Oilfield Drilling Fluid Additives Market- By Type; By Fluid Formulation (Water based, Oil based, Synthetic based, others); By Geography- Forecast (2024 - 2030)

- Nanotechnology in Drilling Fluids: Nanoparticle has been in a prominent use in almost all the industry operation and requirement in oil and gas mining industry in order to minimize the environmental factors connected with recovery of oil is perilous. Many research studies have also concluded that nanoparticles introducing into drilling lubricant can increase its thermal stability. R&D from major players have reported that nano-additives are capable to increase the strength of well bore, reduce the loss of fluid, friction reduction at the time drilling to a maximum extent.

- Integrated Drilling Fluid System: There is always a demand for an integrated system which provides multiple solution in single unit and the customer requires it to be available across the regions. These integrated solution systems available across the region can make possible by means of acquisition and merger. Whole in One is an integrated drilling fluid system which is a combination of more than one component can be used for multi directional drills, provides flexible lubricity and provides performance and speed of an OB drilling lubricant in a favored water based system.

- Exploration in offshore drilling: The Oil and Gas Industry move its exploration efforts towards offshore oil mining with a remarkable project along the coastal sides of South America and West Africa. Nanofiltrate membrane is a sodium chloride permeability which is capable to reject more than 50% sodium chloride components, barium and sorium sulphate when operating under sea water. GE’s recent launch, seawater sulphate removal (SWSR) which filters all sulphate composites from the water that has been injected for offshore drilling production.

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

Table 6. Global Oilfield Drilling Fluid Additive Market Revenue, by Formulation, 2014-2020 ($Million)

Table 7. Global Oilfield Drilling Fluid Additive Market Volume, by Formulation, 2014-2020 (KT)

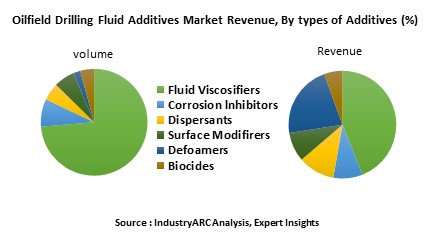

Table 8. Global Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 9. Global Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 10. Global Fluid Viscosifier Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 11. Global Fluid Viscosifiers Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 12. Global Fluid Viscosifier Oilfield Drilling Fluid Additive Market Revenue, by Formulation, 2014-2020 ($Million)

Table 13. Global Corrosion Inhibitor Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 14. Global Corrosion Inhibitor Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 15. Global Corrosion Inhibitors Oilfield Drilling Fluid Additive Market Revenue, by Formulation, 2014-2020 ($Million)

Table 16. Global Dispersant Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 18. Global Dispersants Oilfield Drilling Fluid Additives Industry Revenue, by Formulation, 2014-2020 ($Million)

Table 19. Global Surface Modifiers Oilfield Drilling Fluid Additives Industry Revenue, by Formulation, 2014-2020 ($Million)

Table 20. Global Defoamer Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 21. Global Defoamer Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 22. Global Defoamer Oilfield Drilling Fluid Additives Market Revenue, by Formulation, 2014-2020 ($Million)

Table 23. Global Biocide Oilfield Drilling Fluid Additives Market Revenue, by Type, 2014-2020 ($Million)

Table 24. Global Biocide Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 25. Global Oilfield Drilling Fluid Additives Market Volume, by Region, 2014-2020 (KT)

Table 26. Global Oilfield Drilling Fluid Additives Market Revenue, by Region, 2014-2020 ($Million)

Table 27. North America Oilfield Drilling Fluid Additives Market Volume, by Type, 2014-2020 (KT)

Table 28. North America Oilfield Drilling Fluid Additives Market Revenue, by Type, 2014-2020 ($Million)

Table 29. North America Oilfield Drilling Fluid Additives Market Volume, by Country, 2014-2020 (KT) Table 30. North America Oilfield Drilling Fluid Additives Industry Revenue, by Country, 2014-2020 ($Million)

Table 31. U.S. Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 32. Canada Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 33. Mexico Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 34. Europe Oilfield Drilling Fluid Additives Industry Volume, by Type, 2014-2020 (KT)

Table 35. Europe Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 36. Europe Oilfield Drilling Fluid Additives Industry Volume, by Country, 2014-2020 (KT)

Table 37. Europe Oilfield Drilling Fluid Additives Industry Revenue, by Country, 2014-2020 ($Million)

Table 38. Russia Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 39. U.K. Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 41. Roe Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 42. APAC Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 43. APAC Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 44. APAC Oilfield Drilling Fluid Additive Market Volume, by Country, 2014-2020 (KT)

Table 45. APAC Oilfield Drilling Fluid Additive Market Revenue, by Country, 2014-2020 ($Million)

Table 46. China Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 47. India Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 48. Middle East Oilfield Drilling Fluid Additive Market Volume, by Type, 2014-2020 (KT)

Table 49. Middle East Oilfield Drilling Fluid Additive Market Revenue, by Type, 2014-2020 ($Million)

Table 50. Middle East Oilfield Drilling Fluid Additive Market Volume, by Country, 2014-2020 (KT) Table 51. Middle East Oilfield Drilling Fluid Additives Industry Revenue, by Country, 2014-2020 ($Million)

Table 52. Saudi Arabia Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Table 53. Row Oilfield Drilling Fluid Additives Industry Volume, by Type, 2014-2020 (KT)

Table 54. Row Oilfield Drilling Fluid Additives Industry Revenue, by Type, 2014-2020 ($Million)

Email

Email Print

Print