - Entropy

12.1. New product launches

12.2. M&A's, collaborations, JVs and partnerships

13. Oilfield Surfactants Market – Industry / Segment Competition landscape Premium

13.1. Market Share Analysis

13.1.1. Market Share by Country- Top companies

13.1.2. Market Share by Region- Top 10 companies

13.1.3. Market Share by type of Application – Top 10 companies

13.1.4. Market Share by type of Product / Product category- Top 10 companies

13.1.5. Market Share at global level- Top 10 companies

13.1.6. Best Practises for companies

14. Oilfield Surfactants Market – Key Company List by Country Premium

15. Oilfield Surfactants Market Company Analysis

15.1. Market Share, Company Revenue, Products, M&A, Developments

15.2. CP Kelco Oil Field Group

15.3. Huntsman Corporation

15.4. Croda International PLC

15.5. Weatherford International

15.6. Stepan Company

15.7. Enviro Fluid

15.8. Rimpro-India

15.9. Evonik Industries AG

15.10. Flotek Industries

"*Financials would be provided on a best efforts basis for private companies"

16. Oilfield Surfactants Market -Appendix

16.1. Abbreviations

16.2. Sources

17. Oilfield Surfactants Market -Methodology Premium

17.1. Research Methodology

17.1.1. Company Expert Interviews

17.1.2. Industry Databases

17.1.3. Associations

17.1.4. Company News

17.1.5. Company Annual Reports

17.1.6. Application Trends

17.1.7. New Products and Product database

17.1.8. Company Transcripts

17.1.9. R&D Trends

17.1.10. Key Opinion Leaders Interviews

17.1.11. Supply and Demand Trends

List of Tables:

Table 1. Product Benchmarking for the Top Five Companies in Oilfield Surfactants Market, 2014

Table 2. Oilfield Surfactant Market, By Application, 2014-2020 ($Million)

Table 3. Oilfield Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 4. Eu Regulation: Legal Requirement

Table 5. Oilfield Anionic Surfactant Market, By Application, 2014-2020 ($Million)

Table 6. Oilfield Non-Ionic Surfactant Market, By Application, 2014-2020 ($Million)

Table 7. Oilfield Cationic Surfactant Market, By Application, 2014-2020 ($Million)

Table 8. Oilfield Amphoteric Surfactant Market, By Application, 2014-2020 ($Million)

Table 9. Oilfield Others Surfactant Market, By Application, 2014-2020 ($Million)

Table 10. Oilfield Others Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 11. North American Oilfield Surfactant Market, By Application, 2014-2020 ($Million)

Table 12. North American Oilfield Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 13. South American Oilfield Surfactant Market, By Application, 2014-2020 ($Million)

Table 14. South American Oilfield Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 15. European Oilfield Surfactant Market, By Application, 2014-2020 ($Million)

Table 16. European Oilfield Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 17. APAC Oilfield Surfactant Market, By Application, 2014-2020 ($Million)

Table 18. APAC Oilfield Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 19. Middle East and Africa Oilfield Surfactant Market, By Application, 2014-2020 ($Million)

Table 20. Middle East and Africa Oilfield Surfactant Market Volume, By Application, 2014-2020 (Kilo Tons)

Table 21. Market for Oilfield Surfactants, Revenue By Type, 2014-2020 ($Million)

Table 22. Market for Oilfield Surfactants, Volume By Type, 2014-2020 (Kilo Tons)

Table 23. North America Oilfield Surfactants Market Revenue, By Type, 2014-2020 ($Million)

Table 24. North America Oilfield Surfactants Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 25. South America Oilfield Surfactants Market Revenue, By Type, 2014-2020 ($Million)

Table 26. South America Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 27. Europe Oilfield Surfactants Market Revenue, By Type, 2014-2020 ($Million)

Table 28. Europe Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 29. APAC Oilfield Surfactants Market Revenue, By Type, 2014-2020 ($Million)

Table 30. APAC Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 31. Middle East and Africa Market for Oilfield Surfactants, Revenue By Type, 2014-2020 ($Million)

Table 32. Middle East and Africa Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 33. Anionic Market for Oilfield Surfactants, Revenue By Type, 2014-2020 ($Million)

Table 34. Anionic Market for Oilfield Surfactants, Volume By Type, 2014-2020 (Kilo Tons)

Table 35. North America Anionic Market for Oilfield Surfactants, Revenue By Type, 2014-2020 ($Million)

Table 36. North America Anionic Market for Oilfield Surfactants, Volume By Type, 2014-2020 (Kilo Tons)

Table 37. South America Anionic Market for Oilfield Surfactants, Revenue By Type, 2014-2020 ($Million)

Table 38. South America Anionic Market for Oilfield Surfactants, Volume By Type, 2014-2020 (Kilo Tons)

Table 39. Europe Anionic Oilfield Surfactant Market Revenue, By Type, 2014-2020 ($Million)

Table 40. Europe Anionic Oilfield Surfactants Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 41. APAC Anionic Oilfield Surfactant Market Revenue, By Type, 2014-2020 ($Million)

Table 42. APAC Anionic Oilfield Surfactants Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 43. Middle East Anionic Oilfield Surfactant Market Revenue, By Type, 2014-2020 ($Million)

Table 44. Middle East Anionic Oilfield Surfactants Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 45. Non-Ionic Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 46. Non-Ionic Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 47. North America Non-Ionic Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 48. North America Non-Ionic Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 49. South America Non-Ionic Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 50. South America Non-Ionic Market for Oilfield Surfactants, Volume By Product Type, 2014-2020 (Kilo Tons)

Table 51. Europe Non Ionic Market for Oilfield Surfactants, Revenue By Type, 2014-2020 ($Million)

Table 52. Europe Non Ionic Oilfield Surfactant Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 53. APAC Non Ionic Oilfield Surfactants Market Revenue, By Type, 2014-2020 ($Million)

Table 54. APAC Non Ionic Oilfield Surfactant Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 55. Middle East Non Ionic Oilfield Surfactants Market Revenue, By Type, 2014-2020 ($Million)

Table 56. Middle East Non Ionic Oilfield Surfactant Market Volume, By Type, 2014-2020 (Kilo Tons)

Table 57. Cationic Oilfield Surfactants Market Revenue, By Product Type, 2014-2020 ($Million)

Table 58. Cationic Oilfield Surfactant Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 59. North America Cationic Oilfield Surfactants Market Revenue, By Product Type, 2014-2020 ($Million)

Table 60. North America Cationic Oilfield Surfactant Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 61. South America Cationic Market for Oilfield Surfactants, Revenue By Product Type, 2014-2020 ($Million)

Table 62. South America Cationic Market for Oilfield Surfactants, Volume By Product Type, 2014-2020 (Kilo Tons)

Table 63. Europe Cationic Market for Oilfield Surfactants, Revenue By Product Type, 2014-2020 ($Million)

Table 64. Europe Cationic Market for Oilfield Surfactants, Volume By Product Type, 2014-2020 (Kilo Tons)

Table 65. APAC Cationic Market for Oilfield Surfactants, Revenue By Product Type, 2014-2020 ($Million)

Table 66. APAC Cationic Market for Oilfield Surfactants, Volume By Product Type, 2014-2020 (Kilo Tons)

Table 67. Middle East & Africa Cationic Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 68. Middle East & Africa Cationic Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 69. Amphoteric Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 70. Amphoteric Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 71. North America Amphoteric Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 72. North America Amphoteric Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 73. South America Amphoteric Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 74. South America Amphoteric Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 75. Europe Amphoteric Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 76. Europe Amphoteric Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 77. APAC Amphoteric Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 78. APAC Amphoteric Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 79. Middle East & Africa Amphoteric Oilfield Surfactant Market Revenue, By Product Type, 2014-2020 ($Million)

Table 80. Middle East & Africa Amphoteric Oilfield Surfactants Market Volume, By Product Type, 2014-2020 (Kilo Tons)

Table 81. Market for Oilfield Surfactants, Revenue By Substrate, 2014-2020 ($Million)

Table 82. Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 (Kilo Tons)

Table 83. North America Market for Oilfield Surfactants, Revenue By Substrate, 2014-2020 ($Million)

Table 84. North America Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 (Kilo Tons)

Table 85. South America Market for Oilfield Surfactants, Revenue By Substrate, 2014-2020 ($Million)

Table 86. South America Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 (Kilo Tons)

Table 87. Europe Market for Oilfield Surfactants, Revenue By Substrate, 2014-2020 ($Million)

Table 88. Europe Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 (Kilo Tons)

Table 89. APAC Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 ($Million)

Table 90. APAC Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 (Kilo Tons)

Table 91. Middle East & Africa Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 ($Million)

Table 92. Middle East & Africa Market for Oilfield Surfactants, Volume By Substrate, 2014-2020 (Kilo Tons)

Table 93. Market for Oilfield Surfactants, Revenue By Region, 2014-2020 ($Million)

Table 94. Market for Oilfield Surfactants, Volume By Region, 2014-2020 (Kilo Tons)

Table 95. North America Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 96. North America Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 97. Canada Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 98. Canada Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 99. Mexico Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 100. Mexico Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 101. U.S. Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 102. U.S. Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 103. U.S. Proved Reserves of Crude Oil & Less Condensate-By Years, 2010-2013 (in Million Barrels)

Table 104. South America Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 105. South America Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 106. Argentina Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 107. Argentina Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 108. Brazil Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 109. Brazil Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 110. Venezuela Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 111. Venezuela Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 112. Others Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 113. Others Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 114. Europe Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 115. Europe Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 116. Germany Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 117. Germany Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 118. France Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 119. France Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 120. Italy Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 121. Italy Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 122. Russia Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 123. Russia Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 124. U.K. Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 125. U.K. Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 126. Others Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 127. Others Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 128. APAC Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 129. APAC Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 130. China Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 131. China Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 132. South Korea Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 133. South Korea Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 134. Japan Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 135. Japan Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 136. India Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 137. India Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 138. Others Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 139. Others Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 140. Middle East & Africa Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 141. Middle East & Africa Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 142. Saudi Arabia Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 143. Saudi Arabia Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 144. U.A.E. Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 145. U.A.E. Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 146. Africa Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 147. Africa Market for Oilfield Surfactants, Volume By Country, 2014-2020 (Kilo Tons)

Table 148. Others Market for Oilfield Surfactants, Revenue By Country, 2014-2020 ($Million)

Table 149. Others Oilfield Surfactants Market Volume, By Country, 2014-2020 (Kilo Tons)

Table 150. Akzonobel: Revenue By Year, 2011-2013 ($Million)

Table 151. Basf: Revenue By Year, 2011-2013 ($Billion)

Table 152. Clariant: Sales By Year, 2011-2013 ($Million)

Table 153. Huntsman: Total Revenue By Year, 2011-2013 ($Billion)

Table 154. Kao Corporation: Net Sales By Year, 2011-2013 ($Billion)

Table 155. Dow: Net Sales By Year, 2011 – 2013 ($Million)

Table 156. Stepan Company: Net Sales, 2011-2013 ($Million)

Table 157. Stepan Company: Net Sales, By Segment, 2011-2013 ($Million)

Table 158. Dupont: Revenue By Year, 2011-2013 ($Billion)

Table 159. Henkel: Revenue By Year, 2011-2013 ($Billion)

Table 160. Weatherford: Revenue By Year, 2011-2013 ($Million)

Table 161. Cytec: Net Sales By Year, 2011-2013 ($Million)

List of Figures:

Figure 1. Oil Field Surfactants By Type, 2014

Figure 2. Oil Field Surfactants Market Revenue, 2014-2020 ($Millionillion)

Figure 3. Oil Field Surfactants Market Shares By Region, 2014-2020

Figure 4. Market Share Analysis for Oil Field Surfactants – By Company, 2014

Figure 5. Oil Field Surfactant - Patent Analysis, By Year, 2011-2014 (Number of Patents)

Figure 6. Oilfield Surfactant - Patent Analysis, By Company, 2011-2014 (%)

Figure 7. Value Chain, Oilfield Surfactants Market

Figure 8. Surfactant Pricing Analysis, By Type, 2014-2020 ($)

Figure 9. Industry Life Cycle

Figure 10. Oilfield Surfactants Market, By Application

Figure 11. Production of Oil By Co2 Injection, U.S, 2010-2020 (000 Units)

Figure 12. Production of Oil, 2010-2020 (Million Barrels Per Day)

Figure 13. Number of Oil Spills, 2008-2014

Figure 14. Pipeline Incidents, 2010-2013

Figure 15. Oilfield Anionic Surfactant Market Volume, By Application, 2014 (Kilo Tons)

Figure 16. Figure - Oilfield Anionic Surfactant Market Volume, By Application, 2020 (Kilo Tons)

Figure 17. Oilfield Non-Ionic Surfactant Market Volume, By Application, 2014 (Kilo Tons)

Figure 18. Oilfield Non-Ionic Surfactant Market Volume, By Application, 2020 (Kilo Tons)

Figure 19. Oilfield Anionic Surfactant Market Volume, By Application, 2014 (Kilo Tons)

Figure 20. Oilfield Anionic Surfactant Market Volume, By Application, 2020 (Kilo Tons)

Figure 21. Oilfield Amphoteric Surfactant Market Volume, By Application, 2014 (Kilo Tons)

Figure 22. Oilfield Amphoteric Surfactant Market Volume, By Application, 2020 (Kilo Tons)

Figure 23. Oilfield Surfactants Market Classification– By Type U.S Oil Production, By Region, 2014-2015

Figure 24. Emissions Into Air, By Pollutant, Europe, 2014

Figure 25. Cationic Market for Oilfield Surfactants, Revenue By Type, By Region, 2014 ($Million)

Figure 26. Amphoteric Market for Oilfield Surfactants, Revenue By Type, By Region, 2014 ($Million)

Figure 27. Other Market for Oilfield Surfactants, Revenue By Region, 2014-2020 ($Million)

Figure 28. Types of Biosurfactants

Figure 29. Estimated Canada Oil Production-By Years, 2015-2030 (in Mbpd)

Figure 30. Estimated U.S. Oil Production-By Years, 20150-2030 (in Mbpd)

Figure 31. Oil Exploration Investment Share in Brazil, By Types, 2021-2023 (%)

Figure 32. Production Development Investment Share, By Types, 2021-2023 (%)

Figure 33. Estimated China’s Oil Production-By Years, 2013-2015 (in Mbpd)

Figure 34. Estimated India’s Oil Production-By Years, 2014-2025 (in Mbpd)

Figure 35. Estimated Africa’s Oil Production-By Years, 2014-2025 (in Mbpd)

Figure 36. Akzonobel: Revenue Share By Business Segment in 2013 (%)

Figure 37. Basf: Revenue Share By Chemicals Segment in 2013 (%)

Figure 38. Clariant: Sales Share By Segment in 2013 (%)

Figure 39. Huntsman: Revenue Share By Segment in 2013 (%)

Figure 40. Huntsman: Revenue Share By Geography in 2013 (%)

Figure 41. Kao Corporation: Sales Share By Segment in 2013 (%)

Figure 42. Dow: Net Sales Share By Operation Segment in 2013 (%)

Figure 43. Dupont: Sales By Segment, 2013 (%)

Figure 44. Henkel: Sales By Geography, 2013 (%)

Figure 45. Weatherford: Revenue Share By Region in 2013 (%)

Figure 46. Cytec: Revenue Share By Geography in 2013 (%)

Figure 47. Cytec: Revenue Share By Business Segment in 2013 (%)

Email

Email Print

Print