Insoluble Dietary Fibers Market - By Type , By Function , By Sources , By End-Use Industry , By Geographic Analysis - Forecast (2024 - 2030)

- North America: The U.S., Canada, Mexico

- South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

- Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

- APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

- Middle East and Africa: Israel, South Africa, Saudi Arabia

- Insoluble dietary fibers increases the weight of stool and decreases the transit time of colonic that guarantees the prevention of constipation and diverticulosis. One of the major benefit of insoluble dietary fibers is their antioxidant capacity which comes phenolic and thus contributes in their health aids. Inspite the proven health benefits of insoluble dietary fiber on risk reduction of chronic disease, the average consumption of it is seen low globally. There is persistent need for daily intake of insoluble dietary fiber.

- The number of patents has observed an abrupt growth in 2013 & 2014 because of the swelling demand and active investment from stake holders. The growing need for new formulations and related applications, patents and intellectual properties are playing a key role in maintaining the competitive position in the market.

Key Market Players:

The Top 5 companies in the Insoluble Dietary Fibers Market are:

- Roquette Freres

- Ingredion

- Cargill

- Tate & Lyle

- ADM

For more Food and Beverage Market reports, please click here

List of Tables:

Table 1: Insoluble Dietary Fibers Market Revenue, By Type, 2015-2021 ($Million)

Table 2: Insoluble Dietary Fibers Market Revenue, By Source, 2015-2021 ($Million)

Table 3: Insoluble Dietary Fibers Market Revenue, By Industry, 2015-2021 ($Million)

Table 4: Total Feed, By Region & Livestock, 2015 (Million Metric Tons)

Table 5: North America Insoluble Dietary Fibers Market Size, By Country, 2015-2021 ($Million)

Table 6: Europe Insoluble Dietary Fibers Market, By Country, 2015-2021 ($Million)

Table 7: APAC Insoluble Dietary Fibers Market, By Country, 2015-2021 ($Million)

Table 8: RoW Insoluble Dietary Fibers Market, By Region, 2015-2021 ($Million)

List of Figures:

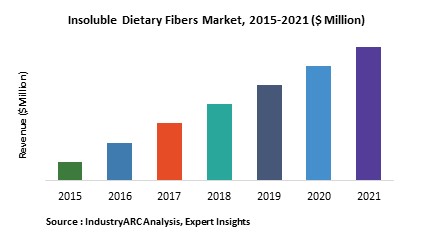

Figure 1: Global Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 2: Global Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 3: Global Insoluble Dietary Fibers Market Revenue, By Type & By Source, 2015 ($Million)

Figure 4: Global Insoluble Dietary Fibers Market Revenue Share, By Industry, 2015 (%)

Figure 5: Food & Beverage: Insoluble Dietary Fibers Market Revenue, By Segment, 2015 & 2021 ($Million)

Figure 6: Global Insoluble Dietary Fibers Market Revenue,By Region, 2015 ($Million)

Figure 7: Global Insoluble Dietary Fibers Market Volume, By Region, 2015 (KT)

Figure 8: Global Insoluble Dietary Fibers Market Share, By Key Players, 2015 (%)

Figure 9: Insoluble Dietary Fibers Market, Number of Patents Granted,By Company, 2012- 2016* (%)

Figure 10: Number of Patents Granted, 2012- 2016

Figure 11: Insoluble Dietary Fibers Market, By Type, 2015 & 2021 ($Million)

Figure 12: Insoluble Dietary Fibers Market Volume, By Type, 2015-2021 (KT)

Figure 13: Cellulose: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 14: Cellulose: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 15: Hemi-cellulose: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 16: Hemi-cellulose: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 17: Lignin: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 18: Lignin: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 19: Chitin & Chitosan: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 20: Chitin & Chitosan: Insoluble Dietary Fibers Market Revenue, 2015-2021 (KT)

Figure 21: Resistant Starch: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 22: Resistant Starch: Insoluble Dietary Fibers Market Revenue, 2015-2021 (KT)

Figure 23: Fiber/Bran: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 24: Fiber/Bran: Insoluble Dietary Fibers Market Revenue, 2015-2021 (KT)

Figure 25: Others: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 26: Others: Insoluble Dietary Fibers Market Revenue, 2015-2021 (KT)

Figure 27: VegeTable s: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 28: VegeTable s: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 29: Whole Grains: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 30: Whole Grains: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 31: Fruits: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 32: Fruits: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 33: Others: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 34: Others: Insoluble Dietary Fibers Market Volume, 2015-2021 (KT)

Figure 35: U.S.: Per Capita Cheese Consumption, 1989 - 2014 (Pounds)

Figure 36: Insoluble Dietary Fibers Market, By Industry, 2015 (%)

Figure 37: Insoluble Dietary Fibers Market, By Industry, 2021 (%)

Figure 38: Bakery: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 39: Convenience Food: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 40: Dairy Products Consumption, 2015 – 2024 (Million Tons)

Figure 41: Dairy Products: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 42: Global Fish Production, 2015 – 2021 (Million Tons)

Figure 43: Global Beef, Pig Meat & Sheep Meat Production, 2015 – 2024 (Million Tons)

Figure 44: Global Poultry Meat Production, 2015 – 2024 (Million Tons)

Figure 45: Meat, Poultry & Sea Food: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 46: Functional Food & Dietary Supplements: Insoluble Dietary Fibers Market Revenue,2015-2021 ($Million)

Figure 47: Beverages: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 48: Breakfast Cereals: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 49: Pastas & Tortillas: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 50: Others: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 51: Animal Feed : Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 52: Feed Production Volume, By Species, 2015 (%)

Figure 53: Pharmaceuticals : Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 54: Others: Insoluble Dietary Fibers Market Revenue, 2015-2021 ($Million)

Figure 55: Global Insoluble Dietary Fibers Market Revenue, By Region, 2015 & 2021 ($Million)

Figure 56: Global Insoluble Dietary Fibers Market Volume, By Region, 2015-2021 (KT)

Figure 57: U.S. Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 58: Canada Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 59: Canada: Bakery Products Revenue, 2013-2015 ($Million)

Figure 60: Mexico Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 61: Europe Insoluble Dietary Fibers Revenue, By Type, 2015 & 2021 ($Million)

Figure 62: Europe Insoluble Dietary Fibers Revenue, By Industry, 2015 & 2021 ($Million)

Figure 63: U.K. Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 64: Germany Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 65: France Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 66: Europe Pharmaceutical Industry Revenue, By Country, 2014 ($Billion

Figure 67: Italy Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 68: Spain Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 69: Rest of Europe Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 70: APAC Insoluble Dietary Fibers Revenue, By Type, 2015 & 2021 ($Million)

Figure 71: APAC Insoluble Dietary Fibers Revenue, By Industry, 2015 & 2021 ($Million)

Figure 72: China Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 73: Japan Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 74: Australia Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 75: India Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 76: Others Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 77: RoW Insoluble Dietary Fibers Revenue, By Type, 2015 & 2021 ($Million)

Figure 78: RoW Insoluble Dietary Fibers Revenue, By Industry,2015 & 2021 ($Million)

Figure 79: Latin America Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 80: MEA Insoluble Dietary Fibers Market, 2015-2021 ($Million)

Figure 81: Roquette: Total Revenue, By Business Segment, 2015 (%)

Figure 82: Roquette: Total Revenue, 2011-2015 ($Billion)

Figure 83: ADM: R&D Expenses, 2011-2015 ($Million)

Figure 84: ADM: Total Revenue, 2012-2015 ($Billion)

Figure 85: Ingredion Inc.: Total Revenue, 2012-2015 ($Million)

Figure 86: Ingredion Inc.: Total Revenue, By Region, 2015 (%)

Figure 87: Ingredion Inc.: Total Revenue, By Business Segment, 2015 (%)

Figure 88: E.I. DuPont: Total Revenue Share, By Segment, 2015 (%)

Figure 89: E.I. DuPont: Total Revenue Share, By Region, 2015 (%)

Figure 90: E.I. DuPont: Total R&D Expenses, 2011-2015 ($Million)

Figure 91: E.I. DuPont: Total Revenue, 2011-2015 ($Million)

Figure 92: Cargill Inc.: Total Revenue, 2011-2015 ($Million)

Figure 93: Brenntag Inc.: Total Revenue, 2011-2015 ($Million)

Figure 94: Brenntag Inc.: Total Revenue Share, By Region, 2015 (%)

Figure 95: SunOpta Ingredients Group: Total Revenue, 2011-2015 ($Million)

Figure 96: SunOpta Ingredients Group: Revenue, By Business Segment, 2015 (%)

Figure 97: North America Insoluble Dietary Fibers Revenue, By Type, 2015 & 2021 ($Million)

Figure 98: North America Insoluble Dietary Fibers Revenue, By Industry, 2015 & 2021 ($Million)

Email

Email Print

Print